The original source of this article is Crypto Leaks, an investigative company that exposes scandals in the cryptocurrency industry. The first two cases they exposed were about the manipulation of ICP prices by capital and malicious short selling. In the SBF section, Crypto Leaks conducted an investigation into the market doubts and conditions at that time, and believed that the ICP token was clearly manipulated before and after its listing. As the “spokesperson” for Solana, which was extremely popular in 2021, SBF had both the motive and the ability to destroy its biggest competitor, the IC network (although there is no substantial evidence and there never will be in the future).

This article is about Arkham and provides a large amount of video evidence showing that Arkham received sponsorship and published a research report deliberately defaming ICP. The DFINITY Foundation later quoted this article to sue Arkham and The New York Times for defamation. The article was published on June 9, 2022, with some deletions and modifications made by the translator.

Summary of the article:

• Using spy dialogue videos and facts to examine the ICP report released by Arkham Intelligence in June 2021.

- Grayscale interprets the July cryptocurrency market the market share of altcoins increases, and the future trend of the overall market depends on the US economy.

- NYDIG Taking Litecoin halving as a reference, how will Bitcoin halving unfold?

- Grayscale’s Review of the July Market Cryptocurrencies and the Dream of a Soft Landing

• The report focuses on the IC network launched by the DFINITY Foundation, whose native token is called ICP.

• At that time, Arkham was just a new company with no records or obvious expertise related to cryptocurrency research.

• The only publicly known team member was the founder Miguel Morel—aside from claiming on his LinkedIn page that he is a cryptocurrency investor and has helped create a cryptocurrency business called Reserve, we could not collect any information about him.

• The Arkham ICP report claims that “pump and dump” activities were carried out by insiders when the DFINITY Foundation launched the IC network, which is the reason for the fluctuation in ICP prices. However, they did not provide any substantial evidence.

• The report was published on Twitter and accompanied by a video made in the style of a crime documentary.

• Because its content was not objective and lacked substance, the report should not have received any coverage, but it mysteriously became associated with The New York Times. The New York Times turned it into a “lethal weapon” against the reputation of DFINITY.

• Arkham’s founder Miguel claimed that the report was not paid for.

• However, the spy videos we collected showed that Arkham was commissioned to produce a “defamatory” report targeting the ICP token, and the client may be a competitor of the IC network.

• The Arkham ICP report and articles in The New York Times were subsequently used as the basis for attacks on the DFINITY Foundation.

• After the report was published, the Arkham team moved to a luxury mansion in Chelsea, London, in the UK, apparently obtaining a large amount of funds from somewhere. The video shows a security team guarding unidentified goods entering the mansion.

Investigation Background

The Internet Computer (IC) blockchain went live on May 10, 2021, developed by a large team from the DFINITY Foundation. People were very excited before the official launch of IC because it was claimed that the IC network could play the role of the “world computer,” providing a decentralized alternative to traditional IT and supporting fully on-chain Web3 services, such as social networks.

After the mainnet went live, the native token ICP can be transferred on the network, and cryptocurrency exchanges around the world began creating spot markets where users can trade ICP tokens. In the initial hours after the mainnet launch, the price of ICP tokens remained above $450, with a fully diluted market cap of $230 billion, which was an undisputed overvaluation. Then, the price started to decline.

As of June 28, 2021, the price of ICP has dropped to $50, with a fully diluted market cap of $23.5 billion, which can be considered comparable to other competing networks at the time.

Subsequently, an unknown research company called Arkham Intelligence, led by its unknown founder and CEO Miguel Morel, released the “Arkham ICP Report”.

The basic claim of the Arkham ICP Report is that the DFINITY Foundation, along with relevant insiders, somehow set a higher initial price for the ICP token and conducted “pump and dump” when the token was listed.

However, it is highly unusual for an organization consisting of hundreds of renowned computer science researchers, cryptographers, and engineers to spend years developing a blockchain network only to abandon its vision upon mainnet launch. Furthermore, the report is filled with unverified claims, inaccuracies, and blatant logical fallacies. For any experienced observer in the cryptocurrency field, this looks very much like market manipulation aimed at damaging the reputation of DFINITY, possibly sponsored by competitors of the IC network or financial participants looking to short its tokens.

