Author: Scarlett Wu, Investment Manager at Mint Ventures

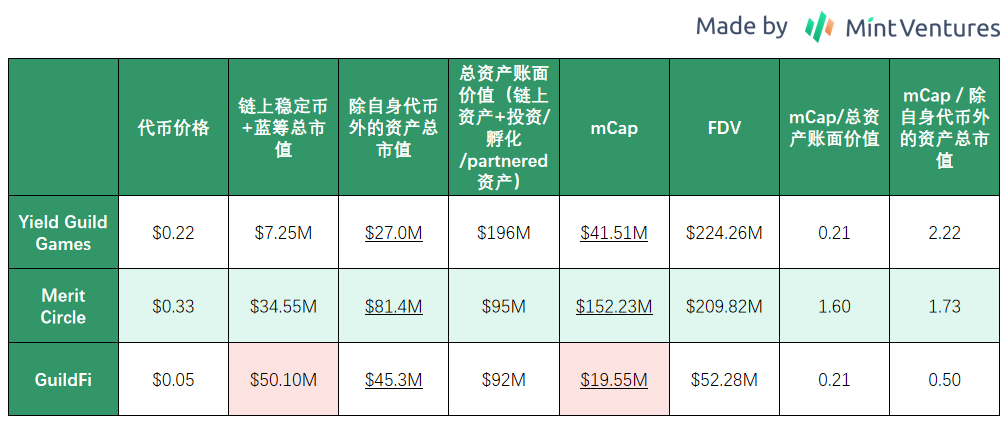

In the past two weeks, the roller coaster ride of YGG prices has refocused the market’s attention on the game guild track. At the beginning of the rise, I shared a summary of the game guild treasury and market value comparison from the perspective of the treasury on Twitter, titled “Comparison of Cryptocurrency Game Guild Treasury and Market Value: $YGG, $MC, $GF”. At that time, $MC was the most promising, and now its price has risen by 50%. On the other hand, the price of YGG has rapidly declined after reaching a new high and doubling, returning to the price before the summary was written. This article is a revision and expansion of the summary, providing a comprehensive review of the game guild track from the perspectives of business capabilities, investment capabilities, risk control capabilities, and valuation.

Many game guilds, Quest platforms, game information aggregation platforms, and post-payment NFTfi protocols are actually subdivisions of the same service. This is because game project parties have only three demands:

- New Narrative of DeFi? Interpreting the New Security Model of Smart Contracts without Oracle Protocols

- Dialogue with Standard Crypto Partners Diverse New Narratives Emerge, Now is the Best Bear Market Cycle in History

- With the support of the Ethereum Foundation twice, will EthStorage become the storage center of Ethereum?

- Acquiring new users

- Driving user engagement

- Promoting in-game consumption

On the other hand, Web3 players have only two demands:

- A sense of companionship

Due to the demand for upfront capital investment brought about by Ponzi schemes in the early years of 2020-2022 (such as guilds purchasing NFTs and renting them to players in Southeast Asia and taking a cut from their subsequent income), as well as the wealth effect generated by the rapidly expanding economic system, people mistakenly believe that the drumbeat of the Ponzi scheme will never stop. This has given rise to another important function of Web3 game guilds:

- Providing upfront capital

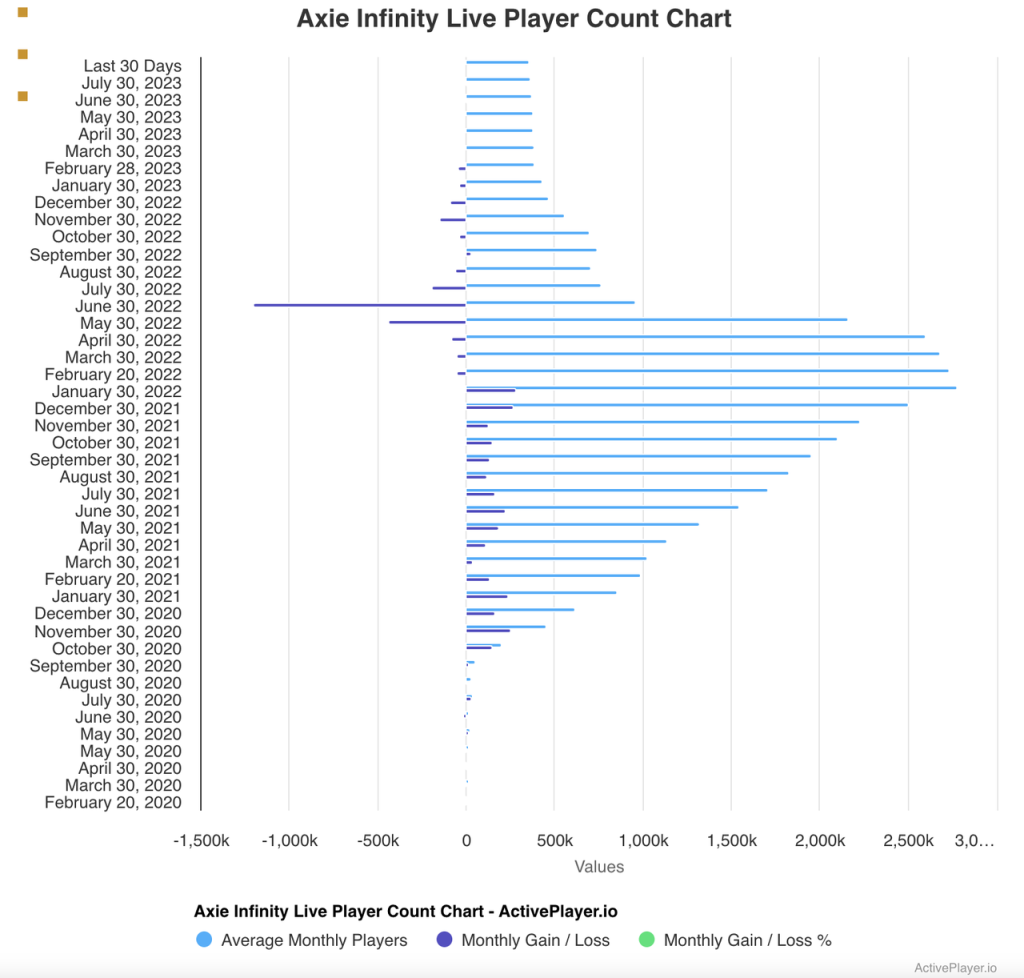

The prerequisite for generating the need for companionship is that users will spend a sufficient amount of time on the game, which is not satisfied by most non-Ponzi Web3 games currently. In order for guilds to invest and purchase “shovel” NFTs to rent to users, there needs to be a Web3 game with a continuously expanding economy. If the upfront capital invested two weeks ago has already started to lose money, any institution that provides upfront capital will be on tenterhooks. However, the fact is that apart from the crypto game Ponzi pioneer Axie Infinity, there has not been a game in the industry that has sustained user growth for more than six months. Considering that the premise of Ponzi profit is user growth, guilds willing to provide upfront capital need to spend two months finding a “game that can consistently make money,” two months observing that “this game can indeed make money consistently,” and two months implementing the plan, only to despairingly discover that the upfront capital cannot be recovered because the “scholars” (the guild’s term for their players) may never be able to recoup their investment even if they play for ten years.

Guilds have obviously realized this problem earlier. Unable to replicate the popularity of Axie in every Ponzi scheme, and unable to charge for the need for companionship through methods such as live streaming (the traditional source of income for game guilds), guilds have transitioned from “serving players” to “serving project parties”: on the one hand, guilds have a large number of player resources (which is now in doubt and will be discussed later in this article), and on the other hand, the guild treasury has a large amount of funds (although its liquidity is questionable and will be discussed later in this article), allowing guilds to enjoy the growth dividends of the Web3 game track through investment. Of course, there are also cases like Merit Circle, which partnered with Avalanche to create a subchain and used the narrative of a gaming blockchain to enhance its valuation imagination.

