Author: Aleks Gilbert, DL News

Translation: Felix, LianGuaiNews

Liquidity staking is the largest sub-track of Ethereum, with the highest proportion, and the share of collateral used in DeFi protocols on other blockchains is growing rapidly.

In the Solana ecosystem, developers and investors also hope for the same.

- Fair Value Comes New Cryptocurrency Accounting Standards in the United States Will Take Effect by the End of the Year.

- Unveiling the Unknown Types of MEV in Ethereum Transaction Bundles

- Sui Lutris Report Digest Core Distributed System Protocol of the Sui Public Chain

Ethereum, Solana, and other blockchains that rely on proof-of-stake technology allow users to lock (or stake) their tokens to earn certain returns.

These tokens are necessary for the complex but critical transaction ordering and validation work on blockchains that use proof-of-stake technology.

Although staked tokens are actually locked, liquidity staking protocols issue redeemable derivative tokens at a 1:1 ratio, allowing users to leverage the staking yields of the blockchain (5% for Ethereum, 7% for Solana) while using them in other DeFi protocols to earn additional profits. This is called “Liquidity Staking Derivatives” (LSD), but the term has not been actively mentioned by the project party thereafter, possibly due to concerns about regulatory scrutiny.

Over 70% of SOL tokens on Solana are delegated to individuals, companies, and protocols, which use them to order and validate transactions. However, less than 3% of them are delegated to liquidity staking tokens (LST) projects.

Ben Chow, the founder of Solana protocols Meteora and Jupiter, said that out of over $9 billion worth of staked SOL, only 3% is LST. “We have done a lot of work to increase the adoption of LST and unlock this funding, which will greatly increase TVL and trading volume.”

Lucas Bruder, CEO of Jito Labs, agrees with this. “This is a huge opportunity to unlock the remaining 97% of staking on the network. I don’t think any LST protocol has figured out the right marketing and narrative yet, and we are excited to try and find the answer.”

If this situation changes, it could greatly change the DeFi ecosystem on Solana. But it’s easier said than done.

Low risk

According to data compiled by Hildobby, an anonymous data analyst at venture capital firm Dragonfly, approximately one year ago, Ethereum shifted to proof-of-stake technology (PoS), and only one-fifth of ETH (approximately 26 million) was staked.

Compared to other blockchains that have been using proof-of-stake technology from the beginning (such as Solana), this is negligible.

But the difference lies in liquidity.

On Ethereum, one-third of tokens are delegated to the liquidity staking protocol Lido. According to data from research firm Rated’s Elias Simos, nearly 40% of ETH has been deposited into many liquidity staking protocols on Ethereum.

Meanwhile, according to Solana ComLianGuaiss data, less than 3% of SOL has been deposited into Solana’s liquidity staking protocols.

According to data from the Spire data platform, among the “stakeholders” on Solana, 1,651 people have staked at least 5,000 SOL, of which only 152 hold liquidity staking tokens.

In May, Solana co-founder Anatoly Yakovenko vented his frustration on Twitter (now called X). “SOL has a very small share in liquidity staking and DeFi,” he wrote. “We need industry-wide efforts to change that.”

“Additional Risks”

Alex Cerba, core contributor to the liquidity staking protocol Marinade, said that a survey of SOL stakers revealed two reasons for relatively low usage.

Marinade is the largest liquidity staking protocol in the Solana ecosystem and issues liquidity staking tokens called mSOL.

Measured by the total value of cryptocurrency deposits, Marinade is the largest liquidity staking protocol on Solana

The first is the potential tax issue of staking. When users deposit SOL and receive liquidity staking tokens, is this a taxable event? When do they have to pay taxes on the earnings from staking tokens?

Secondly, Solana’s design is meant to make staking simple, efficient, and risk-free. But stakers are not always convinced that the additional returns from Solana DeFi are worth the effort and risk, as it requires entrusting millions of dollars to third-party protocols, which carries a certain level of risk.

