DeFi remains the foundation of the entire industry, but the problem of fragmented liquidity is a major challenge facing the DeFi sector. The current conventional solutions for this problem mostly involve strategies such as cross-chain bridges, intermediate chains, and multi-chain Dapps, which have their pros and cons. In addition, there is another solution called TapiocaDAO, which adopts a full-chain LayerZero approach as discussed in this article. In fact, this approach is not unique to TapiocaDAO; Wormhole was one of the representatives of this approach, but it suffered a hacker attack last year, resulting in a loss of up to $326 million.

However, we should not regard the failure of Wormhole as the failure of the full-chain LayerZero approach. TapiocaDAO has its own understanding and technological advantages when it comes to the full-chain LayerZero approach. The following is a detailed introduction to TapiocaDAO. By reading the following text, perhaps we can have a clearer understanding of TapiocaDAO itself and what it aims to do.

This article is sourced from @DewhalesCapital, and veDAO Research Institute has obtained permission for its Chinese translation.

Original article link: https://dewhales.substack.com/p/tapiocadao-explained-LianGuairt-1-the-infrastructure

- LianGuai Morning News | a16z is selling 7 million dollars worth of MKR tokens at a high price

- LianGuai Observation | The UBI Idea Behind Worldcoin Cannot Change the World

- Blockchain game PixeLAW wins the Best Use Case Award from ETHGloble, learn about its features and gameplay in 3 minutes.

TapiocaDAO Project Introduction

Link: https://app.vedao.com/projects/4fd42244d7fc918b996e23a643474505d9c1e152ab13b2f29de54afa4f067798

This article is divided into two parts. We will start with the first part to delve into the details of the Tapioca infrastructure:

-

Singularity

-

Big Bang

-

YieldBox

-

twAML

-

DSO

-

PearLayer

Remember: these are not just random terms. They are the building blocks of TapiocaDAO’s unique DeFi ecosystem, with each module playing a unique role in creating a seamlessly connected financial center. TapiocaDAO aims to address the problem of fragmented liquidity in DeFi, enabling borrowing and utilization of various assets on any network. This initiative enhances capital efficiency and increases lending opportunities by unifying liquidity.

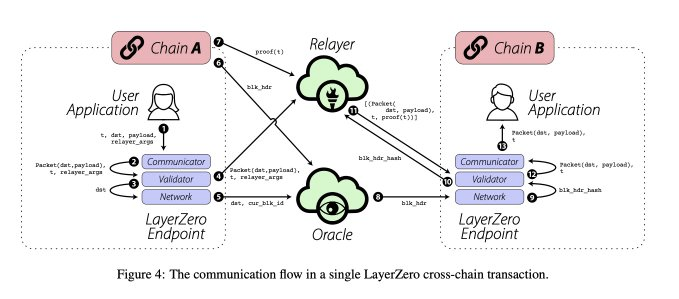

The fragmentation of liquidity between different chains and protocols in DeFi reduces capital efficiency. Liquidity for the same asset is not shared between two different chains, resulting in significant slippage. Thanks to the broad message network of LayerZero, TapiocaDAO becomes the first “full-chain” money market protocol. Its goal is to eliminate well-known bridge-related risks, including smart contract vulnerabilities and user friction.

TapiocaDAO’s unique token economy involves the $TAP, twTAP, oTAP, and $USD0 tokens, each targeting specific aspects of DeFi. From risk management to yield optimization, these tokens constitute a dynamic ecosystem designed to drive protocol growth.