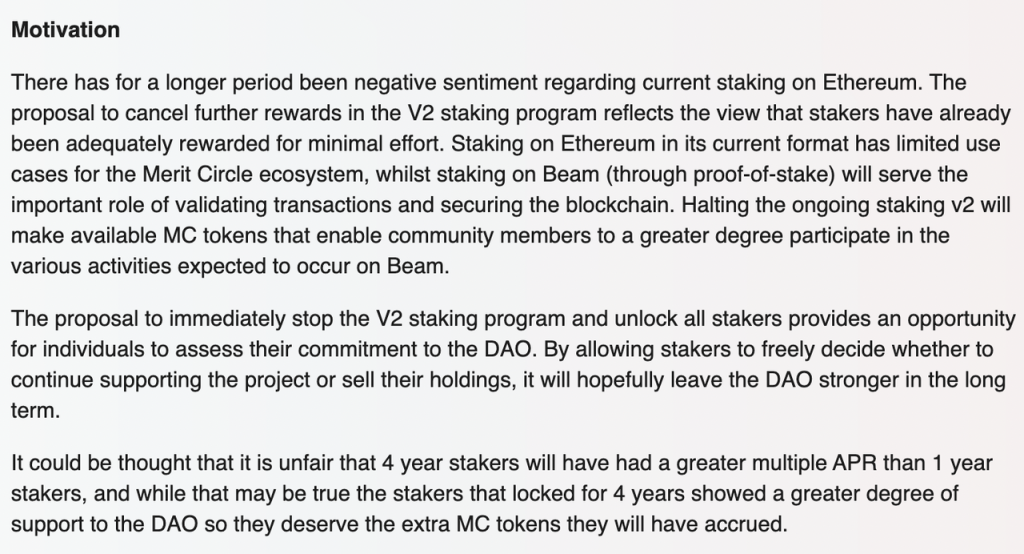

1. Business Data Comparison: YGG and MC are still active, while GF has fallen behind in terms of volume

Currently, the main traffic sources for the major guilds are:

- Quest system

- Discord

Among them, Discord is deceptive. Even in the DC group chat with 70,000 members in YGG, there are only over 100 messages in the General Chat section every day, half of which are greetings and the other half are team members answering questions with Medium/official website links.

Twitter can provide insights through page views. Even though YGG has 180,000 Twitter followers, Merit Circle has 100,000, and GuildFi has 120,000, the page views of YGG’s Twitter content remain stable at several thousand to tens of thousands, with only major updates reaching 40,000 to 50,000 views. Merit Circle falls slightly behind, with daily content views around 5,000 and tens of thousands for major updates. GuildFi is even more dismal, with less than 1,000 views for regular updates and only 10,000 views for semi-annual reports. In comparison, my Twitter account with over 2,000 followers easily garners hundreds of views for a casually posted tweet, and a more in-depth summary can attract tens of thousands of views. With transparent data display on Twitter, the inflated data of game guilds becomes apparent.

Quest systems can be explored from two aspects: project status and incentives:

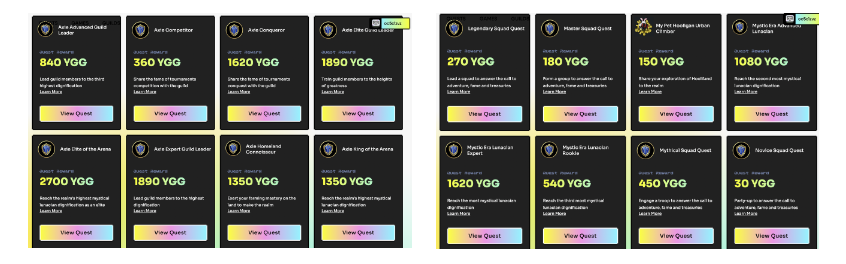

YGG Guild Advancement Program: Recently, YGG launched Guild Advancement Program Season 4, where players can earn rewards by completing tasks and uploading proof. Among them, Axie’s rewards still dominate, with individual rewards reaching up to 2700 $YGG (equivalent to about 900 USD at the current $YGG price), while rewards for other games range from 30 $YGG (10 USD) to over a thousand $YGG. For players who are still capable of competing for the Axie Infinity reward pool, the rewards offered by Axie are undoubtedly more appealing (with a maximum value of tens of thousands of USD), while for players of other crypto games, the reward pool, which needs to be shared with competitors, ranging from several tens to hundreds of USD, is not very attractive. From a user’s perspective, YGG’s Quest System is difficult to attract a lot of attention.

- From the perspective of project teams, YGG’s collaboration with games will likely receive cash or other game assets, while what players receive are rewards denominated in YGG, effectively exchanging YGG tokens for other cash/game assets.

https://www.yieldguild.io/gap/season-4

Merit Circle Gaming:

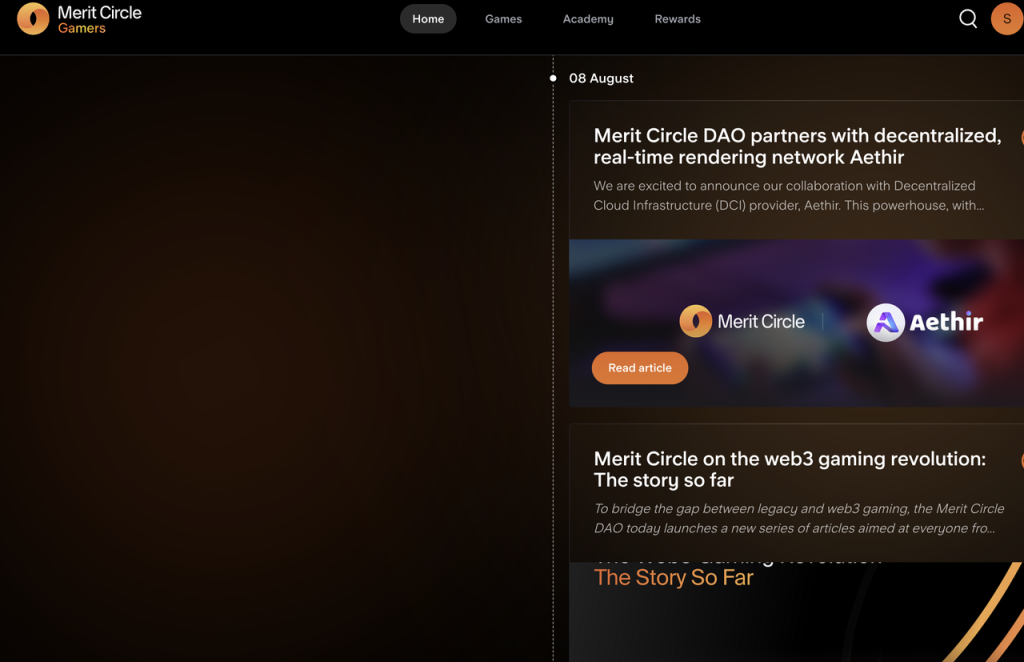

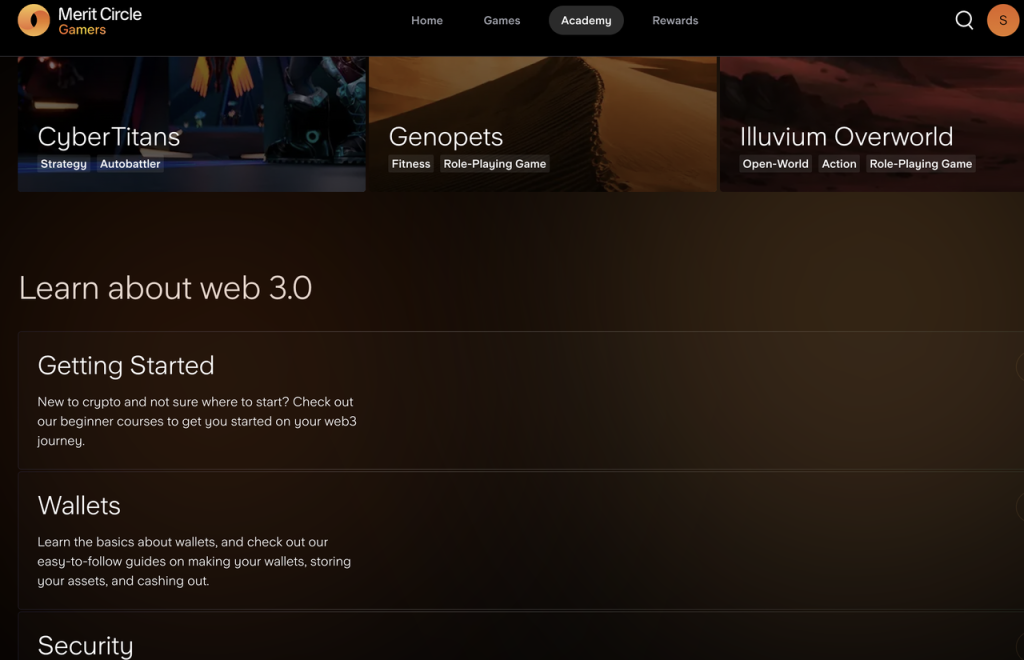

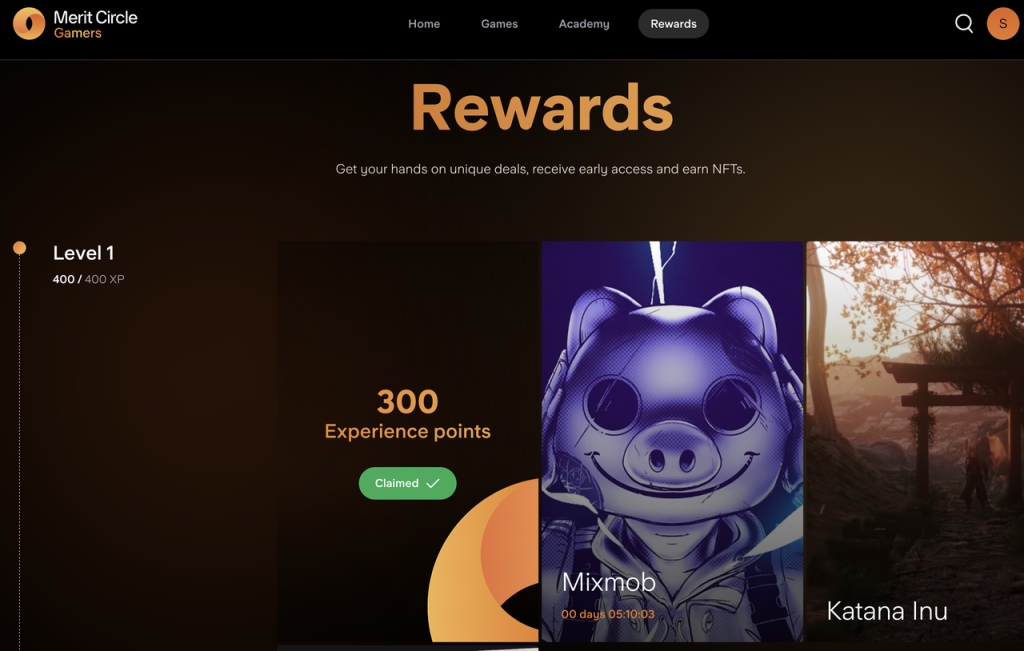

- Compared to the straightforward task-based system of YGG’s Quest System, Merit Circle Gaming has a more user-friendly interface. The official website of this incentive system is divided into four parts: Home (highlighting game introductions and activity timelines), Games (showcasing games and providing related information summaries), Academy (game tutorials and basic Web3 operation tutorials), and Quest System (complete tasks, earn experience, and participate in game NFT lottery).

- In YGG’s Quest system, players can have a more direct calculation of ROI (although the ROI is not high, it still has some appeal for the Southeast Asian audience), while Merit Circle’s Quest system leans more towards information aggregation and game showcases, with task rewards mostly distributed through lotteries.

Merit Circle - Home

Merit Circle - Featured Game Display

Merit Circle - Academy

Merit Circle - Task Reward System

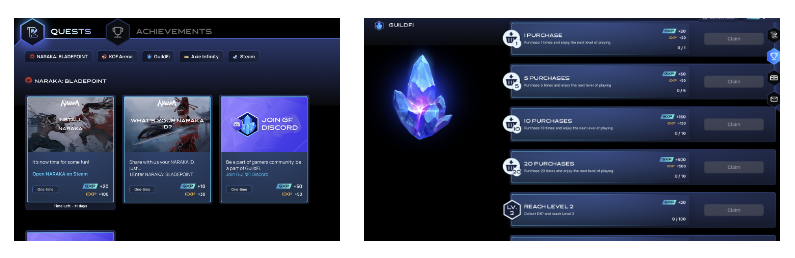

GuildFi Quest & Achievements

- GuildFi has created a task and achievement system using in-game points. By completing corresponding tasks and achievements, players can earn corresponding point rewards.

GuildFi Quest & Achievements

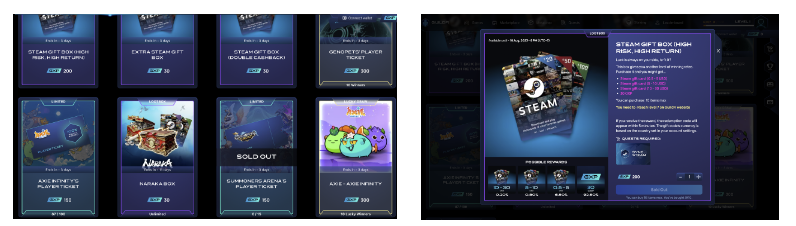

Points can be used to redeem gift cards, game tickets, whitelists, treasure chests, NFTs, etc. However, currently, GuildFi’s experience is fairly limited in terms of redeemable products, mainly consisting of Steam gift cards (with a probability of obtaining gift cards worth $0.5 – $30, or a 15% refund of the cost), Genopet and Axie game tickets, Axie NFTs, and CyBall NFTs (distributed in the form of limited-time lotteries). This kind of lottery blind box exchange for Steam gift cards/game items has already been widely used in traditional game information aggregation and casual gaming platforms. On one hand, it cooperates with game project parties to distribute game assets (although it can be seen that GuildFi’s business development capabilities are quite limited, and it collaborates with mostly old projects); on the other hand, it directly converts a small portion of the revenue into assets with existing value concepts for players, and introduces blind box mode to gamify the elimination of inflation.

GuildFi Marketplace

In GuildFi’s semi-annual summary, they stated, “In the past year (2H22 – 1H23), the platform has had over 200,000 purchases, a 42% increase compared to the previous year. Clearly, our community’s enthusiasm for the game products on our platform is rising. It is worth noting that the Lootbox activity for Diablo IV ranked first with over 65,000 purchases, while the KOF Lootbox had over 30,000 purchases.” With such collaborations, GuildFi has brought a total of 92,000 pre-registered users to 21 partnering parties in a year, averaging less than 5,000 registrations per game. Considering that pre-registration usually does not require wallet interaction and it is easy for users to create multiple accounts for profitable projects, the actual number of effective users brought in is worrying.

Source: GF Semi-Annual Summary

Combining the previous content, it is not difficult to see that the power of game guilds in the market has significantly decreased. YGG and Merit Circle are still relatively active in the market, while GuildFi has fallen behind in terms of business resources and content production.

