SBF no longer works for FTX and can not speak for the group.

Gambling chain

FTX’s new CEO, John Ray III, submitted a document to the Delaware Bankruptcy Court in the United States, disclosing the assets and operations of FTX Group, as well as the previous problems of internal management chaos and financial disorder.

“Never in my career have I seen a company like this one with a total failure of internal controls, a complete lack of trustworthy financial information…control concentrated in a handful of inexperienced, immature and potentially compromised In the hands of an individual, this situation is unprecedented,” said John Ray III.

Because the investigation has just begun, the team led by John Ray III has limited information. However, it stated that based on the information currently available, it is believed that many employees of the FTX Group may have been exploited. “Many employees of FTX Group, including some executives, were unaware of the shortage of funds. In fact, their personal investments and reputations were also affected.”

- What did regulators say after the collapse of the FTX?

- Changpeng Zhao: FTX’s near-collapse “severely shakes” confidence in the cryptocurrency industry

- 200 million dollars vanished! Sequoia Capital wrote down its FTX assets to 0, and BlackRock and SoftBank also stepped on the thunder

At the end of the document, John Ray III once again emphasized that SBF (the founder of FTX) is no longer employed by the FTX Group and cannot speak on behalf of the group. “Mr. SBF is currently in the Bahamas and continues to make erratic and misleading public statements.”

After reading the full text of the bankruptcy documents, we summarized the following key points.

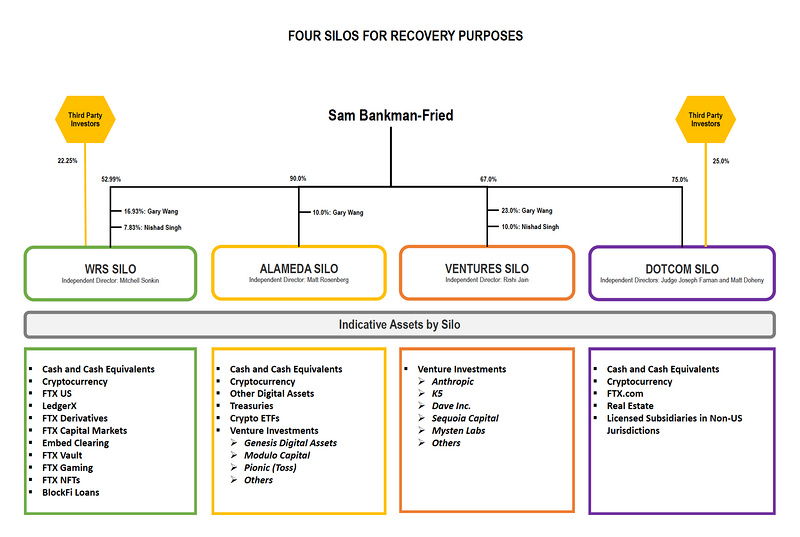

- In the document, Ray divides the FTX Group into four business groups according to different businesses, namely: WRS Silo, Alameda Silo, Ventures Silo, and Doctom Silo, as follows:

- WRS Silo consists of the debtor West Realm Shires Inc and its debtor and non-debtor subsidiaries, including FTX US, LedgerX, FTX US Derivatives, FTX US Capital Markets, FTX NFTs, Embed Financial Technologies Inc and other business subsidiaries. All of the aforementioned companies are 100% owned by West Realm Shires Inc., and are all incorporated in Delaware—except for the trust company FTX Vault, which is incorporated in South Dakota.

In West Realm Shires Inc, SBF holds 52.99%, Gray Wang holds 16.93%, Nishad Singh holds 7.83%, and another 22.25% comes from third-party investment.

From Ray’s understanding, all companies in the WRS Silo are solvent. As of September 30 this year, WRS Silo had total assets of $1.36 billion and total liabilities of $316 million.

- Alameda Silo, composed of the debtor Alameda Research LLC and its debtor subsidiaries, is an “encrypted hedge fund” that includes off-market transactions, quantification, and management of other debt and equity investments. SBF owns 90% of Alameda Research LLC and Gray Wang holds 10%.

