Author: Loopy Lu

The growth potential of a financial product/asset is often determined by market capacity. This market capacity includes both the size of the funds and the number of investors. If we consider this dimension, the future of friend.tech is not optimistic.

Take illiquid NFTs as an example. A “standard” PFP series has a “asset” quantity of 10,000. Theoretically, this NFT collection can accommodate ten thousand investors. However, in order to improve poor liquidity, the industry has introduced various NFTFi products such as fragmentation, lending, and leasing.

- Base completely binds Optimism with shared income to open up a new paradigm in the industry.

- LianGuai Daily | Uniswap spot trading volume exceeds Coinbase for two consecutive quarters; Magnate Finance experiences a Rug Pull, losing approximately $6.5 million.

- a16z Why We Can’t Build Stateless Blockchains?

Now let’s talk about friend.tech. How many investors does one “user” share target accommodate?

Let’s take Racer, the top 1 on the share market value ranking, as an example. Racer currently has a share market value of 773 ETH. According to Dune data, Racer only has 232 individual shares, held by as few as 138 addresses. There have been a total of 960 transactions, including 596 purchases and 364 sales.

As you can see, even the most talked-about asset in friend.tech still has very low-frequency trading. This means that even with very few transactions, the market value can soar to a relatively high position (compared to market participation enthusiasm).

Why is this happening?

The evolution of matching: nullifying the role of counterparties

Here, we need to re-understand the mechanism design of friend.tech.

In traditional trading venues such as CEX, the core pricing mechanism is achieved through matching orders in the order book. Buyers and sellers continuously make bids, and a transaction is made when both parties agree. The transaction price is immediately displayed by the trading platform and is the instantaneous price we observe, balancing the expectations of both parties. However, this continuous trading process does not exist in friend.tech.

The above image is a typical buy transaction in friend.tech. We can see that the 2.83 ETH used to purchase shares is transferred to a contract address with the last four digits “a4d4” after deducting two 5% shares. (By the way, it is also an important innovation of this project to directly “exchange money for money” without using NFT as an intermediary. In addition, canceling the mint also saves gas.)

In a sell transaction, we can see that the contract address with the last four digits “a4d4” directly transfers the amount received from the sale to the seller after deducting two shares.

The contract with the last four digits “a4d4” is called Friend tech Shares V1, which is used to store the ETH exchanged by users for buying shares. Currently, there are 3434 tokens in the contract.

In simple terms, buyers and sellers in friend.tech have never engaged in direct transactions.

Yes, this is the magical power of friend.tech. I even think it is a “great invention” comparable to AMM.

Do you still remember the shock brought by AMM to traders when it first appeared? It eliminates the disadvantage of real-time execution of the order book, allowing buyers and sellers to no longer need to “exist” at the same time of execution.

Real-time execution requires a high level of liquidity. For nascent cryptocurrency markets, it is difficult for a niche asset to maintain sufficient and high-frequency transactions 24/7.

AMM makes LPs become “eternal sellers/buyers”. As long as the LP is still there, buyers/sellers can reach transactions at any time.

Friend.tech is even more radical than AMM. It even eliminates LPs. Without the role of LP “pretending” to be the counterparty, it allows the initiator of the transaction to ignore liquidity and can execute trades at any time.

Since friend.tech has never released a white paper and has not named its mechanism, for convenience in the following text, I will refer to its trading mechanism as “Void Trading”.

Void Trading: The “Great Innovation” that Manipulates the Price Timeline

Odaily Star Daily has introduced its pricing mechanism in an article titled “How are personal stocks priced in Friend.tech?”. In summary, the price of friend.tech is determined by the supply of the traded asset – the more personal shares in existence, the higher the price.

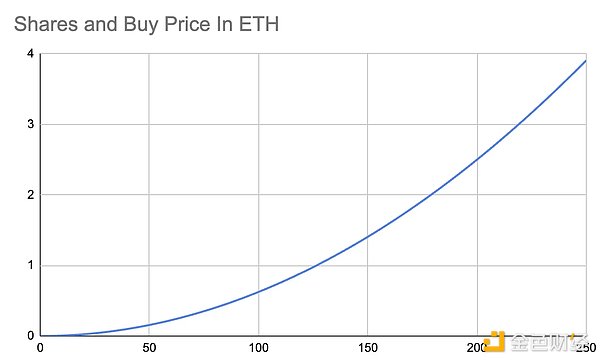

The horizontal axis represents the number of shares, and the vertical axis represents the trading price.

Intuitively, this mechanism seems to make sense – the stronger the buying pressure, the more buyers there are, and the more shares are created, thus driving up the price – scarcity leads to price increase.

But is it really the case?

Let’s take a look at traditional matching trading again. In matching trading, transactions are executed in real time. When you buy an asset for $1000, there must be someone willing to sell it for $1000. And when the market expects it to rise, due to “demand exceeds supply,” other traders will bid $1001 to buy it. Eventually, a transaction at $1001 is reached.

No one “priced” this asset at $1001. It was the market that spontaneously traded at $1001, and the trading platform simply displayed it.

AMM is also similar to this, where LPs act as “eternal” counterparty orders.

In matching trading and AMM, the price has already happened, it is in the “past tense”.

