With the progress of the FTX incident and XRP being recognized as a non-security, Solana, as a public chain deeply integrated with FTX, and its governance token SOL being recognized as a security by the SEC in lawsuits against Coinbase and Binance, has once again attracted market attention under the blessing of dual narratives. This article will analyze the current situation of Solana from the perspective of on-chain data and ecosystem projects.

Summary

According to on-chain data, Solana’s total value locked (TVL) has increased by about 47% since January, ranking second only to Arbitrum, Optimism, and Mixin among the top public chains and layer 2 solutions in terms of TVL growth. In terms of transaction volume, there were two peaks in trading activity after the FTX incident, which were highly correlated with BTC NFTs, SMB NFTs, and the overall market. Solana’s average daily on-chain transaction volume in July was around 20 million transactions, which remained relatively stable overall. The development activity is greatly influenced by non-full-time developers, resulting in relatively low overall development activity.

Currently, the liquidity staking sector dominates the ecosystem, with Marinade occupying 46% of Solana’s market share, and the recent increase in TVL of other liquidity staking protocols has been mainly driven by the rise in SOL token price. The utilization rates of the two major on-chain lending protocols are approximately 16% and 21%, which are much lower than Ethereum. On-chain native DEX operations are relatively conservative with no major highlights. The overall trading volume of the NFT sector is showing a shrinking trend, with recent trading volume concentrated in SMB. Overall, although there have been some new movements from established protocols in the Solana ecosystem, there hasn’t been much impact, and there are no signs of a reversal in ecosystem activity.

- Project Research | Rootstock, a Bitcoin Sidechain Network Compatible with EVM

- In-Depth Analysis Survival Considerations for Mining Equipment Manufacturers in the New Cold War Environment

- Quick look at Binance’s newly launched FDUSD a US dollar stablecoin with a Hong Kong label.

On-chain Data

1. TVL

As of July 23rd, Solana’s TVL is 359.9 million, ranking 10th among all public chains and layer 2 solutions in terms of TVL. Compared to its peak, TVL has dropped by over 95%. It has dropped by over 70% since the FTX incident. Its historical low in TVL was around 244 million (January 2023), and it has since increased by about 47%. Among the top 10 public chains and layer 2 solutions, Solana’s TVL growth rate is only behind Arbitrum, Optimism, and Mixin.

