The BTC ecosystem has been hot for two months, but with the pullback of ORDI, many people are beginning to worry that the BTC ecosystem hype has ended. Let’s first look at whether this ecosystem is worth continued attention with data.

At the same time, this article brings you a detailed inventory of the key projects in this ecosystem.

BTC Ecosystem Update

From the number of daily active addresses of BTC, we can see from the data of Glassnode in the following figure that the number of on-chain active addresses of BTC has been on the rise from the beginning of the year to now, and the transaction volume has also shown a sharp rise. From the current level of activity in the BTC ecosystem, it can be seen that it still has vitality despite the price drop of ORDI.

- Shutting down TradeBlock: DCG’s desperate survival plan

- What’s behind the proposal of Venus VIP-122: Diluting BNB to repay debt?

- Everything you need to know about the Optimism Bedrock upgrade

(Figure: Trend of weekly active addresses, Source: https://studio.glassnode.com/metrics?a=BTC&m=addresses.ActiveCount&resolution=1w&s=1230508800&u=1684800000&zoom=)

(Figure: Trend of weekly transaction volume, https://studio.glassnode.com/metrics?a=BTC&category=Transactions&m=transactions.Count&resolution=1w&s=1230508800&u=1684800000&zoom=)

So, in the case where the BTC ecosystem is still hot, what projects are worth our attention? Below, we will list some projects in the BTC ecosystem that are worth paying attention to.

Categories are as follows: (you can jump to the interested category for browsing)

1. Ordinals NFT project

2. BRC-20 projects and other standards introduction

3. L2 and sidechain projects

4. DeFi projects

Ordinals NFT Project

The Ordinals protocol is a system for numbering Satoshis. Ordinals tracks them in transactions by assigning each Satoshi a sequence number, and users can attach additional data (images, videos, text, etc.) to Ordinals on the Bitcoin blockchain, making each Satoshi unique and having the properties of an NFT.

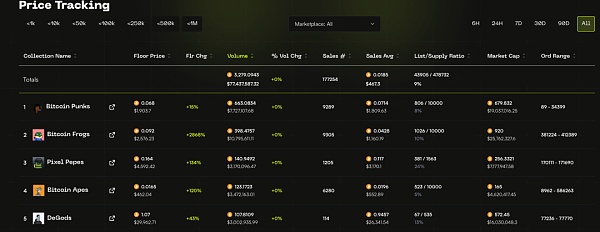

(Figure: The top five NFT series with the largest transaction volume of all time)

From the total trading volume of Ordinals NFTs in the above figure, the top five are Bitcoin Punks, Bitcoin Frog, Pixel Pepes, Bitcoin Apes, and DeGods. From the trading volume in the past 30 days, DogePunks and Naked Bitcoin Frogs Misprints have also entered the top five. Let’s introduce these projects one by one:

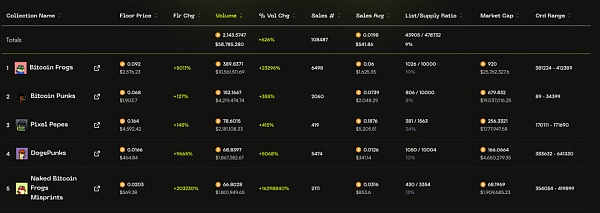

(Figure: Top 5 NFT series by trading volume in the last 30 days, source: https://www.ordinalhub.com/price-tracking?dateRange=All&Blockingge=1&sort=volume_btc%3Adesc)

1. Bitcoin Punks is the first project to use the Ordinals protocol and derive from CryptoPunk on Ethereum, successfully bringing CryptoPunk on Ethereum to Bitcoin’s NFT project, currently with a floor price of 0.0068 BTC.

2. Bitcoin Frogs consists of 10,000 generated frogs, free mint, no roadmap or airdrop, with an anonymous founder and known for its meme narrative and wide reach, currently with a floor price of 0.092BTC.

3. Pixel Pepes is a project that Ordinals Wallet airdropped on February 28th, with a total of 1563 pieces. The airdrop condition was to trade at least once with the wallet before block 777888. The airdrop has now ended, and the floor price is currently 0.164 BTC.

