Original author: Zach LianGuaindl Original translation: Luffy, Foresight News

-

Since the end of 2022, there have been clear signs of recovery in the digital asset market, and the cryptocurrency industry is benefiting from technological and legislative advances.

-

Macroeconomic factors may be the biggest risk for the current cryptocurrency market. Recent economic data has shown low inflation and stable growth, which greatly reduces the possibility of an economic recession. Market expectations of a “soft landing” have driven the previous underperforming risk assets such as crude oil and regional bank stocks.

-

If the US economy can achieve a soft landing, the rebound in the cryptocurrency market can continue. However, if the economy falters or the Federal Reserve further raises interest rates, the cryptocurrency recovery may pause in the short term.

- EU’s MiCA Interpreting the Cryptocurrency Market Regulation Act Implementation Background, Main Contents, and Comparative Analysis

- Grayscale interprets the July cryptocurrency market the proportion of altcoin market capitalization increases, and the future trend of the overall market depends on the US economy.

- ETH’s skyrocketing 800 times, BRC-20 founder’s praise, is the summer of inscriptions coming?

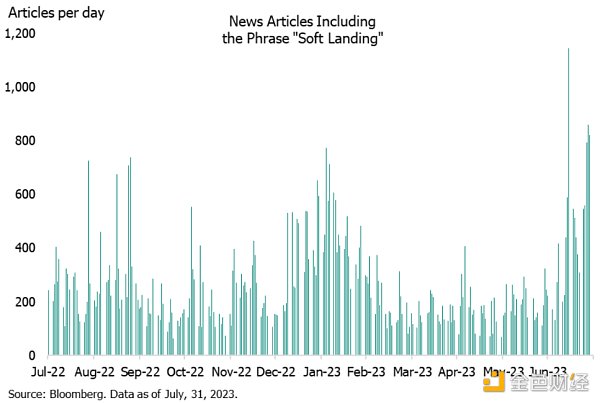

Although Bitcoin experienced a brief consolidation in July, the rise of other risk assets has further expanded due to expectations of a “soft landing” in the US economy: that is, gradually bringing inflation back to target levels without a recession (Chart 1). We believe that the cryptocurrency market may benefit due to the correlation between mainstream tokens and risk assets, as well as various favorable factors in the industry. However, a soft landing is not a certainty, and it is increasingly becoming a consensus, so the market has already partially priced in the benefits of a soft landing.

In addition to regulatory progress, the near-term prospects of cryptocurrencies may largely depend on the sustainability of expectations for a soft landing. If the upcoming economic data continues to support the argument for a soft landing, the rebound of mainstream tokens may continue. However, if the economy falters or the Federal Reserve further raises interest rates, the cryptocurrency recovery may pause in the short term. Until the outcome is determined, the cryptocurrency market may experience significant fluctuations in altcoins, as seen in the past month.

Chart 1: Recent optimism about a soft landing

Last month’s data and signals from the Federal Reserve supported the view that the economy could achieve a re-balancing without entering a recession. Inflation further slowed down, especially for “core” indicators (excluding volatile food and energy prices). Despite low unemployment, strong job growth, and a decrease in the number of people claiming unemployment benefits, there were signs of a slowdown in economic recovery. During the FOMC meeting (Federal Open Market Committee meeting) on July 25-26, Powell stated in the press conference that the Federal Reserve staff predicted that the economy would not suffer another recession.

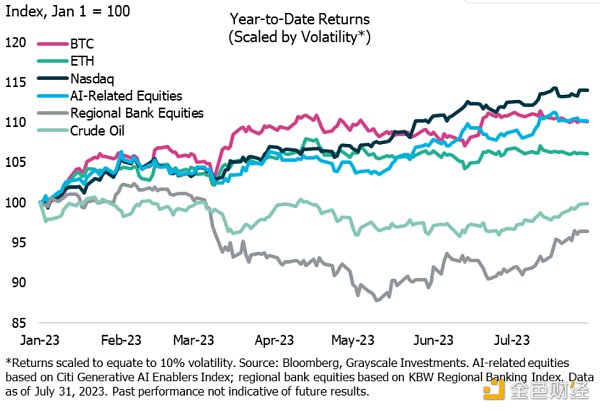

In the financial market, the prospect of a soft landing has given rise to new performing stock portfolios. In the year leading up to June 1 of this year, the performance of Bitcoin, the Nasdaq Composite Index, and AI-related assets outperformed the broader market, benefiting from the launch of AI tools including ChatGPT (public blockchain technology may provide solutions to some challenges in AI). However, during July, the leadership position shifted to previous underperformers, including US regional bank stocks and crude oil (Chart 2). It is worth noting that many of the top-performing stocks in the US stock market are heavily shorted, indicating that many active investors are not buying into the idea of a soft landing.

Chart 2: Assets that lagged behind at the beginning of the year performed better in July.

