Editor | Callum@Web3CN.Pro

Table of Contents

1. Project Introduction

- In-Depth Analysis Survival Considerations for Mining Equipment Manufacturers in the New Cold War Environment

- Quick look at Binance’s newly launched FDUSD a US dollar stablecoin with a Hong Kong label.

- In-depth Perspective Survival Considerations for Mining Machine Manufacturers in the New Cold War Environment.

2. Project Vision

3. Project Architecture

- RSK

- RIF OS

4. Development History

5. Team Background

6. Financing Information

7. Development Achievements

- Ecosystem Construction

- Community Status

8. Economic Model

- RBTC

- $RIF

9. Advantages and Risks

1. Project Introduction

The Rootstock (RSK) blockchain is a scaling solution for the Bitcoin network, launched on the mainnet in January 2018, bringing smart contract functionality to the Bitcoin ecosystem. Transactions on RSK can be confirmed, aggregated, and then sent to the Bitcoin base layer for final settlement, increasing the throughput of Bitcoin and expanding its capacity to support more users, applications, and transactions.

As the first EVM-compatible sidechain on the Bitcoin network, it is a smart contract platform that allows developers to build dApps and smart contracts using Ethereum’s language. RSK enables developers to build their DeFi protocols and integrate them with the Bitcoin ecosystem.

Overall, the RSK network improves Bitcoin in three aspects: scalability, instant settlement, and smart contracts.

2. Project Vision

The initial purpose of Rootstock was to establish a more free and fair global financial system based on Bitcoin. By combining mining, built-in two-way pegging protocol, and smart contract functionality, Rootstock brings the advantages of decentralized applications to the Bitcoin ecosystem.

It aims to address the shortcomings of Ethereum by leveraging Bitcoin’s unparalleled stability, security, and economic strength. By porting its smart contracts from Ethereum, RSK makes all Ethereum applications compatible with the Bitcoin blockchain. According to official data, RSK can provide about 10 times faster transaction speed and 50 times cheaper Gas fees compared to Ethereum.

3. Project Architecture

RSK

1. Merge Mining

One of the highlights of Rootstock is merge mining, where Bitcoin miners can mine both Bitcoin and RSK blocks simultaneously, allowing developers to earn better rewards.

The RSK blockchain uses the same Proof of Work (PoW) consensus algorithm as Bitcoin, but the speed at which miners generate blocks is significantly faster than the Bitcoin base layer. Since both blockchains use the same consensus, miners can engage in merge mining, mining both Bitcoin and RSK blockchains. Bitcoin and RSK consume the same mining power, so miners can contribute their computing power to mining blocks on RSK. Ultimately, merge mining can increase the profitability of miners without requiring additional resources.

Merged mining allows RSK to verify transactions, create blocks, and send them to Bitcoin. During the mining process, users can mine with confidence because RSK smart contracts benefit from the proven security of the Bitcoin blockchain.

2. Powpeg

Powpeg is a bi-directional bridge for transferring Bitcoin into and out of the RSK blockchain. This protocol is implemented through RSK’s asset smartBTC (RBTC).

Technically, the RSK platform does not have its own native Gas token. Instead, RSK uses smartBTC (RBTC), which is issued at a 1:1 ratio with locked Bitcoin. RBTC will always have the same value as BTC and is used to pay for RSK’s transaction fees.

The bridging of funds between RSK and Bitcoin is controlled by two main mechanisms: Vaults and smart contracts. The process of transferring Bitcoin to RSK is called “pegging” and requires users to lock a certain amount of BTC in the Vault on the Bitcoin network. This allows the corresponding amount of BTC to be unlocked on RSK. Conversely, transferring BTC from RSK (peg-out) back to the Bitcoin network requires users to send a certain amount of RBTC to the smart contract on RSK. This will then unlock the corresponding amount of BTC from the Bitcoin Vault.

RSK achieves bi-directional conversion of funds with Bitcoin through anchoring, without additional fees, and reduces transaction costs.

3. RSK Virtual Machine (RVM)

One advantageous component of RSK is its interoperability with Ethereum smart contracts. The RSK Virtual Machine (RVM) is based on the Ethereum Virtual Machine and allows for the execution of Ethereum smart contracts on RSK. Developers can seamlessly use the same code, tools, and libraries when building RSK applications. In turn, this provides the Ethereum community with a cheaper and faster alternative to interact with their favorite dApps. This means that RSK developers can use Solidity for coding, the same smart contract programming language used on Ethereum.