4. DeGods is an NFT project on Solana that was launched on the Bitcoin network in March. The NFT series has a total of 534 pieces (because 534 pieces were destroyed on Solana before, they plan to reissue them on the Bitcoin network), of which 500 will be used for Bitcoin casting at a price of 0.444 BTC, and the other 34 DeGods will be auctioned/raffled in the form of DUST tokens. The current floor price is 1.07 BTC.

5. DogePunks is a Bitcoin Ordinals project that combines Dogecoin and CryptoPunks concepts, with a total of 10,000 pieces, and the current floor price is 0.0166 BTC.

6. Naked Bitcoin Frogs Misprints is a project derived from Bitcoin Frogs’ sale when the clothing layer was incorrect, resulting in some frogs having no clothing layer and showing naked frog pictures. It has meme properties and high discussion, and the current floor price is 0.0203 BTC.

7. Other projects worth paying attention to include: Sub 10K, because each Bitcoin NFT has an inscription number, and Sub10k is the earliest 10k Bitcoin NFTs minted, with early value. Ordinals Punks is one of the series in Sub10k.

BRC-20 projects and other standards

The BRC-20 standard is based on the Ordinals protocol, which deploys, mints, and transfers tokens by writing token name, total amount, and other information in a standardized JSON format in the SATOCHI blockchain.

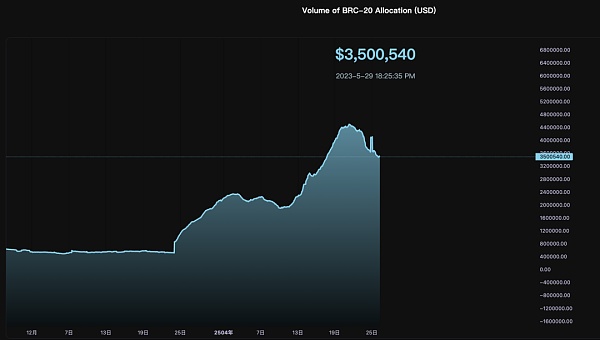

From the following chart showing the trading volume trend of BRC-20, it can be seen that the popularity of BRC-20 has been consistently rising, and even though the head $ORDI has already fallen by more than half, its impact on its trading volume is relatively small, indicating that people’s attention and funds have not withdrawn too much from the BRC-20 ecosystem.

(Data source: https://brc20insider.com/global)

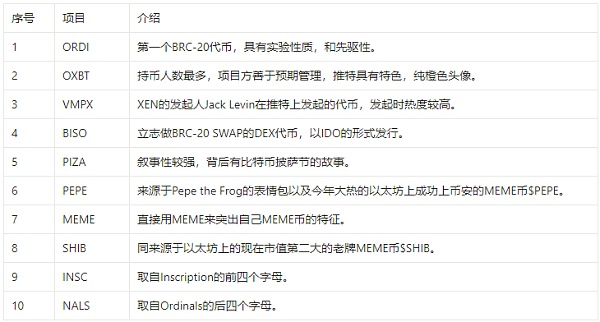

According to the Chaineye tool website, the top five BRC-20 tokens by market capitalization are ORDI, OXBT, OG, VMPX, and BISO. Below, we list these tokens and some others worth paying attention to:

(Data source: https://chaineye.tools/)

ORC-20:

Due to the three major problems with the BRC-20 standard:

1) The token supply and maximum minting amount cannot be changed, limiting the development of tokens;

2) Token naming is limited to only 4 digits;

3) BRC20’s “Inscribe Transfer” and “bookkeeping” heavily rely on external centralized index services;

To solve these problems, the ORC-20 standard was born. ORC-20 eliminates the token naming restrictions and adds token upgradability, allowing project parties to do more empowerment based on tokens. At the same time, advanced features such as setting royalties and whitelists have been added.