Cerba said in the survey: “I don’t get the same returns in DeFi because to get a 9% annualized return, I have to take additional risks in mSOL. Whereas I can get a 7% annualized return just by staking, and without any smart contract risk.”

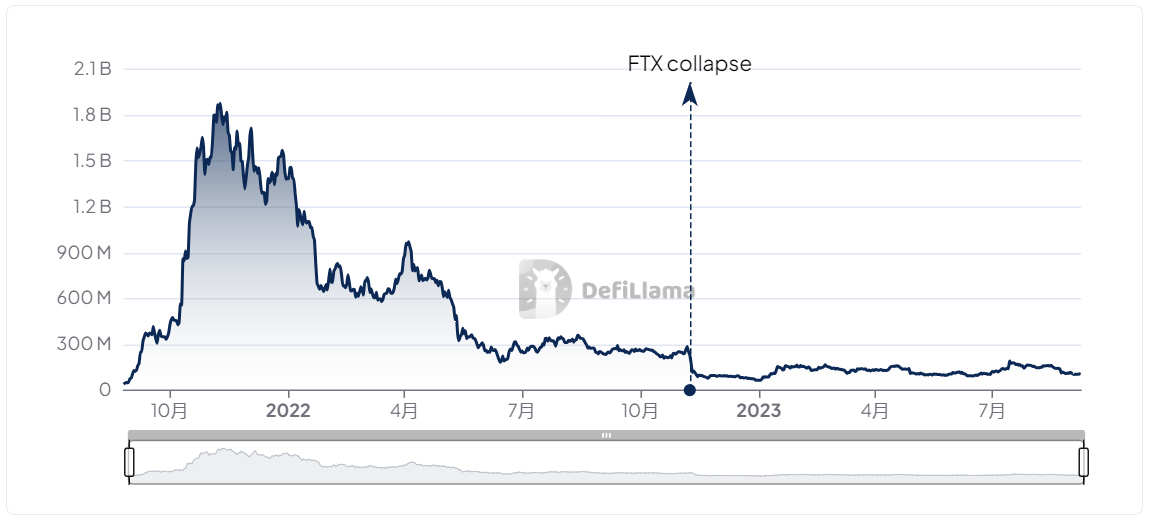

Kel Eleje, research analyst at Messari, agrees with this. Eleje said that validators representing user interests are usually free. Additionally, users can withdraw their stake within two days, while those holding ETH need two weeks. “This essentially feels like lower-risk liquidity staking,” Eleje said. In response to this, Marinade recently launched its own version of Solana’s built-in staking service called Marinade Native. We hope that people who have already staked SOL can use it and eventually transition to liquidity staking with Marinade. According to data from DefiLlama, the number of new liquidity staking protocols Jito and BlazeStake has surged this summer.

Liquidity staking protocol Jito has experienced rapid growth this summer

Eleje attributes this growth to airdrop speculation and the popularity of its liquidity staking token on MarginFi, a lending protocol that is also gaining popularity.

However, Bruder said that users may be attracted by the innovation. “When you observe the usage of jitoSOL in DeFi, you will find that the usage rate is much higher than other LSTs.”

Ethereum is “a bit ahead”

The liquidity staking protocol BlazeStake has grown rapidly this summer

If the additional 4% of staked SOL is staked through protocols such as Marinade or Jito, the total value of cryptocurrencies in Solana DeFi will double. But Cerda is uncertain if Solana is ready. “Some people see this as a bit naive because they only see the influx of funds into DeFi as an opportunity. In addition, there are relatively few places to deposit a large amount of DeFi funds on Solana.” Solana DeFi needs to grow in order to handle a large amount of token flow, which creates a chicken-and-egg problem. You still need the operation of DeFi protocols and more use cases and a larger scale to basically absorb all the capital. These are all areas where Ethereum is ahead.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!