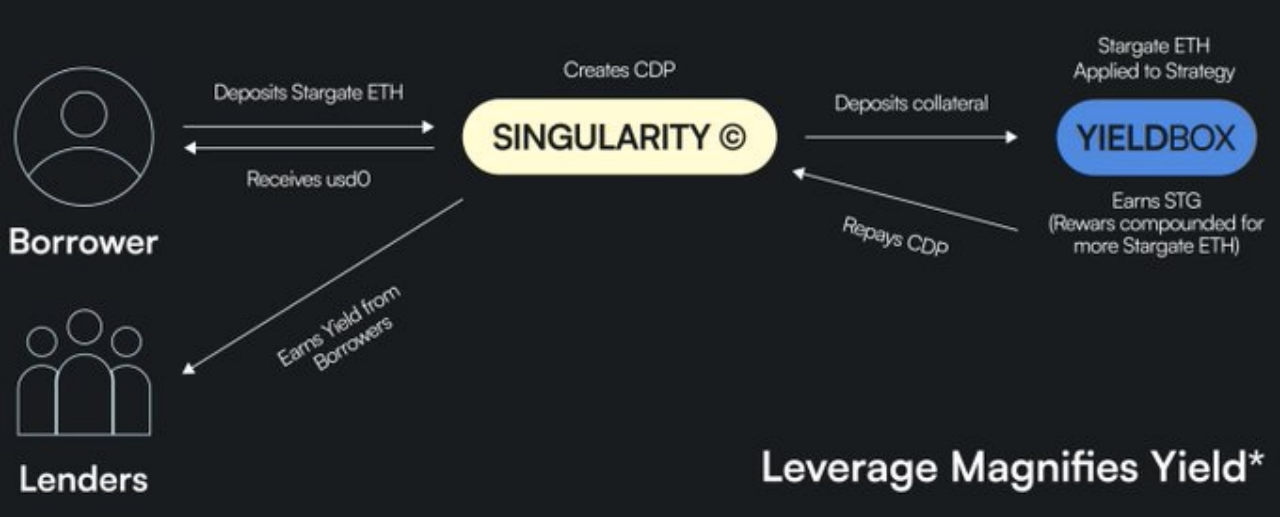

Lending Market: Singularity

We will start with Singularity, which is a modified version of Kashi by BoringCrypto. Singularity serves as a lending market that supports higher risk assets without jeopardizing the entire protocol by isolating the market to diversify risks.

Compared to traditional lending protocols, where all assets share one liquidity pool, Singularity takes a different approach. It allows users to create separate lending pairs. Each lending pair is isolated from other pairs, meaning that if one asset fails, it only affects that specific lending pair and not the entire pool.

In addition, it also allows for one-click leverage, automatically providing leverages of up to 5x with a single click. Its purpose is to optimize the utilization of volatile assets by sharing market liquidity across multiple chains.

Stablecoin Minting Mechanism: Big Bang

Big Bang is another evolution of Kashi that uses Gas tokens as collateral to mint USD0 stablecoins. This concept introduces a self-amortizing loan protocol. In other words, it allows users to mint USD0 stablecoins by providing accepted assets as collateral.

To ensure the stability of the protocol, Tapioca uses a mechanism called Collateral Debt Ratio (CDR) to adjust the supply of USD0 based on market demand. By adjusting interest rates, this will incentivize arbitrage and provide more favorable conditions for borrowers or lenders.

