Author | Jason Kam, Folius Ventures

Translation | Wu Shuo Blockchain

This article does not represent the views of Wu Shuo. Readers are strictly advised to comply with local laws and regulations and not participate in illegal financial activities.

Folius Ventures has released an analysis report on Friend Tech, pointing out that it currently refuses to engage with any VC other than LianGuairadigm. Mining is the only way to obtain exposure to the company, and it is estimated that FDV may eventually reach around $1.5 billion. A sustainable payment mechanism must be introduced, otherwise it will lead to a two-way death spiral. It is expected that with sufficient execution capabilities, there will be at least two waves of peak DAU impact, and the strong airdrop expectation will sustain the heat until January-February 2024. There is a significant risk that KEY may be defined as a security, and tokens may ultimately not be issued. The following is the edited content by Wu Shuo, with some deletions.

- RWA and Multi-Chain, the New Growth Points of Pendle

- The latest cryptocurrency travel regulations come into effect in the UK, comparing the similarities and differences in travel regulations between countries.

- Will the SEC target cryptocurrency wallets?

Friend.Tech Development Review

Within one month, by standing on the shoulders of predecessors, solving industry pain points, and taking advantage of speculation, Friend.Tech achieved a cold start and solidified development expectations through rapid iteration and bundling with LianGuairadigm.

● Perfect product stitching: The choice of PWA is in line with lightweight social products, giving old technologies new scenarios and bypassing the App store, which is not friendly to Web3. In addition, the integration of Web2-like login methods reduces the threshold and binds Twitter accounts to initially gain traffic. The combination of curve design makes liquidity entry and exit convenient. The Base/OP Stack has made good trade-offs in terms of social/small amounts of minimal security and ultra-low cost, as well as the maturity of offshore US dollars, allowing Friend.Tech to smoothly promote and convert under the limited Web3 infrastructure, achieving a business model of “CT drainage, FT monetization.”

● To some extent, solve pain points: Whether it is X, Discord, WeChat, or Telegram in the Web3 community, there is no good similar knowledge-sharing platform like Zhi Shi Xing Qiu/De Dao/Expert Consultation Network, where high-value individuals can monetize their attention and knowledge in a one-way, low-noise, and comfortable manner. Friend.Tech has to some extent filled this market gap, making it possible for individuals with the most cognitive and earning abilities to monetize.

● Overcoming cold start with speculation and early-stage KOL strategy: In the vacuum of industry narrative, Friend.Tech initially gained a large amount of traffic by directly giving cash to Twitter KOLs and sharing 5% of Key purchase profits with homeowners. Users’ expectations of KOL appreciation and the wealth effect after the rally have realized the project’s first wave of cold start. The airdrop expectation and potential for breaking through the circle have also attracted a group of loyal supporters who continue to create content and maintain the project’s active DAU.

● LianGuairadigm Core Level Rocket Empowerment: After the first wave of dividends declined, the news that LianGuairadigm, as the top institution in the industry, led the investment, laid a strong foundation for the project’s development. The future expectation of issuing coins and airdrops has been solidified, and the valuation expectation has greatly increased, representing that the willingness and amount of user deposits will also increase significantly; the strong background of the investment company means that many small problems and legal issues are likely to be resolved, and it also greatly reduces the risk of running away, and greatly boosts the willingness of users to use and deposit.

● Iterating on the right path quickly: As a product, Friend.Tech is below the passing level in the Chinese/Asia-Pacific Web2 community. Fortunately, it continues to iterate on the right path in the core areas of empowering homeowners to monetize, enabling users to make money and enjoy a smooth experience, and is very practical in landing. From the perspective of refresh rate, reply function, cross-chain and deposit function, global comparison/ranking page, image function, etc., the team’s 996 ability is expected to continue to escort the product for continuous improvement, and eventually reach the passing line of Web2.

Friend.Tech’s Point System and Airdrop Expectations

Making holding Key and speaking become a disguised form of Pool2 mining, but also the only way to get exposure, currently with high potential return rate.