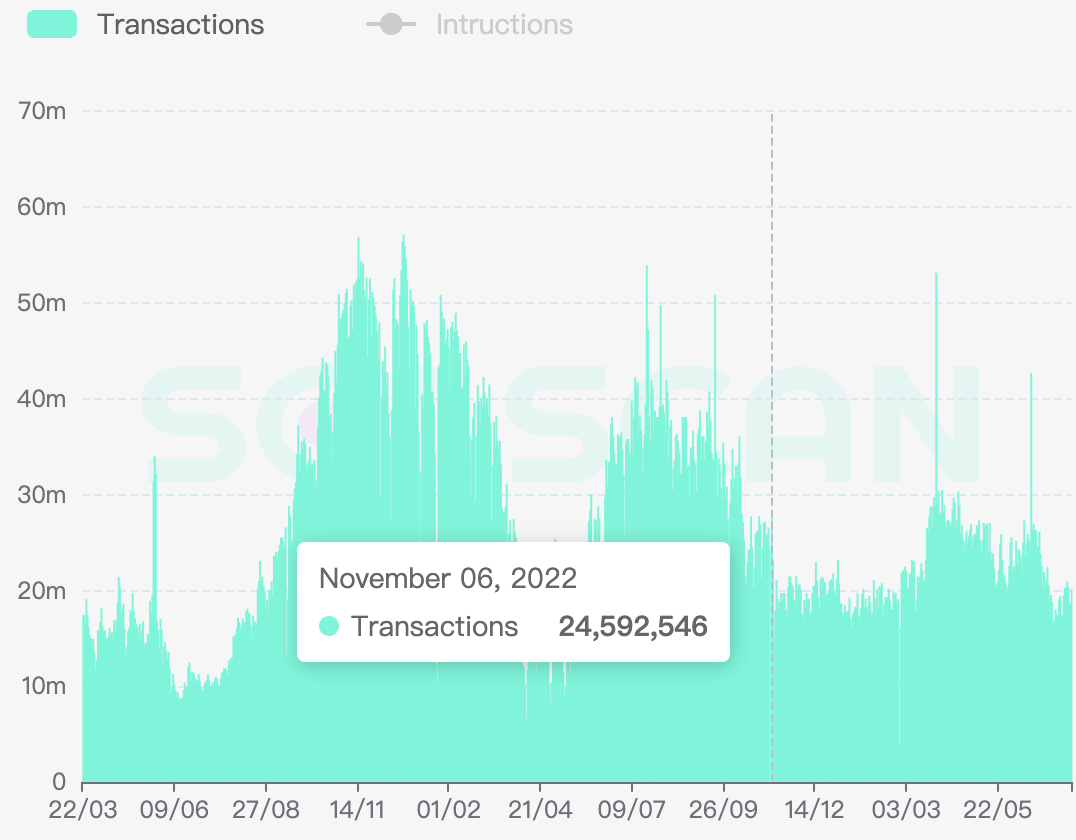

2. Transaction Volume

After the FTX incident, trading volume remained relatively quiet for nearly 2 months, followed by two phase peaks in trading activity from March 21st to May 15th and around June 19th, with daily trading volume exceeding 25 million transactions. Currently, the daily trading volume fluctuates around 20 million transactions. The trading volume from March to May was greatly influenced by BTC NFT transactions, while the June 19th peak may have been influenced by the overall market.