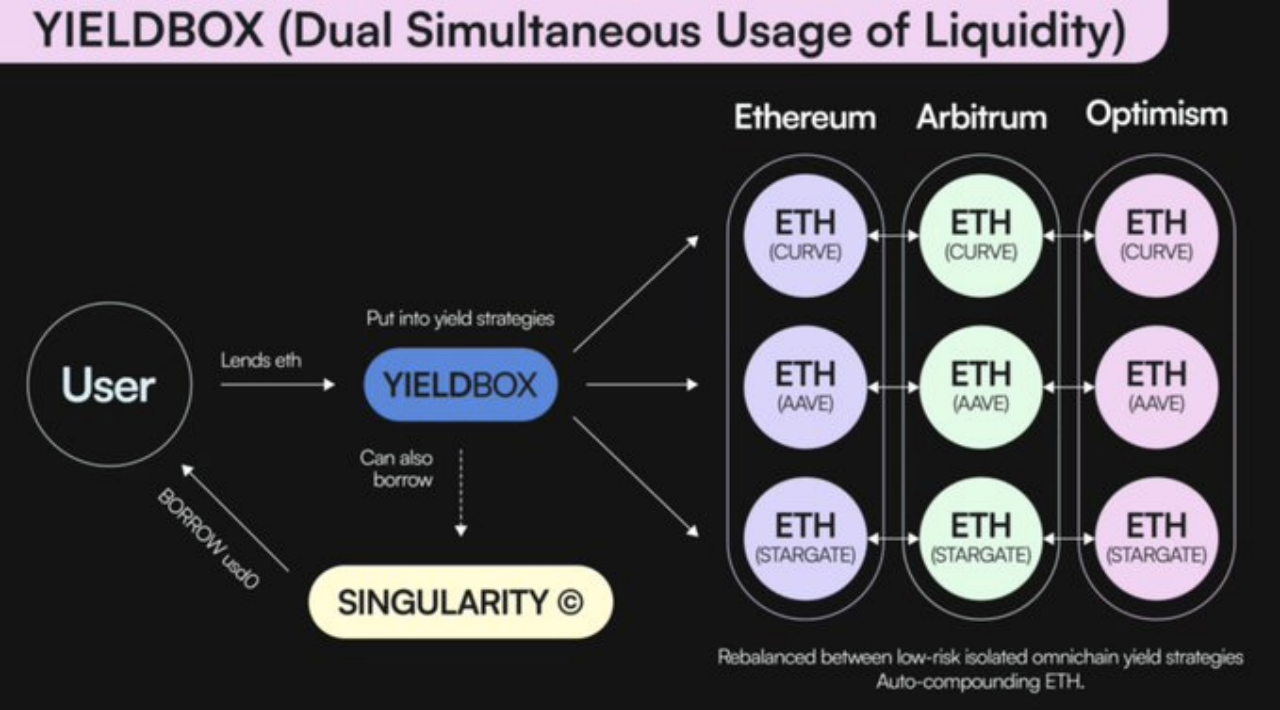

Permissionless Token Vault: YieldBox

YieldBox (BentoBox V2) is a permissionless token vault. Compared to BentoBox V1, YieldBox introduces upgrades, optimizes gas consumption, and simplifies the token approval process. It supports NFTs, token resets, and isolation strategies. Through isolation strategies, it allows tokens to rebalance between different risk-isolated yield strategies. Tapioca achieves this by using proxy contracts on Arbitrum, which is outside the supported chains, to pass messages between chains.

BentoBox is essentially a token vault where users can deposit tokens and use them among multiple DeFi applications without having to withdraw them from the vault. YieldBox builds upon this foundation but refines and expands its functionalities. It aims to achieve the best yield for deposited assets by utilizing various strategies involving yield farming, lending, staking, and more.

YieldBox continuously tracks and adjusts to maximize the returns for token holders. Simply put, when users deposit tokens into YieldBox, the system automatically utilizes those tokens to participate in strategies that maximize yield.

