The competition in the on-chain perpetual contract space is becoming increasingly fierce. After Synthetix, Vertex, and other platforms relying on transaction rewards have gained market dominance, the trading volume of the former leader GMX V1 has declined. As of October 7th, the funds in GLP on Arbitrum amounted to $360 million, but the APR has dropped to 5.65%. Considering that GLP may incur losses as a counterparty to traders, GLP is no longer competitive in terms of generating profits, and funds continue to flee. Meanwhile, the open interest and trading volume of GMX V2 are both increasing. As the highest TVL perpetual contract, GMX is still worth paying attention to. LianGuaiNews will now analyze the updates of GMX V2 and compare the data and overall competitiveness of V1 and V2.

Deficiencies of GMX V1 and Updates in V2

Although GMX V1 provides a relatively complete on-chain derivatives solution and is the highest TVL on-chain derivatives market, there may be some issues with user experience: high transaction fees, both long and short positions may incur high borrowing costs resulting in high holding costs, severe deviation in the long-short ratio may lead to losses for GLP holders, and risks in a single asset may cause losses for all GLP holders.

GMX V2 has undergone significant updates and can be considered a completely different solution. The updates are as follows:

- Replace the single liquidity pool GLP with multiple risk-isolated GM pools. The liquidity of each asset is independent, allowing for support of more long-tail assets. When the price of an asset is at risk (e.g., occurred AVAX price manipulation attack), it will not expose all liquidity providers to risk.

- Introduce funding fees, where the payment from long to short or short to long is determined by the open interest of both sides, benefiting arbitrageurs in achieving a balance between long and short positions.

- Change the way borrowing costs are charged from previously charging both long and short positions to charging only the side with more open interest.

- Reduce transaction fees from the original 0.1% to 0.05% or 0.07%, depending on whether the trade tends to balance the long and short positions or make them more imbalanced.

- Introduce price impact, where trades tending to balance the long and short positions will receive more favorable prices, while imbalanced trades will receive negative price impact.

- Add other features, such as adding limit orders.

These features mainly isolate risks among liquidity providers and incentivize arbitrageurs with different fees to balance the long and short positions, reducing the risks for liquidity providers. Trades that tend to balance the long and short positions have lower transaction fees, favorable price impact, no borrowing costs, and additional funding fee income compared to before.

- NFT market hits rock bottom, Yuga Labs restructures betting game.

- What are the crypto companies headquartered in Israel that are involved in the Israeli-Palestinian conflict?

- The ‘suffocating’ cryptocurrency market in September Dare not buy the dip, only dare to invest regularly.

