Today’s Highlights:

MakerDAO DAI deposit interest rate has been lowered to 5%. Justin Sun redeemed 206 million DAI from the DSR pool last night.

HashKey will launch a virtual asset platform for retail investors on August 28th, limiting investments to no more than 30% of total assets.

The Wall Street Journal: Zuckerberg’s social platform Threads will launch a web version this week.

- IOSG Weekly Report Panoramic Scan of On-chain Data Tools Product Types, Business Models, and Development Directions

- Revealing the current situation of the Lumaogong Studio Some projects have been lurking for years, and under internal competition, they have shifted towards specialization and operating multiple business models.

- DappRadar claims that Ordinals’ trading volume has dropped by 97% and refutes three points of its errors.

SlowMist Cosine: Wallet addresses corresponding to over 100,000 Twitter accounts on friend.tech have been leaked, posing a risk of further privacy exposure.

Data: The total market value of stablecoins is currently about $123.4 billion, the lowest level since the end of July 2021.

Dogecoin’s chief developer: The possibility of Dogecoin transitioning to a PoS consensus is very low. If it happens, he may quit the project.

Lending protocol THORFi Lending has gone live, with initial support for BTC and ETH collateral.

NFT brand experience platform Recur will permanently shut down on November 16th. It previously raised $50 million in funding.

Regulatory News

A parliamentary committee has been established in Kenya to investigate Worldcoin.

According to local media reports in Kenya, the Kenyan government has formed a parliamentary committee consisting of 15 members, led by Narok West MP Gabriel Tongoyo, to investigate the cryptocurrency project Worldcoin. The committee has 42 days to investigate the project and submit a report to the House Committee. Previously, Kenya suspended the operation of Worldcoin because it failed to comply with the government’s order to stop scanning users’ irises.

The police in Mianyang solved a case of telecommunication fraud and money laundering involving the transfer of funds through virtual currencies, with an amount involved of over 30 million yuan.

According to Sichuan News Network, the Mianyang Public Security Bureau’s Youxian District Branch recently successfully solved a case of telecommunication network fraud and money laundering, and successfully cracked down on a telecommunication fraud and money laundering gang of nearly 100 people controlled directly by an overseas fraud base, arrested more than 90 criminal suspects, destroyed three bases, seized more than 80 crime-related mobile phones, three vehicles, more than 100 bank cards involved in the case, and investigated and verified an amount involved of more than 30 million yuan. The case is still under further investigation.

In the course of the investigation, the police found a professional criminal gang led by Hu and Liu, who are returnees from overseas fraud bases, specializing in money laundering (whitewashing funds for online telecommunication fraud) and profiting from it. This team has close “cooperative relations” with overseas brushing fraud bases. Hu is mainly responsible for docking and receiving money laundering business; Zhong is responsible for organizing and commanding “fleet” members to recruit card farmers, withdraw money, and receive payments; Liu transfers the funds involved in fraud to overseas merchants by purchasing virtual currencies.

NFT

NFT brand experience platform Recur will permanently close on November 16th, after previously raising $50 million in funding

NFT brand experience platform Recur announced on X platform (formerly Twitter) that it will gradually disable platform functions starting from August 18th and will completely close on November 16th, 2023. All NFT metadata on the platform will be migrated to IPFS.

Earlier, Recur announced in September 2021 that it had completed a $50 million Series A financing round, with a valuation of $333 million. Investors in its $5 million seed round in March 2021 included IOSG Ventures, Delphi Digital, Gemini, and ConsenSys founder Joseph Lubin.

Project Updates

The MakerDAO DAI deposit rate has been lowered to 5%, and Justin Sun redeemed 206 million DAI from the DSR pool last night

Makerburn data shows that the MakerDAO DAI deposit rate (DSR) has been lowered to 5%, and the current amount of DAI deposited in the DSR has decreased to 1.14 billion.

In addition, according to on-chain analyst Yu Jin’s monitoring, due to the DSR adjustment, Justin Sun redeemed 206 million DAI from the DSR (Dai Savings Rate) pool last night and reclaimed 235,500 wstETH collateral. It is reported that the 9-day profit from the 206 million DAI is 257,000 DAI, and it has now been converted into 154 ETH.

HashKey will launch a virtual asset platform for retail investors on August 28th, with investment limited to 30% of total assets

According to Sing Tao Daily, HashKey, a licensed virtual asset platform approved by the Hong Kong Securities and Futures Commission earlier this month, will launch a trading platform application for retail investors on August 28th. Livio Weng, Chief Operating Officer of HashKey Group, said in an interview that initially, retail investors will be able to invest in Bitcoin and Ethereum, and the investment in virtual assets will be limited to 30% of total assets.