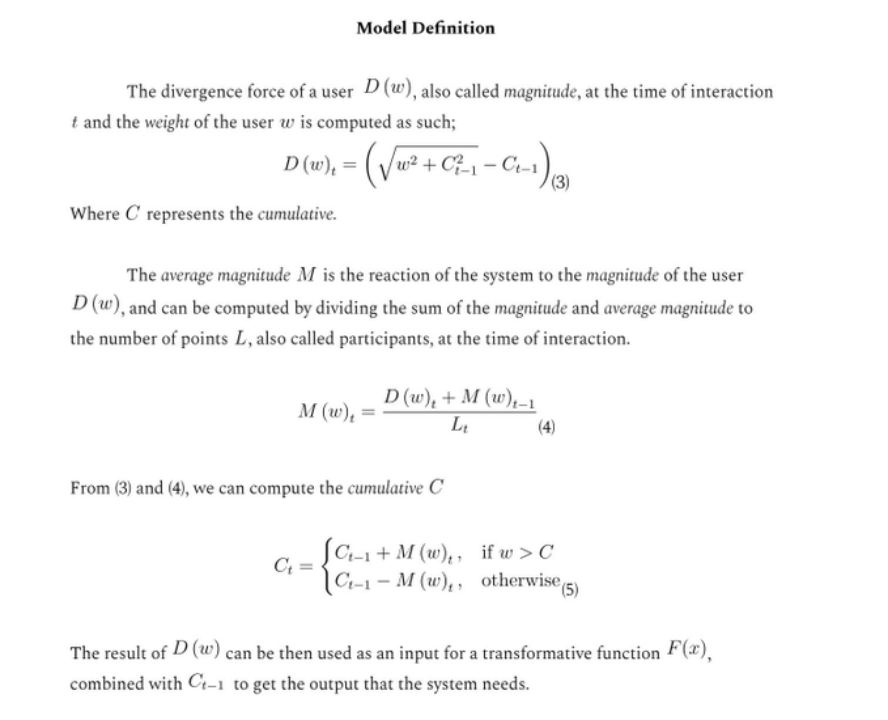

Economic System: twAML

twAML is an economic system that dynamically achieves maximum allocation efficiency based on economic activities. It adopts game theory, and users’ custodian commitments continuously adjust AML, which is a metric defined by consensus and free market. In the traditional liquidity mining model, irresponsible issuance and high inflation often lead to unprofitable practices, resulting in a steady decline in the value of protocol tokens, reduced returns, user interest, and liquidity.

TapiocaDAO has released a detailed whitepaper aiming to address these challenges and improve models from OlympusDAO, GMX, Convex & Aura, OLM, and Keep3r to better overcome their limitations.

Link: https://www.tapioca.xyz/docs/twAML.pdf

AML measures the system impact of users based on the scale of their contributions and the total number of participants during interactions. System incentives can oscillate based on user behavior and system state, avoiding stagnation and promoting new growth states. Tapioca’s AML is influenced by Keep3r’s OLM (Option Liquidity Mining), which suppresses immediate profit-selling behavior of liquidity miners. It ensures a sustainable balance between user incentives and the long-term treasury, crucially creating a Protocol-Owned Liquidity (POL).

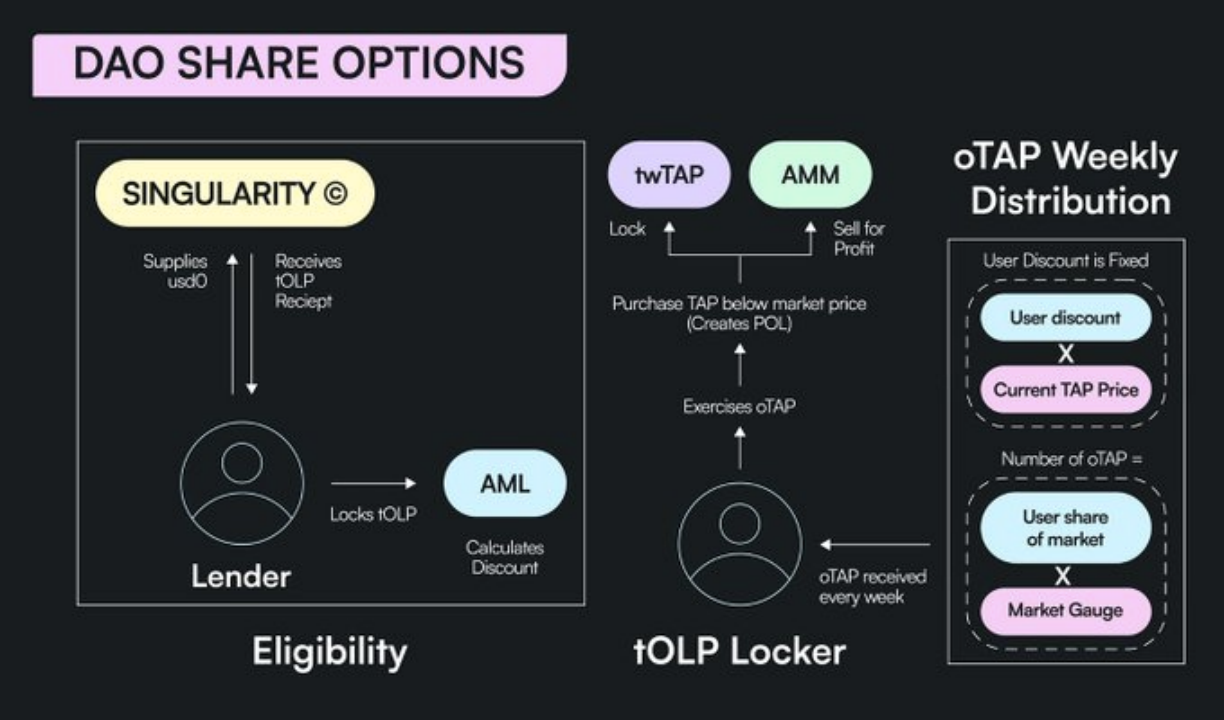

DAO Call Options: DSO

DSO (DAO Call Options) is a mechanism that allows the creation of POL, long-term TVL, and twAML. This concept serves as a key building block in operating their unique economic model.

