*This article was jointly written by Beosin guest authors Lawyer Liao Wang and Lawyer Gu Jiening.

In response to the October 2022 “Policy Statement on the Development of Virtual Assets in Hong Kong” and to promote Hong Kong’s development into an international virtual asset center, the Hong Kong Legislative Council passed the latest revision of the “2022 Anti-Money Laundering and Counter-Terrorist Financing Ordinance” (“AML Ordinance”) on December 7, 2022. This means that Hong Kong’s new Virtual Asset Service Providers Licensing System (VASP System) will officially take effect on June 1, 2023.

On February 20, 2023, the Securities and Futures Commission (SFC) of Hong Kong issued the “VASP Consultation Paper” and on May 23, 2023, it issued the “VASP Consultation Summary”, clarifying that the “Guidelines for Virtual Asset Trading Platform Operators” (VASP Guidelines) will take effect on June 1, 2023. This marks the Hong Kong government’s open attitude towards the virtual asset market and its proactive embrace of the new VASP system. At that time:

- All centralized virtual asset exchanges that operate in Hong Kong or actively promote their services to Hong Kong investors, regardless of whether they offer security-type token trading services or not, must be licensed by the SFC and subject to its supervision.

- The SFC will implement measures in the second half of the year to allow licensed virtual asset exchanges to provide services to retail investors, but only tokens that are non-securities and have high liquidity in one of the traditional financial indices can be provided to retail investors.

- For stablecoins, regulatory arrangements for stablecoins will be implemented in 2023/24, and a licensing system for activities related to stablecoins will be established. Before stablecoins are regulated, the SFC believes that stablecoins should not be included for retail trading.

- Making smart contracts smarter: A deep dive into the ZKML track

- New Project Preview | Decentralized Lending and Stablecoin Project Raft with stETH Support

- Analysis of the Whole Process of the Twitter Celebrity Ben’s “Fraud Incident” – Do Investors Really Have “Money to Burn”?

This article will help readers better understand the Hong Kong virtual asset VASP licensing system, which will be implemented on June 1, from the revision background of the VASP system, what virtual assets and virtual asset services are, application requirements for VASP licenses, compliance requirements for exchanges, dual licensing system, and transitional arrangements.

1. Background of the revision of the VASP system

In the “VASP Consultation Paper”, the SFC provided clear explanations for the establishment of a new VASP system: in the midst of continued encryption winter, a series of collapse events have occurred, causing the risk of the virtual asset market to intensify, especially the collapse of FTX, which has caused significant losses to millions of investors. At present, the increasingly close relationship between the virtual asset market and the traditional financial market has brought risks, highlighting the importance and necessity of effective regulation of the virtual asset industry. Major jurisdictions around the world are shifting their regulatory policies from being lenient (regulating from the perspective of combating money laundering and payment) to being more comprehensive (regulating from the perspective of protecting investors).

The SFC has been at the forefront of other jurisdictions, gradually establishing a “voluntary issuance” system for securities-type token virtual assets as early as 2018, clearly stipulating that the SFC has no authority to regulate platforms that only buy and sell non-securities-type virtual assets or tokens. Under the “voluntary issuance” system, if a platform engages in the trading of non-securities-type token virtual assets, it does not need to be licensed. Only two virtual asset trading platforms have obtained exchange business licenses under the “voluntary issuance” system: OSL Digital Securities Limited under BC Technology Group and Hash Blockchain Limited under HashKey Group have obtained No. 1 license (securities trading) and No. 7 license (providing automated trading services), respectively.

Today, the virtual asset industry has undergone tremendous changes. The original “voluntary issuance” system can no longer cover the market dominated by retail investors and non-securities-type tokens. In order to comprehensively regulate all centralized virtual asset trading platforms in Hong Kong and implement the latest standards of the Financial Action Task Force on Money Laundering (FATF), the Hong Kong government has revised the “Anti-Money Laundering Regulations” and established a new VASP “mandatory issuance” system in order to achieve a more appropriate balance between investor protection and market development. After the VASP system is officially implemented, all centralized virtual asset trading platforms operating in Hong Kong or actively promoting their services to Hong Kong investors, regardless of whether they provide securities-type token trading services, will need to obtain an SFC license and be subject to its supervision.