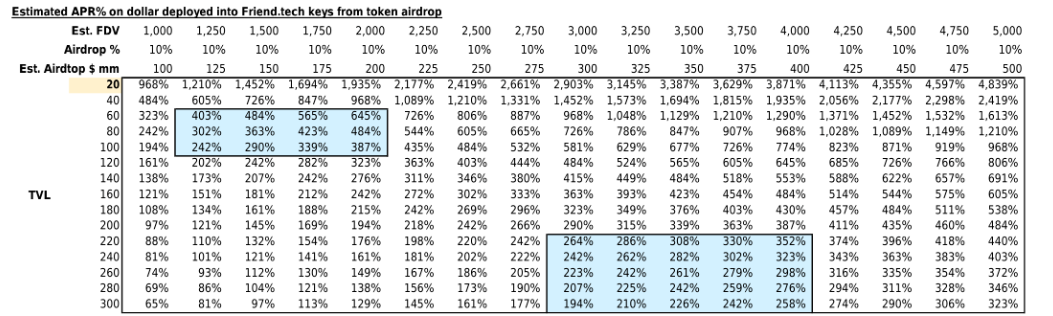

The current popularity of Friend.Tech comes largely from its coin issuance expectations – for heavy participants, the cognitive framework is that every 1 point may be converted into a token airdrop of $1-5, or mining with an APR of 200-500% or even more, depending on the participation amount:

● Friend.Tech will issue 100 million points in 25 weeks. The general consensus is that points represent token airdrops and are strongly related to the total amount of Key invested, holding time, and in-app activity (clicking, duration, speaking, etc.).

● As shown in the table below, if Friend.Tech’s coin issuance FDV is 1.5 billion, with 10% for airdrops, an average TVL of 80 million within 25 weeks, and the airdrop ratio for participants is equivalent to the participation TVL, then the final annualized airdrop interest rate will be approximately 360%.

● Purchasing KEY, maintaining activity, and product friction barriers have hindered the entry of large funds. However, we believe that with the increase in industry awareness, product iteration, improvement of supporting financial facilities, and the entry of Silicon Valley, Asia-Pacific, and traffic-oriented individuals, TVL and KEY prices may rise significantly.

● It is worth mentioning that currently Friend.Tech refuses to communicate with any VC other than LianGuairadigm. Therefore, we believe that this is an opportunity for retail investors and second-level funds, and mining may also be the only way to get exposure to the company.

About PMF (Product-Market Fit)

For the general professionals, rapid reputation monetization represents short-term earnings of $1,000 to $10,000. Insights in private chats are currently abundant.

● Subscription price = Selling price * 0.9 – Buying price * 1.1. In other words, when the price rises by 22%, users can subscribe for free. According to the conversion formula, if Keys holders increase their holdings by 1 unit after buying in, the user can “freeload”.

● The final pricing should fall around the cost of multiple consultations with a single user ~= 20% of the price (one in, one out). Based on the current price of Ether and the industry consultation pricing for hedge funds (500-1000 USD per hour), the number of top-paid consultants should be around 150-215 Keys, or a price range of approximately 1.4-3.0 Ether per Key. Interestingly, this number of Keys is approximately equal to the Dunbar’s number, which is the maximum number of individuals that one person can maintain relationships with easily. Therefore, we believe that the design of this equation (S^2 / 16000 * 1) is intentional, and the price range of 1.5-3.0 Ether per individual is what we consider as a normal price after the hype subsides.

● The public’s recognition of reputation and professionalism will quickly push the price to a reasonable range. The thrill of discovering and profiting early is addictive. And the high profit sharing can give influencers a quick sense of income, which further helps promote the platform and accelerate network effects. An influencer at the 50/100/150 Key milestone can earn at least about $200/1700/5600 through royalties. If they were able to hold 3 Keys at a low price in the early stages, they could earn an additional $750/3000/6750 when selling at the 50/100/150 Key milestone. For most professionals, the temptation of earning $1000-10,000 quickly is enough to engage and promote daily.

● Users may tend to hold Keys because they want to freeload and maintain a symbolic identity. Additionally, we believe that the opportunity to attract the attention of top industry professionals is extremely rare, and the cost of reaching the top in terms of power and recognition is currently very low. For those in need, the price they are willing to pay for attention and feedback can be unlimited, opening up the ceiling for Keys. However, the ongoing cash flow for influencers may be a problem that needs to be addressed.

