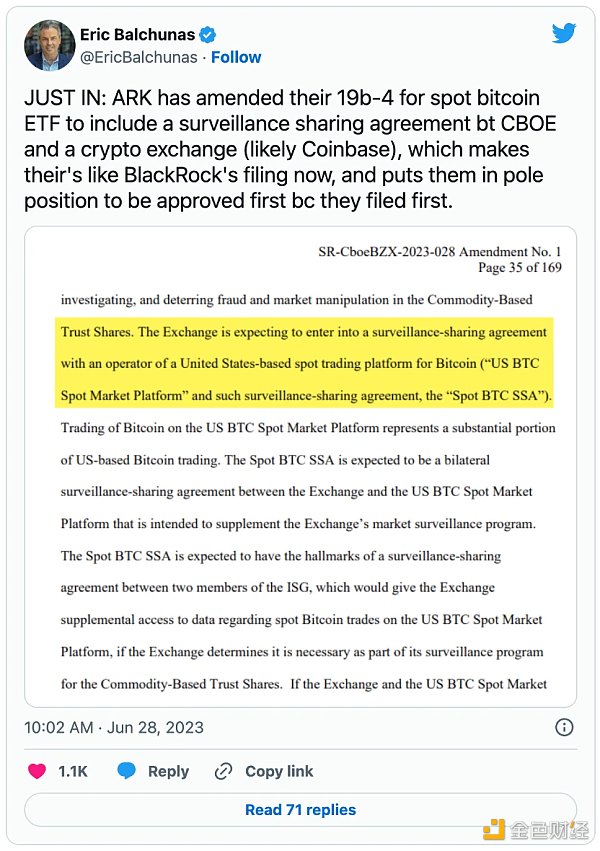

Bloomberg ETF analyst Eric Balchunas pointed out that ARK’s application may now be in first place waiting for approval as ARK’s application was submitted ahead of BlackRock’s application.

BlackRock

BlackRock, the top asset management company, recently submitted a Bitcoin ETF application, which is the beginning of this round of institutional accelerated entry into Bitcoin ETFs. On the afternoon of June 15th, BlackRock’s iShares department submitted the iShares Bitcoin Trust application to the US SEC. According to the submitted documents to the US Securities and Exchange Commission (SEC), the iShares Bitcoin Trust will use Coinbase Custody as its custodian.

Before BlackRock submitted its application, the price of Bitcoin fluctuated around 25,000, but after the news was released, it rose sharply. The single-day increase on the 15th was not large, only 2%; but then it continued to rise and reached 27,000 US dollars on the 19th.

- High opening and low walking: Did the first leveraged BTC ETF in the United States disappoint market expectations?

- Multi-chain NFT presale platform launched by Magic Eden in collaboration with Helio

- Decentralized proof, proof market, and ZK infrastructure

Bitcoin’s trend before and after BlackRock’s application. Source: Coinmarketcap

Technically, BlackRock’s proposal is to establish a trust, but it is a redeemable trust, so its function is like an ETF. Therefore, the iShares product is completely different from GBTC, which has no redemption mechanism. The key difference is that the spot Bitcoin ETF “will be able to purchase Bitcoin at the end of the trading day to keep the fund assets consistent with its trading price.” Bitcoin Layer market analyst Joe Consorti said that the trust is not capable of doing so.

Previously, the SEC has repeatedly rejected spot Bitcoin ETFs submitted by other institutions, and there are rumors that it is concerned about the transparency of the market and the possibility of market manipulation. BlackRock’s application includes a monitoring sharing agreement, which may alleviate these concerns, and there are similar proposals for subsequent applications from other institutions.

At the same time, there are also some conservative voices in the industry, such as Mike McGlone, senior macro strategist at Bloomberg Intelligence, who stated in the latest “Crypto Outlook” published on Twitter that even if BlackRock’s spot Bitcoin ETF application is really approved, it will not be launched within 2023. The report pointed out that since 2021, Bitcoin’s key price has been around $30,000, benefiting from the largest increase in currency supply in history, which has promoted the rise of many risk assets. However, most central banks have chosen to continue to tighten monetary policy in June. Although risk assets rebounded due to expectations of mild US recession and loose monetary policy of the Federal Reserve, they are still in a difficult situation and are therefore unlikely to have much liquidity increase.