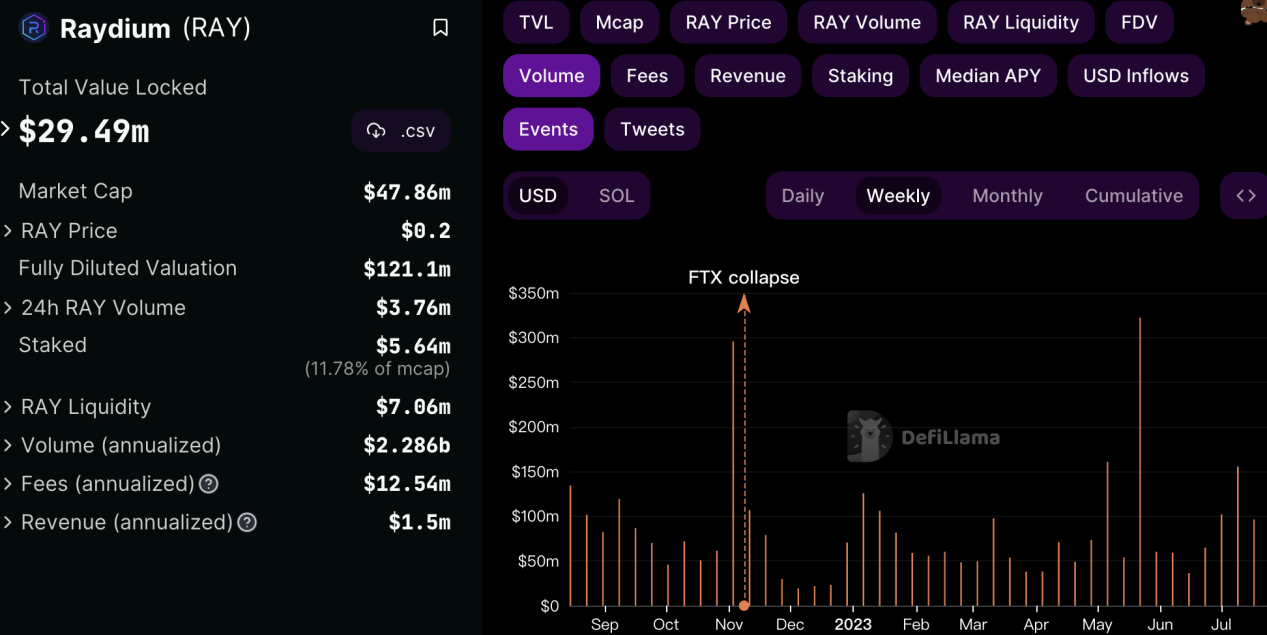

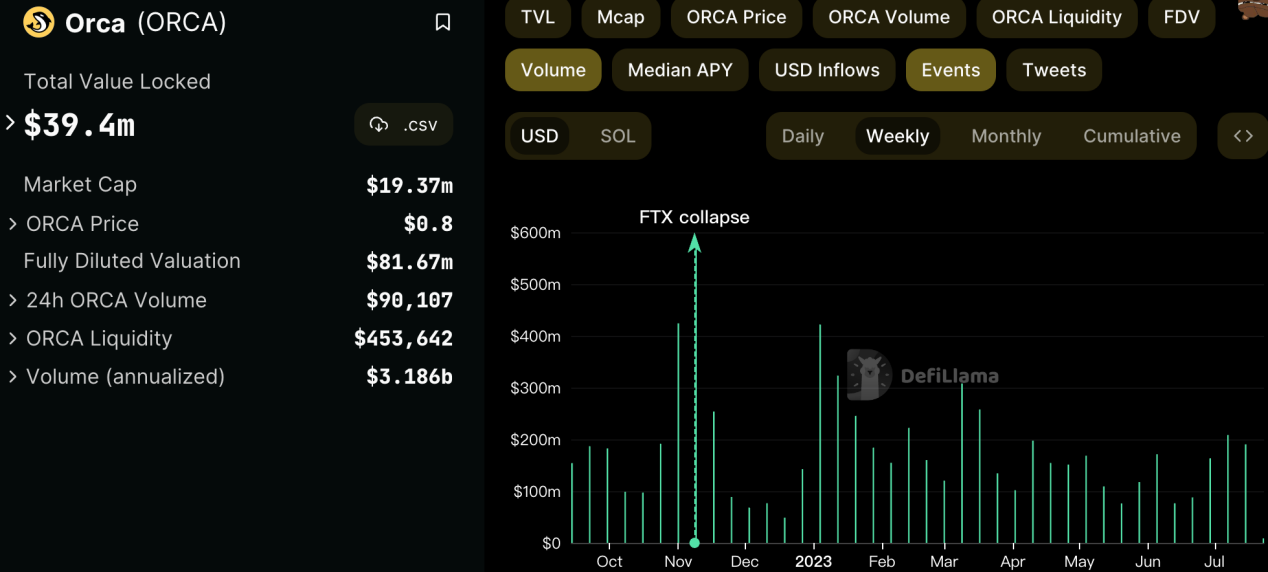

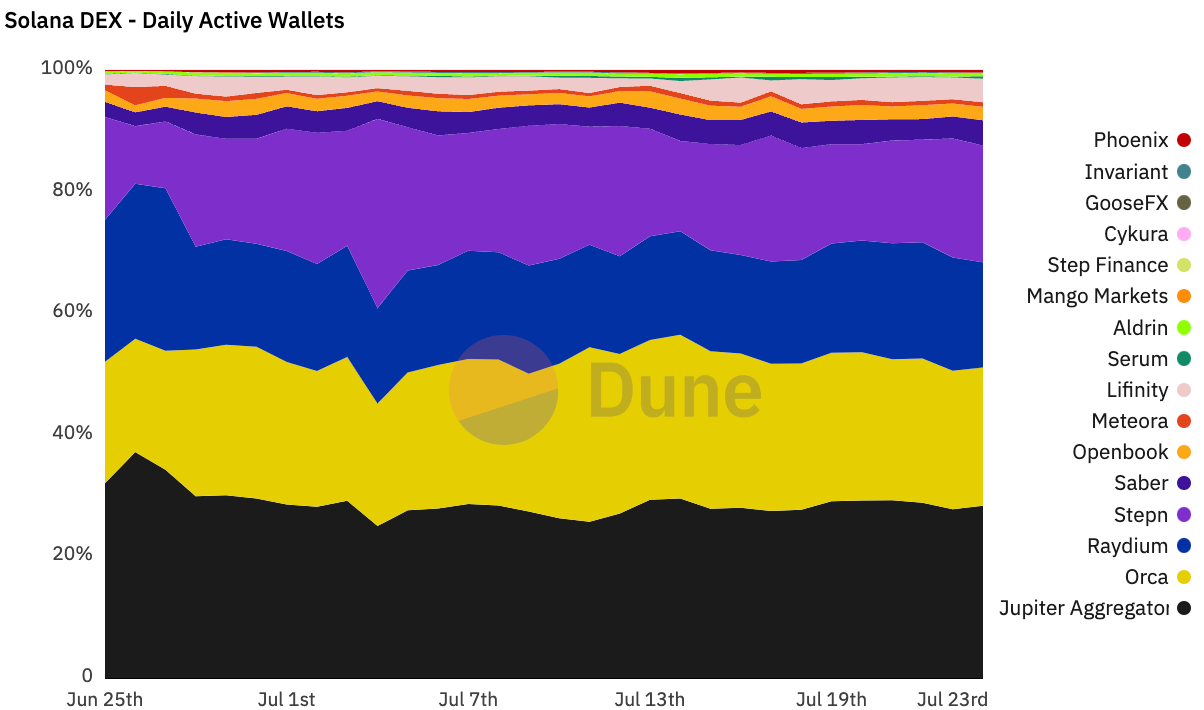

The top DEXs on Solana in terms of TVL are Orca and Raydium. From the trading data, the DEX trading volume increased significantly during the week of the FTX incident, followed by a month of sluggish trading volume. The trading volume started to rebound at the beginning of 2023 and is currently maintaining a relatively stable state.