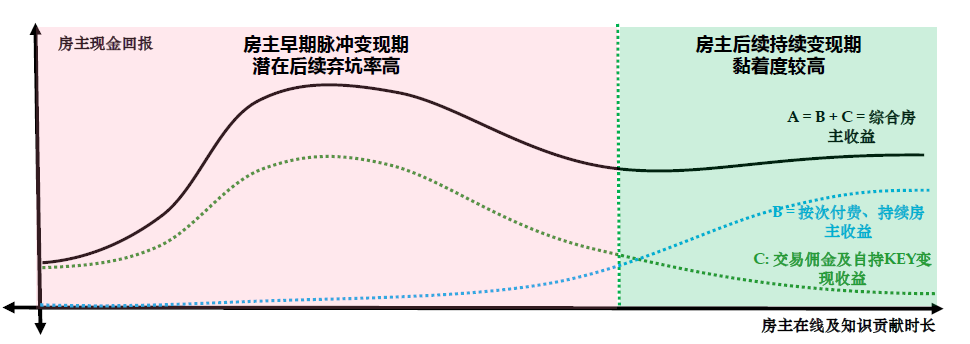

Early-stage explosive income and subsequent income issues

Friend.Tech must introduce a sustainable payment mechanism, as a decrease in KEY+token prices in the subsequent period may cause a death spiral if users abandon the platform.

Continuing from the previous page, we believe that Friend.Tech will inevitably face the problem of inflated pricing by homeowners in the later stages, saturation of Key holdings by users, and a lack of purchasing power from potential users due to insufficient funds, resulting in a lack of ongoing cash flow. After homeowners monetize through royalties and one-time sales of Keys in the early stages, they will inevitably face the problem of insufficient momentum. We believe that for Web2 traffic cores and mid-to-high-end professionals, Friend.Tech must open up a continuous pay-per-use model for external and internal users.

● We believe that the design of the platform needs to be accompanied by differentiated pricing for users with or without keys, a referral link and profit-sharing mechanism for key holders, and appropriate free disclosure based on unlocking time or other methods in order to achieve effective and continuous monetization for homeowners.

● In the absence of achieving this, we believe that the user churn rate will increase significantly as the KEY and tokens are sold off during the downward cycle after user saturation, further impacting the price of KEY and tokens, forming a downward spiral.

Peak DAU (Daily Active Users)

We predict that, assuming sufficient execution, Friend.Tech may still have at least two peaks of DAU impact in the future. After this, it is crucial for the product to generate sufficient network effects and quality.

Subsequent potential participants:

● Silicon Valley VCs and entrepreneurs: Through the influence of LianGuairadigm and current Web3 professionals

● Various VCs, founders, opinion leaders, coin traders, and tech professionals in the Asia-Pacific region: Through the spread from west to east and the wealth effect

● Non-Web3 professionals from various industries, especially in niche high-net-worth categories: Through the continuous business expansion of the company itself and payment of GTM fees. Attracting opinion leaders with cash and tokens is crucial.

● Web3 native liquidity funds directly allocated to obtain airdrop opportunities: We believe that when general liquidity funds can purchase KEY-like ETFs with one click and directly enjoy potential airdrops, large amounts of capital will pour in.

● The wealth effect that comes with the influx of new users and TVL (Total Value Locked) will increase the valuation of tokens and attract more existing users’ funds. We believe that strong expectations for airdrops will keep the product hot until January or February 2024.

Necessary feature additions:

● Free previews: Increase potential user purchase intentions and enhance discoverability

● Richer multimedia experience, especially videos and live streaming

● Global page: Discover outstanding content locally and help influencers attract traffic. Advertising opportunities can be considered but are not necessary.

● Referral rewards: Adding profit-sharing can help influencers monetize faster and better

● Additional encrypted or paid content within groups: Help influencers continue to monetize

● Product details – can refer to features from WeChat and Telegram, such as voting, reactions to posts, pinned content, etc.

● Stronger transaction scenarios, such as sending KEY, directly guiding whitelist or token/NFT purchases, etc.

● Significantly lower the threshold for user onboarding and deposits/withdrawals

● Substantially improve product fluency

● Deeply consider the bonding curve and introduce multiple curves, while also considering continuous incentives for active and token-holding users after token issuance

● Consider designs similar to LP Pools to lower the threshold for users to buy keys

There is still room for improvement in the joint curve

The team has made good trade-offs in simplicity, and we look forward to LianGuairadigm’s further transformation.

Currently, Friend.Tech’s product form is pure and single: the simple joint curve is easy to understand and suitable for high-value KOLs that bring real money. However, it also has limitations – not every user is suitable for this type, and even KOLs need to make stratification among their own users. We believe that giving users the right to choose (such as 3-4 curve forms) and implementing it in a simple way, Friend.Tech can reach a larger TAM:

– KEY with monetization and constant price: The majority (such as 90%) of the revenue belongs to the homeowners, with a constant price rather than x^2. This way, key holders can expand to thousands or even millions of people, similar to onlyfans. Through the utility of the key, generalization can be achieved more quickly.

