Author: CoinKickoff; Compiled by: Leo, BlockBeats

The history of cryptocurrency can be traced back to the financial boom of the 1980s, when the financial culture was elevated by movies such as “Trading Places” and “Wall Street.” In 1983, pioneering cryptographer David Chaum published research that laid the foundation for electronic payments, blockchain, and cryptocurrency.

At the time, these were all futuristic ideas, and for many years, cryptocurrency was rarely discussed outside of the circles of free-market “libertarian” policies. But in 2009, a turning point occurred – Satoshi Nakamoto developed bitcoin, and the cryptocurrency market exploded in 2010.

Today, there are thousands of cryptocurrencies on the market, making it a challenging market for investors and regulators alike. Many believe that there are too many types of tokens in circulation, comparing it to the “dot-com bubble” of 25 years ago.

- Conversation with Pendle Protocol: How to bring the interest rate derivatives market into DeFi?

- News Weekly | Hong Kong is exploring the launch of stablecoin HKDG

- 2023 Q3 Ultimate Guide to Cryptocurrency Investing

To analyze the cryptocurrency market, we conducted a visual analysis of tokens that have disappeared due to collapse over the past decade, from failed ICOs to waning interest in the market.

We referred to the data on more than 2,400 disappeared tokens from Coinopsy, compiled the current status of each token, analyzed their performance over the past decade, and recorded the time and reason for each token’s elimination.

After compiling this data, we compared it with CoinMarketCap’s annual historical snapshots, providing us with accurate data on all tokens that have circulated in the market.

Data Overview

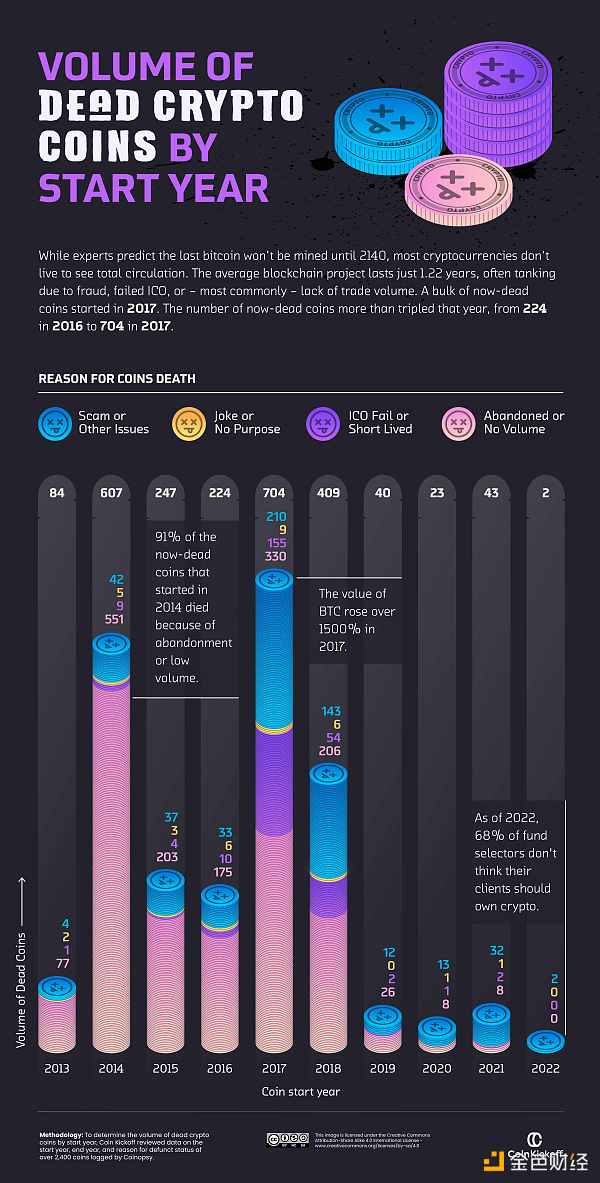

In 2017, 704 disappeared tokens began to be issued, compared to 224 in 2016.