2. Financial Comparison: MC has balanced development in finance and business levels, YGG has strong business capabilities but lacks financial level, GF’s market value is less than the value of holding blue chip + stablecoin assets

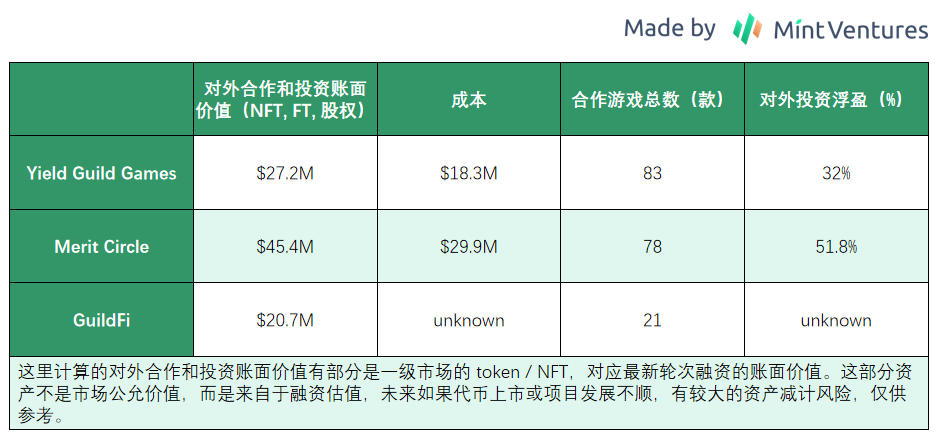

YGG: Game dissemination platform + game investment fund, the treasury is almost all YGG, less than 4.4% of high liquidity assets on-chain

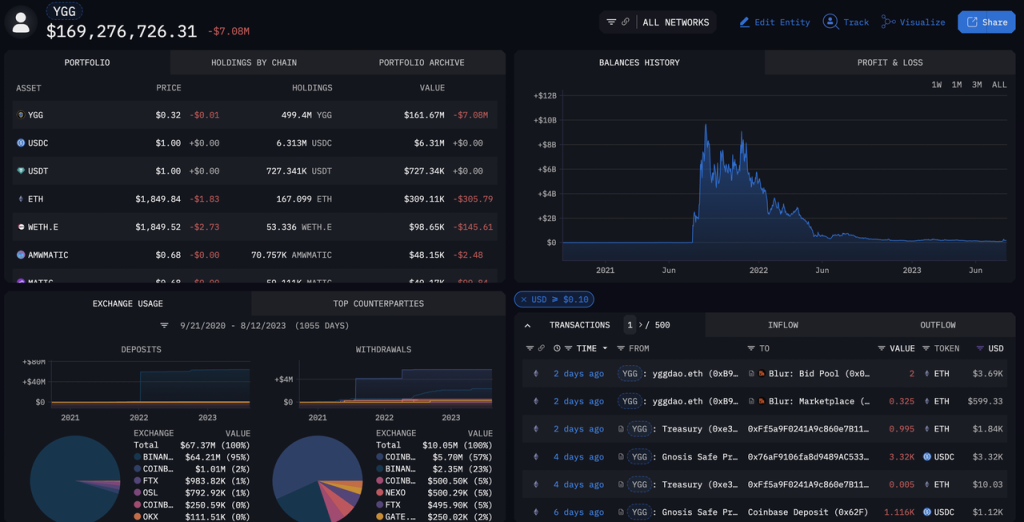

Due to the significant depreciation and illiquidity of game NFTs currently on the market, we can roughly estimate the situation of the project party’s treasury directly from FT. According to the address officially announced by YGG, 95% of the on-chain treasury of YGG is its own token $YGG, and only less than 4.4% is high liquidity stablecoins and blue chip assets ($USDC/$USDT/$ETH, etc.), which shows a fairly unbalanced asset allocation.

YGG Treasury Address Asset Situation Arkham, Mint Ventures Chart

* Excluding assets on non-EVM chains, the amount of these assets is about $220,000, which can be ignored when calculating

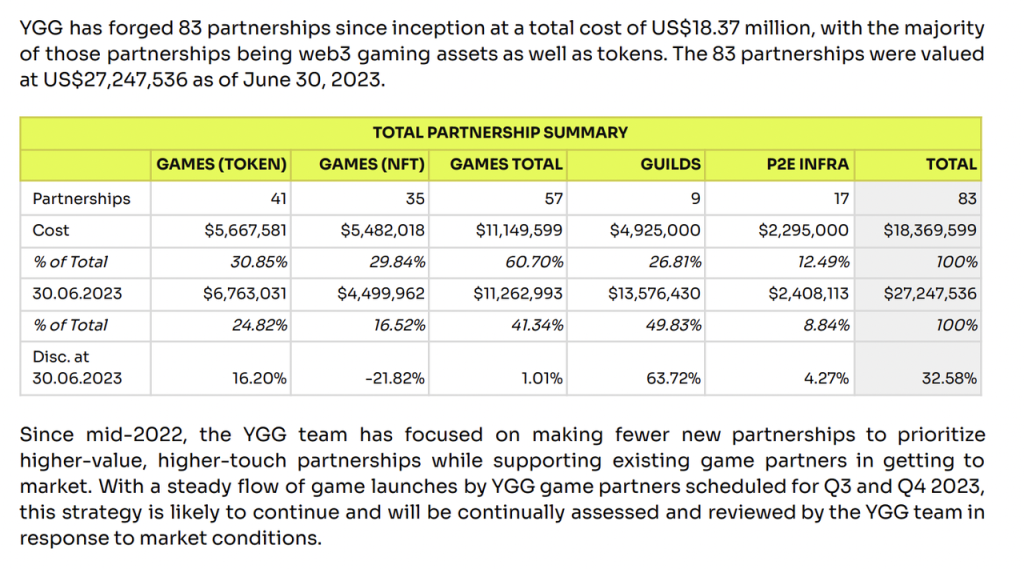

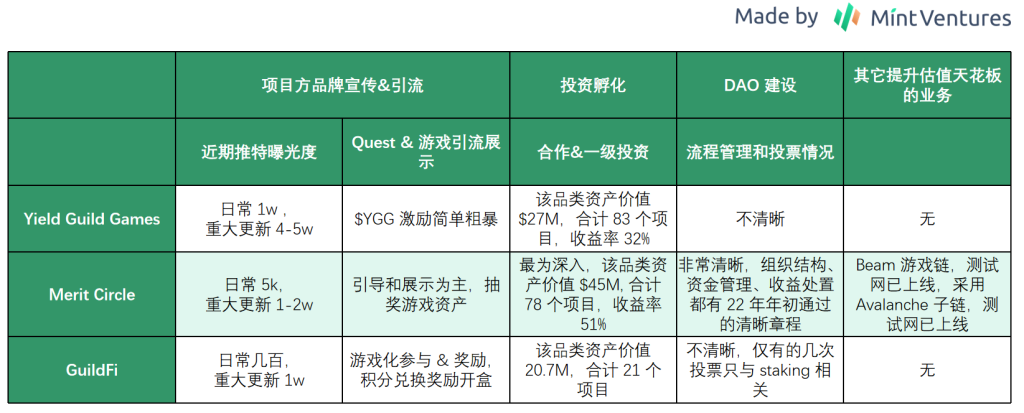

In addition, YGG gave a value calculation of investment/cooperative project assets in the 2023 Q2 Community Update released in early August: YGG holds a total of $27.2 million worth of game assets (NFTs, tokens, equity, etc.), with a corresponding cost of $18.3 million, and a book profit of 32%.

Source: YGG Medium

Although YGG honestly made public the market price decline of Gaming NFTs, there may be some calculation errors in the valuation of token/NFT in the Games section: even if YGG obtained a good price when investing, under the current market situation, the book value of first-level invested game tokens is likely to be greatly reduced after listing, and in the current situation of extremely poor NFT liquidity, it requires significant effort to sell the NFTs. The same situation also applies to Merit Circle and GuildFi.

