Source: Coindesk

Translation: LianGuaiBitpushNews Mary Liu

In the crypto industry, some rollup operators have been criticized for using “centralized sequencers” to bundle and pass on transactions to Ethereum, but the real risks may lie elsewhere.

Low-cost and fast rollup networks like Arbitrum, Optimism, and Coinbase’s Base are quickly becoming attractive alternatives for transactions on the Ethereum network. Transactions are completed on these “L2” networks and then recorded on Ethereum for subsequent transactions.

- To attract more developers, Polygon has launched the CDK.

- Looking ahead to the Lightning Network in 2025 New prospects for enhancing privacy and convenience

- LianGuai Daily | 204 people worldwide have more than 100 million in cryptocurrency assets, with 22 people having over 1 billion US dollars; Story Protocol completes $25 million Series A financing.

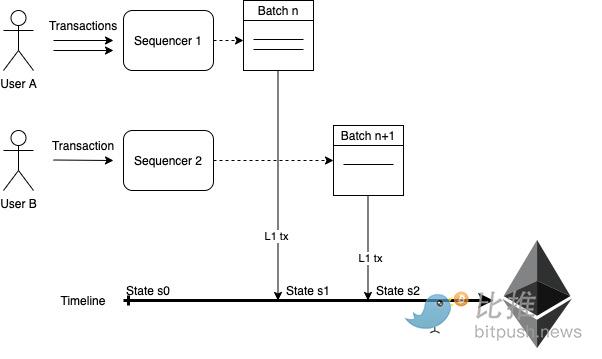

Recently, there has been a lot of discussion about how these Layer 2 networks rely on the critical infrastructure of “sequencers,” which are responsible for bundling user transactions and guiding them to Ethereum.

Sandy Peng, co-founder of Scroll rollup, explained in an interview this week that sequencers are like “air traffic controllers for the specific L2 ecosystem they serve.” “So when A and B try to transact at the same time, who goes first? That’s determined by the sequencer.”

When users transact on L2 rollup networks, sequencers are responsible for verifying, ordering, and compressing these transactions into packages that can be sent to the first layer chain (such as Ethereum). In return, sequencers take a small portion of the fees collected from users.

The criticism of this setup is that current rollup sequencers are often operated by “centralized” entities, which can represent single points of failure, potential transaction censorship issues, or become bottlenecks if the entities choose to shut them down entirely.

For example, Coinbase operates sequencers for its new Base blockchain, which, according to analysis firm FundStrat, could generate approximately $30 million in net revenue per year for this role.

It’s not just Base. Today’s leading rollups rely on “centralized” sequencers, which means a single party (usually the company building the rollup) is responsible for sorting them.

The option of a “decentralized” system is brewing, but Ethereum’s largest L2 has not yet embraced it – or simply hasn’t taken the time to embrace it.

In the blockchain world, trust should be minimized, and the idea of a single company controlling key elements of chain operation can often raise concerns.

However, after speaking with experts, it becomes apparent that the greater risks to L2 decentralization and security lie elsewhere.

What are sequencers?

The operation of Coinbase’s new Base network is similar to other rollup networks: it promises fast and cheap transactions to users and ultimately “settles” on the Ethereum main chain.

In addition to convenience, the main selling point of rollups like Base is that they run directly on top of the Ethereum main network – which means they are designed to leverage its main security apparatus.

When users submit transactions on Base, sequencer nodes intervene in a timely manner and compress them with transactions from other users into a “batch”. The sequencer then hands off these transactions to Ethereum, where they are formally recorded in its ledger.

Similar to other large-scale Rollups, Coinbase is currently the only sequencer on Base, which means the company is fully responsible for transaction sequencing and batch processing for Base users.

During a quarterly earnings call with Wall Street analysts last month, CEO Brian Armstrong acknowledged the role this setup plays in Base’s business model: “Base will earn revenue through sequencer fees, and we can earn sequencer fees for any transaction executed on Base. Essentially, over time, Coinbase can operate as one of the sequencers, like other sequencers.”

