Author: Cole Garner, Crypto KOL

Translation: Felix, LianGuaiNews

Bitcoin and the cryptocurrency market seem ready to launch a bull market, and crypto KOL Cole Garner has listed 7 bullish indicators.

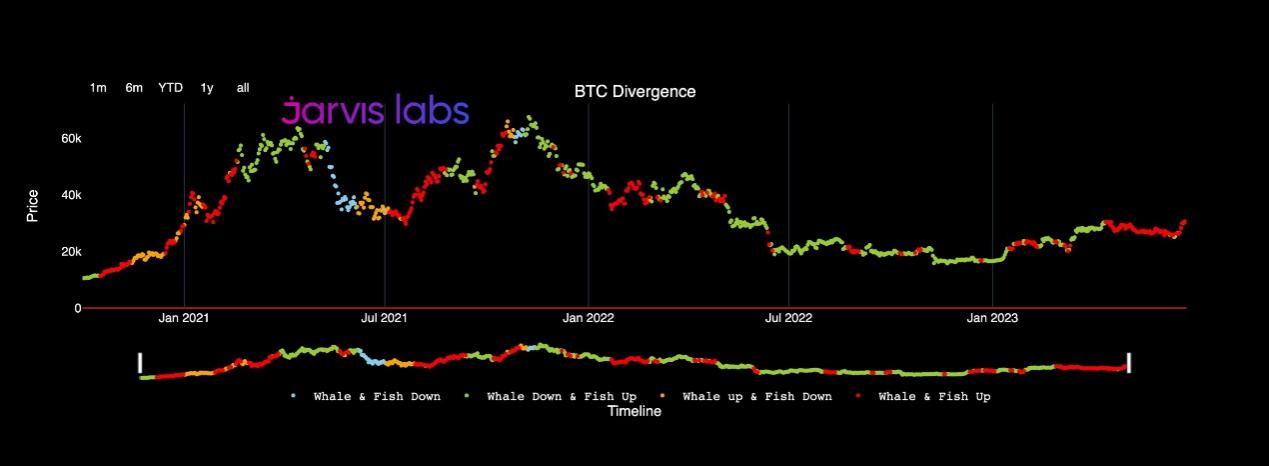

Whale Accumulation

Data research company Jarvis Labs has been pointing out the accumulation pattern of whale wallets since May.

- Investigation into the Mystery of Market Manipulation of ICP Who Precisely Killed the Rising Star DFINITY? (Arkham Chapter)

- Grayscale interprets the July cryptocurrency market the market share of altcoins increases, and the future trend of the overall market depends on the US economy.

- NYDIG Taking Litecoin halving as a reference, how will Bitcoin halving unfold?

The accumulation trend of whales is the cornerstone of a bull market, and below is another (very different) indicator about whales.

Nansen’s Smart Money Indicator

Nansen’s Smart Money Indicator shows that smart money is not making much profit but is accumulating ETH.

Asian Market

When buyers dominate the Asian trading session, the prices of BTC and ETH rise. It has almost always been the case during major bull markets. The time when the Asian market starts selling is usually near the market top. The author has developed an algorithm to test the current dynamics of the market (the author is about to open-source the algorithm), and the test shows that the Asian market is currently in the buying phase.