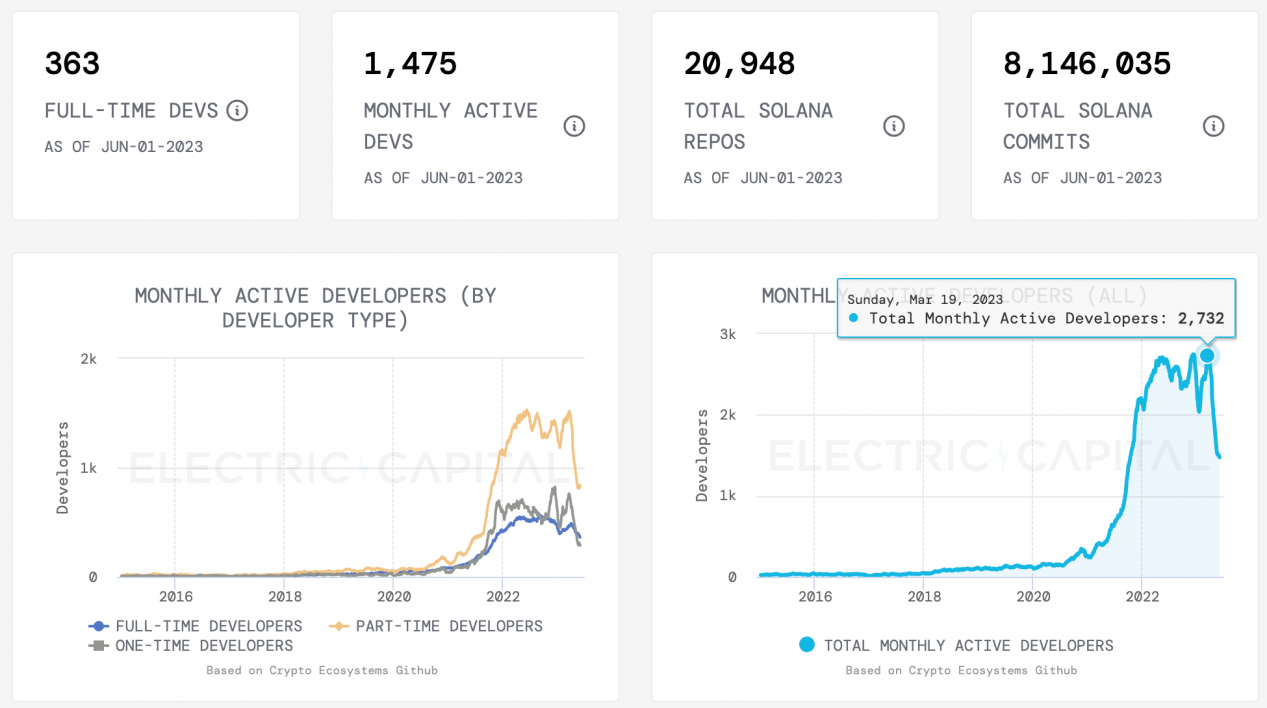

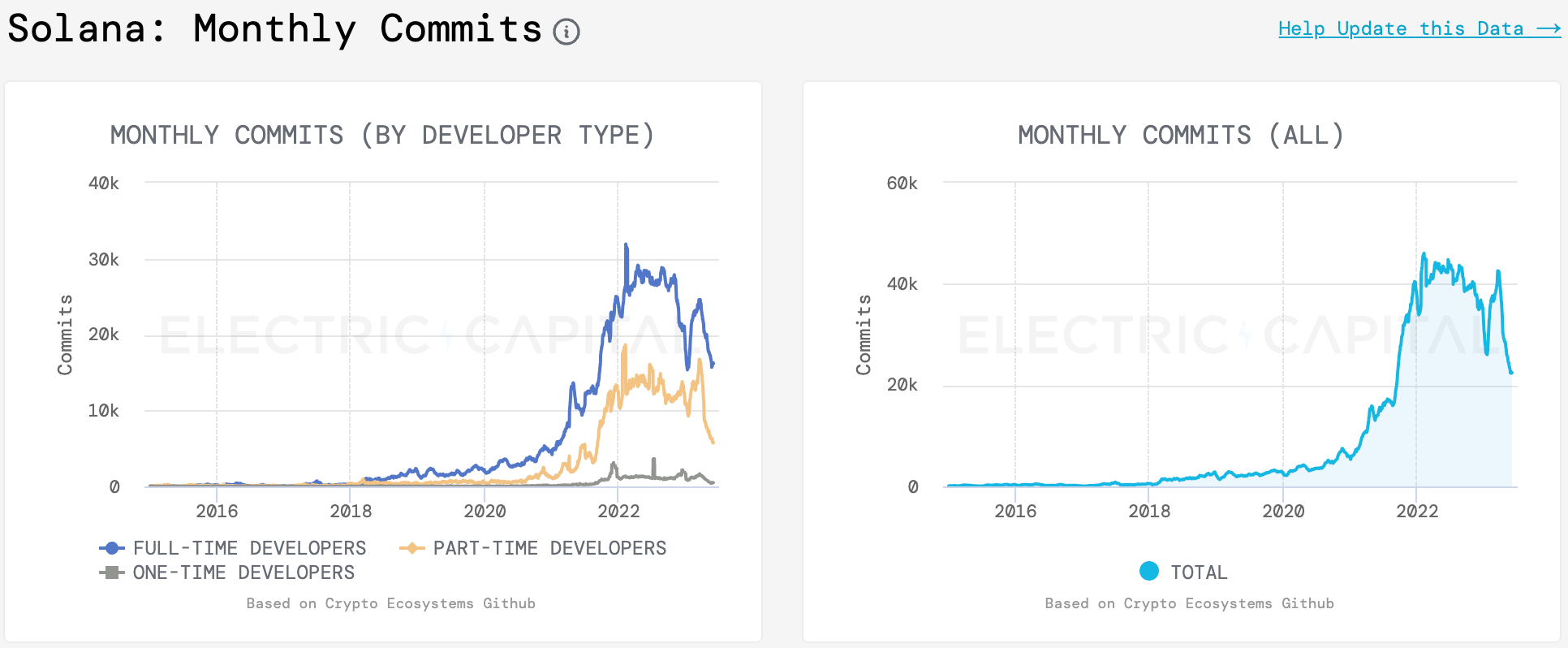

3. Development Activity

After the FTX incident, Solana’s development activity increased in March, with a monthly active developer count of 2,732. As of June 1st, the number of active developers decreased to 1,475, a decrease of nearly 50%. The code commit count also showed a similar pattern. The code commit count peaked in March and then decreased rapidly. The fluctuation in development activity since March 2023 is mainly due to significant changes in non-full-time developers, with only a small decrease in the number of full-time developers. Overall, development activity has decreased since March.