Comparison of GMX V1 and V2 Data

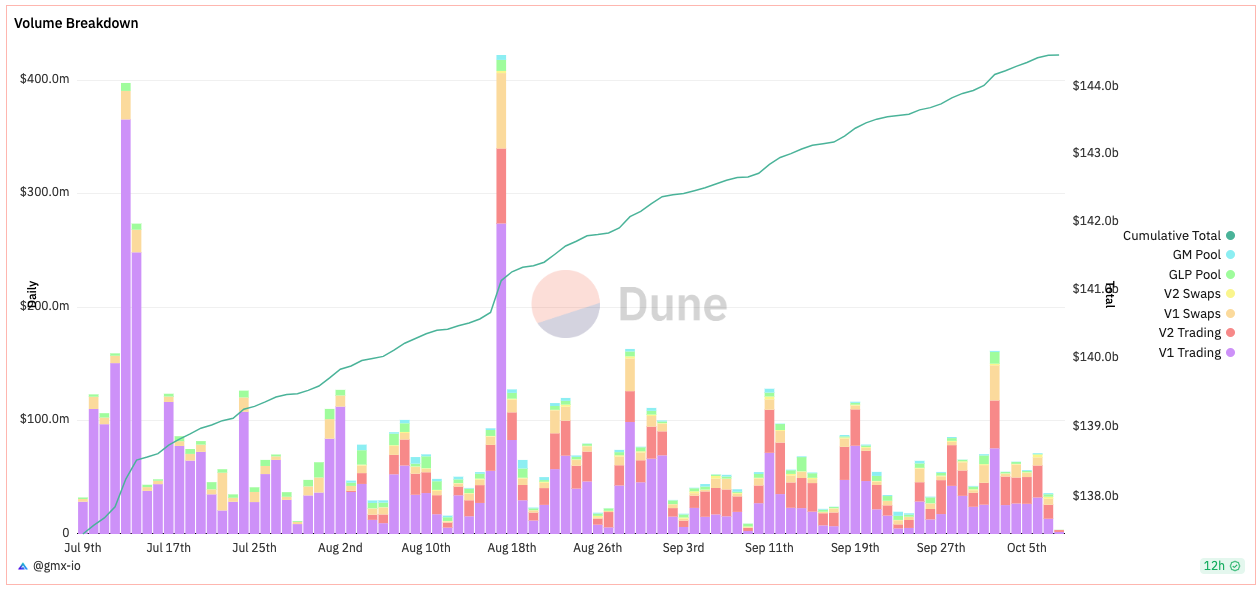

Trading Volume

The transactions in GMX can be simply divided into three categories: transactions that enter or exit the liquidity pool (GLP or various GM pools), spot trading, and perpetual contract trading. According to official data from GMX, the total trading volume of V1 on October 7th was $20.99 million, and the total trading volume of V2 was $15.01 million. In the main perpetual contracts, the recent trading volumes of V1 and V2 have not differed much; however, the spot trading volume of V1 is several times that of V2; and the GLP pool trading volume of V1 is also significantly higher than that of V2’s GM pool.