Currently, the application is still under review. The approval process is not transparent and may take “months or years” to be approved, but industry insiders believe that BlackRock’s reputation and influence in the financial industry may make it easier for regulators to approve the product in “days to weeks.”

Fidelity Investment

Two weeks after BlackRock submitted its application for a bitcoin spot ETF, Fidelity Investment also submitted an application for a spot bitcoin exchange-traded fund. Prior to this, Fidelity had submitted the same application, but it had been rejected by the SEC. This is its re-submitted application, which is said to be due to BlackRock’s application being seen as a sign that the SEC’s position may change soon.

After Fidelity Investment applied for the ETF, the bitcoin market began to soar, rising from around $30,100 to around $30,800, an increase of about 2.3%. After the SEC announced on June 30 that the application was “inadequate,” there was a slight pullback.

Thursday’s application was filed by Cboe BZX Exchange for the public offering of the “Wise Origin Bitcoin Trust,” the name of Fidelity’s previously proposed bitcoin ETF that was rejected by the SEC in 2022. Over the past two weeks, the exchange has filed similar applications for other companies.

Similar to BlackRock’s filing, Fidelity Investment’s filing today includes a “monitoring sharing agreement” with an unnamed U.S. spot bitcoin trading platform, aimed at helping alleviate the SEC’s concerns about market manipulation.

Fidelity Investment’s current asset management scale has reached $11 trillion, with tens of millions of retail brokerage clients. The company is no stranger to cryptocurrencies, having operated institutional custody and trading services in the market since 2018.

Valkyrie, WisdomTree, Invesco, Bitwise

Compared to giants BlackRock and Fidelity Investment, these asset management companies are relatively small in scale: Valkyrie and Bitwise have asset management scales of about $1 billion, WisdomTree is $87 billion[1], and Invesco is about $1.48 trillion[2]. These asset management companies have all applied for bitcoin spot ETFs after BlackRock’s application, believing that BlackRock’s application may make bitcoin spot ETFs possible.

Among them, Bitwise submitted the earliest application, submitting the application on June 16, the second day after BlackRock announced its application. The Bitcoin rose by about 3% on that day. It cannot be ruled out that there was some follow-up effect from BlackRock. However, when Invesco, WisdomTree, and Valkyrie announced their submissions on the 20th and 21st respectively, Bitcoin began to soar all the way, rising from around 26,700 to more than 30,000 US dollars, an increase of 12.4%. When BlackRock applied alone, there were many conspiracy theories that the SEC sued native exchanges and asset management companies in the currency circle some time ago, thus giving way to US domestic old-fashioned institutions to enter the currency circle. However, the follow-up of these institutions has strengthened investors’ confidence in other US asset management institutions entering Bitcoin, leading to a sharp rise in Bitcoin.

Bitcoin’s trend around June 20. Source: Coinmarketcap

As the popularity of Bitcoin spot ETFs continues to rise, the Bitcoin futures market also ushered in the first leveraged Bitcoin futures ETF in the United States by Volatility Shares. The US SEC has been approving Bitcoin futures ETFs since 2021. The first futures ETF was released by ProShares, and the fund size has reached 1 billion US dollars. The leveraged ETF released by Volatility Shares on Tuesday did not meet market expectations. The daily trading volume in the first two trading days after its launch was less than 300,000 US dollars, and the current fund size is 5.7 million US dollars. The lawsuit between Grayscale and the SEC is still ongoing, and it is not clear whether the trust can be successfully converted into an ETF.

Whether it is a spot Bitcoin ETF that is currently applying, or a futures Bitcoin ETF that is already operating, the emergence of these products further proves that Bitcoin’s position in the traditional financial system is gradually being recognized. As more and more financial institutions enter the cryptocurrency market, the development of Bitcoin ETFs will inevitably provide investors with more choices, increase market liquidity, and further promote the value and recognition of Bitcoin. However, investors still need to maintain rationality, understand the risks of the cryptocurrency market, and carefully evaluate their own investment capabilities and risk tolerance. The rise of Bitcoin ETFs marks a new chapter in digital assets, and we look forward to seeing more innovative products and investment opportunities emerge, bringing more diversified choices to global investors.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!