The Arkham ICP Report would not have received much attention, but it was apparently thanks to Andrew Ross Sorkin, a columnist for The New York Times, who published the report alongside an article and a Dealbook newsletter on The New York Times, both promoting the report. By providing credibility to the report, The New York Times has caused significant damage to the reputation of the DFINITY Foundation, its leaders, and the IC ecosystem. It can be said that this has led to a devaluation of the ICP token by hundreds of billions of dollars. Why The New York Times chose to promote the Arkham ICP Report is unclear, as it clearly does not deserve to be regarded as a credible source of information.

In every aspect, the DFINITY Foundation did not sell any ICP tokens in the weeks following the mainnet launch. The project’s founder, Dom, stated that he only sold a small portion of the tokens (only 5% of his holdings). Furthermore, common sense tells us that if the market price of ICP tokens is too high after the mainnet launch, it would naturally decline through normal price discovery in any case, without the need for “internal dumping”.

In this article, we explore the individuals and content behind the Arkham ICP Report, as well as the puzzling decision of The New York Times to promote the report. As we have shown through undercover videos and other means, the more we investigate, the more confusing The New York Times’ actions appear.

Why did The New York Times support the Arkham ICP report?

The New York Times published an article titled “The Dramatic Collapse of Cryptocurrency is Shocking,” and at the same time, they released “How the Proud 1C0 of ICP Collapsed” on their Dealbook newsletter, which was also sent to subscribers. (Note: After this article was published, the DFINITY Foundation filed a defamation lawsuit against The New York Times and Arkham Intelligence. The New York Times subsequently edited the title and removed the term “1C0”.)

In the “How the Proud 1C0 of ICP Collapsed” article, The New York Times referred to Arkham Intelligence as a trusted “cryptocurrency analysis company” and promoted the Arkham ICP report, providing a link to the report. Meanwhile, although Arkham had not published any content before, as of June 2022, over a year later, it has not published any other content either.

In “How the Proud 1C0 of ICP Collapsed,” The New York Times repeatedly and erroneously referred to the IC network, which is undergoing mainnet launch, as “Initial Coin Offering,” or “1C0” (involving an organization selling non-usable tokens to the public to raise development funds, with the promise that it will make the tokens usable) – something that regulatory agencies in many countries have long prohibited – apparently deliberately smearing the DFINITY Foundation’s engagement in illegal activities.

The basic gist of the article can be summarized by a statement in a short video promoting the Arkham ICP report by Miguel Morel on Twitter. The video uses the background music commonly used in crime exposés in TV shows and expresses his claim – that the DFINITY Foundation and insiders are “guilty”:

Our findings lead us to believe that insiders at DFINITY continuously deposit and sell billions of dollars’ worth of ICP tokens on exchanges while others watch their investments shrink. If the available data in our analysis is accurate, we should propose that ICP tokens might be one of the most extreme cases of investor abuse in the history of the cryptocurrency market and the entire financial market.”

Miguel made a clear statement about the “crimes” of the DFINITY Foundation and insiders. Although Arkham Intelligence had only 200 followers on Twitter at the time of the release, due to The New York Times’ promotion, by May 2022, this video by Arkham Intelligence had been viewed nearly 20,000 times, and their “views” became well-known.

As we mentioned in the SBF article, the Arkham ICP report was likely created for a specific purpose of causing harm to ICP, either by competitors or market manipulators who want to short ICP. So why did The New York Times, with its outstanding history and mission to seek the truth on behalf of readers, provide credibility and the reputation that Arkham should have?

Something was off from the moment our investigators began collecting spy videos and learning about what had happened…

Investigating Arkham Intelligence

The name Arkham Intelligence seems to be a tribute to Gotham Research, a well-known and respected financial research company. However, we do not believe that The New York Times confused the two when deciding to promote Arkham as a credible “cryptocurrency analysis firm”. Arkham Intelligence has no previous record and has only publicly disclosed one employee, Miguel Morel, who also has no prior record.

Just these two points alone already raised serious red flags, and we later discovered even more troubling issues.

Where is the Arkham team really located?

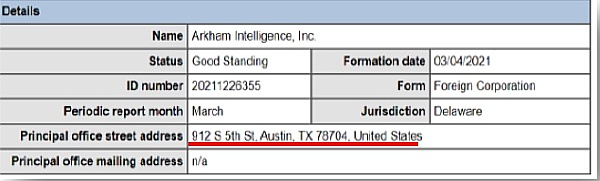

They are registered in Delaware, USA, and were established on March 4, 2021.