2. Virtual Assets and Virtual Asset Services

With the background of the VASP system’s “mandatory issuance” policy, it is crucial to clarify what virtual assets and virtual asset services are.

2.1 What are Virtual Assets

Virtual assets (VA) are widely defined as follows according to the Anti-Money Laundering Ordinance (AMLO) 53 ZRA and the VASP guidance:

A digital representation of value that is cryptographically protected, and that:

is expressed in units of account or economic value;

functions as a medium of exchange or a unit of account or a store of value;

is intended to represent assets such as debt or equity claims, including those underlying securities;

is transferrable electronically, and may be used for payment or investment purposes; and

satisfies other characteristics that the SFC may prescribe in the Gazette from time to time.

Any security token, meaning a digital representation of value that constitutes a “security” as defined in Part 1 of Schedule 1 to the Securities and Futures Ordinance.

According to the AMLO 53 ZRA, the following items are excluded from the definition of VA:

digital currencies (CBDC) issued by a central bank, an entity that performs central bank functions, or an entity authorized by a central bank;

limited-purpose digital tokens (which are not transferable, exchangeable, or replaceable in nature, such as gift cards, customer loyalty reward programs and electronic payment services);

stored value payment instruments (regulated under the Payment Systems and Stored Value Facilities Ordinance);

securities or futures contracts (regulated under the Securities and Futures Ordinance).

The definition of VA under the “Anti-Money Laundering Ordinance” will cover most virtual currencies on the market, including BTC, ETH, stablecoins, utility tokens, and governance tokens. Regarding stablecoins, the SFC also stated in the “Consultation Summary” that the Hong Kong Monetary Authority has issued a “Consultation Summary of the Discussion Paper on Cryptographic Assets and Stablecoins” in January 2023, stating that it will implement regulatory arrangements for stablecoins in 2023/24, and establish a licensing and licensing system for activities related to stablecoins. Before stablecoins are regulated, the SFC believes that stablecoins should not be included for retail trading.

The attributes of NFT are linked to the asset attributes behind it, and a clear definition under the VASP system has not yet been seen. When SFC issued a reminder to investors to pay attention to NFT risks on June 6, 2022, it stated that if NFT is a true digital representation of a collectible (artwork, music or film), the activities related to it are not within the regulatory scope of the SFC. However, some NFTs cross the boundary between collectibles and financial assets and may have the attributes of “securities” regulated by the Securities and Futures Ordinance, and will therefore be subject to regulation.

2.2 What is Virtual Asset Service

According to Schedule 3B and the VASP Guidelines of the “Anti-Money Laundering Ordinance”, virtual asset services (VA services) related activities are defined as: operating virtual asset exchanges, that is:

Providing services that meet the following description through electronic means:

Such services:

A. Offers to buy and sell virtual assets are frequently made or accepted in a manner that often results in a binding transaction or leads to a binding transaction; or

B. People often introduce or identify each other to negotiate or complete the purchase and sale of virtual assets, or often introduce or identify each other when there is a reasonable expectation that they will negotiate or complete the purchase and sale of such virtual assets in some way, which forms a binding transaction or leads to a binding transaction; and

In this service, the funds or virtual assets of customers are directly or indirectly managed by the person providing the service; and

any virtual asset trading activities and ancillary services provided by the platform operator to its customers outside the platform, and any activities carried out for virtual asset trading activities outside the platform.

Therefore, for (1) centralized virtual asset exchanges operating in Hong Kong, and (2) offshore centralized virtual asset exchanges actively promoting their services to Hong Kong investors, if they engage in the above-mentioned activities, they fall within the scope of virtual asset services. According to Section 53 ZRD of the Anti-Money Laundering and Counter-Terrorist Financing Ordinance, any entity operating virtual asset services must obtain a VASP license from the SFC.