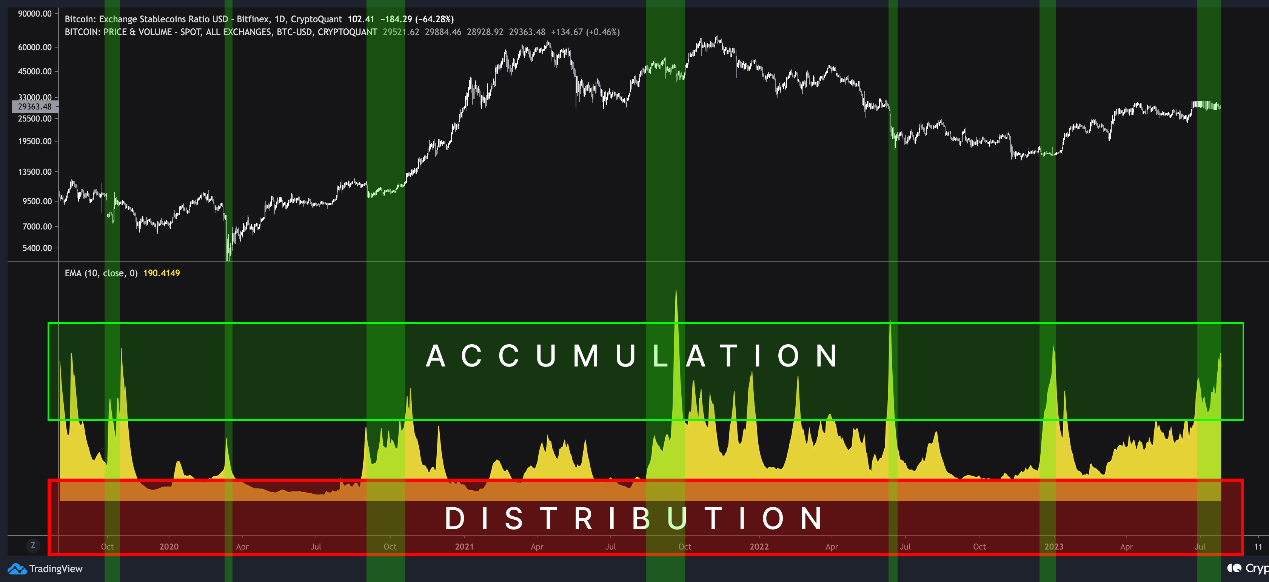

Bitcoin-to-Stablecoin Ratio

The Bitcoin-to-stablecoin ratio on Bitfinex sharply rises a few weeks before the start of a major Bitcoin bull market.

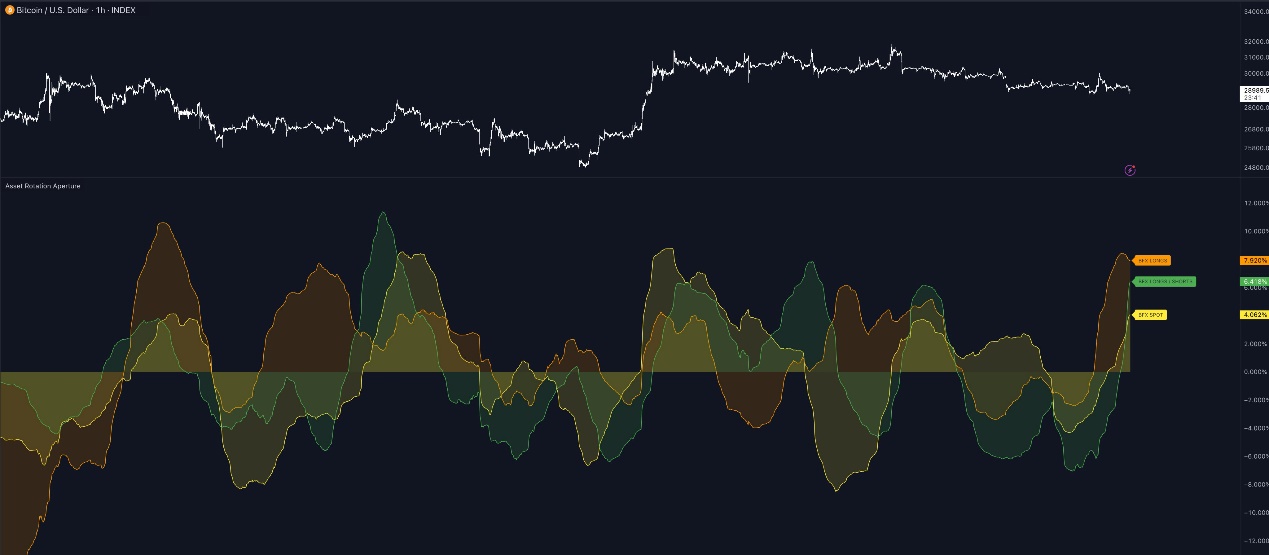

Asset Rotation Aperture

Bitfinex’s Asset Rotation Aperture indicator tracks the delta of accumulated trading volume and open interest of multiple assets side by side. Currently, three of them are bullish.

