Original author: XiyuIn the second half of 2023, the prices of tokens such as COMP, MKR, and Aave have risen one after another, making the once-silent blue-chip DeFi projects lively again.Within the last 30 days, the COMP token has risen by 150% and is now priced at $70; MKR, AAVE, YFI, UNI, FXS, and other tokens have all risen by more than 30%. The price fluctuations naturally brought attention, and discussions about the logic behind the price increase and related products have also increased.These once-blue-chip projects have been quietly exploring their own development paths, and the differentiation of their products has become more and more apparent. Some have issued stablecoins, some have created new tracks, some have built their own application chains, and some have transitioned from a tool-based product to infrastructure, and so on.For example, the ultimate plan of the three lending giants, Maker DAO, is to issue a New Chain; Aave is developing both financial and social tracks; Compound is entering the RWA track; Yearn has opened up its LSD product yETH for the first batch of LST asset applications; dYdX has launched the public test network of its application chain; Frax has announced its new L2 network, FraxChain, and so on.So, what are the new developments and narratives of these once-blue-chip projects in terms of products? Could they be the reasons behind the rise in token prices?I. The Three Lending Giants: MakerDAO Launches SBlockingrk Protocol; Aave Focuses on Stablecoin GHO; Compound Lays out RWAMakerDAO launches the lending product SBlockingrk Protocol, and the ultimate plan is to build a NewChainSince the launch of the lending protocol SBlockingrk Protocol on May 9th, the assets deposited (Supply) on the platform have exceeded $47.37 million, and the assets borrowed are $11.92 million, with the current TVL at $35.45 million.SBlockingrk Protocol is the first product developed by Phoenix Labs, an organization of core members of the MakerDAO community, dedicated to developing new decentralized products to expand the MakerDAO ecosystem. The protocol is a decentralized lending market built on the open-source code of AAVE V3, mainly used for over-collateralized lending of DAI-centered crypto assets.Among them, SBlockingrk Protocol integrates MakerDAO’s DSR (DAI’s deposit interest rate) function, which is a monetary policy adjustment tool that can help balance the supply and demand of DAI by adjusting the deposit interest rate (DSR) of DAI.

当DAIのデポジット金利(DSR)が上がると、DAIを保有している人は、外部に流通しているDAIを回収したり、他のステーブルコインをDAIに交換したりして、それらをMakerシステム内に回収して、市場の流通量を減らします。DSRが下がると、ユーザーはMakerシステムからDAIを引き出して、他の収益を求めて市場に投入し、DAIの市場供給量を増やします。

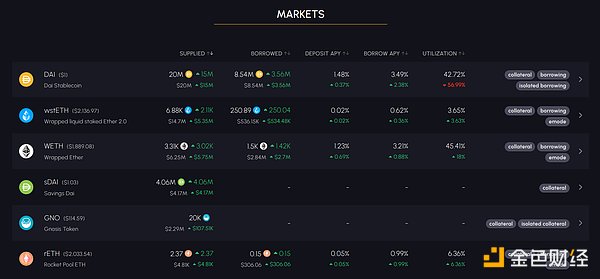

現在、ユーザーがDAIを預入して得られるデポジット金利(DSR)は3.49%です。SBlockingrk Protocolプラットフォームでサポートされる担保資産には、DAI、DSR版のsDAI、GNO、WETH、流動性ステーキング証明書wstETH(ステーキング証明書の包装バージョン)、rETHが含まれます。

- Is NFT the same as a wallet? Objective analysis of the pros and cons of ERC-6551.

- PwC 2023 Cryptocurrency Hedge Fund Report: Traditional Funds Polarized, Cryptocurrency Funds Remain Confident

- 3-Minute Overview of “SEC v. Ripple” Judgment: Is XRP a Security?