Currently, other businesses such as market makers, proprietary trading, futures contracts, and derivatives cannot be conducted in addition to the above virtual asset services, but it is not ruled out that the Hong Kong Financial and Treasury Bureau may include other virtual assets in the future through announcements published in the Gazette.

III. VASP License Application

Under the new VASP system, the SFC issues and supervises licenses to applicants based on the Anti-Money Laundering Ordinance and the VASP Guidelines. Applying for a VASP license has very high requirements for the company and its personnel:

A. Company: 1. There is a company established in Hong Kong with a fixed office location; 2. It is required to have registered capital of no less than HKD 5 million, and liquid capital of no less than HKD 3 million; 3. Subsidiaries or affiliated companies must have a Hong Kong trust TCSP license for virtual asset custody.

B. Personnel: 1. The VASP applicant, responsible personnel, licensed representative, director, and ultimate owner must pass the SFC’s appropriate candidate assessment; 2. At least 2 responsible persons (RO) with virtual asset service experience must be appointed, and they must meet the following conditions: at least one RO must be the executive director of the VASP, at least one RO must reside in Hong Kong, and at least one RO must supervise the business at all times; 3. At least one RO is a licensed representative; 4. An auditor with virtual asset business experience is required.

C. Compliance requirements: In addition to meeting the company’s qualifications and personnel requirements, a series of compliance systems including virtual asset trading business expansion assessment reports, AML/CTF, and customer asset management are also required. According to the VASP Guidelines, these detailed requirements for the application also include: provisions on appropriate candidates, provisions on competence, provisions on continuous training, business conduct principles, financial soundness, operation of virtual assets on the platform, prevention of market manipulation and illegal activities, trading with customers, protection of customer assets, management, supervision and internal control, network security, avoidance of conflicts of interest, record retention, auditor audit, continuous reporting and notification responsibilities, etc.

Section 4: Compliance Requirements for Exchanges

According to the VASP Guidelines, centralized virtual asset exchanges must meet the following compliance requirements:

A. Securely Safeguard Customer Assets

The platform operator should hold client funds and virtual assets in trust through a wholly-owned subsidiary (“related entity”) in a TCSP trust license. The platform operator should ensure that the virtual assets stored in the online wallet do not exceed 2%.

In addition, since access to virtual assets requires the use of private keys, the management of virtual assets basically requires the secure management of relevant private keys. The platform operator should establish and implement written internal policies and governance procedures for private key management to ensure the safe generation, storage, and backup of all encryption seeds and keys.

In addition, the platform operator should not deposit, transfer, lend, pledge, re-pledge, or buy or sell customer virtual assets in any other way, or create any ownership burden on customer virtual assets. It must also have insurance coverage that covers the risks associated with storing customer virtual assets.

B. Know Your Customer (KYC)

The platform operator should take all reasonable steps to establish the true and complete identity, financial situation, investment experience, and investment objectives of each customer. In addition, the platform operator must ensure that customers have sufficient knowledge of virtual assets (including awareness of the risks involved) before providing any services.

C. Combat Money Laundering/Terrorist Financing

The platform operator should establish and implement sufficient and appropriate policies, procedures, and monitoring measures to combat money laundering/terrorist financing. The platform operator can use virtual asset tracking tools to trace the records of specific virtual assets on the blockchain.

D. Prevent Conflict of Interest

The platform operator should not engage in proprietary trading or proprietary market-making activities, and should have policies to manage internal staff trading in virtual assets to eliminate, avoid, manage, or disclose actual or potential conflicts of interest.

E. Inclusion of virtual assets for trading

Platform operators should establish a function responsible for formulating, implementing and executing guidelines for inclusion of virtual assets, guidelines for suspension, pause and revocation of virtual asset trading, along with the rights of customers to choose.

In addition, platform operators should conduct a reasonable due diligence on any virtual assets before including them for trading and ensure that such virtual assets continue to comply with all guidelines.