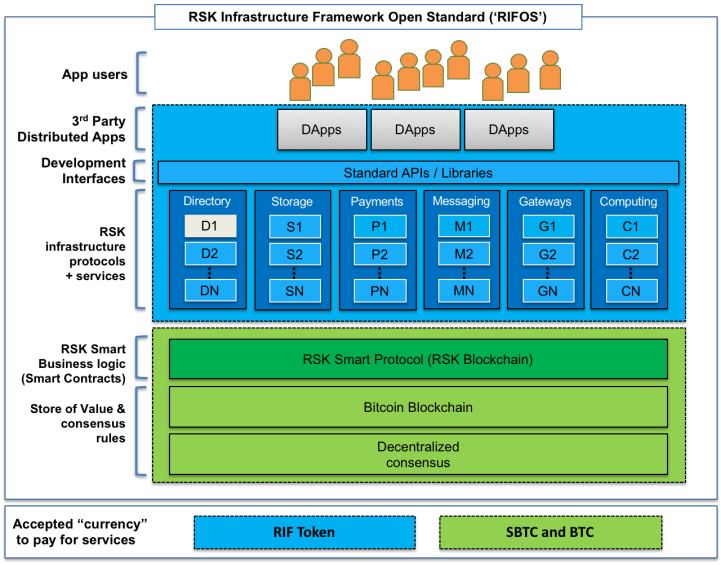

RIF OS

RIF OS (Root Infrastructure Framework Open Standard) is an open standard infrastructure architecture built on Rootstock. It serves as the infrastructure that provides blockchain infrastructure and services to developers. The RIF ecosystem includes a range of products, including DeFi, storage, domain name services, payment solutions, etc.

RIF OS, as a protocol and interface built on RSK, is actually an off-chain development stack. Its goal is to address the barriers that hinder developers from adopting blockchain technology and promote the development of a fair market for decentralized infrastructure services. It provides open and decentralized tools and technologies, and with RIF, developers can quickly and easily create scalable DeFi products.

Main protocols of RIF OS:

- RIF Directory: Name service protocol that supports name operations and secondary markets.

- RIF Storage: Decentralized data redundancy storage access protocol.

- RIF Payments: A protocol for accessing any off-chain payment network, especially payment channel networks.

- RIF Secure Communications: Node discovery protocol for identity-verified and encrypted communication.

- RIF Data Gateways: Oracle protocol for accessing external data feeds.

- RIF Explorer: Browse services registered on each RIF OS protocol.

In the entire architectural relationship, BTC serves as the first layer for value storage, the Rootstock smart contract network serves as the second layer for execution, and the RIF OS protocol provides infrastructure services for the third layer.

Compared to other public chains, RSK does not need to rebuild its security architecture. Its underlying layer is the Bitcoin main chain, and its token is also Bitcoin, which avoids smart contract vulnerabilities and is therefore more secure. In addition, RSK is loosely coupled with the Bitcoin main chain and does not need to modify the underlying layer of Bitcoin. This layered approach is more conducive to system maintenance.

IV. Development History

In late 2015, RSK released a technical white paper, positioning itself as a Bitcoin sidechain, aiming to improve the Bitcoin ecosystem.

In early 2016, RSK Labs (now IOV Labs) was established.

In January 2018, the RSK mainnet went live, realizing functions such as normal blockchain operation, bidirectional anchoring with Bitcoin, merged mining, transaction transfer, and smart contract deployment.

In November 2018, RIF Labs issued RIF OS through the RSK smart contract platform, and RSK merged with RIF Labs. This plan allows the RSK protocol to go beyond supporting the Bitcoin and Ethereum networks and add various P2P functionalities.

In May 2019, the Lumino Network, which is part of the RIF payment protocol, a second protocol of RIF core components, was released. At the same time, RIF Labs was renamed IOV Labs to differentiate the organization (IOV), platform (RSK, RIF), and developed services.

In February 2023, IOVLabs released the RIF Flyover protocol to facilitate BTC transfers on the Bitcoin mainnet and RSK sidechain. In May, IOVLabs launched a $2.5 million funding program to support the adoption of Rootstock.