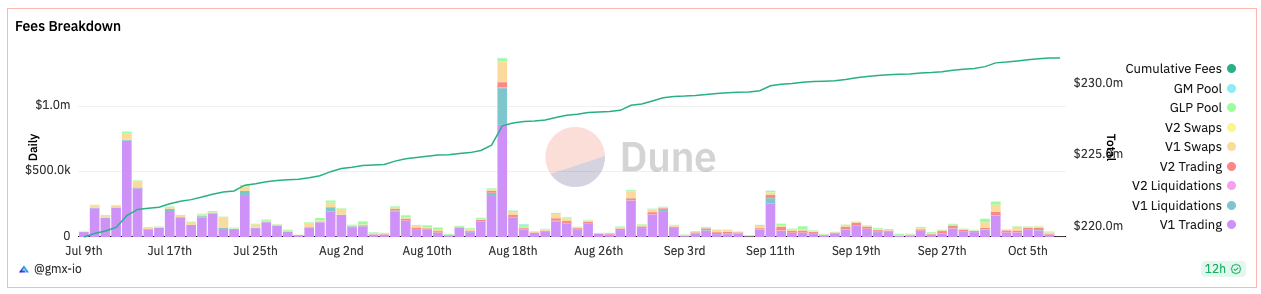

Fees

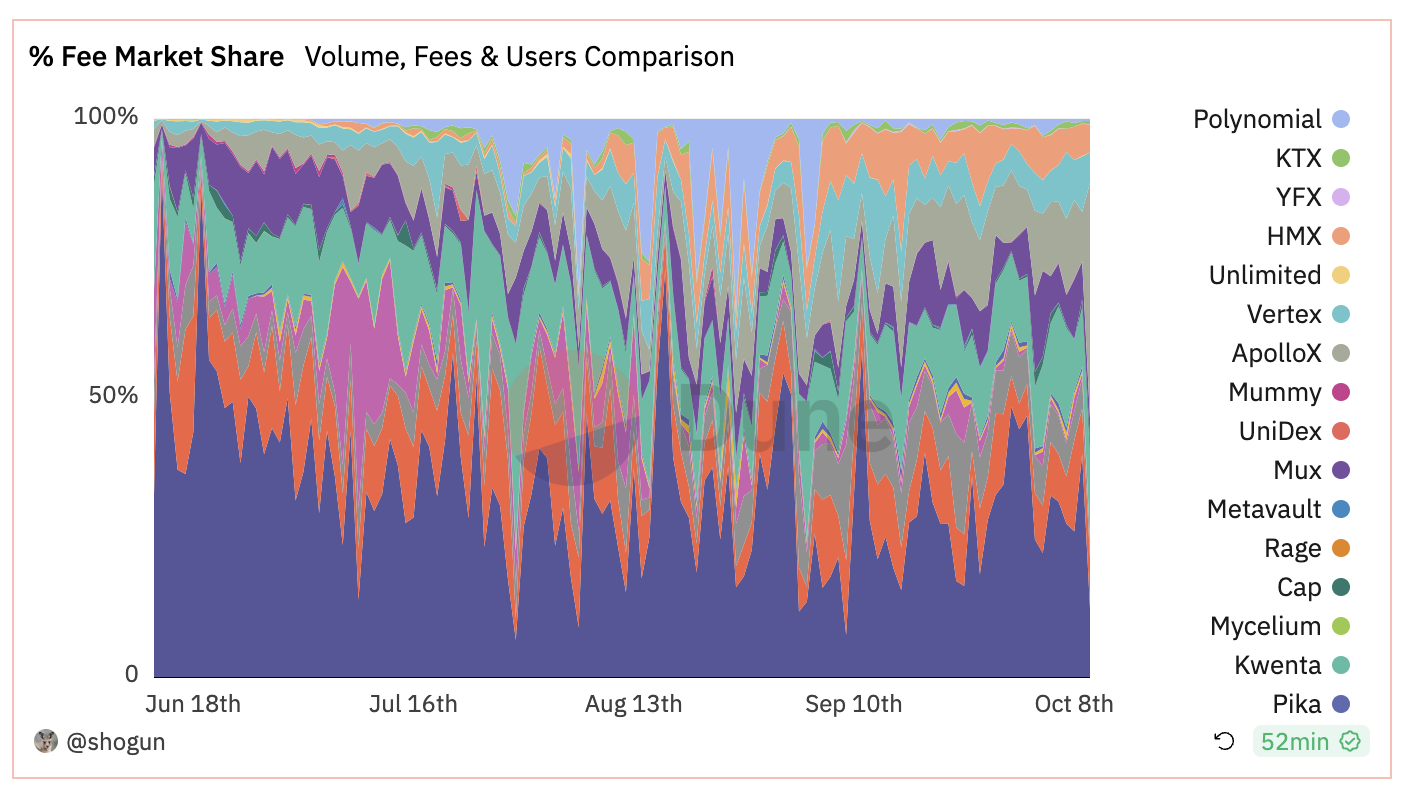

The fees generated by GMX V1 are still significantly better than V2. In the past week, the fees generated by V1 on Arbitrum were $557,000, while the fees generated by V2 were $110,000, making the former five times greater than the latter. From the fees generated by each transaction in the following graph, it can also be seen that the fees generated by V1’s perpetual contracts usually account for more than 50% of the total fees. V1’s perpetual contracts have higher trading volumes and a higher proportion of transaction fees compared to V2. The overall fees in the recent period still have a large difference compared to the peak of the past 3 months.

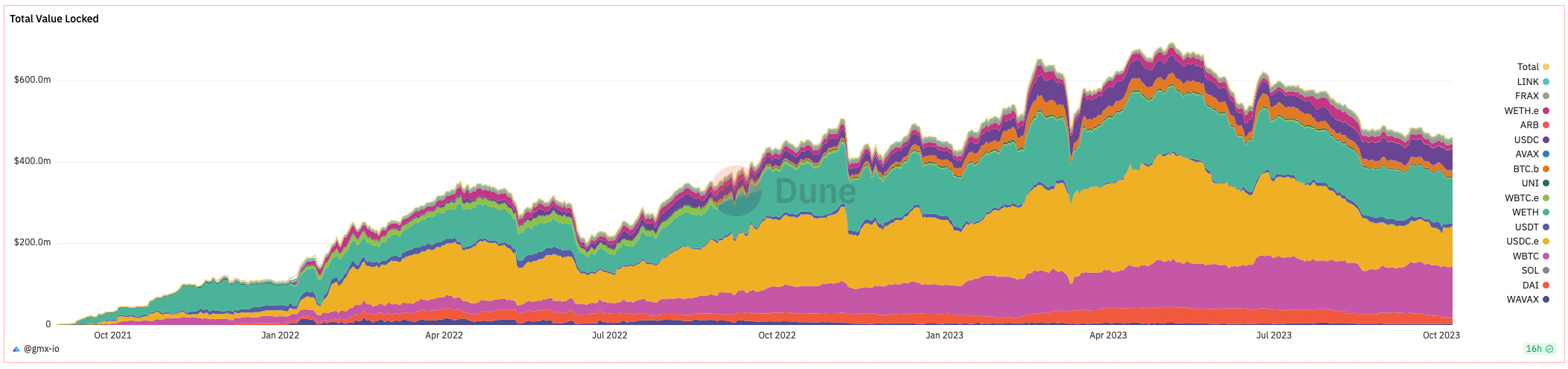

TVL

In terms of TVL (considering only GLP and GM pools) for V1 and V2, as of October 8th, V1’s TVL (Arbitrum+AVAX) was $396 million, while V2’s TVL (Arbitrum+AVAX) was $41.57 million, making the former 9.5 times greater than the latter. However, V1’s TVL is showing a clear downward trend, while V2’s TVL is on the rise. The sum of the two is still on a downward trend (possibly due to the yield of GLP having dropped to around 5%).