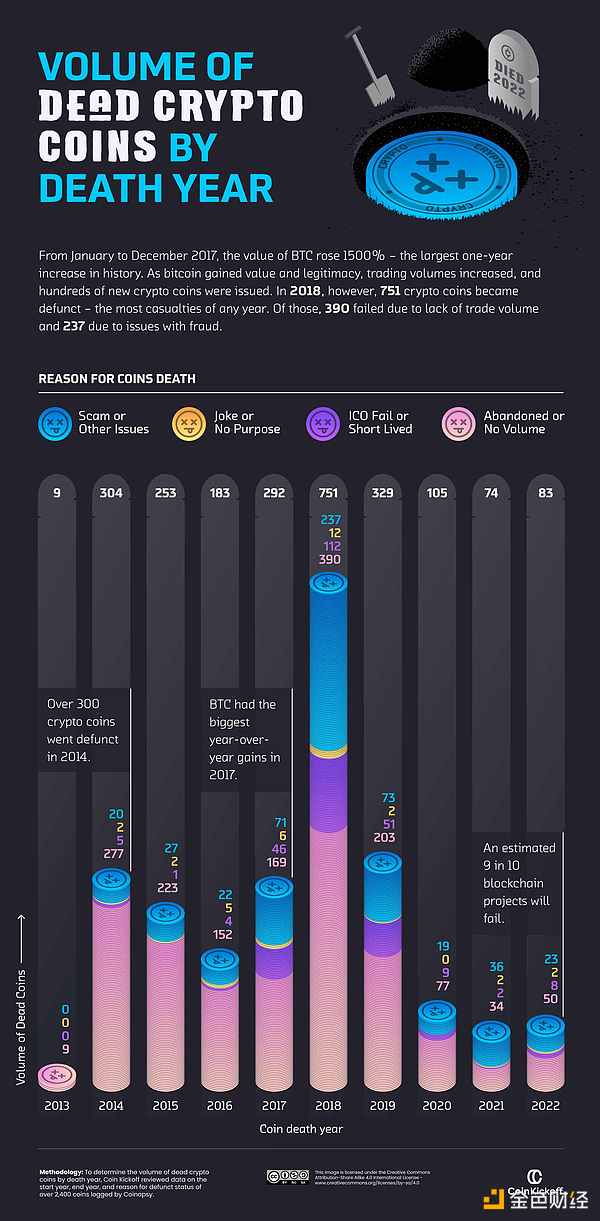

2018 was the most dangerous year for the cryptocurrency industry, with 751 tokens disappearing.