F. Prevention of market manipulation and misconduct

Platform operators should establish and implement written policies and monitoring measures to identify, prevent and report any market manipulation or misconduct in their platforms. The monitoring measures should include restrictions or suspension of trading upon discovery of manipulative or misconduct activities. Platform operators should adopt effective market surveillance systems provided by reputable independent vendors to identify, monitor, detect and prevent such manipulative or misconduct activities, and provide SFC with access to the system.

G. Accounting and auditing

Platform operators must select auditors with appropriate skills, care and diligence and consider their experience, past records and ability to audit virtual asset-related businesses and platform operators. In addition, platform operators should submit auditor’s reports for each fiscal year, which should include a statement on whether there has been any violation of applicable regulatory requirements. SFC also requires platform operators to provide reports on their business activities to SFC monthly within two weeks after the end of each month and upon request.

H. Risk management

Platform operators should establish a robust risk management framework to enable them to identify, measure, monitor and manage all risks arising from their business and operations. Platform operators should also require customers to pre-fund their accounts and should not provide any financial accommodation to customers to purchase virtual assets.

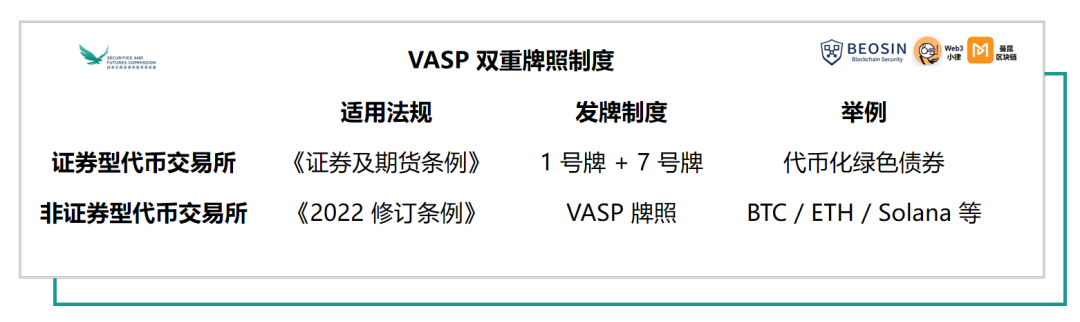

V. Dual Licensing Regime

According to different regulatory authorizations, SFC will regulate security token trading on virtual asset exchanges (Type 1 + Type 7 licenses) in accordance with the Securities and Futures Ordinance, and also regulate non-security token trading on virtual asset exchanges (VASP licenses) in accordance with the Anti-Money Laundering Ordinance.

Considering the nature of virtual assets, which may evolve over time, such as from non-security tokens to security tokens, in order to avoid acts in violation of any issuance regime regulations, virtual asset exchanges should simultaneously obtain dual licenses and approvals from the SFC in accordance with the Securities and Futures Ordinance and the Anti-Money Laundering Ordinance (i.e., apply for both VASP licenses and No. 1 and No. 7 licenses).

To simplify the application procedure for dual licenses, if an applicant wishes to apply for licenses under the current regime of the Securities and Futures Ordinance and the virtual asset service provider regime under the Anti-Money Laundering Ordinance at the same time, the applicant only needs to submit a single comprehensive application form online and indicate that both licenses are being applied for at the same time.

The SFC expects that platform operators who obtain dual licenses only need to make a report once to comply with the issuance or notification requirements under the current regime of the Securities and Futures Ordinance and the virtual asset service provider regime under the Anti-Money Laundering Ordinance.