- Developers who commit code for more than 10 days per month are considered full-time, and only original code commits are counted towards the developer count.

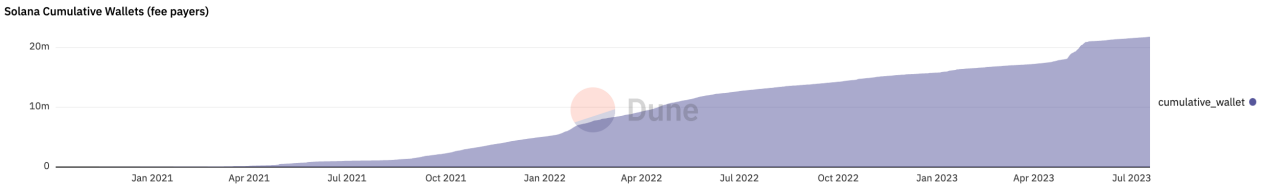

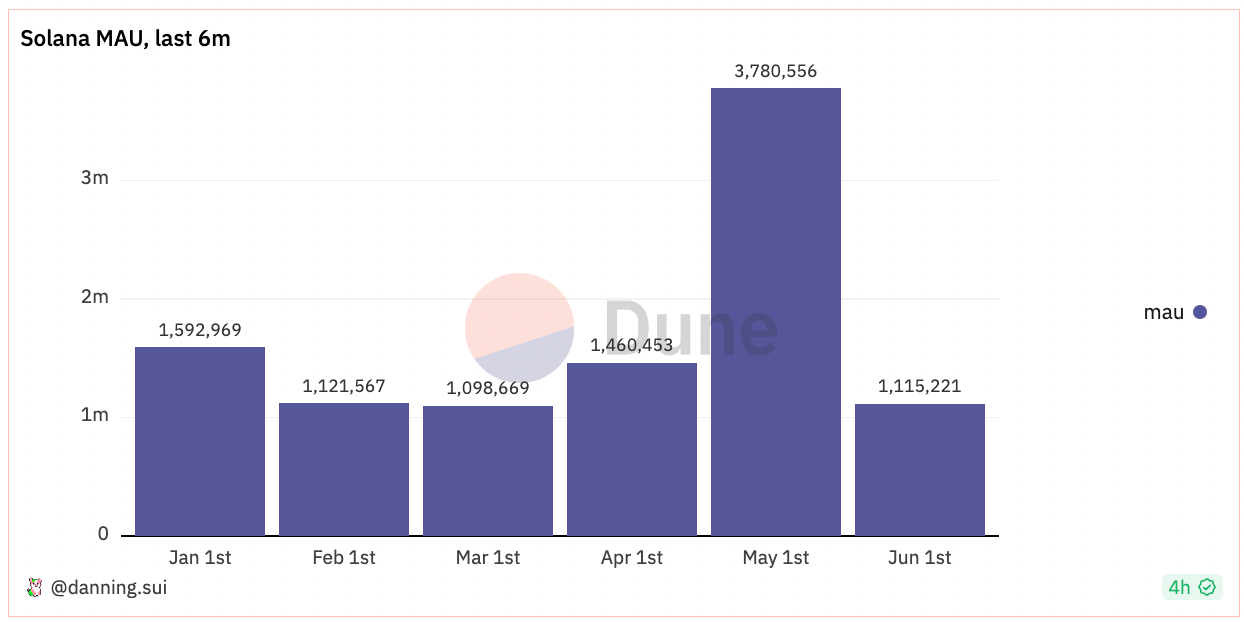

4. Users

The number of new wallet addresses on Solana grew rapidly from late April to May, with an increase of 3 million addresses in one month. The number of active addresses saw a significant increase in May, far surpassing other time periods. The main reason was the launch of the Solana-based NFT marketplace Magic Eden, which became one of the main trading platforms during the active period of Ordinals NFT transactions.