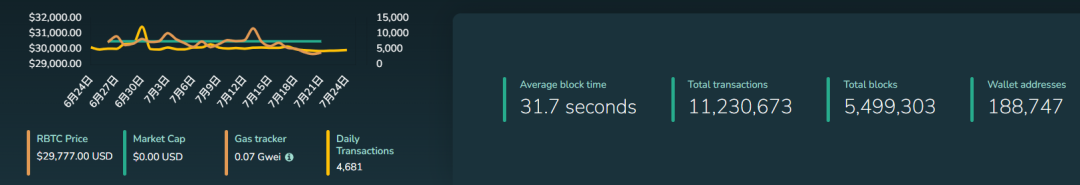

Currently, there are over 11 million transactions on the RSK network, with a block height of 5,499,303 and nearly 190,000 wallet addresses.

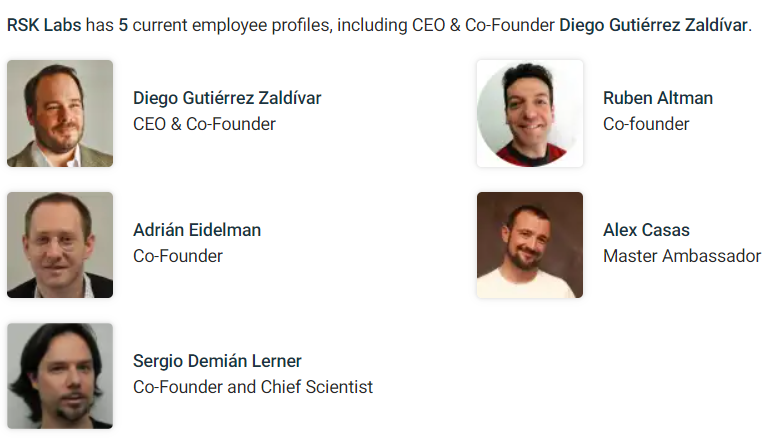

V. Team Background

Diego Zaldivar – Co-founder and CEO

Diego Zaldivar was previously the founder of the financial lending company Koibanx and has extensive experience in financial and internet product development.

Ruben Altman – Co-founder

One of the founders of the Argentine Bitcoin community and the Latin Bitcoin non-governmental organization BitcoinLatam

Sergio Demian Lerner – Co-founder and Chief Scientist

Sergio Demian Lerner has been with RSK Labs since November 2015. He was previously a security auditor at the cryptocurrency computing security company Coinspect and a technical advisor at the cryptocurrency development software factory CoinFabrik.

Adrián Eidelman Co-founder and CTO

Former founder of a software development company specializing in cloud solutions.

Sixth, Financing Information

According to public information, RSK Labs has raised a total of 9 rounds of funding, raising a total of $7.3 million. Investors include Bitmain, Coinsilium, DCG, and other corporate investors, as well as individual investors such as Decentral and Jaxx CEO Anthony Di Iorio.