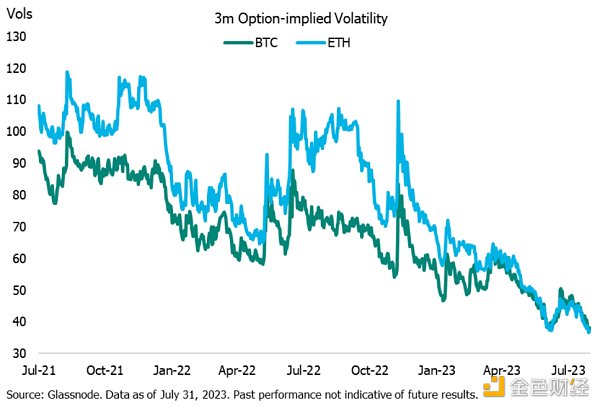

Bitcoin and Ethereum fluctuated within a small range and fell slightly compared to the previous period, as the dominant forces in the market have shifted away from technology-related themes to other areas. Compared to earlier this year, there are fewer driving factors for Bitcoin, such as concerns about regional banks (March 2023) and optimism about the approval of spot ETFs (June 2023). The actual volatility and implied volatility of cryptocurrencies have both dropped to historic lows (Chart 3). At the same time, their correlation with the S&P 500 Index has rebounded after experiencing a decline in the first half of the year. Bitcoin’s on-chain transaction fees decreased again in July, and after a surge in interest around ordinals in May, they steadily declined. In contrast, Ethereum transaction fees increased in July, and Gas prices and Maximum Extractable Value (MEV) rewards spiked on July 30 after the attack on the Curve protocol.

Chart 3: BTC and ETH volatility decreases.

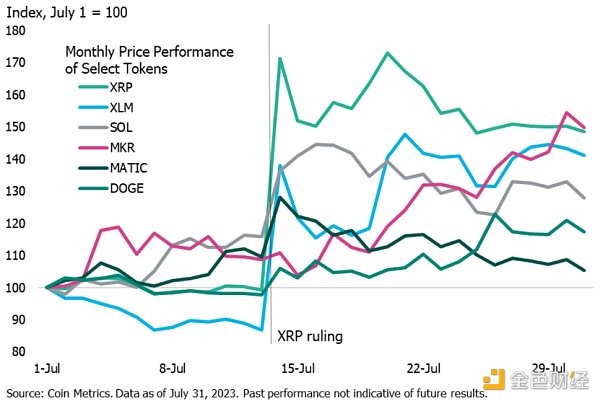

Throughout July, “altcoins dominance” increased, and their volatility was higher than that of Bitcoin and Ethereum. We believe the main catalyst was the U.S. District Court’s ruling on July 13 in the SEC v. Ripple Labs case. In the case, the judge ruled that certain sales to institutional investors met securities transaction standards and should be registered with the SEC, while certain sales to the public did not. It is worth noting that the court stated that Ripple’s native token XRP “is not an investment contract in and of itself.” XRP’s price rose in response, roughly doubling, although it declined at the end of the month, it still increased by 48% compared to June. The clarification of XRP’s legal status has driven the prices of other tokens, including XLM, SOL, OP, and MATIC. In addition to the Ripple ruling, the bipartisan group of legislators continues to make progress on bills related to cryptocurrency market structure and stablecoins.

The performance of other digital assets is closely related to changes in the underlying fundamentals of the protocols, highlighting how incremental technological progress is driving the crypto industry forward. For example, after the proposal was made at the end of June, the governance token MKR of MakerDAO rose by 50% in a month. In addition, since last quarter, rising interest rates have increased the profitability of the protocol by about 4 times, and this trend may continue due to Blocktower’s Andromeda treasury (a real-world asset lending tool). Similarly, the prices of UNI and LINK tokens have also risen with technological advancements – UniswapX protocol and Chainlink’s new cross-chain interoperability protocol, respectively. Dogecoin also rose in late July, possibly driven by Elon Musk changing his Twitter name to “X”. Finally, Worldcoin (WLD) was listed on cryptocurrency exchanges at the end of this month, with a fully diluted market cap exceeding $20 billion.

Chart 4: XRP court rulings and fundamental improvements driving some token price increases

Since the end of 2022, the recovery of cryptocurrencies has achieved significant results, and we have reasons to be optimistic about recent technological advancements as well as legal and legislative progress. Therefore, we believe that the macro outlook is now the biggest risk facing the cryptocurrency market. An economic soft landing may benefit risk assets, including cryptocurrencies, as it may prompt the Federal Reserve to lower real interest rates. Considering Bitcoin’s role as an alternative non-sovereign currency system and a substitute for gold in combating inflation, Bitcoin may also appreciate if the Federal Reserve decides to tolerate persistently higher-than-target inflation in the long term. However, if central banks decide to further increase real interest rates or if the economy falls into recession, the cryptocurrency recovery may temporarily pause in the short term.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!