Weng said that a tiered system will be set up for retail investors, and their past experience and risk tolerance will be assessed through the KYC process. A questionnaire will also be used to determine whether they have a correct understanding of virtual assets, and the participation of beginners will be relatively limited. He revealed that the first batch of retail investors can only trade Bitcoin and Ethereum. Currently, margin and derivative instruments are not provided by the Securities and Futures Commission. When regulatory approval is obtained in the future, various products will be launched for different types of users. The platform cooperates with multiple commercial banks to provide users with fiat currency deposit and withdrawal services, initially supporting US dollar transactions and not yet supporting Hong Kong dollars. Only bank card transactions are accepted for now, and credit cards are not supported. If a retail investor’s investment in virtual assets on the platform exceeds 30% of their total assets, a risk warning will be issued and their investment will be restricted. However, the platform cannot verify the user’s total assets, so it can only rely on users’ self-reporting.

HashKey also collaborates with 4 to 5 securities firms in the market to facilitate buying and selling for clients. If operations go smoothly, it is estimated that more securities firms will be approved to provide trading services to clients next year. Currently, the platform does not conduct any business with mainland Chinese clients. In the next step, HashKey aims to develop institutional business, especially custody services, and also research on using virtual assets as underlying assets for virtual asset ETFs in the future, subject to regulatory permission.

Earlier on August 3, the Hong Kong Securities and Futures Commission approved the upgrade of HashKey Exchange’s license, allowing it to provide services to retail investors.

The Wall Street Journal: Zuckerberg’s social platform Threads will launch a web version this week

According to The Wall Street Journal, Meta, formerly known as Facebook and owned by Zuckerberg, plans to launch a web version of its social platform Threads earlier this week. Insiders familiar with Meta’s plans said that although the web version is planned to be launched this week, these plans are not certain and may change.

Sam Saliba, a Silicon Valley technology executive and former global brand marketing manager at Instagram, said, “The web version of Threads will be a major advantage for Meta in its competition with X. It will allow the company to have a broader coverage, more features, and better data collection capabilities.”

It is reported that after Threads was launched on July 5, the number of users quickly grew to over 100 million, but most of them quickly churned. The number of daily active users dropped by 70% two weeks later and 85% by mid-August. The lack of functionality in Threads was one of the reasons for user churn, with the biggest flaw being the absence of a web version. According to The Wall Street Journal, the web version is one of the most anticipated features for users of Threads. Currently, the web interface of Threads only allows users to view specific posts through a browser.

Dogecoin’s chief developer: The possibility of Dogecoin shifting to PoS consensus is very low, and if it happens, he may quit the project

Mishaboar, the chief developer of Dogecoin (Doge), replied to a user on Twitter, saying that the possibility of Dogecoin shifting to PoS consensus is very low. However, if Dogecoin seeks to transition to PoS consensus, he may quit the development of Dogecoin and join another PoW cryptocurrency project. He said that many PoS chains have not lived up to expectations, showing centralization characteristics, encountering major failures, or being difficult to use. The biggest advantage of PoS is lower energy consumption and faster transactions, but most transactions do not really need them. For transactions that require these advantages, it seems that they can be achieved through other solutions, such as payment channels and integration with payment providers.

Lending protocol THORFi Lending is now online, initially supporting BTC and ETH collateral

Decentralized cross-chain trading protocol THORChain announced that the lending protocol THORFi Lending is now online, initially offering loans with ETH and BTC collateral, and will soon open up lending to all L1 Gas assets supported by THORChain (BNB, BCH, LTC, ATOM, AVAX, DOGE). The lending limit depends on the outstanding supply of RUNE and the maximum collateralization ratio is 500%, with a minimum collateralization ratio of 200%.

Users can lend their native L1 assets (BTC and ETH) to THORChain and borrow debt denominated in USD, without liquidation, interest, or expiration date. The debt is denominated in TOR, but can be repaid with any asset supported by THORChain, including stablecoins. The minimum loan term is 30 days. Borrowers can repay the debt and retrieve the collateral at any time after 30 days. Debt can be partially repaid, but the collateral will not be released until the debt is fully repaid. THORChain notes that there may be vulnerabilities in THORChain Lending that require suspension or fixing. Node operators and developers will remain vigilant and fix them promptly.

Previously, THORChain announced that it will launch a lending protocol that will increase the burning mechanism of RUNE and promote deflation of RUNE.

