Article author: rxndy444

Article translation: Block unicorn

Cryptocurrency narratives fluctuate, but stablecoins as a core component of on-chain financial infrastructure have been a stable presence in the market. There are currently over 150 stablecoins in circulation, and it seems like new stablecoins are released every week. How can users make a choice among all the different options?

- Evening Must-Read | Azuki Brings Down the Market, Yuga Labs Struggles Alone, Where is the NFT Road Heading?

- Viewpoint: Bullish on Prime Brokerage, HK Centralized Finance, and On-chain Derivatives Exchanges.

- Bitcoin Cash Soars: Another Performance by “South Korean Capital”?

When evaluating the pros and cons of different stablecoins, it can be helpful to categorize based on common design elements. So, what are the basic ways stablecoins vary?

The main differences between different stablecoins include:

1. Collateral: Are these tokens fully collateralized? Partially collateralized? Or not at all?

2. Centralization: Does collateral involve government-backed assets like USD, GBP, or bonds? Or is it composed of decentralized assets like Ethereum?

With these attributes in mind, we can begin to construct a framework for comparing different stablecoins. Let’s take a look at how some major players today are competing with each other.

Getting into decentralized stablecoins

Looking at the top 10 stablecoins ranked by trading volume, we can see that centralized stablecoins, essentially on-chain USD, are the most commonly used. These stablecoins do not provide resistance to censorship or protection from traditional bank crises. For example, when Silicon Valley Bank collapsed in March, USDC holders had to worry about the fate of the reserves held there. Many rushed to exchange their USDC for more robust options, including LUSD, and this is not the first time we’ve seen decentralized premiums at play.

The ultimate goal of stablecoins is to find an option that achieves decentralization, capital efficiency, and price stability, something that USDC and USDT clearly cannot achieve. To drive the development of the stablecoin space forward, we must move beyond these two options – so how does the current arena look?

Of the top 10 stablecoins, only three can be considered somewhat decentralized; DAI, FRAX, and LUSD.

Frax: The Path of Algorithmic StablecoinsFrax is a fractional reserve stablecoin that uses the AMO (Algorithmic Market Operations) system to change its collateral ratio and bring its price closer to the pegged price. At its most basic level, when the price is below $1, AMO increases the ratio, and when the price is above $1, it decreases the ratio. This means that for FRAX holders, the redemption fulfillment depends on the current collateral level. If the ratio is 90%, redeeming 1 FRAX will get $0.90 from the protocol reserve plus $0.10 worth of FXS (Frax Shares) newly generated by AMO. Due to the dynamic nature of the collateral ratio, it is difficult to determine the actual amount of collateral behind FRAX at any given time.

A recent proposal passed shows support for a move towards a fully collateralized model. The main motivation here is mainly due to increased regulatory scrutiny on algorithmic stablecoins following Terra’s UST debacle. Overall, algorithmic stablecoins remain a highly experimental part of the market, and although Frax has been successful in using its AMO model for development, it appears to be transitioning.

DAI: Partial Decentralization

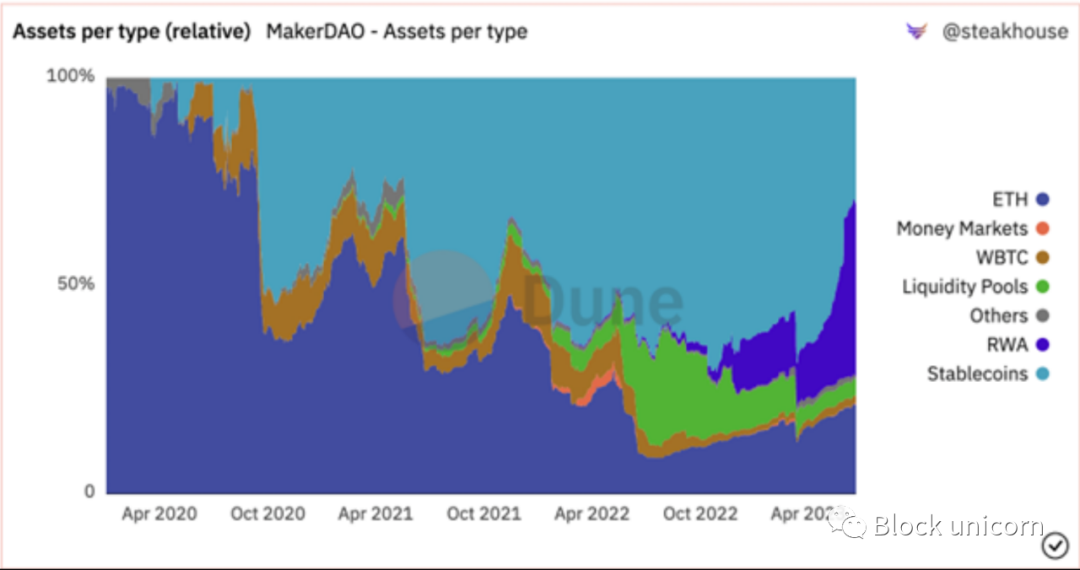

DAI, with its CDP model, has become the most successful stablecoin outside of on-chain dollars such as USDC and USDT. The main issue here is that most people may not initially realize that DAI borrowing is typically collateralized with the same centralized stablecoins, exposing it to the same centralized risks. Since expanding to a multi-collateral model, these centralized stablecoins have become the main component of DAI support, sometimes exceeding 50%!