Ecosystem Projects

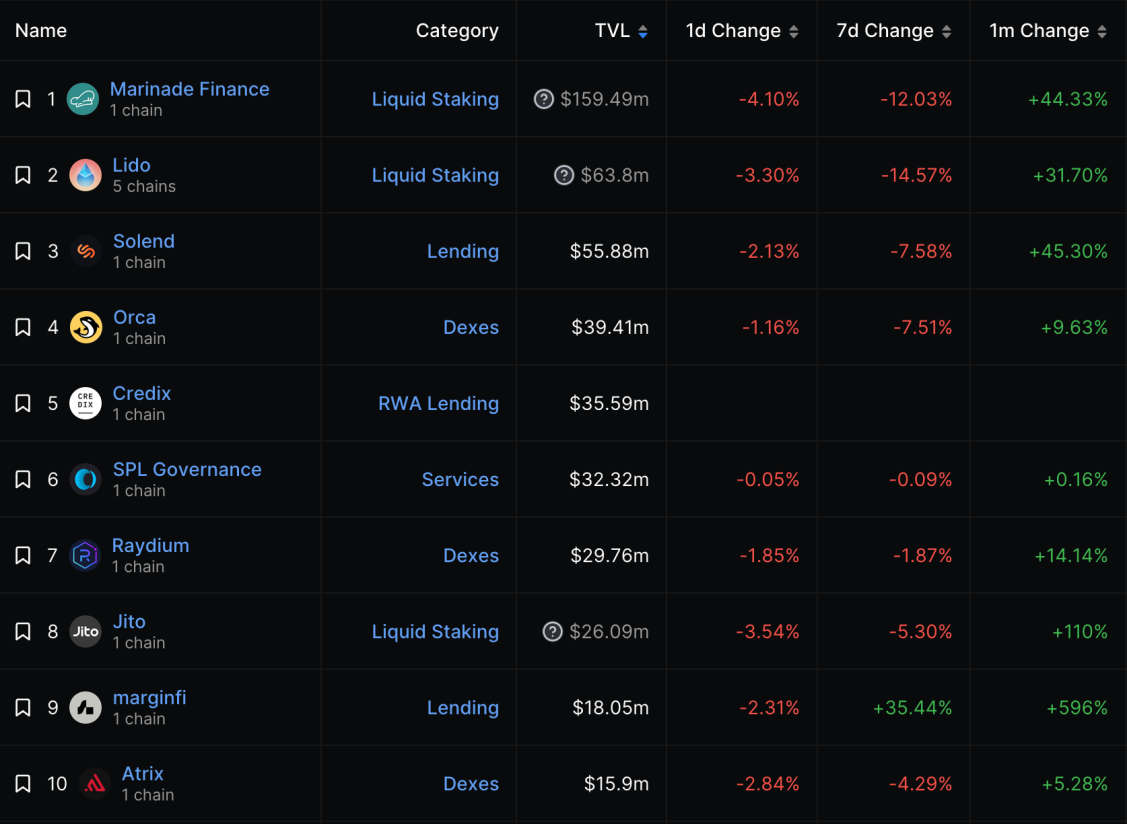

Defillama tracks a total of 98 dapps. Among them, 19 dapps have a TVL (Total Value Locked) exceeding $10 million, mainly distributed in the liquidity staking, lending, and decentralized exchange sectors.

Marinade Finance is the largest liquidity staking protocol on Solana, with a TVL of $159 million, accounting for approximately 43% of the market share on Solana. This protocol allows users to stake SOL and receive mSOL tokens as underlying assets to participate in other defi protocols such as Solend. Currently, mSOL is listed on centralized exchanges such as Coinbase and Kraken, but most trading still occurs on decentralized exchanges. In addition to Marinade Finance, the TVL of liquidity staking protocols has also increased, mainly driven by the rise in SOL token price.

Solend is a well-established decentralized lending protocol on Solana, launched in 2021. Solend launched its v2 version Phase 1 in April, re-enabling liquidity mining with mSOL staking. Starting from June 2nd, users can convert the collateralized SOL tokens within the protocol into mSOL to earn additional rewards. Since June, its TVL has increased from $28 million to $44 million, and the current TVL is $55.28 million. The fund utilization rate on Solend is 16.19%.

Marginfi is a new lending protocol launched in 2023, with a TVL growth rate of nearly 600% in the past month. The current TVL is $17.93 million. The protocol received a $3 million investment in 2022, led by Multicoin and LianGuaintera. The protocol has not yet released its token and introduced a points system on July 3rd, where users can accumulate points through deposits, loans, and referrals. This is likely the main reason for the significant increase in TVL in the past month. The borrowing rate on Marginfi is 21.7%. Aave v3 has a TVL of $2.11 billion on the Ethereum network, with a fund utilization rate of nearly 35%. Compared to Ethereum, Solana has lower transaction volume and leverage ratios.