The proposal to “Activate Base Network Aave V3” has been approved by on-chain voting and has been executed.

The governance page shows that the on-chain vote on the proposal to “Activate Base Network Aave V3” has been approved with a 100% support rate, and the proposal has been executed on-chain.

This proposal allows Aave governance to enable wETH, cbETH, and USDbC to be launched on Base’s Aave V3 after completing all initial setups, thereby activating Aave V3 Base pool.

Exactly Protocol: Suspension lifted, no liquidation occurred

DeFi lending protocol Exactly Protocol tweeted that the protocol’s suspension has been lifted. Users can perform all operations and no liquidation has occurred. The hacker attack only affected users who used the peripheral contract (DebtManager). Users who did not use the contract did not suffer any losses, and the protocol is still operating normally. Regarding the hacker attack and fund recovery work, the team is actively working on multiple aspects and will announce the investigation results and propose potential strategies for DAO voting once there are updates. In addition, the team is also preparing a post-mortem report for a thorough analysis of the incident. This report will be shared with the community in the coming days.

According to previous reports, Exactly Protocol was attacked. Security firm De.Fi stated that Exactly Protocol has lost over 7,160 ETH (approximately $12.04 million) and subsequently announced the suspension of the protocol.

HKVAX plans to launch a virtual asset platform and establish OTC over-the-counter trading half a year later, and will actively promote the next round of financing

According to Ming Pao’s report, Hong Kong Virtual Asset Exchange (HKVAX) recently announced that it has obtained a preliminary approval notice from the Hong Kong Securities and Futures Commission. Kelvin Ho, co-founder and COO of HKVAX, said that it took 3 years from applying for the license to now. He expects that it will take at least another half a year to obtain the license, and plans to launch virtual asset platforms, OTC over-the-counter trading, and other services at that time. As for whether to launch STOs (Security Token Offerings) in the future, he said it depends on the regulations of the Securities and Futures Commission.

Based on the experience of peers in the industry, Kelvin Ho believes that it will take at least half a year to officially provide external services. To meet the needs of future development, HKVAX has conducted multiple rounds of financing since 2020 and has received investment from families and investors based in Hong Kong. Kelvin Ho, co-founder and CEO, also pointed out that they will work closely with strategic investors to actively promote the next round of financing and introduce market participants, including brokers, buyers’ asset management, and investment banks, as well as further connecting businesses to HKVAX’s platform to complement each other. They have also contacted traditional banks and learned that banks also want to explore new paths, such as whether they can leverage blockchain to further launch STOs. Therefore, it is worth researching and exploring cooperation to launch products.

Empowered Funds has applied to launch three Bitcoin futures ETFs, which will use the Ark and 21Shares brand names.

According to the Financial Times, Empowered Funds has applied to launch three Bitcoin futures ETFs, which will use the Ark Invest and 21Shares brand names. The funds are Ark 21Shares Active Bitcoin Futures ETF, Ark 21Shares Active On-Chain Bitcoin Strategy ETF, and Ark 21Shares Digital Assets and Blockchain Strategy ETF. Among them, Ark 21Shares Active Bitcoin Futures ETF will primarily invest in Bitcoin futures traded on the Chicago Mercantile Exchange and will serve as the underlying ETF for the other two Bitcoin-related ETFs.

Ark 21Shares Active On-Chain Bitcoin Strategy ETF will allocate at least 25% of its assets to digital assets and blockchain strategy ETFs. The on-chain ETF will use a proprietary trend indicator model to adjust its allocation strategy, depending on the upward or downward trend of the Bitcoin market. In bullish conditions, the ETF can invest 100% of its assets in related ETFs. In bearish conditions, the fund will allocate up to 75% of its assets to US Treasury bonds, money market instruments, and repurchase agreements. Based on the trend assessment of the model, the fund’s investment team will adjust the fund’s investment in Bitcoin futures. Ark 21Shares Digital Assets and Blockchain Strategy ETF will invest in underlying ETFs and “companies engaged in digital assets, blockchain, technology, and fintech industries”. This ETF can allocate up to 80% of its assets to Bitcoin futures ETFs or other assets, and up to 20% of its assets to cash or cash equivalents (such as Treasury bonds) and real estate investment trusts.