However, this establishment date does not match their Twitter account, which was created in May 2019, two years ago, indicating that the account was renamed. Their first tweet appeared on June 28, 2021, the same day The New York Times published the article. This date also contradicts Miguel Morel’s LinkedIn profile, which states that he joined Arkham in January 2020. But these inconsistencies with dates are just the beginning.

Furthermore, during the period shortly after the release of the ICP report, the Arkham team was still working at their headquarters in the countryside outside Austin, Texas, rather than the luxurious office space you would expect from a reputable research company:

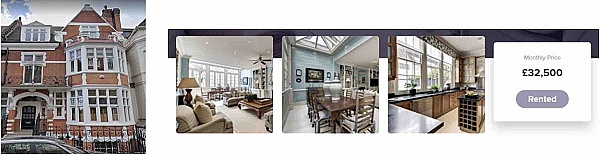

However, after the ICP report gained attention, this small team moved out of Texas. Perhaps they made a lot of money, as they relocated to a luxury residence in Chelsea, London. According to the initial advertisement, the rent for this mansion was £32,500, or $43,000 per month.

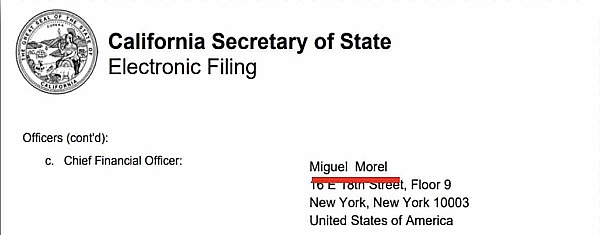

Some may think that “cryptocurrency analysis” might be a simple business, but Arkham is registered all over the United States: Delaware, California, New York, and even Colorado.

Arkham in Chelsea

Arkham’s new headquarters in Chelsea, London, houses many Arkham team members or branch offices. Some new members include Henry Fisher, the head of the cryptocurrency project Reserve and current CTO of Arkham; Charlie Smith, former business development director of Reserve and co-founder of Arkham; Jonah Bennet, a journalist and co-founder of an online magazine that has hired several Arkham employees as writers; Zachary Lerangis, current COO of Arkham; and Keegan McNamara, former TPM of Arkham.

There are three things worth noting.

First, the people here are all in their early twenties.

Second, Charlie Smith and Keegan McNamara have now left Arkham and are starting a new startup, which reflects the mobility of Arkham members and why it should not be seen as a traditional company.

Third, three members are connected to a project called “Reserve,” a “stablecoin” project, and Miguel also claims to be a co-founder of the project…

What is the Reserve project?

Reserve is not a large-scale technology project like the IC network. Its goal is to provide a “stablecoin” that runs on the Ethereum network. Investors can buy stablecoins through its RSR token, which has fallen by over 96.5% since its peak.

Crypto enthusiasts hope to see reports written by thoroughly researched, impartial, and objective professional researchers, rather than by cryptocurrency entrepreneurs, which may lead to subjective and inaccurate conclusions. It is particularly puzzling that their own token and the ICP token both experienced a sharp decline in price at the same time, but they probably would not claim that the price drop is due to insider trading.

Due to the sharp decline in the price of Bitcoin, the prices of many tokens have fallen in response, and this decline has almost started from the moment the IC mainnet went live. From April 14, 2021, to July 20, 2021, BTC fell from $63,314 to $29,807. The largest decline occurred on May 10, 2021, the same day as the launch of the IC mainnet. However, Arkham’s report completely failed to consider the impact of BTC on the price of ICP, even though it also caused their own RSR token to fall by 79.4%.

Even if they have direct experience of how market fluctuations at the time affected token prices, when Arkham produced the ICP report, they mysteriously did not mention these market trends and instead chose to weave a false narrative about inappropriate behavior by DFINITY insiders, enough to prove that their actions were intentional.

Information about Miguel Morel

At the time of the ICP report release, founder and CEO Miguel Morel was the only publicly known Arkham employee. At that time, his LinkedIn profile revealed very few career history and qualifications. Given that the logo of a university has been added to his resume, he seems to have graduated from high school and attended college courses. Miguel claims to be a co-founder of Reserve, but shortly after the release of the Arkham ICP report, Reserve removed all information about Miguel from their official website.