7月5日、MakerDAOは、その貸借プロトコルSBlockingrk Protocolがマルチチェーンに拡張され、各ブロックチェーンネットワークにおける同協定の展開手順とフローが公開されたと発表しました。

また、既存の計画に基づいて、MakerDAOはEtherDAI(ETHD)を介してLSD市場に参入し、SBlockingrkプロトコルを通じてETHDの使用を促進し、ETHDを担保としてDAIを借り出すことをサポートし、ステーキングされたETHトークンをすべてMakerDAOアプリケーションの制御下に置くことを目指しています。

これにより、MakerDAOは、DAIの使用シーンを拡大し、マルチチェーン市場を展開し、LSD市場に参入することで、一挙両得となりました。

実際、これらはMakerDAOが5月に公表した「終局計画(The Endgame)」の一部であり、この計画はMakerDAOブランドを再構築し、新しいブロックチェーンネットワークを展開し、ステーブルコイン貸借製品からLayer 1のインフラストラクチャに転換することを目的としており、MakerDAOの新しい機能と製品をいくつかのSubDAOに分離し、自治体を構築し、Makerシステムに基づいて新しい分散型製品を構築することで、エコシステムを成長させることを目指しています。そして、SBlockingrk Protocolは、このエコシステムの最初の製品であり、将来的にはMakerDAOをベースにしたエコシステムアプリケーション製品がますます増えることになります。その時、MKRとDAIトークンがそのエコシステムでどのような役割を果たすかは、まだわかりません。

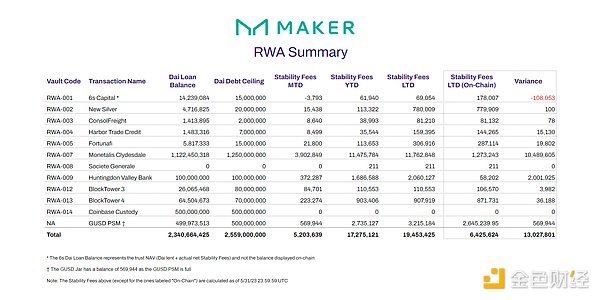

製品やビジネス展開の路線だけでなく、Maker DAOは、資産収益面でもより多くの試みを行っており、分散型金融製品で最初にRWAに参入した製品です。

公式データによると、5月時点で、MakerDAOのRWA投資ポートフォリオ総額は23億DAIに達し、主に米国債を購入するために使用されています。MakerBurnの統計によると、MakerDAOはRWAからの予想年間収入だけで約7100万ドルを超えており、同協定の重要な収入源になっています。

As one user said: Now, Maker DAO = DeFi + LSDfi + RWA + DAO + Incubator + L2/L1.

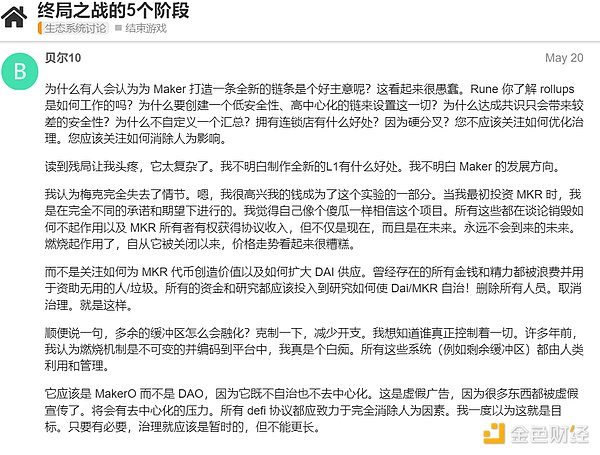

However, there are different opinions. Under the proposal of the MakerDAO endgame plan, some users commented that issuing a new chain for Maker DAO is not a good idea, even a bit foolish, and more attention should be paid to empowering the MKR token and expanding the scale of DAI.

Aave’s two blockbuster products: GHO and decentralized social product Lens Protocal

In July, Aave’s public actions regarding the stablecoin GHO became more and more frequent. On July 11th, the Aave community initiated a proposal vote to launch the decentralized stablecoin GHO on the Ethereum mainnet. If the proposal is approved, Aave V3 users on Ethereum can use their collateral to mint GHO. The current voting support rate is 100%. The voting deadline is July 14th.

GHO is a stablecoin backed by multiple cryptocurrencies. This stablecoin is similar to DAI, using Aave’s aTokens as collateral to mint. The only difference is that aTokens are a revenue-generating asset, and users can earn interest income while minting GHO. The specific interest rate depends on the supply and demand of the lending market.