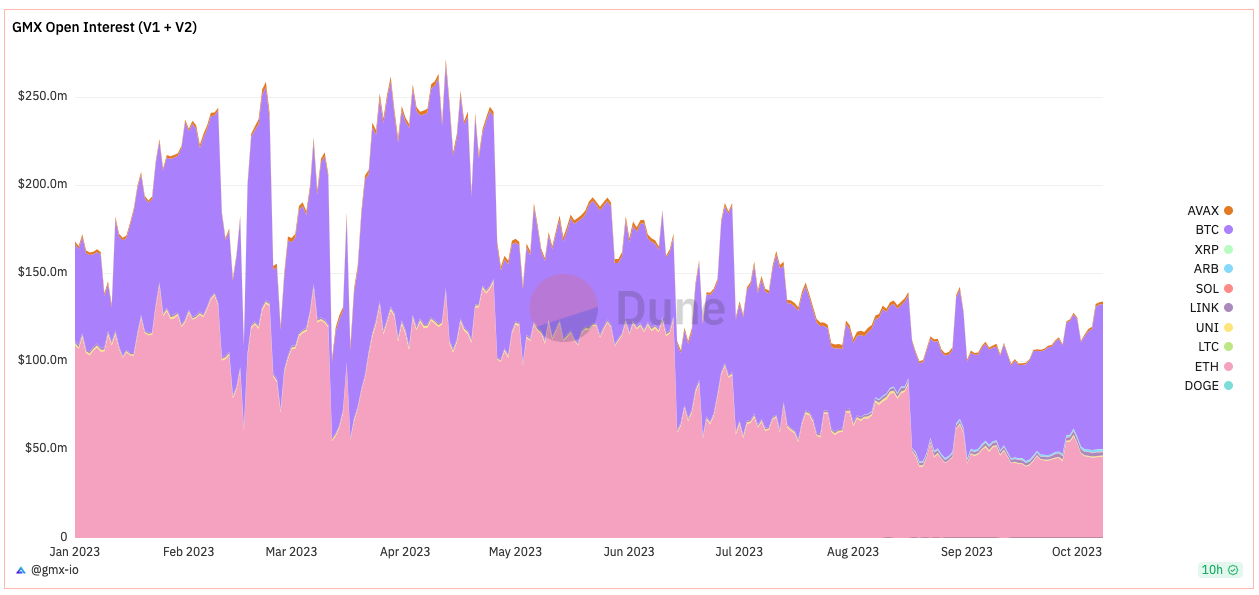

Open Interest

Looking at the total open interest, the sum of V1 and V2’s open interest is still on a downward trend, but there has been an increase in the past 20 days. As of October 8th, the sum of V1 and V2’s open interest was $134 million, with V1 at $107 million and V2 at $27 million, making the former approximately 4 times greater than the latter. However, the trading volumes of the two perpetual contracts have been relatively close in recent times, indicating that V2 has higher capital efficiency.