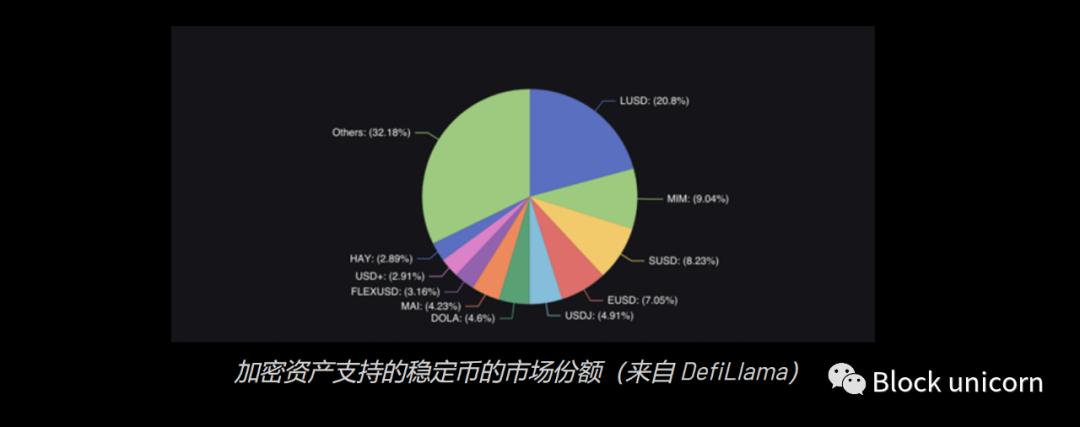

Given our uncertainty about the reserves of Frax and DAI, let’s look at other situations in the decentralized stablecoin market. Continuing to observe which stablecoins are decentralized and supported only by crypto assets.

LUSD

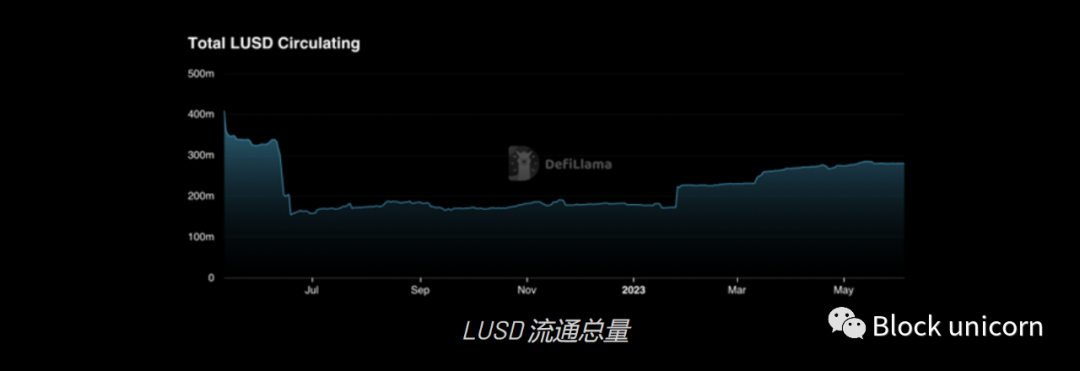

So far, LUSD is the most outstanding in the field of stablecoins that are entirely collateralized by crypto assets. LUSD has achieved this status by building a solid foundation: immutable smart contracts, economically reasonable anchoring mechanisms, and capital efficiency that provides room for growth without jeopardizing the collateral ratio. Although Liquity’s smart contracts will remain on Ethereum forever, LUSD is now also bridged to L2, with liquidity on Optimism and Arbitrum totaling over $11 million.

Since the beginning of this year, circulation supply has increased by over 100M LUSD, with over 10M moved to L2. Rollups have accumulated significant TVL in 2023, with Arbitrum growing from $980 million to $2.3 billion and Optimism growing from $500 million to $900 million. Mainnet users aren’t the only ones interested in decentralized stablecoin options, providing ample opportunity for LUSD to capture more market share on L2.

Along with circulation supply, Trove count has also been sharply on the rise this year, approaching all-time highs. We haven’t seen over 1200 active Troves since the bull market of 2021. Considering that Ethereum’s price is far from the levels it was at then, these users seem to be more inclined towards stablecoins rather than Ethereum leverage.

Stablecoin Market Trends

Forks

As they say, imitation is the highest form of flattery, and the Liquity model is being copied by some new stablecoins. Most are doing the same CDP-style, but with ETH as collateral. Considering the attention ETH and its LSDs have received in the first half of 2023, as well as the withdrawals that are now enabled, collateralized ETH is clearly more liquid and attractive.

Is collateralized ETH better than ETH? It’s hard to say for sure, but some trade-offs certainly need to be considered. The primary benefit of using an LSD like stETH as the backing for a stablecoin is the interest earning feature. The main drawbacks seem to be a combination of reduced risk and LSD unpegging risk. For these reasons, higher minimum collateral ratios are typically used compared to LUSD. In addition to these risks, most of these stablecoin contracts are upgradable and controlled by multisig, unlike the immutable contract behind Liquity.

This means that parameters like collateralization rate could change. Collateralized ETH-backed stablecoins are certainly interesting, performing well in both decentralization and yield generation, but are less capital efficient than plain ETH due to the increased risk.

Dollar Risk and Decentralized Premium

One issue worth revisiting that we mentioned at the beginning of this article is – traditional financial bank crises. Silvergate, SVB, First Republic, the three largest bank failures in US history all occurred in the past few months.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!