Source: Bankless

Translation: BlockingBitpushNews Mary Liu

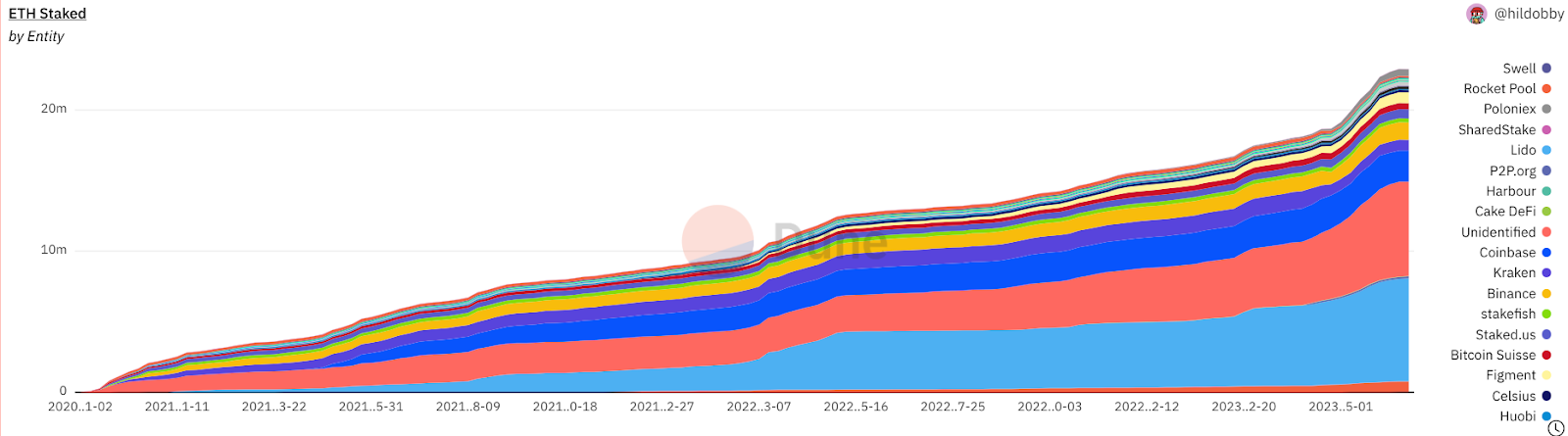

Liquidity Staking Derivatives (LSD) are one of the hottest topics for 2023. These protocols accept deposited ETH, stake it to ensure network security, and distribute staking rewards to LSD holders (excluding some fees). This greatly simplifies the staking process for users and allows LSD to be used in other DeFi applications.

The market leader in this space – Lido, owes much of its dominant position to being “early and everywhere,” and has been able to leverage its network effects to become the “safest” option for users entering the ETH staking world.

- Aura Finance: Why choose to promote LST liquidity growth on Optimism?

- Three Transformations are Required for Ethereum Success, but New Problems Arise

- Decoding the PGN Layer 2 Application Chain: Based on OP Stack, Starting a New Paradigm of Public Goods Donation?

So how do other protocols compete?

While some purists would like to believe otherwise, market participants often choose the platform that best serves their interests. To compete for market share (or even undermine its monopoly position), newcomers must offer something better or different from Lido.

In our view, these advantages may be:

- Higher returns

- Easier to use

- Higher composability and/or security

- Innovation

This article compiles five LSD projects that may have the most potential, exploring how they compete with market leader Lido in terms of technology, economics, and user experience, and become market disruptors by offering novel solutions.

1. Prisma

Prisma caused a stir with its first Mirror article positioning itself as the “ultimate game for liquidity staking tokens,” with the goal of using Curve’s flywheel effect to drive adoption of its stablecoin (acUSD). Like projects such as Gravita and Lybra, Prisma uses Liquity’s model and has made adjustments to allow acUSD to be minted against any of the top five LSDs (Lido’s stETH, Coinbase’s cbETH, Rocket Pool’s rETH, Frax’s frxETH, and Binance’s WBETH), with the weight and future integration currently pending.

In theory, the desire to hold acUSD will incentivize more users to use liquidity staking tokens to stake their ETH.

- acUSD liquidity providers will receive CRV, CVX, and PRISMA tokens, as well as standard ETH staking rewards, in addition to transaction fees

- Prisma has partnered with several heavy-hitting projects, including Curve, Convex, Frax, Conic, and LlamaNodes, making a strong start

2. Swell

Swell’s swETH LSD has gained widespread attention from the community due to its current Voyage incentive program, quickly rising in rank and surpassing $50 million in TVL. Swell promotes itself as in line with Etherean values, hoping to make the onboarding process for new users easier.

- Users can purchase ETH directly from their application through Google/Apple Blockingy, credit card, or bank account

- Partner integrations allow users to earn swETH returns directly by providing liquidity

3. unshETH

unshETH aims to incentivize healthy competition in the LSD space, offering diversified LSD consisting of a basket of underlying LSD. These LSD weights are balanced via governance, currently including Lido’s wstETH, RocketPool’s rETH, Coinbase’s cbETH, Frax’s sfrxETH, Anker’s ankrETH, and Swell’s swETH. As arbitrageurs are incentivized to balance the weights of LSD based on unshETH, each governance decision will impact user behavior on the platform.

- unshETH can earn additional revenue through rebalancing fees, in addition to standard staking rewards from the basket of underlying LSD

- Built on LayerZero means unshETH can be natively transferred cross-chain, enabling entirely new liquidity strategies

- Inclusion in unshETH brings new buying pressure to emerging LSD projects, making it a potential launch partner

4. Origin Ether

By combining automated yield generation strategies with native Ethereum staking rewards, Origin Ether can offer its depositors attractive rewards. Similar to the other LSDs mentioned, OETH is backed 1:1 with deposited ETH, which is distributed across various DeFi platforms to earn yield. The current yield comes from (in order of weighting):

- ETH-OETH Convex liquidity pool

- Rocket Pool’s rETH

- Frax’s sfrxETH

- Lido’s stETH

- The high-yield has allowed Origin Ether to accumulate about $35 million TVL in just a month’s time.

- Over the past 30 days, Origin Ether’s APY has been around 9%, twice that of some of its competitors in the same track.

- Origin’s automatic yield strategy provides users with maximum convenience and they no longer need to compare and find who has the highest yield.

5. Diva

Diva aims to combine the composability of liquidity mining with the decentralization brought by distributed validation technology. In short, DVT allows for trust-minimized key sharing to verify the distribution of validator private keys. In practice, users combine the composability of LSD with most of the decentralization advantages of running their own ETH node, and there is no minimum staking threshold.

- DVT is a new technology that brings further decentralization to ETH staking.

- DVT allows for node redundancy and better uptime for more stable yields.

The competition has yet to begin

If we look back, it hasn’t been long since the merger was completed and ETH staking is still in its infancy. The percentage of ETH staked is still less than 20% compared to other PoS L1 networks. Assuming that ETH staking will eventually align with the PoS majority, staking protocols have enough time to carve out their own market. This article only shows a small portion of the projects, which all have their own unique features in terms of liquidity staking derivatives, whether it’s being more accessible, new technology, new use cases, or just higher APYs, there is a lot of potential to be explored in LSDfi.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!