Author: Chloe, LianGuaiNews

The Ethereum community has expressed concerns and criticism about Lido’s expanding influence in the liquid staking market. The main reason is that community members are worried that Lido’s users in the future may manipulate the entire on-chain mechanism. In order to address these risks, several staking service providers had previously signed a restrictive proposal.

The proposal is mainly aimed at ensuring the decentralized nature of Ethereum and regulating these staking service providers to commit not to occupy more than 22% of the Ethereum staking market share.

However, Lido is not concerned about this, so what will happen in a situation where neither side can “withdraw”?

- Interpreting Vitalik’s latest paper Privacy Pools make compliance no longer come at the expense of privacy and decentralization.

- Vitalik’s latest paper condenses How does Privacy Pools solve the impossible trilemma of privacy, decentralization, and compliance?

- External turmoil has not yet subsided, and internal turmoil is gradually emerging Genesis sues its parent company DCG.

Decentralized community demands Lido to control market share

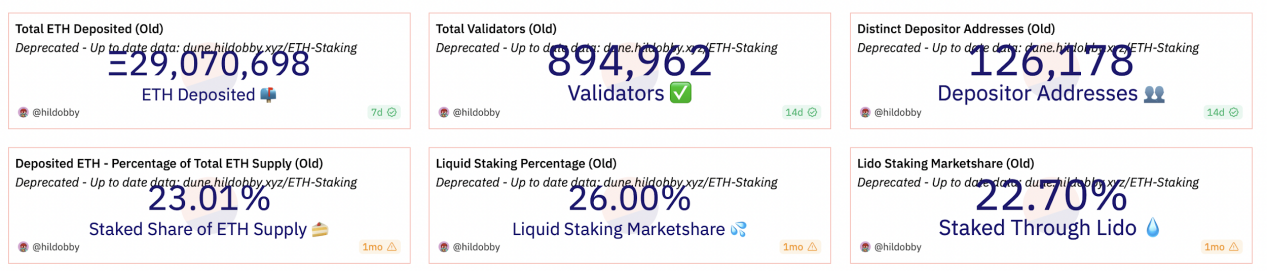

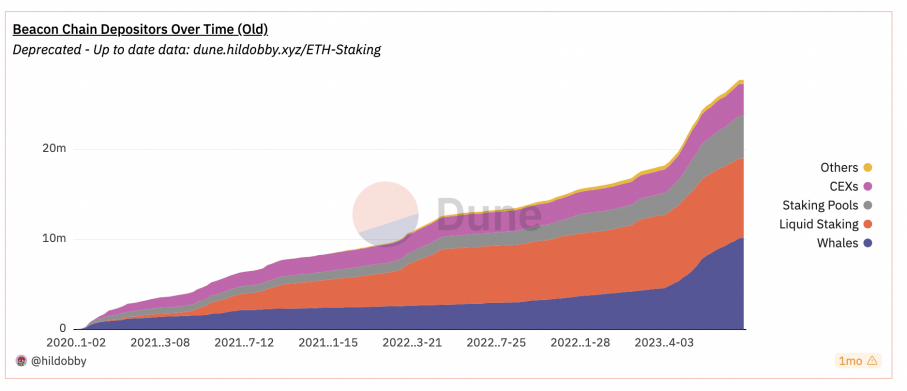

First, let’s analyze Lido’s current market share. As of September 5th, the total Ethereum staked is about 29.07 million coins, with about 890,000 validators, and the Ethereum staking rate is 23.01%.