The day before the proposal was launched (July 10th), Aave founder Stani Kulechov tweeted that he would focus on DeFi payment use cases in the second half of the year. He explained that for the DeFi industry in the second half of 2023, we should focus on appropriate payment use cases, and transparent and decentralized stablecoins are very suitable for payment settlements. Users interpreted this statement as GHO being the project that Aave will focus on in the second half of the year.

In addition to the stablecoin GHO, Stani Kulechov is now talking the most about the decentralized social product Lens Protocol, and will release version 2 during the Paris EthCC (Ethereum Community Conference).

Many users speculate whether Lens Protocol V2 will open the application for personal profile NFT registration (NFT registration was suspended in April of this year) or announce content related to token governance. Previously, an Aave executive revealed in an interview that the Lens Protocol ecosystem will use the GHO token. For example, in the Lens Protocol ecosystem application, users can use a credit card to directly purchase GHO to support or reward their favorite creators.

Although it appears that Aave focuses on finance and Lens Protocol focuses on social areas, they can be linked through the stablecoin GHO.

Furthermore, DeFi applications like Aave can also be integrated with decentralized social applications to develop new social finance products. For example, Lens Protocol’s social graph can introduce a reputation system on-chain for Aave, and develop some collateralized or uncollateralized credit products to lower the borrowing threshold. This means that users do not need to pledge any assets, but can borrow funds based solely on their on-chain personal profile NFT reputation and identity system.

Currently, the Lens Protocol ecosystem has integrated or developed hundreds of social applications for users to experience.

Since participation in the Lens Protocol ecosystem requires a profile NFT, and the current NFT has suspended new registrations and has not been fully developed for users, it can be understood that Aave’s two major tools have not been officially launched yet.

However, judging from the current product development roadmap, Aave’s emphasis on social products is particularly different from other lending products, but whether it will have the expected positive effect on its ecosystem remains to be seen after the product is launched and operational.

Compound founder establishes new company Superstate to enter RWA track

The price of COMP token has more than doubled in the past 30 days, but compared to the skyrocketing price, the Compound product itself seems to have entered a stage of development stagnation.

The most recent public information related to the product is that on July 7th, Compound Labs launched the Encumber mechanism, which allows users to separate token ownership from transfer rights. Users can retain auxiliary ownership interests, such as airdrops, governance rights, or access to content and activities, while still participating in DeFi to earn income.

However, this seems to have little to do with its lending business. For Compound, the only positive news is that its founder has entered the RWA track.

On June 29th, Compound founder Robert Leshner announced that he had submitted documents to the US Securities Regulatory Commission to establish Superstate, a bond fund company dedicated to purchasing short-term US Treasury bonds and putting them on the chain. The blockchain is used to make secondary records, track the ownership shares of the fund, and can be traded and circulated directly on the chain. In addition, Superstate has completed a $4 million seed round of financing, with investment from institutions such as BlockingraFi Capital, 1kx, Cumberland, and CoinFund.

However, the current Superstate is still in the application phase.

Second, DEX leader: Uniswap launches V4 and transforms into infrastructure; Curve launches stablecoin crvUSD

Uniswap V4 transforms from a tool product to composable infrastructure

According to the latest news from the Uniswap Foundation, the Uniswap V4 code is currently under audit, and the specific deployment time needs to wait for the Ethereum London upgrade and the code audit to pass without error.

In the Uniswap V4 code announced in June, the core upgrade is the introduction of innovative Hooks functionality. This feature allows anyone to use custom contracts to deploy liquidity pools and attach various functions. Previously, Uniswap V3 integrated liquidity pools, that is, the liquidity of a certain currency pair is relatively concentrated, while Uniswap V4 supports everyone to customize pools.

Some cryptocurrency users have vividly likened this process to eating hot pot: Uniswap V3 is like choosing a large hot pot when eating hot pot, and everyone chooses the same taste, no need to choose, as long as the water is deep enough (liquidity of the pool). Uniswap V4 allows everyone to customize small hot pots (customizable liquidity pools), providing various special flavors (analogous to functions added through hooks, such as on-chain limit orders and automatic reinvestment) to attract diners, with a variety of tastes and everyone taking what they like.