Although Reserve did not list Miguel as a co-founder when Arkham released the ICP report, their website did include a blog post attributed to Miguel Morel, which was quickly removed.

Although it is not clear what Miguel Morel means when he claims to be a “co-founder” of Reserve, this subordinate relationship suggests that he may have pre-existing economic interests in cryptocurrency, which may make his claims far from fair and objective.

Clearly, when promoting the ICP report that could cause billions of dollars in losses and endorsing it, this is not something that the New York Times can trust as a normal person.

Has Arkham’s ICP report been recharged?

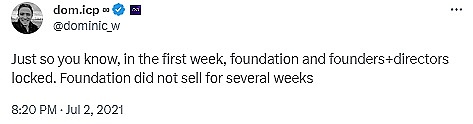

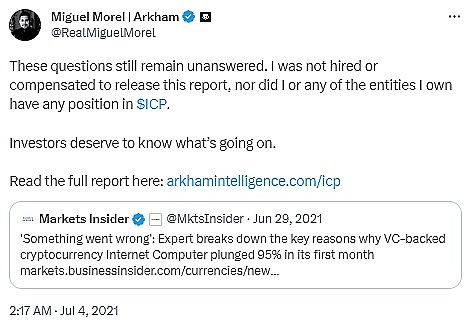

The New York Times published their article and DealBook newsletter on June 28, 2021, promoting the Arkham ICP report. A few days later, as the IC ecosystem and ICP tokens were damaged, Miguel Morel posted his final tweet (at the time of writing), claiming that he was not sponsored to write the report, did not receive any form of compensation, and he did not hold or short ICP:

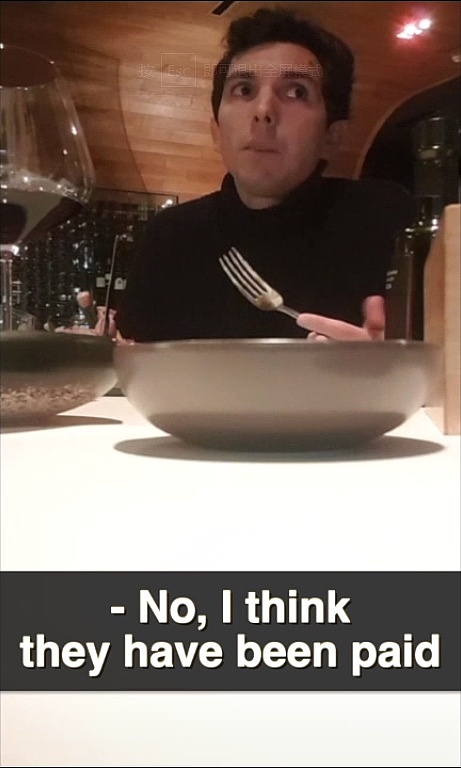

However, in a spy video we collected, Arkham employee Nick Longo said that he believes the client has paid for the production of the report (interested readers can go to the original text to view the video, https://cryptoleaks.info/case-no-2).

Useful dialogue in the video:

Nick: This (ICP report) is a good opportunity to get attention, so we published it. I remember a client paid

Mysterious person: (Payment) to investigate ICP?

Nike: ICP is the first, there are other crypto projects

Johan Bennett is more straightforward about why Arkham produces ICP reports.

Mysterious person: What can Arkham get from it?

Johan: They charge for the report, they are hired to do this. This is how they make money.

Johan: I think they were specifically hired to do this, it must not be chosen from so many blockchains. I think they were hired by dissatisfied users or investors.

Mysterious person: In the case of Arkham, can publishing articles in the New York Times generate income in some way? Or for common interests?

Johan: No, I think they were hired by the client to write it.

The video evidence shows that the report was sponsored and aimed to blame the decline in ICP prices on the DFINITY Foundation and “insiders” involved in the ecosystem. The report arbitrarily picked some large ICP transactions and claimed without any other evidence that these transactions were insiders selling off. The report never questioned why the initial price of ICP was so high, nor explained why the price wouldn’t naturally fall.

The report not only appears to have been created for paying clients, but its strong claims are deliberately made without a reasonable basis:

Nick: We have done some investigations for clients, such as ICP, and basically inferred who owns these wallets, but these are just conjectures… Insiders sold all the tokens, but we didn’t…

Mysterious Person: Evidence?

Nick: Yes.