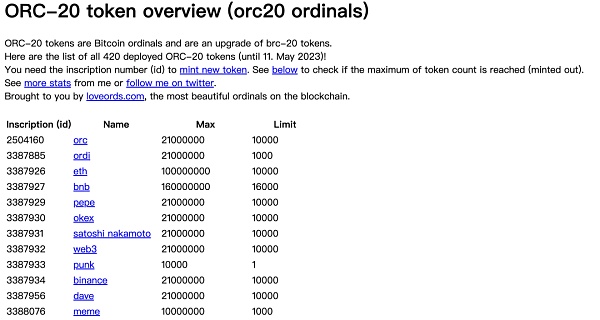

The current mainstream ORC-20 token situation is as follows:

(Data source: https://loveords.com/orc20)

However, because the infrastructure of ORC-20 is not yet fully developed, and wealth effects are still concentrated on BRC-20, ORC-20 is currently receiving limited attention.

SRC-20: In addition to BRC-20 and ORC-20, SRC-20/21 has also attracted some attention. SRC-20/21 is a token standard developed based on the Stamps protocol. BTC Stamps was invented by @mikeinsBlockingce. The biggest difference between him and Ordinals is that the picture/text information of Ordinals is stored in witness data, while the data of Stamps is stored in transaction outputs. This difference has caused an important feature of Stamps, that is, it can always exist on the BTC chain, and the full node must synchronize the data.

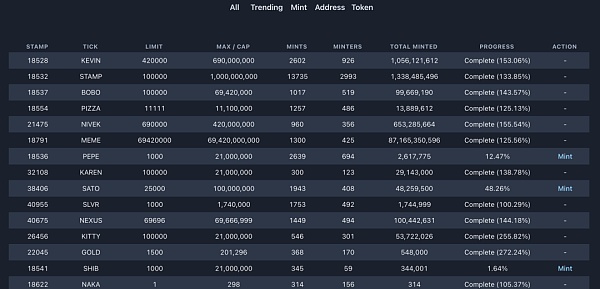

Compared with ORC-20, the infrastructure development of SRC-20 will be more complete, but there is currently no large-scale consensus trading market, and users are relatively few.

Although Stamps has a trading market, the experience process is not as smooth as the BRC-20 trading market. According to the recent announcement by Hiro Wallet, SRC-20 tokens will be integrated to allow users to view assets more conveniently. With the improvement of the infrastructure of this standard, it may be worth paying more attention to in the future.

(Data source: https://www.stampscan.xyz/)

BRC-721: BRC-721 is a standard similar to the Ordinals protocol, but currently the Ordinals protocol lacks a way to categorize NFT projects into a specific collection, so it is more dependent on centralized service providers for accounting and retrieval.

The emergence of BRC-721 is to solve the decentralized NFT collection creation and verification. The BRC-721 protocol is based on three types of lists:

1) CollectionManifest (collection list)

2) InscriptionManifest (inscription list)

3) RevealManifest (reveal list)

Each list has protocol and version fields, allowing third-party services to understand the specifications for API integration and querying, thereby building corresponding applications.

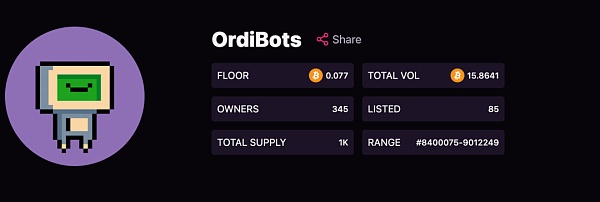

Currently, the development of this standard is in the early stages and worth tracking and paying attention to. The better-known projects at present include Ordibots issued by @0xJerry543, with a total of 1,000 and a floor price of 0.077 BTC.

L2 and sidechain projects

With more and more transactions on BTC, how to use the security of BTC’s underlying while allowing BTC to carry more transactions has become one of the current development directions. At the same time, with the approaching halving, the issue of miner income has gradually emerged.

Due to the limitations of BTC’s block generation, the attraction of single-block rewards to miners’ future income may be limited. In order to achieve the long-term development of BTC, two solutions have emerged: BTC L2 and sidechain solutions.

