Author | TaxDAO

1 Introduction

In recent years, the development of the cryptocurrency market has been rapid, becoming the object of pursuit for young investors in the West. However, the bankruptcies of cryptocurrency exchanges such as FTX have raised concerns among financial regulatory agencies in various countries. The European Parliament has approved the first cryptocurrency regulation, the Markets in Crypto-Assets Regulation (MiCA), which may come into effect in January 2025. However, the stablecoin-related rules may take effect in mid-2024, after a transition period of 12 months. MiCA has become the first major jurisdiction to introduce comprehensive cryptocurrency regulations in the world. This article will analyze the background, main content, and comparison with other international regulatory frameworks (FSM Bill, CARF, CRS) of this regulation.

2 Background of MiCA Implementation

The introduction of MiCA aims to provide a legal framework for cryptocurrencies that are not covered by existing financial services legislation in the European Union. It seeks to establish a robust and transparent legal framework to support innovation, promote the development of cryptocurrencies, and facilitate the wider use of Distributed Ledger Technology (DLT). It also aims to ensure appropriate consumer and investor protection, as well as market integrity. Considering that some cryptocurrencies may gain wide acceptance, it will further enhance financial stability.

During the implementation process of MiCA, there are also challenges and risks. Due to the continuous development of the cryptocurrency market and the emergence of new technologies, it may be difficult to ensure that the regulations remain consistent with market practices. Implementation of MiCA may exacerbate market monopolies or oligopolies, as only a few large companies in the market may have the ability to meet regulatory requirements. If the regulatory standards of MiCA differ from those of other countries or regions, the European cryptocurrency market may face international competitive pressure, and companies may prefer to transfer their assets to areas or countries with lower compliance costs and regulatory requirements. The implementation of the regulation poses higher requirements for active cooperation and effective execution among the competent authorities of EU member states. If there are differences in the implementation of MiCA among countries, it may affect the consistency and effectiveness of regulation.

- Grayscale interprets the July cryptocurrency market the proportion of altcoin market capitalization increases, and the future trend of the overall market depends on the US economy.

- ETH’s skyrocketing 800 times, BRC-20 founder’s praise, is the summer of inscriptions coming?

- Evening Recommended Readings | LTC Falls Instead of Rises, Will BTC Halving Bring a Bull Market?

3 Content of the MiCA Regulation

MiCA mainly covers three types of cryptocurrencies:

Asset-Referenced Tokens (ART): Cryptocurrencies that stabilize their own value by referencing the value of other fiat currencies, commodities, or a combination of cryptocurrencies, such as Digix (DGX), which is backed by an equivalent gold reserve.

Electronic Money Tokens (EMT): Tokens that stabilize their own value by referencing the value of other fiat currencies. The difference between Electronic Money Tokens and Asset-Referenced Tokens lies in the underlying asset allocation supporting the price. ART uses non-cash assets or a basket of currencies, while EMT uses only a single currency, making it closer to the concept of electronic money, such as Alipay or WeChat Pay.

Other Cryptographic Assets: Other cryptographic assets that are not asset-referenced tokens or electronic currency tokens, such as utility tokens, aim to provide digital access rights to goods or services, enabling them to be used on distributed ledger technology (DLT).

MiCA does not cover other regulated cryptographic assets, such as DeFi, NFTs, and security tokens that meet the criteria of other regulated instruments. In addition, MiCA does not cover central bank digital currencies (CBDCs) or digital currencies issued by other international public organizations, such as the International Monetary Fund.

In addition to defining the scope of application, MiCA also specifically regulates abusive practices in the cryptographic market to prevent market manipulation and fraudulent activities, protect investor interests, and ensure the stability and transparency of the cryptographic asset market. MiCA explicitly prohibits any form of market manipulation, including but not limited to:

- Disseminating false or misleading information, including false advertising, misleading statements, or other fraudulent behavior, to influence the price of cryptographic assets or guide other market participants to make incorrect investment decisions

- Trading using undisclosed insider information to gain unfair trading advantages

- Manipulating the supply and demand of cryptographic assets by fabricating trading volumes or other means to manipulate prices

- Exploiting market inadequacies or other vulnerabilities to gain undue advantages

According to the provisions of MiCA, token issuers need to obtain authorization to provide services in the European Union. To obtain authorization, an application must be submitted to the national competent authority of the country of establishment, which should include detailed information related to their business and services, including but not limited to business models, technical implementations, white papers, investor information, etc. Token issuers may have certain requirements for qualifications, such as financial requirements and organizational operations, to meet relevant requirements in terms of finance, risk management, compliance, corporate governance, etc., to ensure that token issuers can comply with relevant regulations, have sufficient financial strength to fulfill their commitments, and protect the rights and interests of investors. Subsequently, the application will go through an examination process, and the national competent authority may review the application materials, consult the European Securities and Markets Authority (ESMA) for opinions, conduct interviews and investigations with the applicant to ensure compliance with MiCA regulations. If an electronic currency token issuer fails to meet the requirements of MiCA or violates the regulations during operation, the national competent authority has the right to revoke its authorization and prohibit it from providing services within the European Union.