Seventh, Achievements

Ecosystem Development

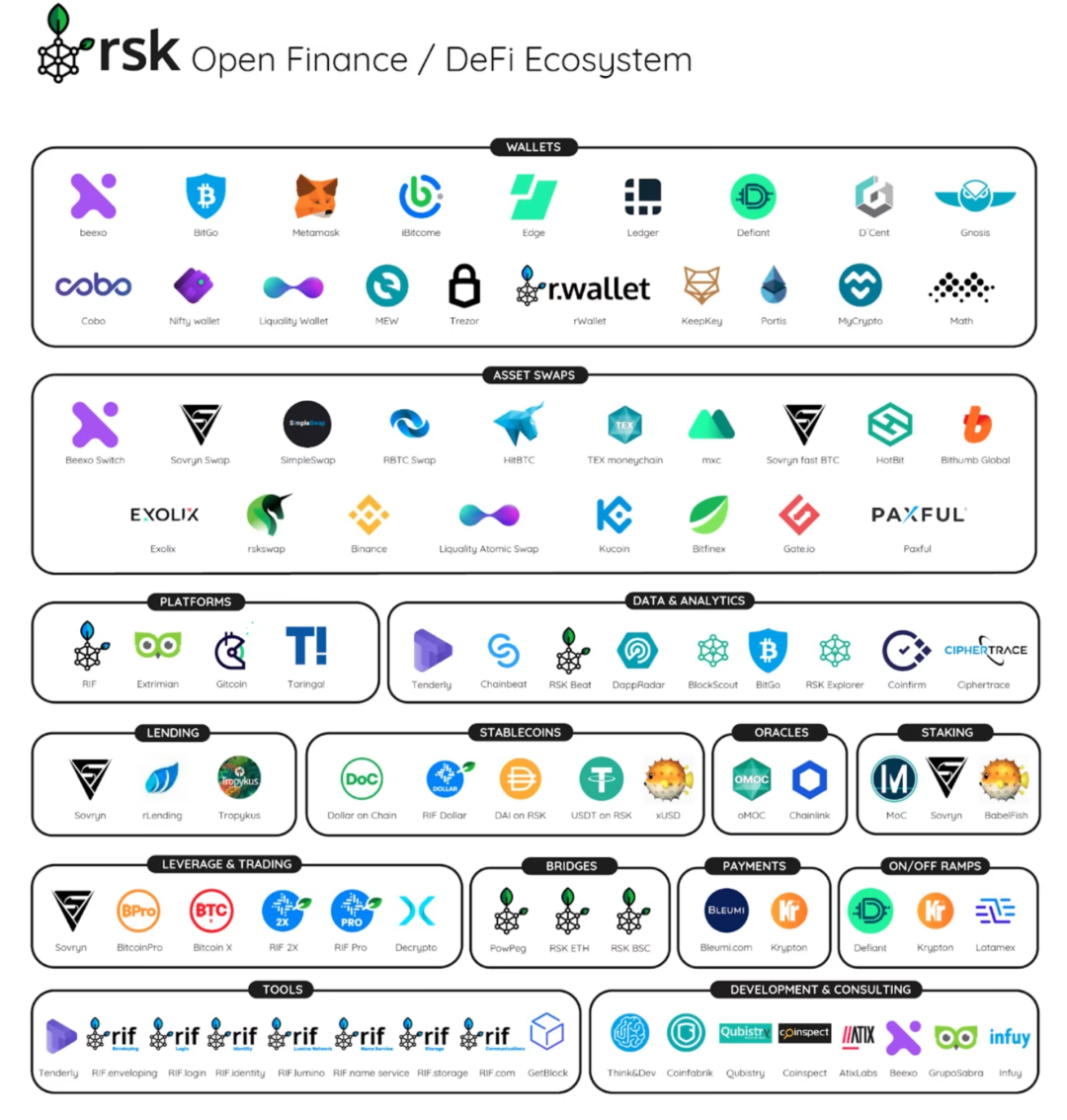

RSK aims to support inclusive and accessible financial systems on the world’s leading blockchain, Bitcoin. With RVM, developers can create new dApps or continue building on existing applications on Ethereum.

Currently, some well-known projects on the RSK network include:

RSK DeFi Applications

- Sovryn – A non-custodial smart contract platform for Bitcoin lending and margin trading.

- RSK Swap – A decentralized exchange on RSK based on the Uniswap protocol from Ethereum.

- Tropykus – A digital savings protocol that eliminates many barriers and restrictions in traditional banking.

RSK Stablecoins

- Dollar on Chain (DoC) – A token pegged to the US dollar at a 1:1 ratio, with Bitcoin as the cryptocurrency collateral.

- BRZ Token – A multi-chain stablecoin pegged to the Brazilian real.

- RSK Dai (rDai) – An alternative to the Dai stablecoin on Ethereum.

RSK Wallets

- Beexo – A Bitcoin wallet with RIF (RSK Infrastructure Framework) relays.

- MetaMask – A browser extension and mobile wallet.

- Ledger – A hardware wallet for securely storing digital assets off-chain.

RSK Bridges

- Powpeg – A two-way peg on RSK for converting between BTC and R-BTC.

- RSK ETH – A token bridge for moving ERC20 tokens between Ethereum and RSK.

- RSK BSC – A cross-chain bridge created by Sovryn for transferring digital assets between Binance Smart Chain and RSK.

Community Status

Currently, RSK has 24,000 followers on Twitter, RIF has 67,000 Twitter followers, and the Telegram group has 2,400 members. The daily online rate is about 5.4, indicating relatively low overall activity.