Next, we will introduce key projects for you:

L2

Lightning Network

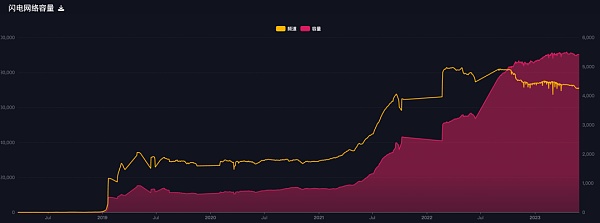

The Lightning Network was proposed by Joseph Poon and Tadge Dryja in 2016 and is one of the Bitcoin Layer 2 solutions. The Lightning Network consists of payment channels and aims to achieve fast and low-cost transactions, allowing users to pay off-chain without confirmation, with final settlement on the main chain. In theory, the Lightning Network can achieve a processing speed of millions of transactions per second.

The following is the development of payment channels on the Lightning Network. It can be seen that the capacity on the Lightning Network has maintained a relatively high growth trend after 2022, and the number of channels has a large increase in 2021-2022, but not much growth in 2022-2023.

(Data source: https://mempool.space/lightning)

Stacks

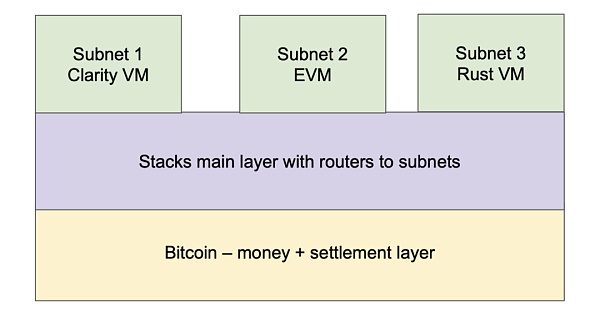

The Stacks technical architecture includes a core layer and a mainnet, and developers can choose either one for development. The Stacks consensus algorithm uses POX (Proof of Transfer) and anchors transactions to ensure transaction security by broadcasting block information of Stacks transactions to the Bitcoin network after they are packaged.

Stacks has a complete execution environment (meaning any application that can be built on chains such as Ethereum can be built on the Stacks layer).

Transaction validators and miners in Stacks can respectively stake $STX and $BTC to mine $STX and $BTC tokens and maintain network security.

From the Stacks roadmap, the release of the Nakamoto network and SBTC in Q4 of this year will be important milestones for the development of Stacks, and are worth paying attention to.

The potential impact of these two major updates is as follows:

1) Stacks transactions can get final confirmation from Bitcoin, increasing the security of Stacks;

2) Increase the block production speed, enabling faster transaction confirmation. According to its white paper, the block production speed can reach 4-5s;

3) Support customized development languages for subnets, meaning subnets can support other programming languages and execution environments (such as Ethereum’s Solidity);

4) Introduce the native on-chain asset SBTC, making it more possible to establish a financial ecosystem on BTC L2.

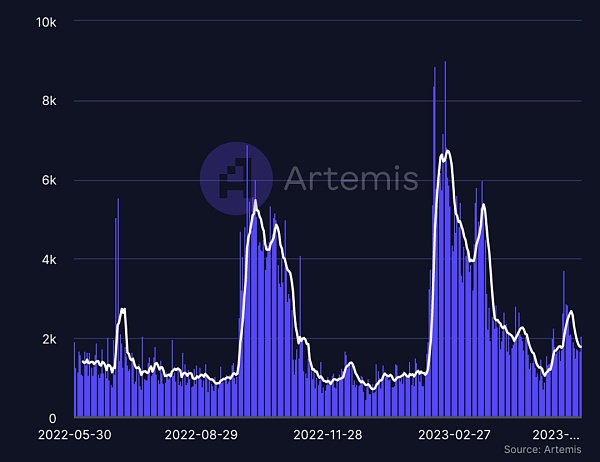

From the development of Stacks in the following figure, the number of daily active addresses is currently less than 4k, with a large increase at the beginning of this year (due to the rise in price and the BTC Ordinal narrative), followed by a sharp decline, with only slight growth compared to 2022.

Compared with the 200k daily active addresses of the popular ETH L2 Arbitrum, the gap is still significant. Although its TVL growth is good, its total TVL amount is still low, indicating that the ecosystem is currently in a relatively niche stage in terms of users and funds.