Empowered is a subsidiary of Alpha Architect and operates under the name EA Advisers. It will serve as the advisor to the fund, while Ark Invest and 21Shares will serve as associate and assistant advisors, respectively. Ophelia Snyder, co-founder and president of 21Shares, will serve as the portfolio manager for these funds. According to data from Morningstar Direct, as of July 31, Empowered Funds’ parent company Alpha Architect has provided 15 ETFs with total assets of $1.9 billion. In the past year ending on that date, investors have invested $717 million in these funds.

Spot on Chain: friend.tech has API data leaks and the issue of contract trading shares without invitation codes.

According to Spot on Chain monitoring, friend.tech has API data leaks and the issue of being able to trade contract shares directly on etherscan without invitation codes. Users can buy and sell through the linked MetaMask directly on etherscan.

Later today, SlowMist Cosmos stated that the wallet addresses corresponding to over 100,000 Twitter accounts have been leaked, posing a risk of further privacy exposure.

LianGuairadigm co-founder Matt Huang denies involvement in investing in AI digital identity provider Prins AI.

LianGuairadigm co-founder Matt Huang denied to LianGuaiNews that LianGuairadigm has ever been involved in investing in AI digital identity provider Prins AI and stated that he has never heard of the Prins AI project.

Today, there were reports that AI digital identity provider Prins AI has completed a Series A+ financing of $22 million, and the specific investors have not been disclosed. It also stated that it raised $10 million in Series A financing, with notable investors including Base 10, Kleiner Perkins, and LianGuairadigm.

Important Data

Data: Over $100 million worth of AVAX and $14 million worth of LDO to be unlocked this week

According to Token Unlocks data, seven crypto projects will unlock their tokens this week, releasing a total value of approximately $147 million.

Injective (INJ) will unlock around 2.86 million tokens worth approximately $22.08 million on August 21st at 8 am.

SLianGuaiCE ID (ID) will unlock around 18.49 million tokens worth approximately $3.73 million on August 22nd at 8 am.

1inch (1INCH) will unlock around 274,000 tokens worth approximately $68,000 on August 24th at 8 am.

Acala (ACA) will unlock around 4.66 million tokens worth approximately $220,000 on August 25th at 8 am.

Lido DAO (LDO) will unlock around 8.5 million tokens worth approximately $14.2 million on August 26th at 1:51 am.

Avalanche (AVAX) will unlock around 9.54 million tokens worth approximately $104 million on August 26th at 8 am.

Yield Guild Games (YGG) will unlock around 12.22 million tokens worth approximately $2.88 million on August 27th at 10 pm.

Data: Total market value of stablecoins is approximately $123.4 billion, reaching the lowest level since the end of July 2021

According to DefiLlama data, the total market value of stablecoins is $123.448 billion, which has decreased by 0.82% (around $1.025 billion) in the past 7 days. This represents a 10% decrease from the $137.77 billion market value on January 1st this year, reaching the lowest level since July 30th, 2021. The top three stablecoins in terms of market value are currently USDT ($82.9 billion), USDC ($25.6 billion), and BUSD ($3.975 billion).

BendDAO and LianGuairaSLianGuaice have a total of 110 BAYC and 111 MAYC with a health factor below 1.2, approaching the liquidation threshold

In the NFT lending protocols BendDAO and LianGuairaSLianGuaice, there are a total of 110 BAYC and 111 MAYC with a health factor below 1.2, approaching the liquidation threshold.

Among them, BendDAO data shows that there are currently 68 BAYC and 50 MAYC with a health factor below 1.2 on the platform, approaching the liquidation threshold. According to the page data of LianGuairaSLianGuaice, there are 4 BAYC in the process of liquidation auction. In addition, there are already 42 BAYC and 61 MAYC with a health factor below 1.2 on the platform, approaching the liquidation threshold.

Vitalik repaid 251,000 RAI and withdrew 1,000 ETH from Maker yesterday

According to Lookonchain monitoring, vitalik.eth repaid 251,000 RAI and withdrew 1,000 ETH (worth approximately $1.67 million) from Maker yesterday.

Earlier reports stated that the wallet address related to Ethereum co-founder Vitalik Buterin, vitalik.eth, transferred 600 ETH (worth about $1 million) to Coinbase.

PeckShield: BNB Bridge hacker’s position has been liquidated, approximately 6.89 million vBNB repaid

According to PeckShield monitoring, the position of the BNB Bridge hacker has been liquidated, with approximately 6.89 million vBNB repaid. The liquidator has repaid 30 million USDT.

Earlier news, as the price of BNB fell below $210, the BNB Bridge hacker’s borrowing health factor on Venus was 0.99. The Venus community has passed a governance proposal to whitelist the liquidation of the previous BNB Bridge hacker’s position.