DSO enables the effective operation of OLM. Inspired by Andre Cronje’s Keep3r, this mechanism makes it possible to create POL, long-term TVL, and twAML.

Users providing liquidity to the credit market will receive token receipts (tOLP) that can be chosen to be locked for a period of time. At the end of this period, they will receive an oTAP with a specified exercise price, allowing them to choose (rather than obligate) to purchase TAP tokens at a discounted price.

The specific role of DSO is to facilitate the creation of Protocol-Owned Liquidity (POL), encourage long-term total value locked (TVL), and support the operation of the twAML mechanism.

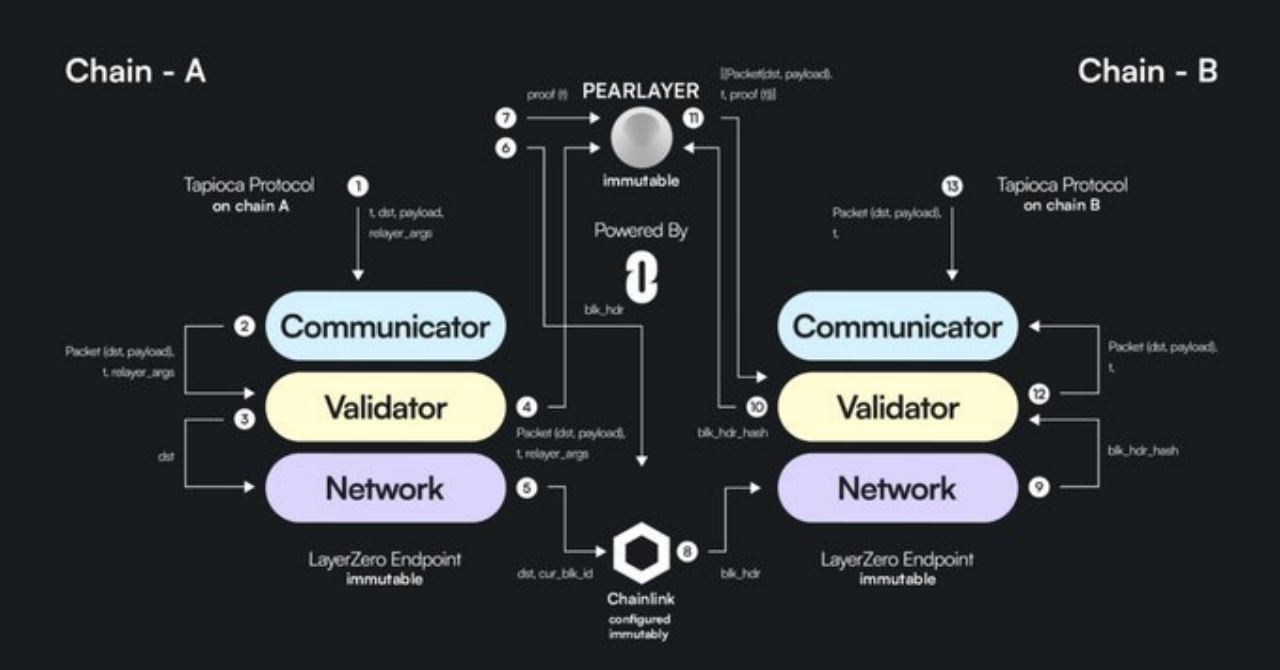

Tapioca’s Relay PearLayer

PearLayer is Tapioca’s relay that leverages LayerZero’s Pre-Crime mechanism, supporting chains such as Arbitrum, Optimism, Ethereum, Avalanche, Base, Berachain, ZKSync, Starknet, Mantle Network, Cosmos, Sei, Polkadot, and more.

With Pre-Crime, PearLayer can verify the potential outcomes of cross-chain messages before delivery, ensuring the integrity of the protocol. Tapioca’s oracle solution comes from Chainlink price data sources.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!