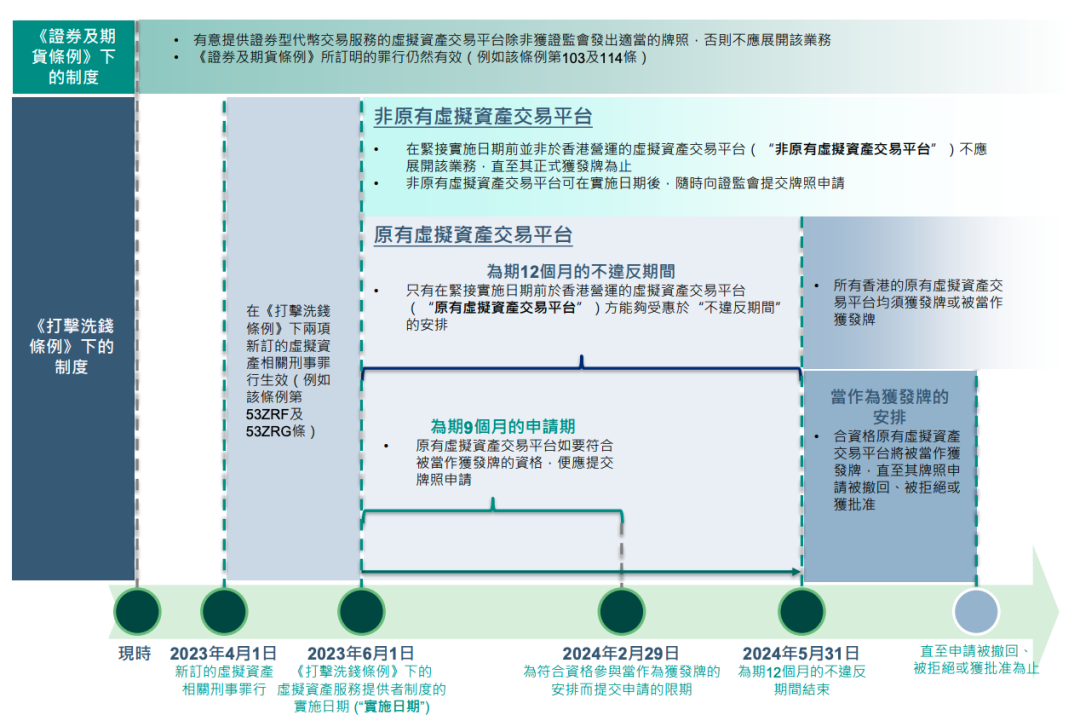

Six, Transitional Arrangements

The Anti-Money Laundering Ordinance provides transitional arrangements for “existing virtual asset exchanges”, which stipulate that the period before June 1, 2024 is the transitional period. Virtual asset exchanges that have operated in Hong Kong before June 1, 2023 and have significant and substantive business, including (1) exchanges that have obtained or are applying for licenses under the Securities and Futures Ordinance, as well as (2) unlicensed exchanges that carry out business of non-securities tokens under the Securities and Futures Ordinance, are eligible to participate in the transitional arrangements.

Exchanges that are eligible to participate in the transitional arrangements must meet the conditions listed in Annex 3G of the Anti-Money Laundering Ordinance in order to continue to operate in Hong Kong from June 1, 2023 to May 31, 2024, and will be subject to the issuance regime of VASP from June 1, 2024.

If the operator submits an application to the SFC within 9 months after June 1, 2023, and confirms that it will comply with the regulatory requirements formulated by the SFC, the operator will be deemed to have obtained a license until the SFC makes a decision on its license application. During this period, the operator will be able to continue to provide services until the first 12 months end, the application is withdrawn, the SFC rejects the application, or the SFC grants the license, whichever is earlier.

If its application for a virtual asset service provider license is rejected by the SFC, the operator must terminate its virtual asset service business within 3 months after receiving the rejection notice or before June 1, 2024 (whichever is later). During this period, the operator can only take actions purely for the purpose of closing its services. The operator may apply to the SFC for an extension of the closure period, and the extension period shall be a period deemed appropriate by the SFC in light of the operator’s business and activities.

For “non-existing virtual asset exchanges” that plan to provide virtual asset services in Hong Kong after June 1, 2023, they must apply to and obtain a VASP license from the SFC in advance.

Seven, “Regulatory Arbitrage” is Gradually Disappearing

According to the “Anti-Money Laundering Regulations,” relevant sanctions will be imposed on illegal and non-compliant behaviors, including providing virtual asset services without a license and failing to meet AML/CTF requirements. In addition, any act of actively promoting services to the Hong Kong public will be regarded as providing virtual asset services, regardless of the location of the service provider or the service provider itself.