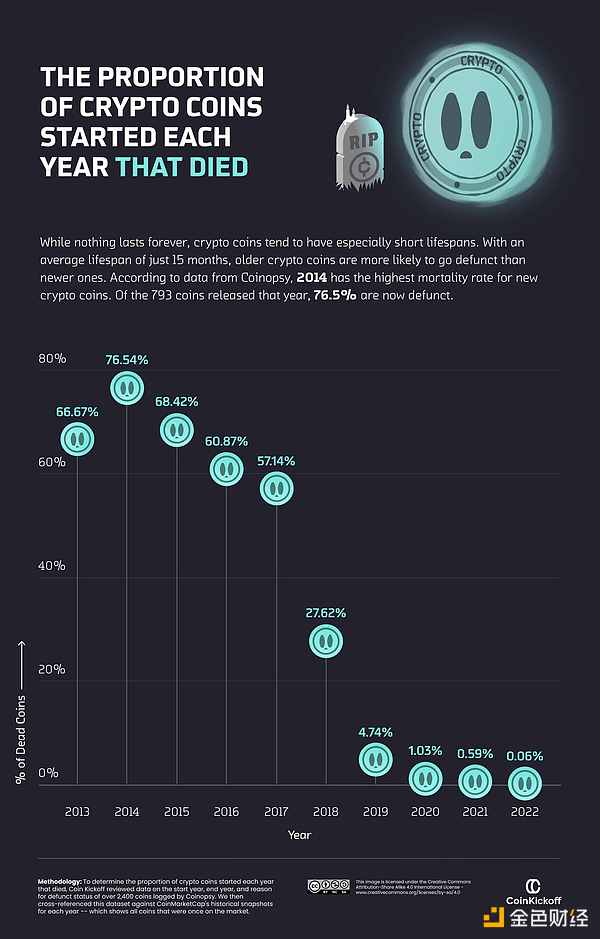

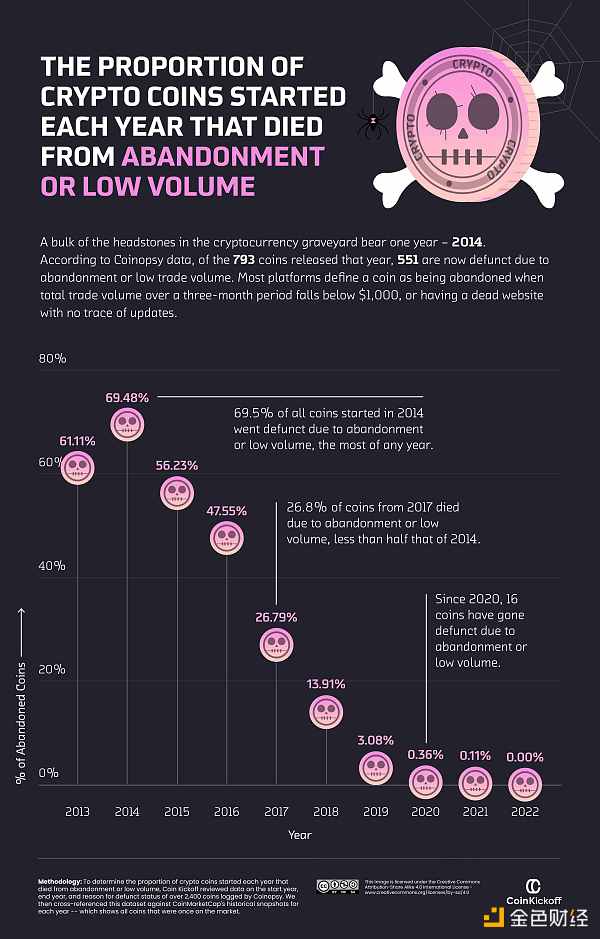

2014 was the year with the highest token mortality rate, with 76.5% of the 793 tokens no longer in circulation, and 551 disappearing.

The Cryptocurrency Collapse of 2014

When looking back at the price history of cryptocurrency tokens, 2013 can be considered the first period of cryptocurrency prosperity. Against a technological backdrop dominated by emerging technologies such as drones and smartwatches, the price of bitcoin soared from $150 to $1,000, reaching an all-time high of $1,127 in November 2013. Before the bitcoin surge, there were only 14 tokens in the cryptocurrency market, and as of 2022, only bitcoin and litecoin remain in the top 10.

The soaring price of Bitcoin led to a wave of competition for market share among tokens. Data shows that in 2013, 84 tokens entered the market, and in 2014, there were 607, all in an attempt to profit from Bitcoin’s collapse in early 2014, when most Bitcoin transactions were related to the dark web black market Silk Road.

However, the squeeze on emerging cryptocurrencies did not last. Data shows that 91% of the tokens created in 2014 eventually disappeared due to low trading volumes or being abandoned (with some exceptions, such as Dogecoin). Many opportunists who tried to monopolize early cryptocurrency markets failed.

The second surge in cryptocurrency prices

2017 became the “summer of love” in crypto history, with everyone loving crypto, and emerging blockchain technology first caught the attention of global business leaders, leading to a surge in investment. In July 2017, Sheba Jafari, a technical analyst at Goldman Sachs, predicted that Bitcoin would reach $3,600 by the end of the year.

That year saw many profitable ICOs, with the most famous being Filecoin, which raised $257 million. However, everything was not as it seemed, with 704 now-defunct tokens entering the crypto market that year, the most in a decade. A 2018 report by ICO consultancy firm Stasis Group stated that 80% of ICOs in 2017 were considered scams, raising a total of $11.9 billion in assets.

Our research shows that of the 751 coins that died in 2018, 30% were fraudulent, the highest percentage in a decade. The most famous ICO scam was the Vietnamese tokens PinCoin and iFan. Local reporters exposed companies like this for scamming up to 32,000 investors out of $660 million, and the Ho Chi Minh City police investigated the matter.

2014 Token Data

But people easily forget one thing: cryptocurrency is still in its infancy. The stock market, on the other hand, has been around for hundreds of years. The first Bitcoin transaction took place in 2010 at a pizza shop in Florida, and the market has yet to gain a solid foothold. Economists are also divided on the future of the cryptocurrency industry.