YGG LianGuairtnered Games (held assets, including first-level investments and secondary market purchases, incomplete statistics from chainplay.gg)

Merit Circle: Stable business development, optimal treasury fund balance, half stable income and high-risk assets

In the official website of Merit Circle (hereinafter referred to as MC), it defines itself as a Gaming DAO with four functions: investment, game studio, reward system, and infrastructure (building a game chain Beam through the Avalanche subchain). In terms of communication transparency, MC outperforms the other two guilds: the board of treasury funds is updated in a timely manner, which not only includes FT/NFT data that can be queried on the chain, but also discloses non-liquid assets such as primary investments. Here, we mainly analyze two parts: investment and incubation situation, and treasury fund allocation.

Merit Circle Official Website

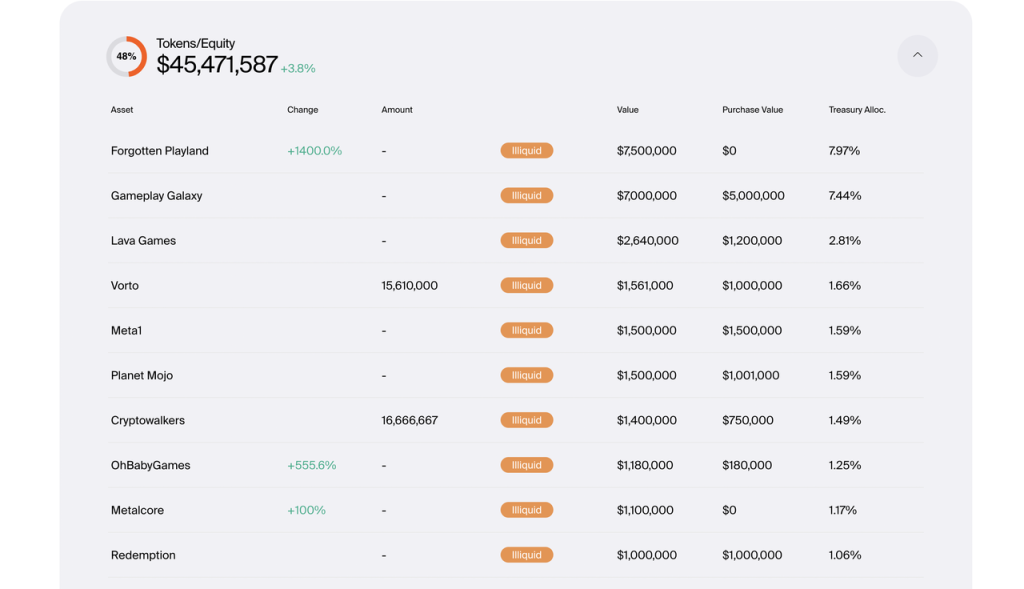

First, let’s look at investment and incubation. According to the data publicly disclosed by MC’s treasury, as of June 23rd, MC holds equity/tokens of 79 game projects, including large projects with good team backgrounds and financing backgrounds such as OhBabyGames and Xterio. The value of these assets is $45.4 million, of which $1.6 million can be publicly traded, $43.8 million is non-liquid assets, and 0.3 million $MC. In addition, according to the disclosed purchase prices, the total cost of these assets is $29.9 million, with a book profit of 51.8%.

https://treasury.meritcircle.io/treasury Incomplete screenshot of MC investment projects

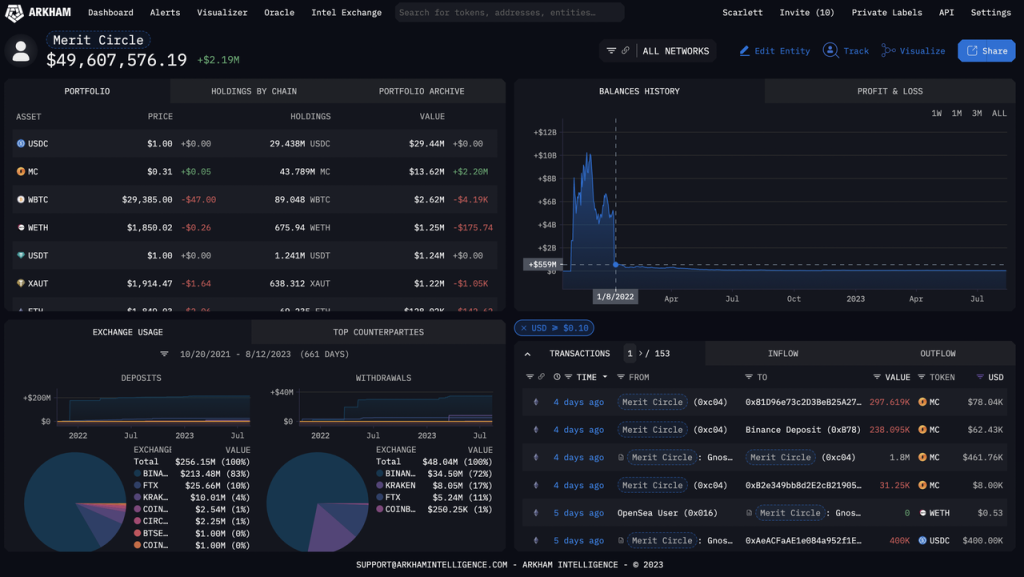

Moreover, MC’s on-chain treasury funds are clearly stronger than YGG. Only 27.4% of the funds in the wallet are MC’s own tokens, while 69.5% are highly liquid stablecoins and mainstream assets.

Merit Circle treasury address asset situation, Arkham, Mint Ventures

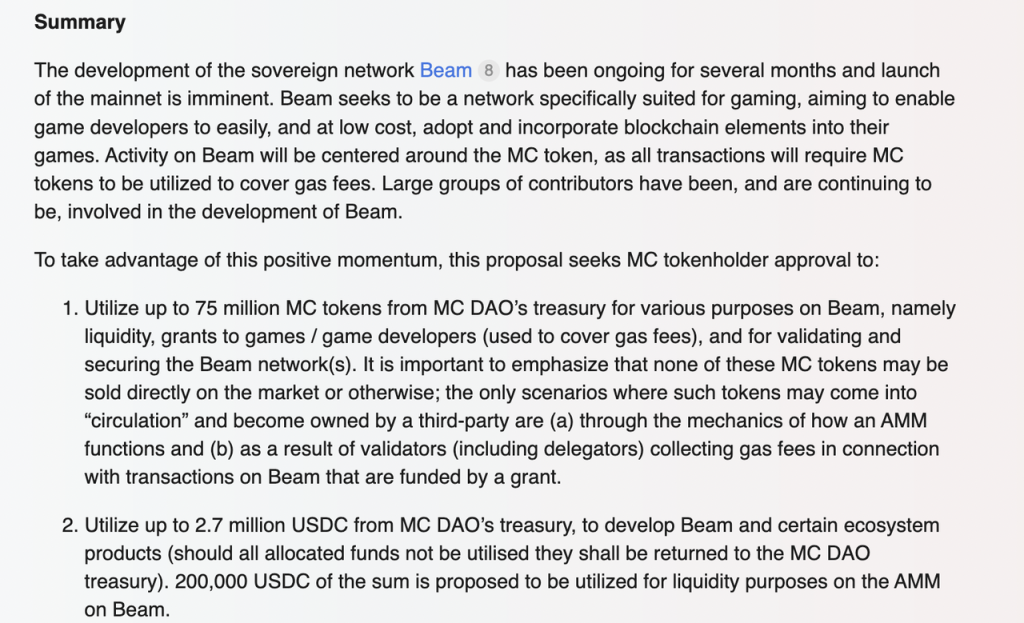

In addition, the launch of the Avalanche subchain Beam by MC on the testnet is also an important event for future trends. Beam will adopt the Proof of Stake mode, use $MC as the gas token, and use LayerZero as the cross-chain infrastructure. Currently, three games are being developed based on Beam. On August 14th, the team proposed a draft in the community governance section and opened it for discussion:

https://gov.meritcircle.io/t/beam-development-and-ecosystem-funding/822

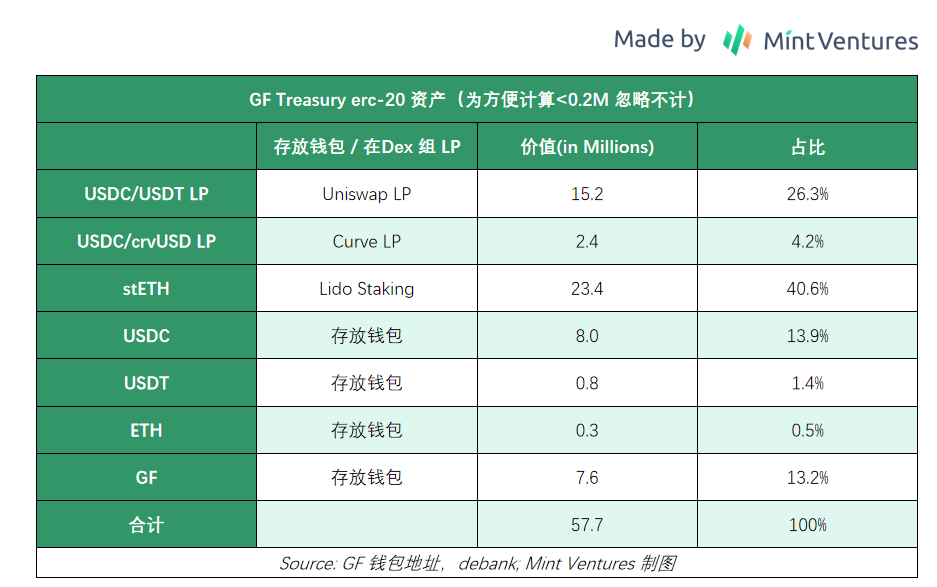

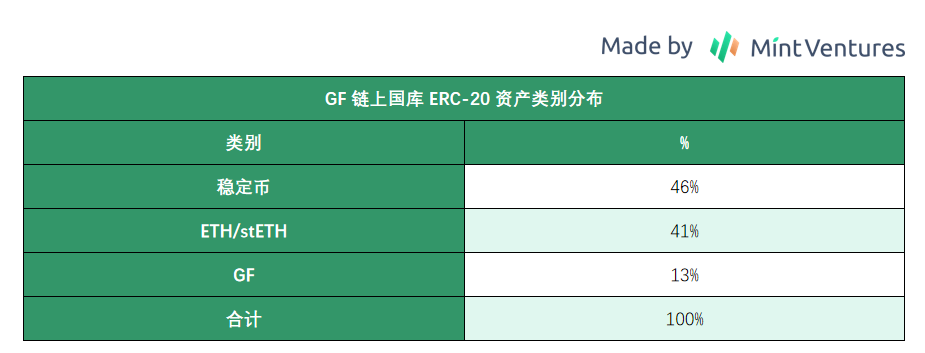

GuildFi: Weak business capabilities, balanced on-chain treasury funds, 13% GF, 46% stablecoins, 41% stETH seeking stable returns

Since GF’s assets include many LPs on Uniswap, it is difficult to directly display them through Arkham. The following figure shows the on-chain asset statistics of the publicly disclosed wallet’s ERC-20 assets: It can be seen that GF’s on-chain treasury consists of 46% stablecoins, 41% ETH/stETH, 13% GF, and some small game-related token investments, totaling 57.7 million.

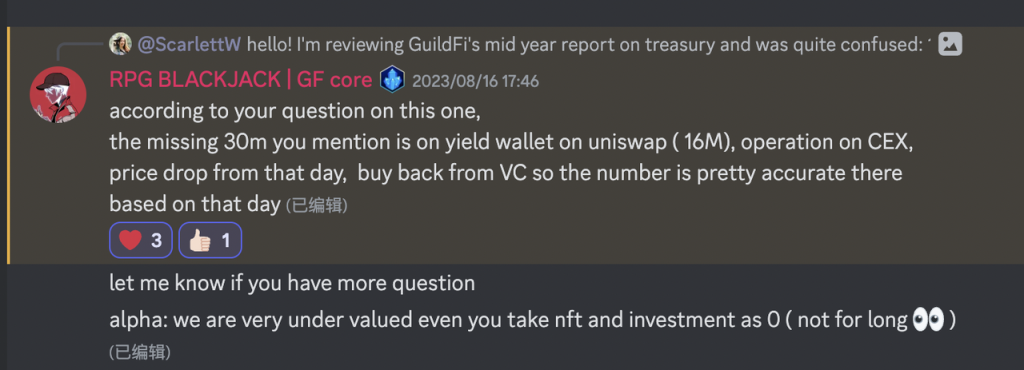

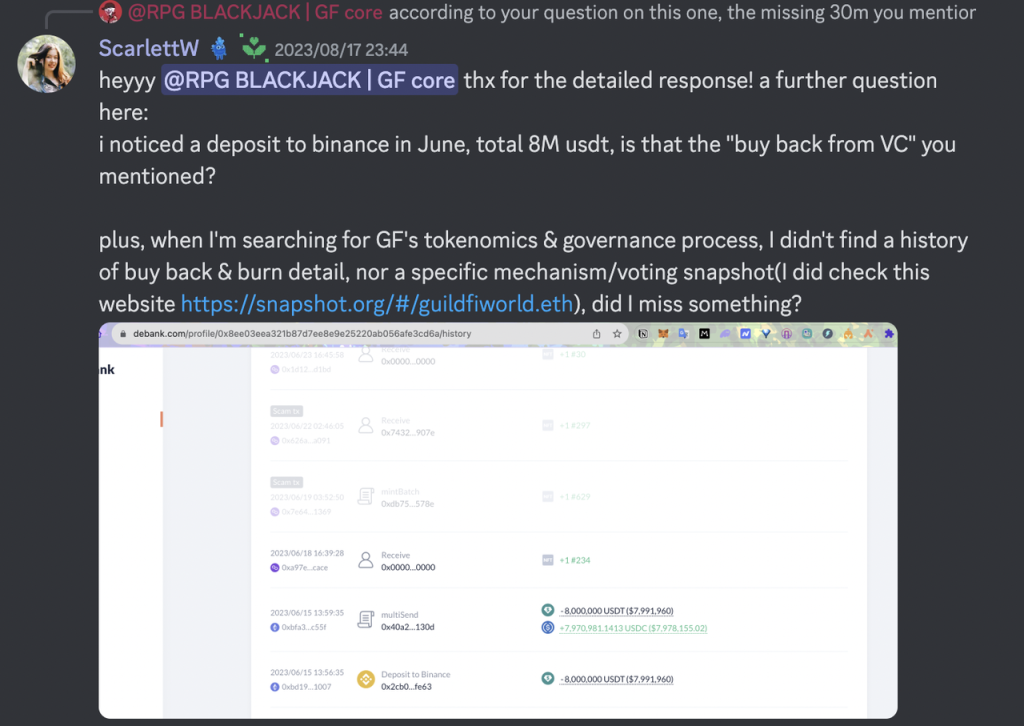

Compared to the financial summary data released by GF, the official on-chain assets have decreased by 19% from the time of the summary release, mainly due to the decline in token prices and the transfer of 8M USDT to Binance. The official team stated that the assets held in cex are mainly used for daily operations and buybacks from investors.