Currently, most of the transactions on Solana occur on Raydium, Orca, and Jupiter Aggregator. Raydium is the earliest AMM DEX on Solana, with TVL (Total Value Locked) staying around 28M after the FTX incident, but the recovery has been average. Orca’s TVL has rebounded from a low point of 30M to 38M, making it the largest DEX on Solana. Overall, the operations of DEXs on Solana are relatively conservative and performing averagely.

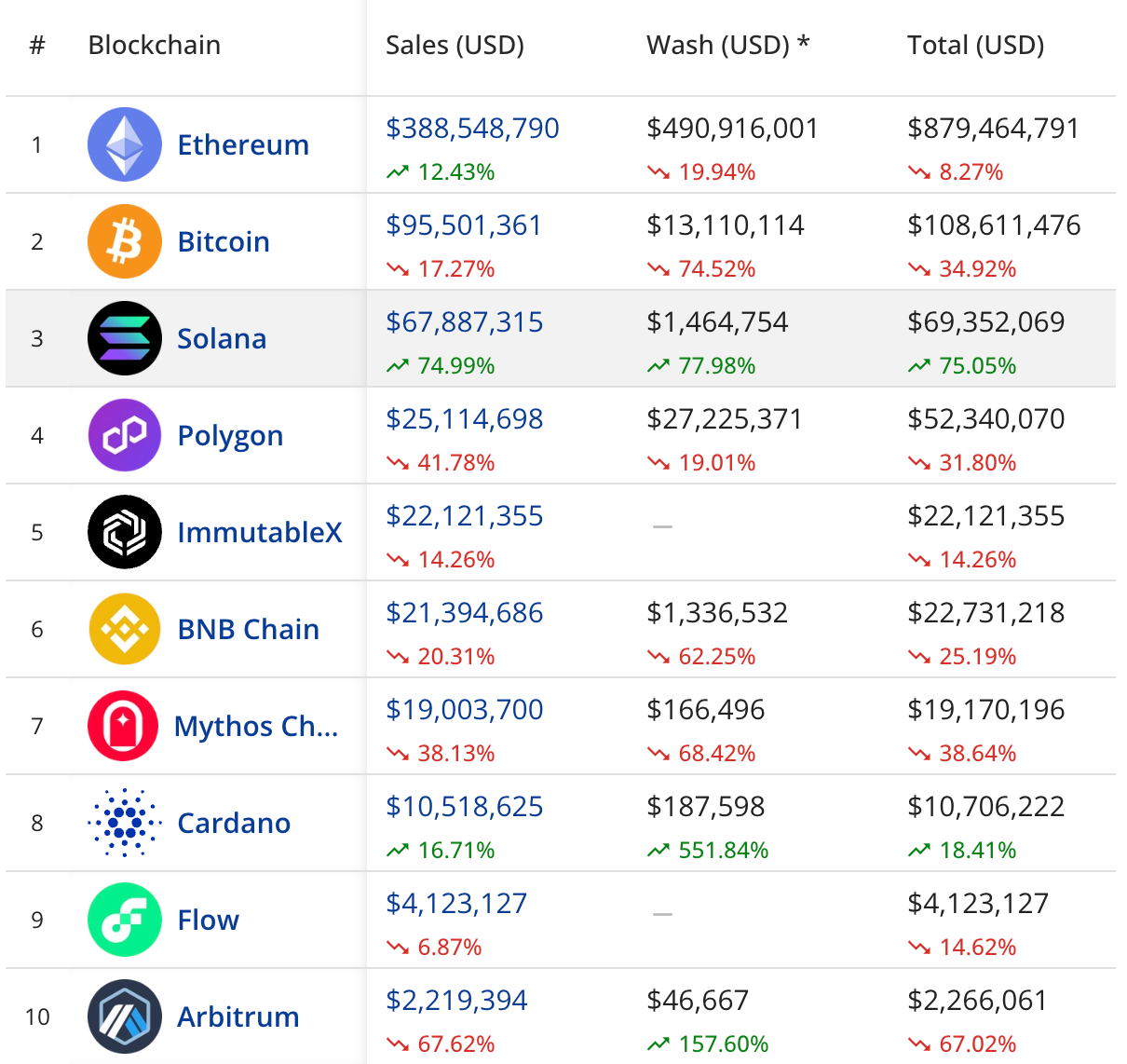

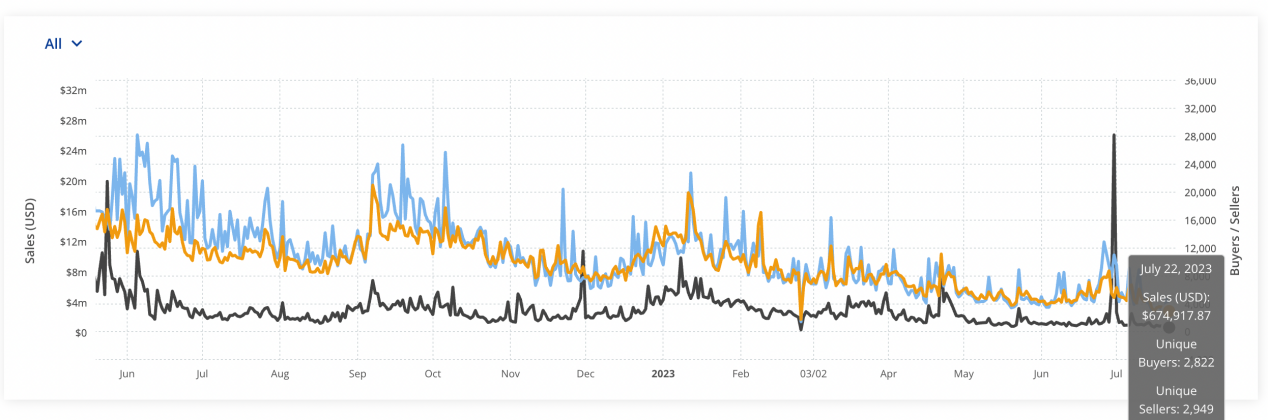

The trading volume of NFTs on Solana is second only to Bitcoin and Ethereum, with a 75% increase in trading volume in the past 30 days. The main reason is the high popularity of the SMB series released in June. However, the overall daily trading volume is shrinking.

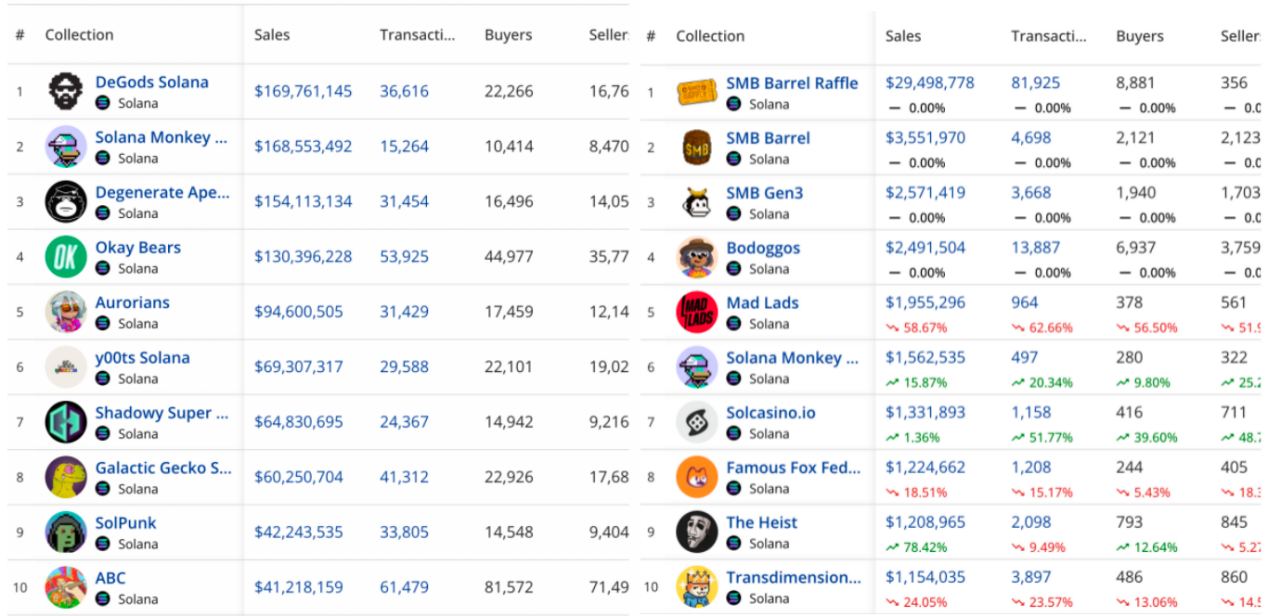

Looking at the trading categories, there is a low overlap between the NFT series with the highest historical trading volume on Solana and the projects with high trading volume in the past 30 days. The recent NFT trading hotspots are concentrated on Smart Monkey Business (SMB).

SMB is a series of algorithmically generated pixel monkey NFTs, with Gen1 and Gen2 series released in June and August 2021 respectively. The team sold SMB Barrel Raffle lottery tickets at the end of June 2023 and forged SMB Gen3. In that month, the SMB series accounted for over 90% of the Solana NFT market share. Apart from the SMB series, the projects with a trading volume of over 2M in the past month include Bodoggos, an NFT series launched by Nifty protocol and @EasyEatsBodega. Whether it is the SMB series or Bodoggos, the daily trading volume has been continuously shrinking after the initial surge upon launch. The short-term activity of individual projects did not drive the overall Solana NFT market.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!