Eighth, Economic Model

RBTC

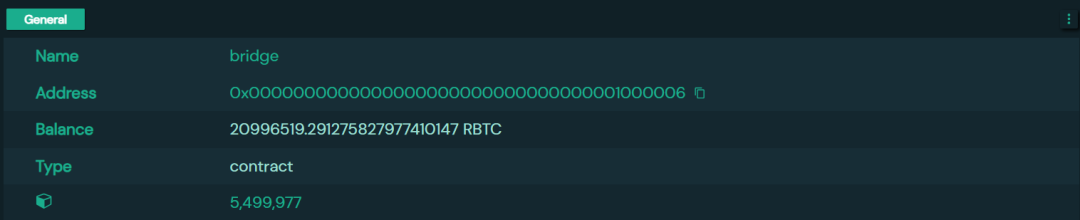

RBTC is the token in the RSK smart blockchain used for paying transaction fees, similar to ETH in the Ethereum network. RBTC has a total supply of 21 million in the RSK network and is locked in the address 0x0000000000000000000000000000000001000006. Currently, there are approximately 20,999,519 RBTC in the address, which means that about 500 RBTC are circulating in the RSK network, indicating low utilization of the RSK network.

RBTC is bi-directionally pegged to BTC in the Bitcoin network. In practice, when BTC is exchanged for RBTC, some BTC is locked in the Bitcoin network, and an equal amount of RBTC is released in the RSK network. When RBTC needs to be converted back to BTC, RBTC is locked in the RSK network, and an equal amount of BTC is released in the Bitcoin network. In this process, a consortium of third parties is responsible for the locking and unlocking of funds.

Currently, there are few exchanges that support RBTC, mainly concentrated on Kucoin and Bitfinex.

$RIF

$RIF is a token issued on the RSK blockchain, with a total supply of 1 billion. It aims to be a utility token that allows any token holder to spend all services compatible with the RIFOS architecture and integrated into the RIFOS. Such services may include infrastructure services developed by third parties, as well as any other applications that may be deployed on it.

The token allocation plan is as follows:

- Approximately 35%-40% will be allocated to private contributors. The initial price is in BTC.

- Approximately 40% will be retained by RIF Labs and unlocked at a rate of 1/60 each month, primarily for the promotion and adoption of RIF OS.

- 20% will be allocated to shareholders, founders, and management team of RSK Labs as part of the acquisition of all assets and intellectual property of RSK Labs and as an adjustment to ensure long-term cooperation with the RIF project. These tokens will be unlocked at a rate of 1/48 within 4 months after the end of the token sale, with an initial cliff of 6 months.

- No public sale of tokens will be conducted, but RIF Labs will initially set aside 21 million tokens for a series of bounties and early adoption programs to provide RIF token rewards for early adopters of RIFOS.

IX. Advantages and Risks

Advantages

The RSK protocol is based on bi-directionally pegged Bitcoin mainnet, which uses RBTC as gas on top of the Bitcoin network and is pegged 1:1 with BTC. It allows Bitcoin to fully unleash its potential through Turing-complete smart contract capabilities.

The RSK protocol ensures security through merged mining, meaning it can achieve a similar level of security as the Bitcoin network in terms of double-spending prevention and settlement finality, provided that pure Bitcoin miners and Bitcoin/RSK merged miners have consistent incentives.

In its current state, the RSK protocol demonstrates scalability far beyond the Bitcoin network (up to 100 transactions per second, 20 times that of the Bitcoin network), while also reducing storage and bandwidth usage.

Risks

Market competition is a significant risk for this project. As more projects emerge, RSK needs to compete with other projects to gain market recognition (such as the emerging BTC Layer 2 project Stacks). RSK protocol needs to be more secure, efficient, and decentralized to gain widespread support in the ecosystem.

In terms of token model, we need to pay attention to the fact that the circulation of RBTC is currently low, indicating that the block mining situation on the RSK network is also low. Increasing the ways to obtain RBTC is crucial for the development of RSK, and progress in this area still needs to be improved. As for RIF, the future development of the RIF OS ecosystem also requires the support of RIF token incentives.

In conclusion, as a smart contract platform that is protected by Bitcoin’s hash power through joint mining, RSK provides more services for the future Bitcoin ecosystem. RIF OS will not be limited to the RSK blockchain, but will build infrastructure on different blockchains, truly creating value and financial systems. The overall architecture of the RSK protocol is reasonable, but there is still room for improvement in the face of competition and challenges in the market.

References

https://dev.rootstock.io/rif/

https://rootstock.io/rsk-whitepaper-updated.pdf

https://rootstock.io/rif-whitepaper-en.pdf

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!