Source: Debank

Source: GuildFi

However, when further asked about the “public buyback mechanism and buyback history,” apart from the “please wait patiently” for two days, no reasonable answer was given.

Discord Q&A Record

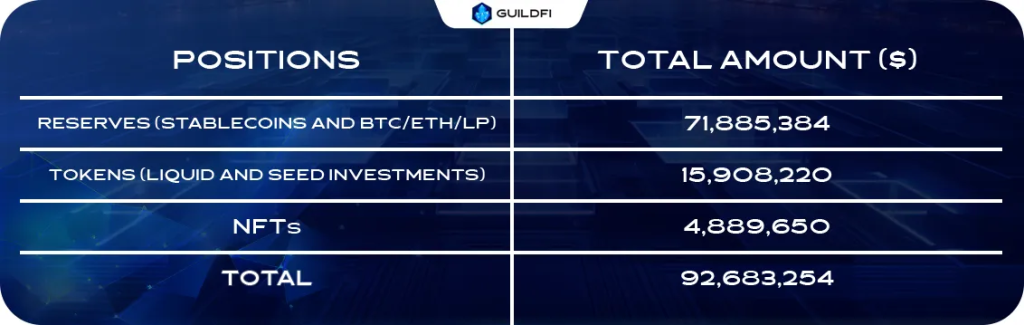

In the semi-annual summary, in addition to the $71M assets in Reserve (now a total of $57.7M on-chain), there is also $15.9M worth of primary market investments and other game tokens, as well as $4.8M worth of NFTs.

GF Cooperative Games

3. Comparison of DAO Construction and Governance Capabilities: Merit Circle is far stronger than its competitors

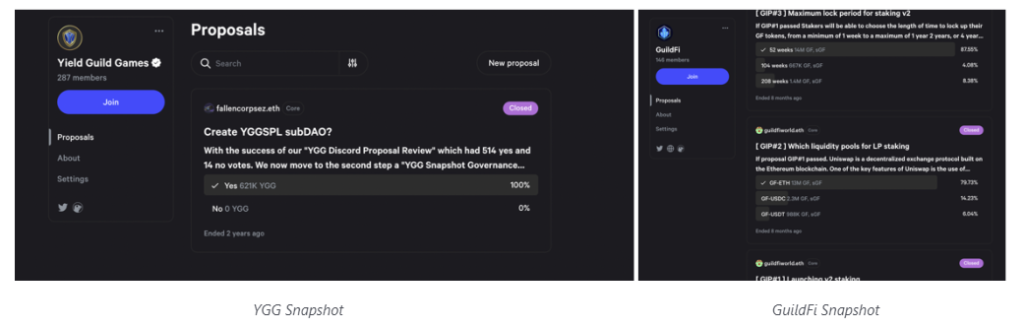

Although in the white paper released in 21, both YGG and GuildFi expressed their hope that the ultimate goal of this game guild is to become a Gaming DAO, it is actually Merit Circle that has truly achieved this goal.

When you click on YGG and GuildFi’s Snapshot, you can only see a few historic votes:

- YGG: A proposal for SubDAO two years ago.

- GuildFi: Three proposals and details about the Staking System launched eight months ago.

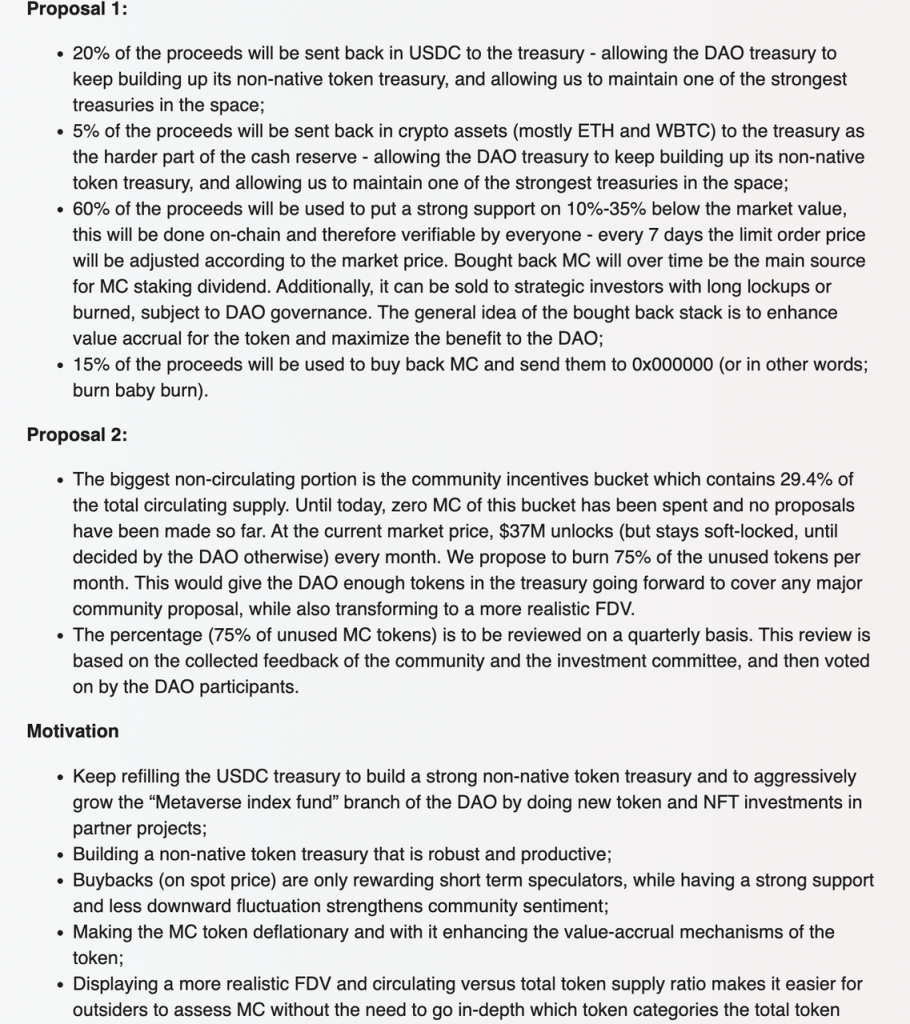

But Merit Circle will show users how a Gaming DAO/Investment DAO with a complete operational process and risk control awareness should operate: In the past two years, Merit Circle’s Snapshot has a total of 26 proposal votes, including DAO governance, investment risk management (authorization mechanism for withdrawal and investment limits), game development, etc. Some important proposals include:

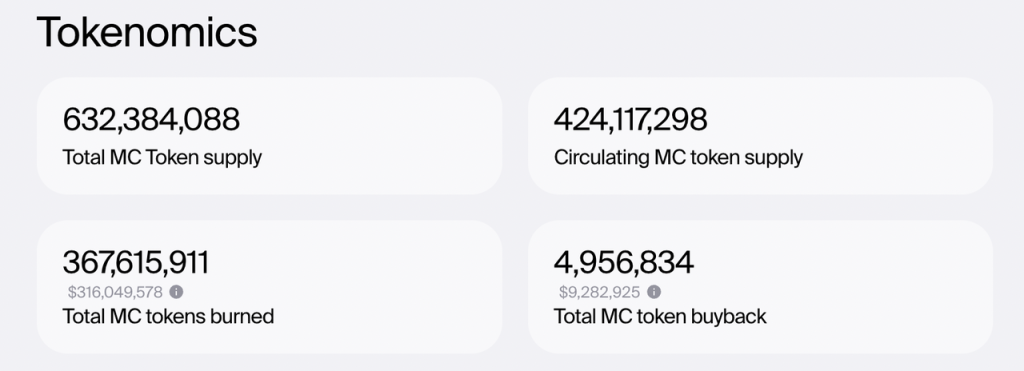

2022.01 MIP-7, which determines revenue distribution and token burning. 20% of the revenue is kept in the treasury in the form of $USDC, 5% of the revenue is kept in the treasury in the form of $ETH/$WBTC, 60% of the revenue is used for low-price buybacks at appropriate times to maintain token price stability (buybacks are conducted when the price is 10-35% below the 7-day average price, and this part of $MC mainly goes into staking rewards or can be sold to strategic investors willing to lock their positions for the long term), and 15% of the revenue is used for direct buyback and burning of $MC. In addition, since most of the unlocked tokens are released for “community incentives,” it is decided to burn 75% of the unlocked “community incentive” tokens each month (the proportion can be modified by community voting). Provide sufficient tokens to the DAO’s treasury to cover any major community proposals and transform mCap into a more realistic FDV. It’s hard not to be surprised by the foresight of $MC and its calmness in the face of huge temptations—actively burning 75% of the tokens released to the community is not an easy decision, and the completeness of the mechanism is the foundation for the balance of $MC’s treasury funds.