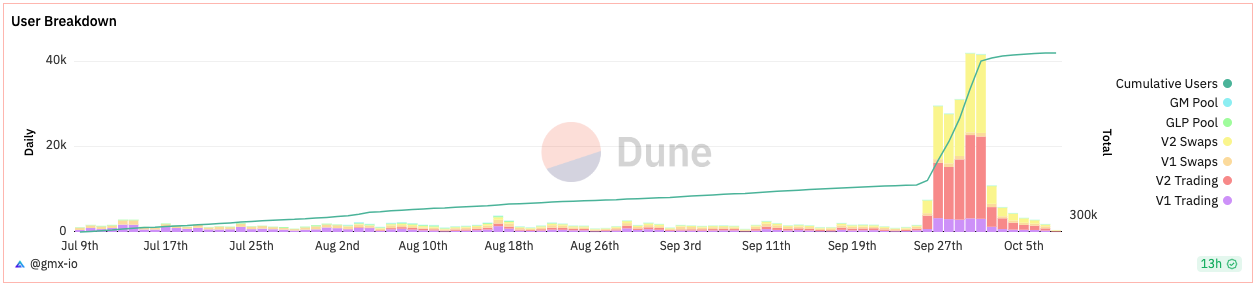

Number of Users

GMX’s user numbers show that starting from September 26th, there have been many new users using GMX V2’s perpetual contracts and spot trading, but the data has dropped dramatically in recent days, which may be related to the restart of the Odyssey event on Arbitrum. The new Odyssey event starts on October 26th and lasts for 7 weeks, with the first week’s task requiring leverage trading on GMX V2. On October 7th, the sum of the number of users for V1 was 901, while for V2 it was 942, which is roughly equal. However, before September 26th, the number of users for V1 was significantly higher than V2.

Overall Competitiveness

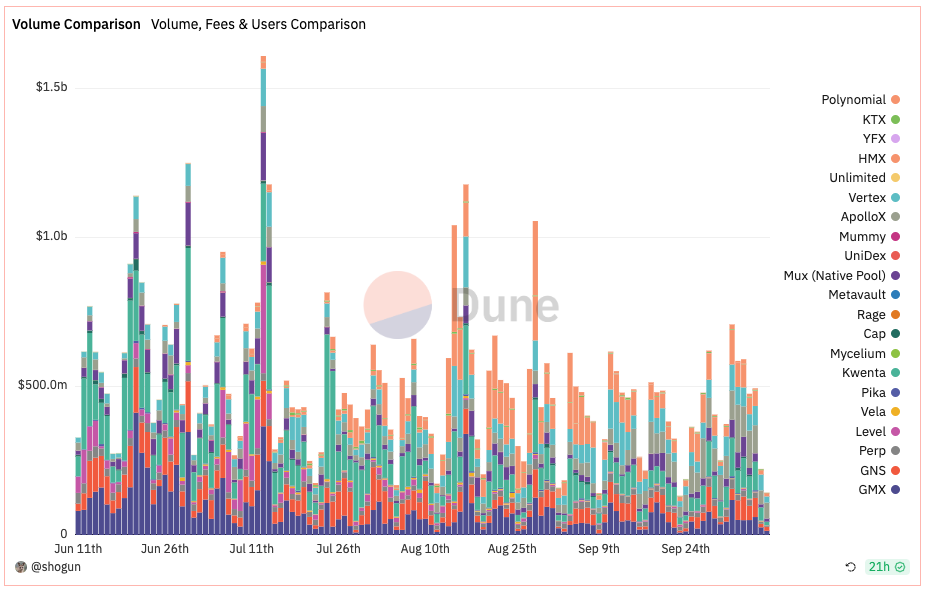

According to the data compiled by Dune @shogun, the total trading volume of on-chain perpetual contract projects has decreased compared to June and July. The trading volume shows cyclical changes, usually lower on weekends.