As of September 30, Alameda Silo had total assets of $13.46 billion and total liabilities of $5.09 billion, the data showed. What is more interesting is that Alameda Research LLC has a related party loan receivable of US$4.1 billion, of which US$1 billion was lent to SBF, US$543 million to Nishad Singh and US$55 million to Ryan Salame. These loans have not yet been repaid.

In addition to Alameda Research LLC, Alameda Silo’s debtors are mainly located in the United States, South Korea, Japan, British Virgin Islands, Antigua, Hong Kong, Singapore, Seychelles, Cayman Islands, Bahamas, Australia, Panama, Turkey and Nigeria.

- Ventures Silo is mainly held by the debtors Clifton Bay Investments LLC, Clifton Bay Investments Ltd., FTX Ventures Ltd, Island Bay Ventures Inc. and possible affiliates. Among them, SBF directly holds about 67% of the shares of Clifton Bay Investments LLC, Gray Wang holds 23% of the shares, and Nishad Singh holds 10% of the shares.

According to the document, as of September 30, Clifton Bay Investments LLC had total assets of $1.52 billion and total liabilities of $1.519 billion; FTX Ventures Ltd had total assets of $493 million and total liabilities of $492 million.

- Dotcom Silo consists of the debtor FTX Trading Ltd and other debtor and non-debtor subsidiaries, including exchanges operating around the world (non-U.S. regions) under the name “FTX.com”, which are collectively referred to as ” FTX Group”. SBF indirectly holds about 75 percent of FTX Trading Ltd, with the other 25 percent owned by 600 third-party equity investors.

The data shows that as of September 30, 2022, Dotcom Silo has total assets of $2.25 billion and total liabilities of $465 million. The debtors in the Dotcom Silo are scattered across jurisdictions around the world, with the parent company, FTX Trading Ltd, based in Antigua.

- FTX Group did not maintain centralized control over its cash. Errors in cash management procedures, lack of accurate bank accounts and account signatory lists. Due to historical failures in cash management, the exact amount of cash held by FTX Group is not known at this time. The new CEO is working with Alvarez & Marsal to verify all cash positions. Based on the books and records available so far, it can be roughly extrapolated that FTX held a total of $564 million in cash as of the filing date. And the debtor has contacted the banking institution to freeze the withdrawal and remind the bank not to accept instructions from SBF or other signatories.

- Previously, FTX did not have a special spending control. FTX Group employees submit payment requests primarily through an online “chat” platform, and various supervisors respond with personalized emojis to approve payments. In the Bahamas, Ray said, FTX Group corporate funds were used to purchase homes and other personal items for employees and consultants, and some real estate was recorded in the personal names of FTX employees and consultants. “The debtor is now implementing a centralized payment approval process reporting to me as the CEO.”

- In terms of digital asset custody, FTX Group did not have proper records or security controls for its digital assets. SBF and Gary Wang controlled access to digital assets of the FTX Group’s principal operations (except for CFTC-regulated LedgerX and certain other regulated subsidiaries), and mismanagement included the use of unsecured group email accounts Access to keys and extremely sensitive data of global FTX Group companies; no daily reconciliations on the blockchain; use of software to conceal misuse of client funds; secret exemption of Alameda from aspects of FTX.com’s automated liquidation agreement; Alameda Lack of independent management from Dotcom Silo (which has third-party investment).

At present, the debtor has obtained about $740 million in cryptocurrency in the new cold wallet, but it is not sure how each Silo will be allocated. In addition, Ray stated that $372 million in assets were transferred without authorization when the petition was launched; after filing for bankruptcy, unauthorized sources created approximately $300 million in FTX platform native token FTT.

- One of the most common failures of the FTX business is the lack of a long-term record of decision-making. SBF often communicates through the use of some applications that can be automatically deleted after a short period of time and encourages employees to do the same. FTX Group has billions of dollars in investments outside of cryptocurrencies. However, the major firms in the Alameda Silo and Ventures Silo did not keep complete books and records of these investment activities. Debtors are using previous records of cash transactions, while also reviewing various third-party sources to determine investments.

- Many of the FTX Group companies, particularly those incorporated in Antigua and the Bahamas, do not have proper corporate governance, and many entities have never held board meetings.

FTX Group has numerous regulated or licensed subsidiaries in various locations which may or may not have going concern value. Creditors are hiring investment banks to help debtors value the businesses for possible sale.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!