$MC Repurchase and Destruction Announcement: https://treasury.meritcircle.io/

https://gov.meritcircle.io/t/mip-7-sustainable-future-vision/192

May-June 2022: Return of YGG’s investment. Termination of relationship with investors who did not provide substantial assistance.

https://snapshot.org/#/meritcircle.eth/proposal/QmT71tWtTwk6q5Cd2kvhoLzxm76SpNaQGBR9RE7pCxBM58

https://snapshot.org/#/meritcircle.eth/proposal/QmanW7dTyF2LvvU9iAGwj3i9D4F3TS7ZbxR33jVCmKMrgR

July 2022: Restructuring of DAO architecture.

December 2022: Proposal for Merit Circle Grants. Allocate 150k USDC quarterly for small-scale incentives in research and game development. Research Grants not exceeding 10k per transaction, Development Grants not exceeding 25k per transaction.

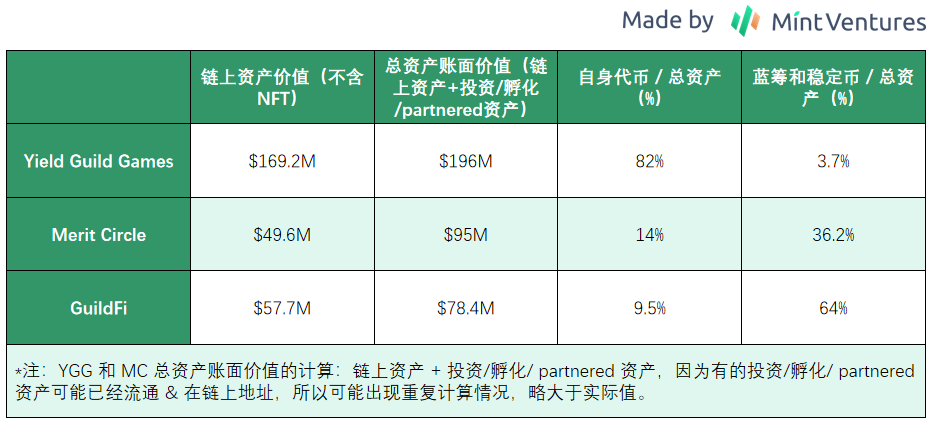

July 2023: Cancel the subsequent Staking rewards for Uni V2 and destroy the future rewards. This is mainly due to the fact that the existing Staking model does not bring much benefit to Merit Circle, but there are clear use cases for staking on Beam (the game chain that MC plans to build, proof-of-stake). Therefore, the V2 rewards will be canceled and the staking rewards will be concentrated on Beam in the future.

https://gov.meritcircle.io/t/mip-26-cancel-all-future-v2-v3-staking-rewards-and-unlock-all-v2-stakers-proposal/803

By reviewing several proposals, it can be seen that although the proposers are mainly the team and the number of voters is not large (basically around 5M $MC), Merit Circle’s team has a clear strategic mindset and is willing to sacrifice short-term benefits to maintain the long-term interests of the community. The governance is also relatively transparent.

4. Summary Comparison: Business Capability, Investment Capability, Risk Control Capability, and Market Value Comparison

4.1 Business Capabilities: MC has more diversified business, YGG has a wider user base, GF is lagging behind

In addition, from the perspective of organizational structure, YGG’s model is a product of the Axie era – YGG extends regional sub DAOs to facilitate regional member reach and management, but lacks an up-to-date risk control system. Merit Circle, on the other hand, is more like a game factory, doing well in investment (with a complete risk control system), incubation, promotion, and infrastructure. GuildFi’s investment capabilities and market activity are inferior to the former two.

4.2 External cooperation and investment capabilities: MC is in the lead, YGG comes second in terms of scale and profitability, GF has the smallest scale, and the profitability is unknown

4.3 Risk control capabilities: MC is in the lead, GF comes next, YGG performs poorly

There are two evaluation criteria for this part:

- Whether the team’s handling, management, and control of assets are transparent and comply with pre-established mechanisms, in this regard, MC >> GF/YGG

- How much the token of the asset affects the total asset price. If the proportion of “token / total assets” is too high, it indicates poor risk control. Position management: GF>MC>YGG.

Overall, MC is in the lead, GF comes next, and YGG performs poorly.

4.4 Valuation Comparison: $MC has reached a high level, $YGG has returned to normal, $GF has a weak business resulting in a market value < the stablecoin and blue chip total value of the treasury

Due to the nature of the guild’s business, the project’s treasury assets can partially reflect the business situation. As mentioned earlier, the core functions of the guild are:

- Serving game project parties relying on the players at hand

- Investment and incubation

Part of the project’s assets corresponding to these functions enter the book value of external cooperation and investment (NFT, FT, equity), and part of them may have been converted into stablecoins and blue chips and kept in the treasury. Therefore, the comparison of treasury assets can partially reflect the valuation of the guild’s projects.

Before the recent surge in $YGG, its daily trading volume was only a few million dollars, indicating limited liquidity. The proportion of $YGG in YGG’s treasury is as high as 82%, which means that selling off will only have a devastating impact on the price. Therefore, the “mCap / total asset book value” and “mCap / total market value of assets excluding its own token” will be compared to ensure objectivity. Taking all factors into consideration, the value support is $GF > $MC >= $YGG (please note that both the “total asset book value” and “total market value of assets excluding its own token” include “stablecoins + blue chips” and “FT / NFT brought by investment / external cooperation”, the pricing of the latter is not fair market value but from financing valuation, which poses a significant risk of asset write-down in the future if the token is listed or the project does not develop smoothly. Additionally, for “FT / NFT brought by investment / external cooperation”, while Merit Circle has disclosed the cost and book value of all projects, the other two have not provided specific algorithms, which may also lead to statistical caliber issues.)

Due to the fact that the unlocking of $MC has been mostly completed, but there is still a large amount of tokens to be unlocked for $YGG and $GF, from the perspective of FDV/mCap, the potential downside risk is $YGG>$GF>$MC.

Except for $MC, which has a clear token buyback mechanism, the rest of the projects do not have token buyback mechanisms. $GF has a Staking mechanism with fixed reward release, while $YGG doesn’t even have staking. Combined with GuildFi’s weak position in terms of business, even if $GF’s market value is smaller than the total market value of its on-chain stablecoins and blue chips, it is still difficult to conclude that it is “undervalued”.

Looking at the future upside, $MC has the narrative of a gaming chain and the logical capture of value through staking on the POS chain, while $YGG’s future plan is to launch a new Quest System on Base. $GF currently lacks a breakthrough in terms of business narrative.

References

https://meritcircle.io/

https://medium.com/@meritcircle/looking-back-at-2022-an-unforgettable-ride-c45b9fdcd225

https://medium.com/guildfi/guildfi-mid-year-update-94ac88a55017

https://medium.com/yield-guild-games/yield-guild-games-community-update-q2-2023-e534b60340fd

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!