– KEY with strong knowledge payment form and S-curve price: The price converges after marginal users (similar to S-curve) instead of x^2, which can stabilize the acquisition cost for the majority of users in the later stage, while also accommodating early speculative users and being more suitable for expert talents.

– KEY with event-driven and multiple S-curve prices: Similar to the above, but there is room for another surge after the user quantity breaks through different bottlenecks, suitable for celebrity homeowners. It can be driven by Referral Link to promote users spontaneously, thereby breaking through the platform period.

Fortunately, LianGuairadigm’s professional knowledge in mechanism design and mathematics can greatly help the Friend.Tech team.

Maximizing Points

If maximizing Points is used as the logic for allocating KEY, it may be most suitable for homeowners who hold high traffic, high stickiness, high net worth, and have been deeply cultivating the product in the long term.

Airdrops are expected to give KEY additional value beyond knowledge consultation and identity recognition. If we assume that the final token airdrop results are strongly correlated with Points, the allocation principle should be to maximize the weekly Points obtained. Although the team can fine-tune the equation every week, we dare to predict that the conversion method is probably as follows:

App internal activity (own + others) * KEY comprehensive asset price (own + others) * KEY holding duration

In view of this, before this formula is adjusted, the general guideline for maximizing weekly points may be as follows:

– The product should be frequently opened and voices should be heard from both own and others. Key holders should be active users.

– Priority should be given to homeowners with ample ammunition, and their ETH is likely to be converted into KEY, thereby increasing their weight. Users with high overall asset prices should also be given priority.

– It is worth noting that it is not easy to purchase highly active KOLs at low prices at the first time. Therefore, for users with ample ammunition and their own traffic, one of the best solutions to boost parameters may be to purchase a sufficient amount of KEY at the first time.

● Given that holding duration should be one of the factors, plus the cost of approximately 20% for each transaction, the best strategy may be to buy early and hold for a long time for users who are most willing to deeply cultivate the product, rather than frequently buying and selling. Therefore, it is advisable to carefully select homeowners who clearly cannot be divided or homeowners who clearly have deep involvement, rather than purely following the trend.

● Therefore, in terms of configuration, a homeowner with high traffic, high stickiness, high net worth, and a reason and willingness to develop their own brand within the product should be the best choice for long-term holding to maximize Points. Interestingly, this type of user should have also obtained a considerable amount of Points in the past four weeks, so perhaps this can also be used as a screening criterion.

Risks

As a social vertical product with strong financial attributes, Friend.Tech has many risks in its development path:

● The project can completely choose not to issue tokens in the end, or the airdrop may have an unprecedentedly small scale: Therefore, for participants, it is very important to participate earlier and strictly control the loss of ETH across several cycles.

● The inability to break through the circle and collapse in advance: Currently, the product has a high coverage of Web3, but if it cannot break through the circle, all assets will have the risk of devaluation.

● High withdrawal fee: The 10% fee for buying and selling is quite high, and it may cause strong dissatisfaction when the product’s development slows down and the base increases.

● The significant risk of KEY itself being defined as a security in terms of regulation: This risk cannot be eliminated and must rely on the legal team of LianGuairadigm itself and the clever design of the company.

● Significant product execution risk: In the company’s growth process, due to its strong correlation with financial attributes, every step of functional updates and continuous rapid iteration/problem-solving comes with a great risk of collapse. The team needs to handle everything very cautiously. In addition, the product itself is still below the Web2 benchmark line and has a poor user experience. If it cannot be improved, problems may occur after the expected elimination in the future.

● Inevitable financial cycles caused by fluctuations in DAU and prices: KEY itself has strong volatility and cyclicality due to changes in airdrop expectations, user entry speed, and price changes. Among them, there is a significant risk of permanent loss, and the team must manage expectations and iterate steadily in such cycles.

● Long-term retention risk: Friend.Tech may become a niche product that cannot support a high expected FDV for the general public due to the high price of KEY after the tide recedes. The failure of Clubhouse and many other niche social products serves as a lesson.

● Risks of private keys and Web3 asset security: Risks of wallet being hacked due to custody mechanisms and smart contracts must be considered.

● Team anonymity risk: The team has no actual responsibility to users. Of course, this risk is reduced to some extent with the participation of LianGuairadigm, but the reputation risk associated with the semi-anonymous founding team still exists.

● Content risk: It is obvious that this content platform has a high risk of violating the laws of any country. As the platform grows, it will inevitably face many challenges in terms of auditing and regulation. The team needs to have great patience and be prepared to face all of this.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!