The total trading volume on friend.tech exceeded 30,000 ETH, growing nearly 50% in 15 hours.

According to Dune data, the protocol trading volume on the decentralized social platform friend.tech has exceeded 30,000 ETH, currently at 30,425.5 ETH, with a growth of nearly 50% in 15 hours. The protocol revenue reached 1383 ETH, an increase of 42% in 15 hours.

Earlier today, the protocol fees of friend.tech surpassed Uniswap and the Bitcoin network in the past 24 hours, amounting to approximately $1.12 million.

LianGuaiNews APP Points Mall officially launched.

Hardcore prizes for free redemption: imKeyPro hardware wallet, First Warehouse Research Report monthly card, Ballet REAL series wallet, AICoin membership, various peripherals, and hundreds of selected research reports collection. First come, first served, experience it now!

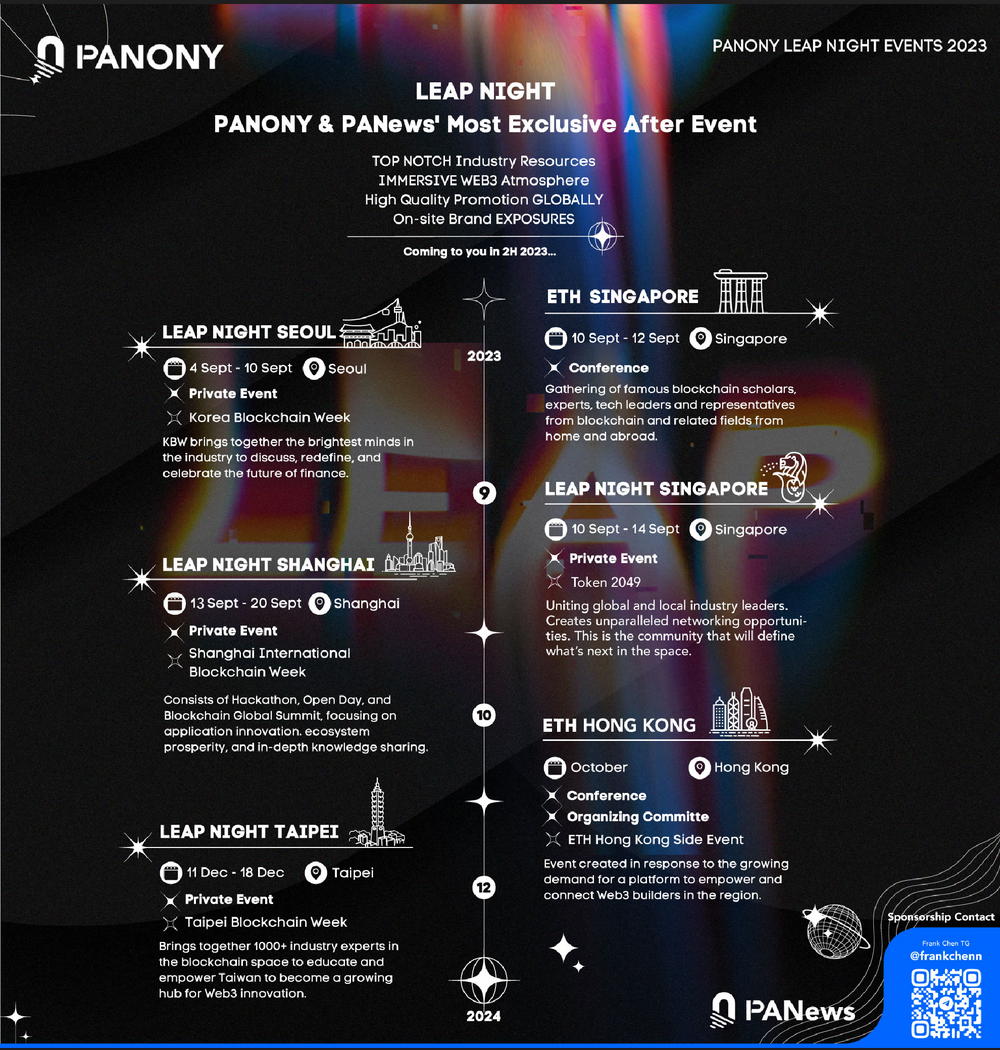

LianGuaiNews launches the global LEAP journey!

South Korea, Singapore, Shanghai, Taipei, September to December, multiple locations gather to witness a new chapter in globalization!

📥Multiple events are being built, welcome to communicate!

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!