Bitfinex BTC longs (deep yellow in the image below)

Bitfinex BTC longs/shorts (green in the image below)

Bitfinex spot BTC (light yellow in the image below)

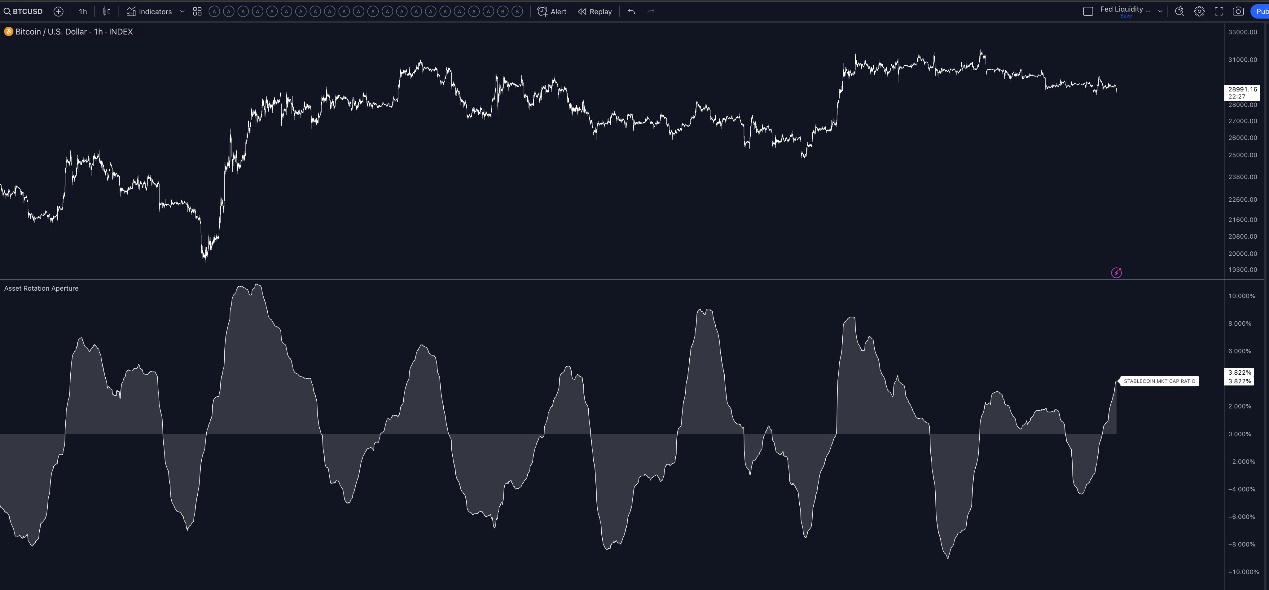

Stablecoin Market Cap

The stablecoin market cap ratio is currently bullish, but it may continue to move sideways indefinitely.

However, the stablecoin market cap ratio is being crushed relative to its logarithmic trendline, which is one of the most important resistance levels in the crypto market (in reverse, resistance levels are like support levels). To enter a full-fledged bull market, the logarithmic trendline may need to be broken (which is entirely possible).

Summer Bull Market

Looking back at the cryptocurrency market trends in the past decade, bull markets have mostly occurred during the summer. It is predicted that a major volatility will occur, but it is likely to happen in September. The market still has a few weeks to go.

This bull market theory will be invalidated when the closing price for the week is below the 200-day moving average.

Related reading: Analyzing the current state of the cryptocurrency market: When will the next bull market arrive?

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!