Arkham’s investor is Tim Draper

Tim Draper is a famous American billionaire with a large cryptocurrency portfolio. His investment in cryptocurrencies began with a large amount of Bitcoin holdings and later expanded to emerging projects such as Ripple, BCH, Tezos, and Aragon. His son, Adam Draper, “inherits” his ambition and holds a large amount of cryptocurrencies such as Bitcoin, Monero, and Ethereum through his own venture capital fund, Boost VC. For the Draper family, the IC network and the DFINITY Foundation may be seen as a direct threat to their family assets, as the innovative IC network can be seen as a direct competitor to all common blockchains.

Nick: Did we have some angel investors at that time?

Mysterious Person: Can you give me the names?

Nick: The most important one is Tim Draper.

Miguel Morel publicly claimed that the Arkham ICP report was not sponsored and was made for the cryptocurrency community. However, it not only appears to have been commissioned by an unknown party for unknown reasons, but as revealed by Nick Longo below, it was made using Tim Draper’s funds:

Nick: When we were focused on ICP (report)… We raised a lot of money at that time, a Series A financing, several million dollars, and we still had some money left from the original angel investors.

Suspicious activities at Arkham’s Chelsea headquarters

After the release of the ICP report, the Arkham team moved from their rural residence in Texas to a mansion in Chelsea, but interesting things happened. Travel bags filled with goods arrived at the mansion, containing unknown items. Miguel’s handbag was sometimes carried by security guards, but always accompanied by them. They nervously looked around on the way until they were taken into the house:

Arkham has caused various damages to the IC ecosystem

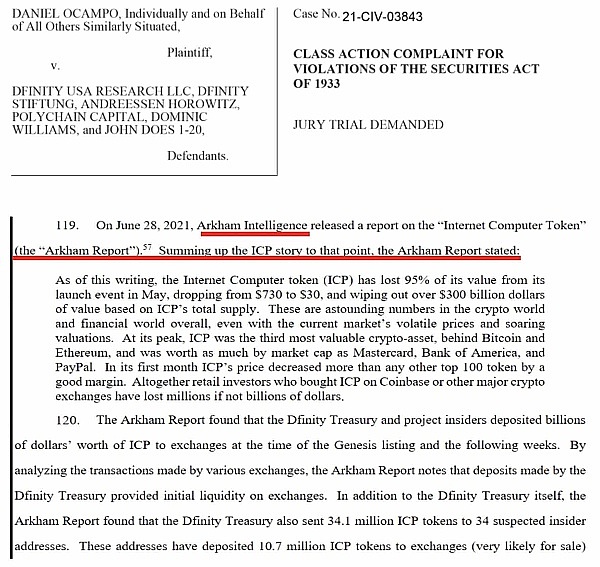

We found that many parties involved in the cases believed Arkham’s claims simply because they thought The New York Times endorsed Arkham’s claims, and then directly engaged in attacks that harmed the IC ecosystem, exacerbating reputational damage. This extends to class action lawsuits, one of which is shown below:

Investigation Summary

As shown in this investigation, The New York Times falsely described Arkham as a respected “crypto analysis company,” which greatly misled crypto enthusiasts. Not only does Arkham seem to lack the skills necessary to write professional reports, but almost every aspect of the organization is highly suspicious. While this investigation has brought conclusive evidence to the world, even a basic and rough investigation of the organization would indicate that they are not trustworthy, from the strange misplaced dates in their profiles to the complete absence of any history about them or their founders on the internet.

Endorsing Arkham and its reports in this way could potentially reduce the market value of ICP tokens by billions of dollars. As we have shown, Arkham may have been paid by competitors or people shorting ICP to produce the report, and the company’s main investors are also investing in blockchains that compete with the IC network. Although false statements may please clients and please their main investors, the result clearly damages the reputation of the IC ecosystem and harms the interests of ICP holders.

Within two weeks of the publication of this article, the DFINITY Foundation filed a lawsuit against The New York Times and all members of the Arkham Intelligence team in the Southern District of New York, accusing them of attack and defamation. In the end, the DFINITY Foundation won the lawsuit.

Risk Warning:

According to the notice issued by the central bank and other departments on “Further Preventing and Dealing with the Risks of Virtual Currency Trading Speculation,” the content of this article is for information sharing only and does not promote or endorse any operating or investment activities. Readers are strictly advised to comply with local laws and regulations and not participate in any illegal financial activities.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!