The cryptocurrency market has proven to everyone that cryptocurrency trading and investment are easy to disrupt traditional financial systems, but the industry also has a high rate of failure. A report from the China Academy of Information and Communications Technology (CAICT) shows that 92% of blockchain projects on the market are inactive, with an average lifespan of only 1.22 years.

The situation in the early cryptocurrency market was fatal for many aspiring tokens. According to our research, more than half of the tokens launched each year from 2013 to 2018 no longer exist. In 2014, more than three-quarters (76.5%) of the tokens issued during the first major cryptocurrency boom had disappeared.

Data improved, only 16 tokens have been abandoned since 2020

According to data from the blockchain research platform LongHash, 63.1% of cryptocurrencies disappeared because investors abandoned them, leading to a price collapse. In a saturated market with more than 12,000 tokens, well-intentioned projects naturally cannot attract people’s attention. Coinopsy summarized the reasons why a token may be abandoned, from outdated blockchain designs to the personal situation of developers.

For example, a token is considered dead if its trading volume is less than $1,000 in three months, or if the project’s website is no longer updated.

The data shows that after the first cryptocurrency price surge in 2013, the probability of some tokens disappearing began to increase. In 2013, 61.1% of tokens and in 2014, 69.5% of tokens disappeared. However, the ratio of tokens being abandoned and disappearing has been decreasing since then, indicating that the frequency of interest in cryptocurrencies has been decreasing. Since 2020, due to a lack of investment, only 16 tokens have been delisted from the market. Nevertheless, people are still concerned that a significant drop in cryptocurrency values in 2022 will lead to more tokens being abandoned in the future.

2017 was the peak of cryptocurrency fraud

Due to the lack of regulation in the cryptocurrency market, fraudulent schemes and opportunistic scams still exist and account for a significant proportion of the market. In addition to these tokens created for fraud, criminals can also use mainstream currencies such as Bitcoin and Ethereum to deceive investors.

The Federal Trade Commission reports that over 46,000 people have fallen victim to cryptocurrency scams since the beginning of 2021, with a total loss of over $1 billion. Chainanalysis data shows that after the latest price surge in 2021, interest in the market has once again skyrocketed, leading to a wave of cryptocurrency crimes involving as much as $14 billion.

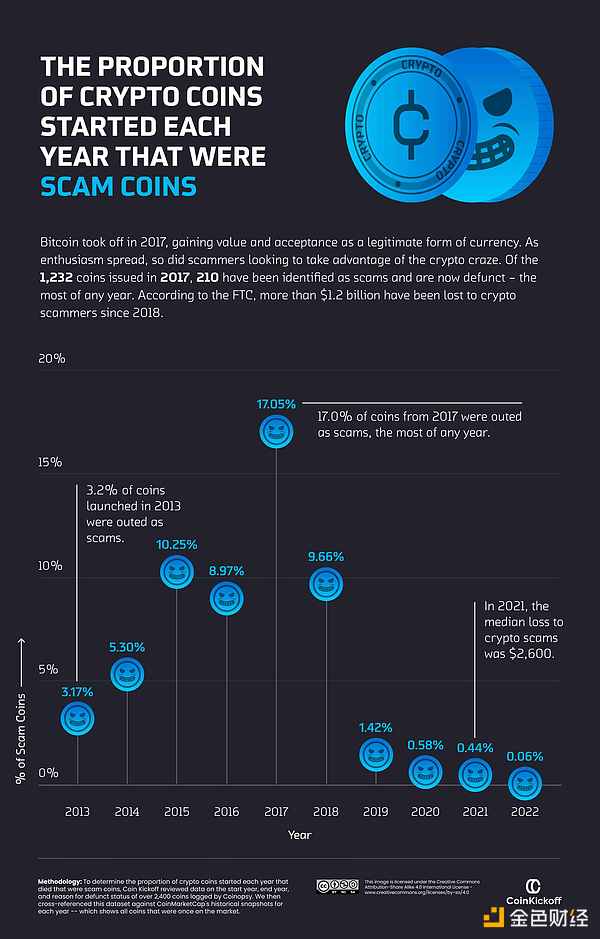

Despite this, less than 2% of tokens issued since 2019 have been exposed as fraudulent. In 2017, the peak of crypto scams, 17% of tokens were fraudulent (210 out of 1,232 tokens were considered scams and have since disappeared), and fraudsters made $490 million during the ICO craze that year.