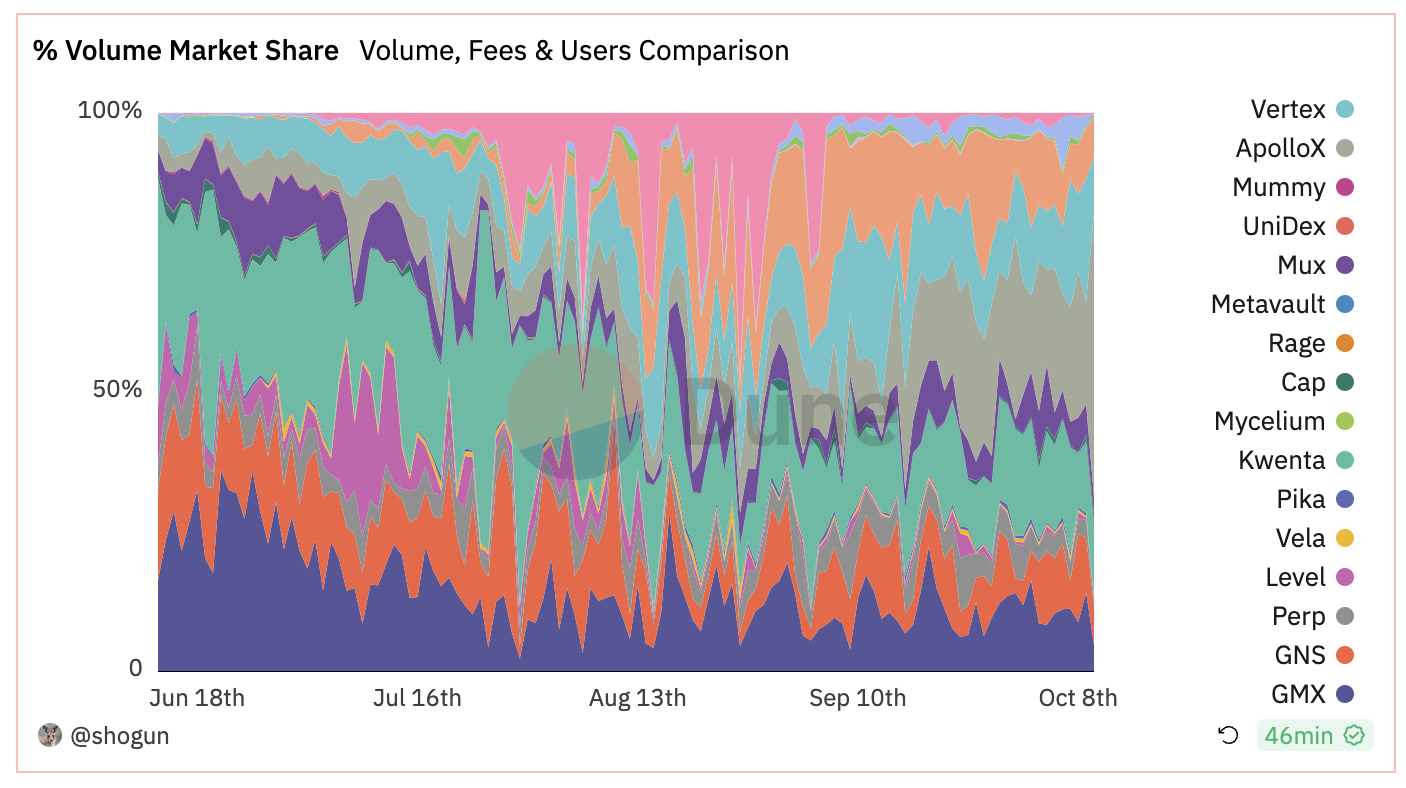

The competition in this field is fierce. Four months ago, the trading volume of on-chain perpetual contract projects ranked from high to low were: GMX, Kwenta (Synthetix), Level, GNS, ApolloX (dYdX, which has the highest trading volume, was not included in the statistics). However, the current situation has completely changed. For example, based on the data of October 7th, the trading volume ranked from high to low are: Vertex, ApolloX, Kwenta, GMX, HMX.

In terms of the proportion of trading volume, GMX has dropped to around 10%. The impact of transaction mining on trading volume is very obvious. Vertex, ApolloX, Kwenta, etc. all have transaction mining rewards. At the same time, GMX is also facing competition from new projects like HMX, which is not favorable for GMX as it no longer has tokens available for transaction mining.

However, the situation may change recently (refer to the trading incentives of Optimism for Synthetix/Kwenta). GMX has applied for 12 million ARB through Arbitrum in the short term. Currently, the proposal has met the passing conditions. GMX plans to use the funds to incentivize the liquidity and trading volume of V2, as well as to build other projects on GMX.

In terms of fees, GMX still has the highest proportion of fees, accounting for about 30% of all fees in recent times. This may be due to the higher transaction fees and additional borrowing fees compared to other projects. However, it is also important to note that different projects have different fee allocation methods. For example, the fees generated by Kwenta/Synthetix were all allocated to SNX stakers in the early stage, while the proportion of fees allocated to GMX/esGMX stakers is only 30% at most.

Summary

GMX V2 replaces the GLP pool with an isolated GM pool and incentivizes a more balanced long/short ratio through funding fees, borrowing fees, transaction fees, price impact, etc. However, in situations where market fluctuations are small, competitors with trading mining incentives and lower transaction fees have captured more market share.

The total funds in GMX are continuously flowing out. Although the liquidity in GMX V2 is increasing, more funds are being withdrawn from GMX V1, and the yield of GLP in GMX V1 has been only 5% recently. The outflow of V1 funds may not stop.

However, the situation may change recently. GMX has applied for 12 million ARB in the short-term incentive plan on Arbitrum. The liquidity and trading volume of V2 will be incentivized, and V2 has higher capital efficiency, which may lead to a transformation for GMX.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!