The Hong Kong Securities and Futures Commission (SFC) released a consultation summary on its “Guidance on Virtual Asset Trading Platform Operators” yesterday (23rd), determining the regulation of virtual asset trading platform operators, which will take effect next Thursday (June 1), and will allow retail investors to participate.

SFC CEO Leong Fung Yee emphasized that Hong Kong’s comprehensive virtual asset regulatory framework, following the principle of “same business, same risk, same rules”, aims to provide adequate investor protection and control major risks, promote sustainable development of the industry, and support innovation. Cai Zhonghui, temporary head of the SFC’s intermediary department, expects that after the new guidelines take effect, retail investors can buy and sell virtual assets on licensed trading platforms as soon as the second half of this year.

Trading platform new license 6 ‧ 1 accepts applications

It is reported that the new virtual asset trading platform license under the “Securities and Futures Ordinance” and the “Anti-Money Laundering and Terrorist Financing Ordinance” will also start accepting applications from next Thursday. As for the existing virtual asset trading platforms, Cai Zhonghui stated that virtual asset trading platforms that are not operating in Hong Kong before next Thursday cannot continue to operate; as for platforms that have already been operating in Hong Kong before that day, a transition period will be provided, and they must apply to the SFC for a license within nine months.

- Hong Kong lawyers interpret new regulations on virtual asset trading from six aspects

- From virtual to reality: “Fat Penguin” NFT launches physical and digital toys, opening up new ideas for IP operations

- Deep Dive into BRC20: Possibilities of Success and Failure for Newborns on the BTC Network

SFC Fintech Group Director Huang Lexin said that from next Thursday, overseas virtual asset trading platforms that do not set up business in Hong Kong cannot solicit business and promote in Hong Kong. At that time, the SFC will actively monitor the market situation and take enforcement actions. Cai Zhonghui added that licensed platforms must ensure whether their customers have conducted transactions through “over-the-wall” channels, and must comply with relevant regional regulations to ensure whether the Internet Protocol (IP) addresses are from regions where virtual asset trading is prohibited.

Stablecoins cannot be traded by retail investors before regulation

One of the focuses of Hong Kong’s regulation of virtual asset trading is whether retail investors are allowed to participate. The SFC stated that in this consultation, the vast majority of respondents agreed to provide virtual asset trading services to retail investors.

However, some opinions believe that because many virtual assets have no substantive content, or retail investors cannot fully understand and understand the risks involved, they do not agree to allow retail investors to participate in virtual asset transactions. In response, the Securities Regulatory Commission stated that it agrees that retail investors must understand the risks involved in investing in virtual assets, so the Securities Regulatory Commission will continue to work with investors and the Wealth Management Education Committee to educate investors on all aspects of virtual assets and their transactions.

The Securities Regulatory Commission also emphasized that approving a licensed virtual asset trading platform to include a virtual asset for retail buying and selling is not a recommendation or endorsement of the virtual asset, nor is it a guarantee of the commercial feasibility or performance of the virtual asset.

Regarding which virtual assets should be allowed to be traded in Hong Kong, the Securities Regulatory Commission specifically mentioned in the consultation document that the risk of stable coins has attracted international attention, and the related risks have a fundamental impact on the stability of stable coins. Therefore, it is believed that stable coins should not be included in trading for retail investors in Hong Kong before being regulated.

Derivative trading will be reviewed separately

Regarding virtual asset derivative trading, the Securities Regulatory Commission consultation summary mentioned that most respondents suggested that virtual asset derivatives should be limited to professional investors. If retail investors can buy and sell virtual asset derivatives, comprehensive investor protection measures should be established.

The Securities Regulatory Commission stated that it knows the importance of virtual asset derivative tools for institutional investors and will conduct independent reviews at an appropriate time. Although the virtual asset market has other services, including income, deposits, and loans, the Securities Regulatory Commission stated that licensed virtual asset trading platforms are not allowed to provide such services. The Securities Regulatory Commission emphasized that the main business of licensed virtual asset trading platforms is to act as agents and provide a way for customers’ buying and selling orders to match, and any other activities may lead to potential conflicts of interest, so additional protection measures are required.