But in “Void Trading”, there are clear “pricing” rules, and the price is in the future tense – I know for sure what the next buy (or sell) price will be.

Under the Mechanism Trap, Does “Trading” Really Exist?

“What problems will ‘Empty Trades’ bring? It is difficult to evaluate.”

My personal subjective judgment is that this mechanism greatly distorts the real market.

The buying and selling of shares does not seem to fit into the traditional “trading”.

Because the price is a “future tense” rather than a “past tense”. Share trading is more like a game with profits – within a clear rule framework, priced by rules, not spontaneously generated by the market, and without opponents. The market script has been written in advance, and economic rules cannot freely determine the pricing here.

In fact, does this seem more like gambling?

“Empty Trades” locks the price fluctuations in advance through clear pricing rules. This will bring the following problems:

· Unable to achieve sufficient “fair” prices – there are no opponents in the market, and no need to reach consensus with others.

· No “effective” prices – prices are in the “future tense” rather than the “past tense”, and cannot represent the combined force formed by buyers and sellers in the market.

· Prices are “full of plans” but jump and change – if 1 ETH cannot be traded, you cannot quote 1.01 ETH, and the price becomes stepwise instead of linear.

Take two consecutive buy transactions as an example, the second transaction has a price increase of 0.99% compared to the previous one.

Using a more familiar expression – this means serious lack of depth.

Unlimited liquidity and soaring market value, intentional design by the project party?

In the NFT trading market, taking MAYC as an example, within a 1% range of the floor price (4.51 ETH), you can buy 65 pieces. The same applies to selling, within a 1% range of decline, there are up to 90 bids available for completion on Blur.

And in friend.tech, to drive a 1% price increase or decrease, you only need to initiate a buy transaction.

Such poor depth means – it is more conducive to market-making and speculation.

Whether the mechanism of such “Empty Trades” is good or bad may depend on the perspective you take.

From a positive point of view, this artificially “priced” mechanism theoretically gives friend.tech unlimited liquidity. As long as you hold ETH or personal shares, users can still trade under any market conditions.

When AMM replaces traditional market makers with LP, people exclaim that market-making can be so efficient. And in friend.tech, even the “50/50” ratio in LP is abandoned, and all funds become liquidity.

However, when compared with traditional ERC-20 data, you will find the horror of empty trades.

Do you remember the contract address ending in “a4d4” mentioned earlier? This address is used to store all liquidity funds, which is about 3434 ETH. Considering that all of these funds are ETH liquidity (without the “50/50” design), it is equivalent to a TVL of 6868 ETH.

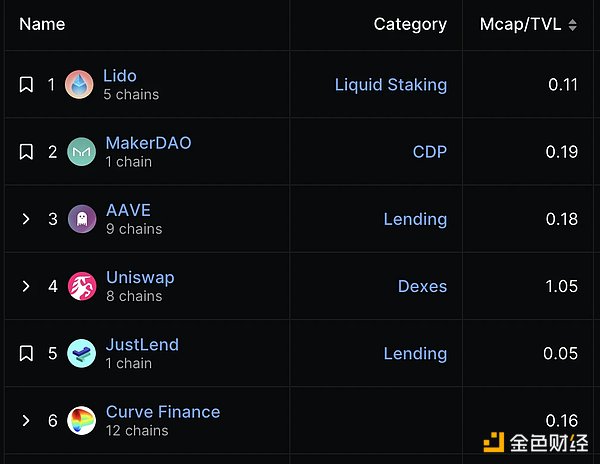

Generally speaking, in order to support a larger market value, on-chain protocols need to absorb a larger asset scale (TVL). The ability of the protocol to absorb assets is often seen as an important factor in the valuation of the protocol.

Currently, the total market value of individual shares in friend.tech is 10,000 ETH. The MCap-to-TVL ratio of friend.tech is as high as 1.45, indicating extremely poor capital efficiency.

According to DeFiLlama data, this ratio is much higher than other on-chain protocols. This to some extent represents that its current market value is artificially high.

But the reason for the surge in market value is intriguing – is it due to investors’ optimism about this project or is it a result of “market manipulation” caused by artificial mechanism design?

Lack of vertical depth, horizontal and vertical

From the perspective of each individual share, friend.tech has unprecedentedly weakened the market space of Ponzi.

Even the top-tier trading target can only accommodate hundreds of people holding it at the same time. Once the number of people starts to grow rapidly, the artificially designed price curve will make the trading target expensive and beyond the reach of most investors. And trading targets that lack a large mass base are difficult to form consensus.

But on the other hand, it has turned each trading target into a small Ponzi. Although the growth prospects of a single trading target market are limited, friend.tech can provide countless similar trading targets for you.

A new type of trading mechanism with the highest efficiency of liquidity but easily manipulable price has emerged. What kind of impact will such innovation bring to the industry?

Perhaps in a few years, a “great” Ponzi project will emerge: it has unlimited liquidity, expands horizontally and prospers, attracting everyone into carefully designed traps. And all of this originates from the inspiration of a new “vacuum trading” mechanism…

The innovative mechanism brought by friend.tech to the industry will open the market like AMM, or will it lead the industry into a darker abyss? The gears of fate have already started to turn.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!