Decentralized L2 sequencing technology exists: roles are distributed among multiple parties.

Coinbase has indicated that it plans to adopt this technology in the future, as have other Rollup platforms. However, so far, decentralized sequencers have proven difficult to deploy on a large scale without slowing down or triggering security risks.

The lucrative income generated by running sequencers seems to inhibit decentralization. This also applies to the potential Maximum Extractable Value (MEV) opportunities brought by centralized sequencing, which can extract additional profits from users by strategically arranging transaction execution.

At the same time, the current centralized sequencer setup carries risks for users.

Binance pointed out these issues in a recent research report: “Since the sequencer controls the order of transactions, it has the power to review user transactions (although full review is unlikely as users can submit transactions directly to L1). The sequencer can also extract Maximum Extractable Value (MEV), which may cause economic harm to the user group. In addition, flexibility may be a major issue, meaning that if the only centralized sequencer fails, the entire Rollup will be affected.”

In the foreseeable future, the sequencer system may remain centralized, meaning these risks may persist for a while. However, when it comes to L2 security issues, the sequencer issue is misleading.

There are even greater risks

The most concerning issue for blockchain users is whether their transactions are processed as expected and whether their wallets are secure from unauthorized transactions that may result in loss of funds.

If centralized sequencers engage in malicious behavior, theoretically they can slow down or reorder transactions to extract MEV, but they generally do not have the ability to fully review, enhance, or deceive new transactions.

Peng said, “When it comes to making L2 a great L2, decentralized sequencers are low on our priority list.”

It is worth noting that the popular Optimism rollup (which Coinbase uses as a template to build its own Base chain) currently lacks fraud proofs, which are algorithms on the L1 chain that can “prove” that L2 transactions have been accurately recorded.

Avail Blockchain founder Anurag Arjun, who focuses on data availability, said: “In addition to decentralized sequencers, an important part is the actual implementation of fraud proofs or validity proofs and having an escape hatch mechanism.”

Fraud proofs are the main means by which Rollup networks such as Optimism and Base “borrow” Ethereum security, allowing validators on the Ethereum main chain to check if the L2 network is working as advertised.

“The whole point of Rollup is to build this mechanism so that Rollup itself does not have to introduce cryptographic economic security,” Arjun said. “From a broader perspective, this is the meaning of inheriting the underlying layer.”

Arjun said that without fraud proofs, Optimism, Base, and other Rollup networks with similar missing features essentially require users to trust their own security practices rather than Ethereum’s security practices.

Optimism and Base also lack an “escape hatch” mechanism for users to withdraw funds back to Ethereum when the sequencer fails.

Arjun explained, “If there is an escape hatch mechanism” and the sequencer fails or goes offline, “you can actually bridge your assets and safely exit.” Without an escape hatch, Rollup users may lose their funds if there are issues.

Three stages of Rollup development

Ethereum co-founder Vitalik Buterin proposed a set of stages numbered from 0 to 2 to categorize the decentralization of different Rollup networks. The phased criteria aim to recognize that new Rollup networks often rely on “training wheels” to safely test and deploy to the public before final decentralization.

According to Buterin’s model, the L2 network data aggregation platform L2Beat tracks the stacking situation of different platforms. According to L2Beat, currently every leading Rollup network relies on some kind of “training wheels”.

Before obtaining effective fraud proofs, Optimism and Base will be considered as “Phase 0” in Buterin’s classification scheme. As the most direct competitor to Optimism and Base, Arbitrum scores higher because it has fraud proofs despite having a centralized sequencer.

Arbitrum also has disadvantages that hinder it from entering the “Phase 2” state — currently, it is still widely regarded as a “Phase 1” Rollup.

The training wheels in the L2Beat document extend from the lack of fraud proofs (or validity proofs in the case of ZK Rollup) to centralized upgrade control.

Through L2Beat’s data, we may discover that centralized sequencers are far from the biggest problem that L2 platforms face in fulfilling their promise of “borrowing” Ethereum security.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!