(Figure: Daily active address, source: https://app.artemis.xyz/dashboard/stacks)

(Figure: Stacks TVL changes)

Sidechain

Rootstock

RSK is a Bitcoin sidechain project developed by IOV Labs that uses Bitcoin’s mining algorithm. Bitcoin miners can engage in “merged mining” while mining and also receive transaction fee income from Rootstock.

The native token in Rootstock is a Bitcoin-anchored coin called rBTC. The company has also developed RIF (Rootstock Infrastructure, token $RIF), a platform built on Rootstock that aims to provide blockchain infrastructure and services, including domains, storage, identity verification, etc., to support dApp development and deployment.

Liquid Network

Liquid Network is a Bitcoin sidechain developed by Blockstream that aims to provide faster, cheaper, and more secure transaction services. It supports cryptocurrency and asset transactions and provides features such as confidential transactions and batch transactions.

DeFi projects

ALex

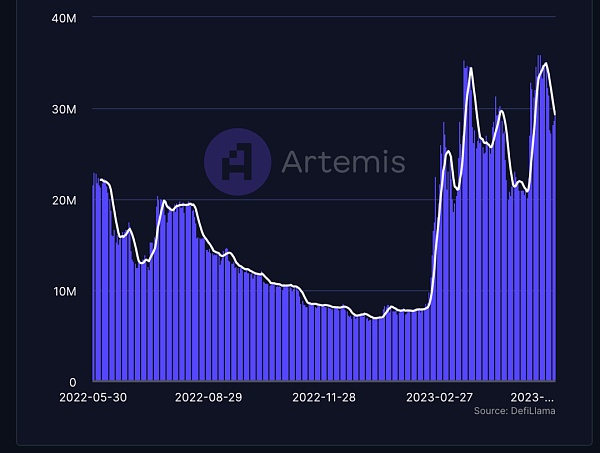

Alex is one of the most important protocols on Stacks. As of May 29th, the TVL on Stacks was 28.31M, and the TVL on ALEX was 26.7M, accounting for most of the TVL on the chain.

Currently, Alex has the functionality of mainstream DEX, including Swap/Add Liquidity/Stake. However, in addition to this, due to the popularity of BRC-20, Alex has also developed a beta version of BRC-20 transactions.

The beta version uses the order book model, and users can currently experience it (with poor liquidity). In addition to trading, Alex also supports LaunchBlockingd to help other projects issue initial tokens. However, due to the current lack of diversity in the Stacks ecosystem, both trading volume and LaunchBlockingd performance are average.

However, as the Stacks ecosystem gradually develops, Alex, as the head DEX on the ecosystem, will also benefit from synchronous development.

From the trading volume and TVL of Alex in the figure below, the project has gradually received attention since March, and its trading volume and TVL have increased significantly.

(Data source: https://defillama.com/protocol/alex?tokenVolume=true&volume=true&denomination=USD&groupBy=daily)

Arkadiko

Arkdadiko is the second largest protocol in terms of TVL in the Stacks ecosystem, with a TVL of 6.9M (Data source: https://info.arkadiko.finance/). Arkdadiko is a protocol similar to Maker DAO.

By over-collateralizing STX, you can mint the stablecoin USDA with this project, which also supports SWAP and Lending. Currently, there are only 7 trading pairs available for SWAP, and there are three assets available for borrowing: STX, xBTC, and ALEX.

As one of the early projects on Stacks and the largest lending project, this type of project has the opportunity to occupy a leading position and share in the benefits of ecosystem development if it can keep up with ecosystem development.

MoneyOnchain

MoneyOnChain is a decentralized, bitcoin-backed stablecoin protocol built on RSK, and its transactions require RBTC as a fee. Users can mint the stablecoin DOC by collateralizing rBTC, and it has also issued $BPro, a leveraged product based on BTC.

Summary

This article introduces some standards and projects in the BTC ecosystem. For the BTC ecosystem, BRC-20, SRC-20, and BRC-721 are some standards worth paying attention to. In terms of L2 and sidechain projects, Lightning Network, Stacks, and Rootstock are important projects. In terms of DeFi, Alex, Arkadiko, and MoneyOnChain are some protocols worth paying attention to.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!