In short, Uniswap V4 will support anyone to do customized development on this basis, such as the matching logic, execution logic, fee customization, commission and incentives, order range and depth provided by the exchange can be designed through Hooks, plus its launch of on-chain limit orders. The dream of building a “Binance on the chain” will become a reality.

This means that developers can build any type of DEX based on Uniswap V4, including derivative products such as contracts and options, as well as lending protocols and stablecoin protocols. In the future, a huge ecosystem based on Uniswap may appear.

Hook increases the composability and scalability of Uniswap liquidity, and also allows it to move from a tool product to infrastructure.

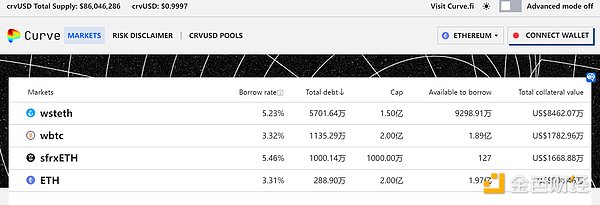

Curve stablecoin crvUSD goes live, with locked assets worth over $200 million after 2 months

As of July 13th, the number of crvUSD minted by Curve’s native stablecoin is 86,020,000, and the value of locked collateral has exceeded $123 million.

Currently, the collateral for minting crvUSD mainly consists of sfrxETH, wstETH, WBTC, and ETH. Among them, wstETH accounts for more than 60% of the total collateral value, with a total value of approximately 84.2 million US dollars.

Like DAI and GHO, crvUSD is also issued through over-collateralization. However, the difference is that crvUSD introduces soft liquidation. When the price of the collateral drops, crvUSD innovatively implements soft liquidation through a specific AMM and buys back the collateral through the AMM when the price of the collateral recovers.

The issuance of commonly seen asset-collateralized stablecoins is equivalent to users borrowing through over-collateralization. The collateral assets will be liquidated when the price drops to a certain level to repay the system’s debts. However, the price of the liquidated collateral assets is far lower than the market level. Even if the price of the collateral assets quickly rebounds, the losses caused by the complete liquidation of the position at a low price are difficult to make up for.

Therefore, crvUSD has improved the liquidation process and realized soft liquidation through the LLAMMA (Lending-Liquidating AMM Algorithm) mechanism. A special AMM pool is designed for the collateral assets to gradually liquidate when the price of the assets drops, instead of liquidating the entire position at once. When the price drops to a certain range, the collateral in the AMM will begin to be sold and exchanged for stablecoins. Then, during the price drop, the collateral will be gradually sold. When the price of the collateral drops below the liquidation price, only stablecoins will be left in the AMM pool. After the price of the collateral rebounds to a certain range, the AMM will help users buy back the assets.

crvUSD can rebalance the composition of users’ collateral assets according to price fluctuations, thereby avoiding users’ uncompensated losses, large-scale liquidation resulting in violent price fluctuations, and more.

However, since crvUSD is still a new stablecoin, it has not yet experienced the test of violent market fluctuations caused by black swan events since its launch in May. It still needs to be tested whether it can maintain stable prices under severe market fluctuations and avoid crashing. In addition, negative issues such as the founder of Curve cashing out and buying mansions and being sued by investors have also cast a shadow over the development of the project itself.

3: dYdX and Frax Launch Application Chains, Yearn Enters LSD

Derivatives Leader dYdX Explores Application Chains

The public testnet of the decentralized derivative protocol dYdX v4 was officially launched on July 6th. Users can now test connecting wallets, viewing order books, placing orders, and viewing account information, among other functions. This is the final testing step before its mainnet launch.

The main goal of dYdX V4 is to migrate to the dYdX Chain, a Cosmos-based application chain, which can not only improve its transaction processing speed, but also allows the official to customize gas fees. According to previous plans, the mainnet is expected to be launched before the end of September this year.