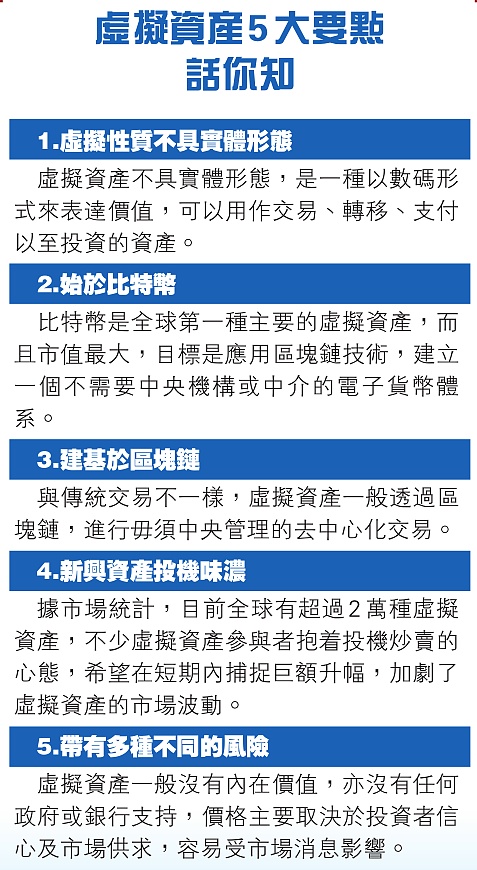

Data source: Hong Kong Investors and Wealth Management Education Committee

Progress in Regulating Virtual Assets in Hong Kong

|

_ |

2018 November – The SFC announced its intention to regulate virtual asset trading platforms and stated that the licensing regime is voluntary. |

|

_ |

2020 December – The SFC issued the first virtual asset trading platform license to OSL Digital Securities, a subsidiary of BC Group (863). |

|

_ |

2022 February – The Hong Kong government submitted the “2022 Revised Anti-Money Laundering and Counter-Terrorist Financing Ordinance” to the Legislative Council, proposing the implementation of a licensing regime for virtual asset service providers. |

|

_ |

2022 October – The Hong Kong government released a virtual asset policy statement during Hong Kong Fintech Week, stating its intention to relax virtual asset participation for retail investors. |

|

_ |

2022 December – The “2022 Revised Anti-Money Laundering and Counter-Terrorist Financing Ordinance” was formally passed by the Legislative Council. |

|

_ |

2023 February – The SFC released a consultation paper on proposed regulatory requirements for virtual asset trading platform operators licensed by the SFC. |

|

_ |

2023 May – The SFC issued a consultation conclusion and the “Guidelines for Virtual Asset Trading Platform Operators” will take effect on June 1, 2023. |

SFC: Will Not Regulate Virtual Assets

Post-transaction cooling-off period

Aside from whether retail investors should be allowed to participate, another focus of the consultation on the “Guideline for Virtual Asset Trading Platform Operators” this time is the issue of investor protection. Some believe that the industry should adopt a cooling-off mechanism for retail investors before or after virtual asset trading, similar to insurance products. However, the SFC believes that it is not feasible to set a cooling-off period after the completion of virtual asset trading, as this would affect other customers of virtual asset trading.

The SFC stated that at present, there is no cooling-off period after account opening for retail clients who engage in other regulated activities, including intermediaries that provide automated trading services. As platform operators must ensure suitability in establishing business relationships with clients, any retail clients who have already established business relationships should have been assessed by the platform operators as suitable for trading in virtual assets.

Therefore, the SFC believes that it is not feasible to set a cooling-off period after trading, as automated trading services involve matching clients’ trades, and the cancellation or reversal of a trade will affect another customer of the platform.

In addition, for those who suggest that the SFC should prohibit licensed virtual asset trading platforms from providing incentives and monetary benefits to retail investors, the SFC agrees and has made it clear in the “Guideline for Virtual Asset Trading Platform Operators” that gifts are prohibited, except for fees or fee discounts.