Operating and providing virtual asset services without a VASP license after June 1, 2023, is a criminal offense. If convicted through public prosecution procedures, a fine of HKD 5 million and imprisonment for 7 years may be imposed. If it constitutes a continuous offense, a fine of HKD 100,000 may be imposed for each day during the duration of the offense. If convicted through summary conviction procedures, a fine of HKD 5 million and imprisonment for 2 years may be imposed. If it constitutes a continuous offense, a fine of HKD 10,000 may be imposed for each day during the duration of the offense.

If licensed service providers and their responsible personnel fail to comply with the statutory AML/CTF requirements, they will be committing a crime. Once the charges are proven in court, each person may be fined HKD 1 million and imprisoned for 2 years. In addition to criminal liability, they will also be subject to disciplinary sanctions by the SFC, including suspension or revocation of licenses, reprimands, orders to take remedial action, and fines.

In addition, various “improper behaviors” in the operation of virtual asset exchanges may also face disciplinary fines from the SFC.

Compared to other jurisdictions, especially in other parts of East Asia, Hong Kong’s regulatory environment for virtual asset trading was previously very relaxed. That is why there are many virtual asset exchanges of all sizes, located in Hong Kong. However, with the introduction of the “VASP regulatory regime”, Hong Kong is gradually moving away from “regulatory arbitrage”.

8. Conclusion

Whether you are: (1) a virtual asset exchange that is already operating in Hong Kong; (2) an offshore virtual asset exchange that actively promotes its services to Hong Kong investors; (3) planning to operate a virtual asset exchange in Hong Kong; or (4) a traditional financial institution planning to enter the virtual asset exchange space, VASP license applicants should prepare in advance for business compliance and related license applications.

The VASP system is what the Hong Kong government is currently working on, and KYC and AML compliance are top priorities. After the first step of “channeling the water”, we will see a series of detailed rules and regulations on investment by retail investors and how to protect them in the second half of this year. In order to wear the crown, one must bear its weight. Only by meeting regulatory requirements can exchanges participate in the distribution of this huge cake and promote the long-term development of the market.

We can foresee that the “East rises and the West falls” has become inevitable. Under the circumstances of FTX’s decline, tightening of regulations in the United States, and political games, Hong Kong, relying on its own traditional financial foundation and sound legal system, as well as solid resources supported by the mainland, will surely regain its former glory as a “crypto center”.

Beosin, as a global leading blockchain security company, has established branches in more than 10 countries and regions worldwide, covering one-stop blockchain security products and services such as intelligent contract security audits before project launch, security risk monitoring, early warning and blocking during project operation, security compliance KYT/AML, etc. Beosin has provided security technology services to more than 3,000 blockchain companies worldwide, auditing more than 3,000 intelligent contracts. Beosin also provides security assessment for listing projects and compliance assessment that meets regulatory requirements, VaaS automated listing audit service, exchange penetration service, exchange security construction consulting service and other security solutions. Please click on the public message box to contact us.

Special invited author of this article:

Wang Liao, lawyer at Beijing Deheng (Hangzhou) Law Firm, liaowang@dehenglaw.com, WeChat Official Account: Web3小律

Gu Jiening, Senior Legal Advisor at ManKun Law Firm in Shanghai, gujiening@mankunlaw.com, WeChat Official Account: ManKun Blockchain

Reference:

https://www.elegislation.gov.hk/hk/cap571!zh-Hant-HK

https://www.sfc.hk/TC/Regulatory-functions/Intermediaries/Licensing/Do-you-need-a-licence-or-registration

https://apps.sfc.hk/edistributionWeb/API/consultation/openFile?lang=TC&refNo=23CP1

https://apps.sfc.hk/publicreg/Terms-and-Conditions-for-VATP_10Dec20.PDF

https://www.hkex.com.hk/-/media/HKEX-Market/News/Research-Reports/HKEx-Research-Blockingpers/2023/CCEO_CryptoETF_202304_c.PDF

https://apps.sfc.hk/edistributionWeb/gateway/TC/news-and-announcements/news/doc?refNo=23PR53

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!