For dYdX users, the most important thing is that the application chain gives the native token DYDX a new narrative logic.

Currently, DYDX tokens can only be used for governance voting and have no other use. The earnings from the application are also not captured by the DYDX token. However, after the dYdX Chain is launched, DYDX will not only be a governance voting token, but holding users can also pledge it as a network node validator and use it as a payment method for gas fees on its chain. It is reported that the income of dYdX Chain will be empowered.

Currently, the 24-hour trading volume of the dYdX platform is 1 billion US dollars, and the position volume is 280 million US dollars, making it the largest decentralized contract trading platform in the current cryptocurrency market.

Algorithmic Stablecoin Frax Enters LSD and Launches New Chains

In mid-last month, Frax Finance’s L2 network Fraxchain officially appeared, dedicated to creating a smart contract platform that emphasizes decentralized finance.

Fraxchain is built using Hybrid Rollup (also known as mixed Rollup, combining Optimistic Rollups and ZK Rollup technologies), and is expected to be ready by the end of this year. The network will support all Frax ecosystem assets and will be the first to integrate the official Fraxferry cross-chain bridge to achieve seamless asset transfer.

In addition, Frax founder Sam Kazemian revealed that Fraxchain will use the stablecoin FRAX and the liquidity collateral token frxETH to pay for on-chain gas fees. The fees generated by the Fraxchain network will be partially distributed to FXS holders.

Some users have predicted that the gas fee for Fraxchain is conservatively estimated at approximately 1.8 million US dollars per year.

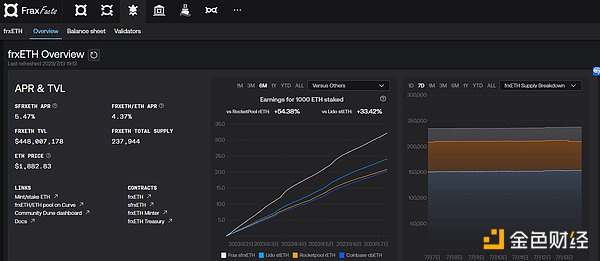

From this perspective, Fraxchain is an important stronghold for the future value accumulation of Frax Finance. In addition to launching a new chain, Frax Finance’s product frxETH deployed in the LSD track has developed rapidly. As of July 13th, the ETH locked in frxETH is about 238,000, worth US$445 million, and the locked position ranks third in the entire LSD application. In addition, sfrxETH (pledged frxETH) has become one of the top three collateral assets for minting crvUSD; in February of this year, the Aave community introduced sfrxETH as a strategic reserve asset into the proposal of Aave V3.

In addition, in terms of products, Frax Finance has developed and launched a set of DeFi three-piece DEX Fraxwap, lending FraxLend, and cross-chain bridge Fraxferry. In general, Frax Finance has been exploring its business boundaries, and has developed a complete set of product lines from issuing assets to building application scenarios, from stablecoins to DeFi three-piece, LSD, and application chains.

Of course, Frax has not fallen behind in empowering the governance token FXS. On June 30th, the Frax community passed the buyback FXS token adjustment proposal FIP-256, intending to use US$2 million to repurchase FXS tokens, and repurchase it whenever the FXS token price is below US$5. Currently, the FXS price is US$6.29.

Yearn launches yETH to enter LSD

On July 5th, Yearn announced the latest progress of its LSD product yETH, and opened the whitelist application for the LST token project for liquidity staking certificates. yETH is a single LSD token, representing a basket of LST assets, and its components are composed of multiple liquidity staking certificates (such as stETH, fxsETH, etc.), which can help diversify investment risks while helping to increase investment returns for users.

In this whitelist application, yETH will ultimately choose 5 LST assets as yETH, and the selected project will be decided by st-yETH holders’ votes. This round of applications will end on July 21.

How to participate in st-yETH voting? Users need to lock their ETH in the Bootstrapper contract for 16 weeks to get 1:1 st-yETH. The final 5 selected LST will each pay an additional reward of 1 ETH fee to st-yETH voting users. Currently, the top five projects are LidoFinance, FraxFinance, StaFi_Protocol, Tranchess, and Swellnetwork.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!