When companies become large enough to trade on the stock market, they launch IPOs to raise funds from public investors. In contrast, ICOs are the primary channel for attracting people to buy newly launched cryptocurrencies, with investors buying tokens, but they can also offer broader interest in the company’s product, including a stake in the company itself.

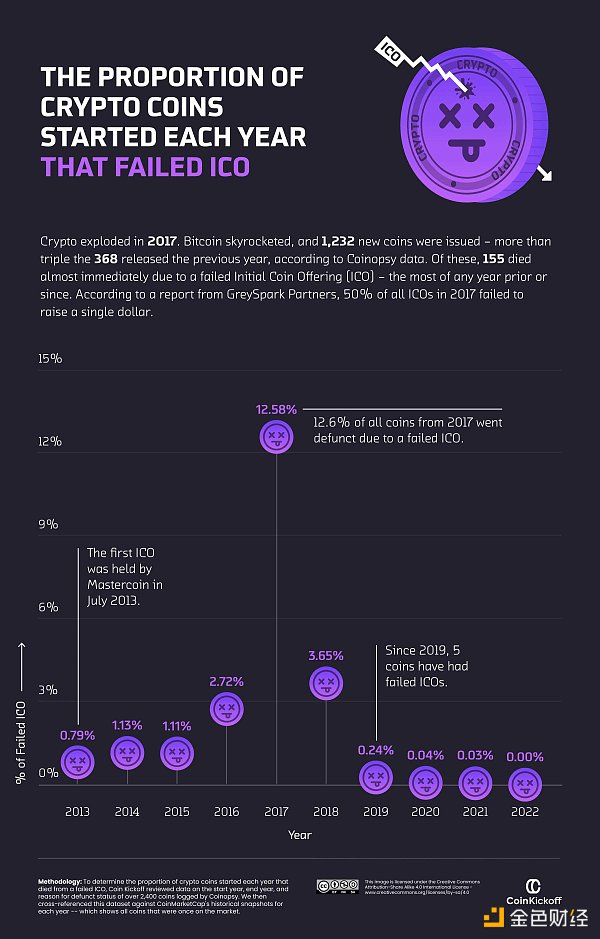

Mastercoin was the first project to launch an ICO in 2013, and this practice peaked in 2017 as mainstream interest in cryptocurrencies grew with their rising prices. Nevertheless, our research shows that 12.6% of all tokens launched that year were rendered invalid due to failed ICOs, more than any other year in the past decade.

Research by consulting firm GreySpark Partners found that nearly half of all ICOs launched in 2017 and 2018 failed to raise any funds, and this practice was vulnerable to fraud, eventually leading to tighter regulation and harsh penalties for wrongdoing in the industry. Therefore, our data shows that only five tokens failed to launch their ICOs.

What’s next for cryptocurrencies after a tumultuous decade?

The cryptocurrency market is growing at an unprecedented pace, with rapidly advancing technology bringing new investment opportunities—the most notable being the NFT craze of 2021. Bitcoin still dominates the market, with some investors predicting its price could reach $100,000 by 2023. However, in 2021, Ethereum’s value grew by 409%. Despite global instability caused by the Russian invasion of Ukraine and resulting economic downturns worldwide, analysts predict Ethereum will bring $4.9 billion in value to the crypto industry by 2030.

Many experts have drawn parallels between the growth of cryptocurrencies and the early 2000s “dot-com bubble,” where innovation led to a surge in internet companies and investors searching for the next Amazon or eBay. In contrast, the surge in cryptocurrency investment in 2013 and 2017 flooded the market with new currencies, as investors raced to profit from the “next big thing.”

While many of these tokens disappeared due to lack of investment, failed ICOs, or scams, the market faces many challenges in regulating cryptocurrencies to protect investors. However, the investment community has taken notice of the crypto industry, and cryptocurrencies have proven their ability to disrupt traditional financial markets over the past decade.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!