The SFC also reminded that whether on the platform or elsewhere, virtual asset trading platform operators have a responsibility to ensure that any materials relating to specific products they publish are based on facts, fair and impartial.

[Editorial Comment in Hong Kong Commercial Daily]

Virtual Asset Regulation Must Be Real

By Ming Sheng Li, Editorial Commentator of Hong Kong Commercial Daily

Last year, the government issued a “Policy Statement on the Development of Virtual Assets in Hong Kong” to clarify its policy stance and direction, including regulatory oversight through a licensing regime; earlier this year, it conducted a public consultation on proposed regulatory requirements for platform operators; yesterday, the SFC issued a summary of the consultation, and most respondents expressed support. The revised regulatory requirements, the “Guideline for Virtual Asset Trading Platform Operators,” will come into effect on June 1, and retail investors could trade on licensed platforms as early as the second half of this year. Virtual assets have become an important part of the financial ecosystem, and as an international financial centre, Hong Kong should not be absent; ensuring real regulation of virtual assets is essential to building confidence in the market and enabling safe and secure investments, which will promote the orderly, healthy and sustainable development of this innovative financial product.

Regarding virtual assets, some believe that the hype is over and Hong Kong is late to the game. However, others believe that virtual assets are still on the rise and may be the future of financial development. Regardless, virtual assets have already been widely included in the financial industry’s asset allocation basket, with blockchain technology and digital currencies being explored around the world. If Hong Kong’s financial landscape lacks this area, its status as an international financial center and asset management center may be affected. The so-called missed opportunity is largely based on speculation and investment, as the transaction volume and price of NFTs, cryptocurrencies, and other virtual assets have peaked and fallen back. However, this highlights the need for regulation, so that investors do not suffer losses due to lack of regulation. Especially in the light of past experience, Hong Kong can regulate more effectively and avoid going down the wrong path.

Without a safe premise, there is little chance of stable development. The reason why the virtual asset market is risky is precisely because of the lack of regulation. For example, in the United States, the “coin circle” has frequently experienced “coin disasters” in the past, and the sudden collapse of virtual asset prices is not uncommon. This includes so-called stablecoins, and trading platforms can suddenly become unable to trade or stop trading. Some have also been exposed for allegedly misappropriating customer funds, resulting in investors losing everything… Because of various market turmoil, regulatory measures are currently being tightened around the world. For example, last month, the U.S. Treasury Department issued a risk assessment of illegal financial activities in global decentralized financial services, and the European Parliament also approved the world’s first regulations for comprehensive regulation of the cryptocurrency market. As for Hong Kong, the Securities and Futures Commission’s consultation showed that the vast majority of respondents agreed with the proposal to allow licensed trading platform operators to provide services to retail investors. The authorities will implement a series of measures, summarizing past experience, including ensuring suitability, good governance, enhanced token due diligence, incorporation of standards and disclosure by operators in the process of establishing business relationships with clients, as well as safekeeping assets, segregating customer assets, avoiding conflicts of interest and network security. Among them, if a platform does not have a license within 9 months after the regulations are implemented, it cannot conduct virtual asset trading business in Hong Kong or promote it in Hong Kong, and the Securities and Futures Commission will also remind investors of the risks of investing in unregulated platforms.

As China Securities Regulatory Commission (CSRC) Executive Vice Chairman Liang Fengyi said, the regulatory framework follows the principle of “same business, same risk, same rules” to provide proper investor protection and control major risks, thereby promoting sustainable development of the industry and supporting innovation. Hong Kong needs to embark on its own path of safe and sustainable development of virtual assets. After all, if the market lacks confidence, no one will participate. Under the banner of stability, Hong Kong has not experienced a run on banks for many years, and the Hong Kong dollar exchange rate has remained stable. The handling of the Lehman Brothers debt crisis also took full account of investor rights. Only by balancing safety regulation with development, implementing regulation of virtual assets, can the market be orderly and healthy, realizing sustainable development, providing a better environment for financial innovation, rather than becoming a frequent disaster area for “sheep shearing”.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!