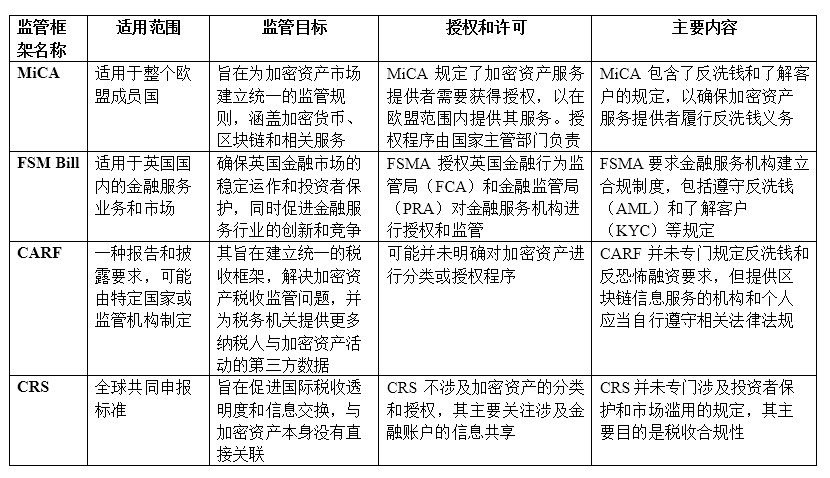

4 MiCA and other international tax regulatory frameworks

Below is a comparative analysis of MiCA and the UK Financial Services and Markets Bill (FSM Bill 2022) for the 2022-23 financial year. Both MiCA and FSMB involve relevant content regarding the management of cryptographic assets. In particular, against the backdrop of the UK’s withdrawal from the EU, the differences between the UK and the EU MiCA in terms of cryptographic asset management have attracted the attention of consumers and investors.

Both the FSM Bill 2022 and MiCA define digital representations of value or rights, but the difference lies in the fact that the definition of crypto assets in the FSM Bill 2022 is more extensive. Regardless of whether they are encrypted, any assets that can be used for payment, transferred, stored, or traded electronically, and can be recorded or stored using technologies such as distributed ledger, are covered within the scope of crypto assets. Therefore, the FSM Bill 2022 may also apply to other digital or crypto assets that meet the above conditions, apart from stablecoins. On the other hand, MiCA emphasizes the use of distributed ledger technology or similar technologies, and categorizes crypto assets specifically, establishing corresponding regulatory rules and requirements for different types of crypto assets.

Both MiCA and the FSM Bill propose regulating the issuance of crypto assets when they are traded or publicly offered on regulated trading venues. MiCA mainly requires the provision of disclosure documents in the form of a ‘white paper’. The UK indicates that it may adopt a similar approach, but further evaluation is still needed, and it may consider imposing ongoing requirements on issuers, as the UK believes that traditional securities disclosure regulations may not be well applicable to crypto assets.

MiCA and the FSM Bill have different regulatory requirements for overseas issuers and service providers. MiCA requires issuers to establish a legal entity in the EU; crypto asset service providers must also have ‘substantial presence’ in the EU; at least one director must reside in the EU and have a registered office in an authorized member state. On the other hand, the FSM Bill explicitly states that the UK intends to regulate activities provided ‘in’ or ‘to’ the territory of the UK. It is not clear whether it is necessary to establish a physical presence in the UK.

Table 1: Comparison of Major Crypto Asset Regulatory Frameworks

Conclusion

There is no doubt that the Crypto Asset Market Regulation Bill will help improve the transparency and credibility of the crypto market, and to a great extent protect the rights and interests of consumers and investors. However, the implementation of the bill will also face many unknown new issues, leading to short-term market fluctuations. In summary, the implementation of this bill will be groundbreaking and may have far-reaching effects on the cryptocurrency market, which deserves continuous attention from all parties.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!