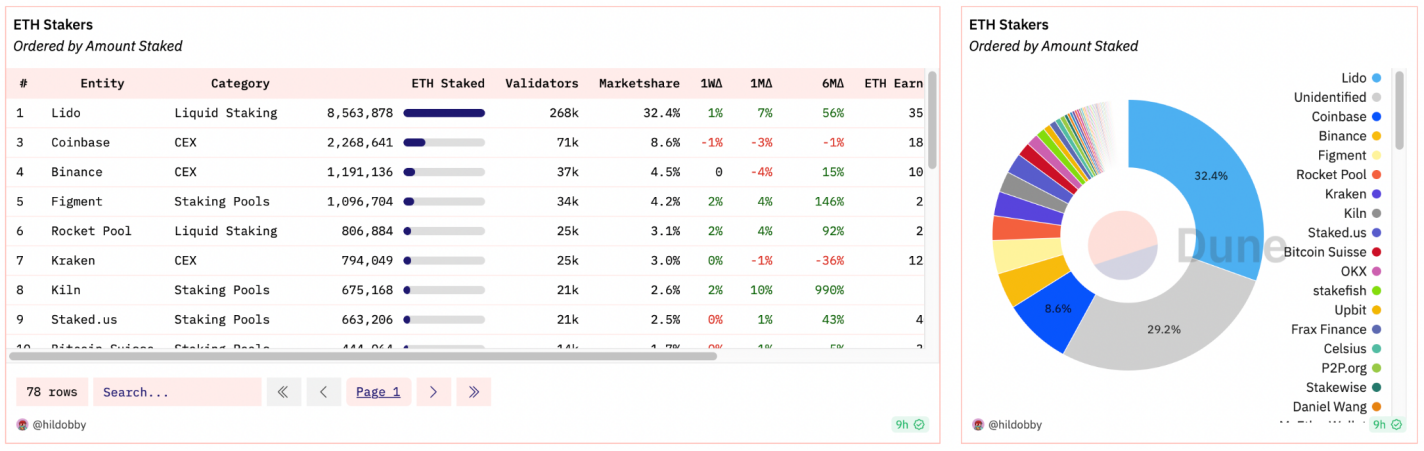

The staking amount is relatively small in mining pools and CEX, and the amount of liquid staking (orange) has surpassed other staking types. By breaking down the sources of liquid staking (see the figure below), it can be found that Lido has the highest share, even four times that of Coinbase.

Currently, Lido’s TVL (Total Value Locked) is still at a high point, occupying about one-third of Ethereum’s staking amount. This whale-like volume has recently caused conflicts among Ethereum community members, who believe that Lido is a “ticking time bomb” towards centralization. Ethereum’s Chief Decentralization Officer, Evan Van Ness, tweeted last week, “Lido may be the biggest threat to Ethereum’s decentralization in its history.”

Ryan Berckman, a member of the Ethereum community and investor, criticized that Lido’s existence threatens Ethereum’s reputation as a decentralized chain through “unrestricted dominance” and may sacrifice ETH’s long-term valuation in the future. According to CoinGecko, Lido currently has a market capitalization of about $13.5 billion, with sETH’s market capitalization at about $14 billion.

The aforementioned restrictive proposal was designed as a countermeasure based on Lido’s dominant position in the Ethereum liquid staking market. Because none of these projects that signed the “Ethereum staking market share should not exceed 22%” exceed 22%, it is just a strategy for some small players to counter whales. Naturally, Lido will not sign it. (Note: 22% is because Ethereum needs to achieve 66% consensus for finality.)

However, Ethereum founder Vitalik Buterin had previously proposed that all staking projects should set their own staking limits, with the suggested threshold set at 15%. At that time, Lido did not accept Vitalik’s proposal and even believed that they were unlikely to monopolize the market, and their share should not easily exceed the range of 30-35%.

Prior to this wave of criticism, in June, Lido had a governance proposal to vote on self-imposed market share restrictions. The result clearly showed that 99.81% of participants voted against the proposal, with only 0.19% voting in favor.

In response to the concerns and criticisms emerging in the market, Sacha, a contributor to the Lido ecosystem, made a statement refuting Ryan Berckmans’ views. Sacha stated that he and other Lido contributors understand that even if Lido dominates market share, they recognize the need to take measures such as introducing dual-currency governance, expanding the collection of node operators, and opening up permissionless validators to enhance the ability to withstand tail risks.

Regarding the concern about the “reputation of Ethereum as a decentralized chain,” Sacha responded to these criticisms by stating that while Lido may be perceived as a single entity in the market, it is actually just a coordination layer between multiple participants, and the governance power of LDO has been greatly weakened and restricted by stETH holders.

Lido’s target, are other projects acting in their own interests or for the reputation of decentralized Ethereum?

However, the main reason for the research community’s strong reaction to Lido is that Ethereum is built on the basis of “maximizing credibility and neutrality,” and Lido’s monopolistic share directly affects the credibility and neutrality of Ethereum. It seems that Lido has repeatedly chosen to ignore this point and refused to take the most direct approach (setting share limits) to restore Ethereum’s neutrality, leading to a growing lack of trust in the Lido community.

However, whether the community’s various criticisms of Lido’s dominant position are a targeted action to collectively exclude giants or truly for the reputation of the Ethereum community?

First, I believe it is reasonable to suggest that Lido should make some sacrifices for Ethereum and voluntarily limit its dominant position to below 22%. But the premise is that these liquid staking service providers must also be of the same scale as Lido, or even face the same difficulties, in order to be considered the same event. Otherwise, it seems like a pure attempt to bring Lido down.

Furthermore, the limitation of market dominance to below 22% “lacks detailed consideration”. Solving the dominance issue requires designing mechanisms from the perspective of the core protocol. In other words, if the staking limit is restricted to 22% or below, it would theoretically make it more difficult for subsequent network takeovers, as it cannot be guaranteed that there won’t be three or more projects colluding to exceed Ethereum’s 66% staking.

Finally, although Ethereum did not intend to conduct on-chain governance at the beginning of its design, the reality is that Lido has essentially become the packaging of Ethereum’s governance. If the Ethereum community decides to incorporate this into the protocol or directly fork Lido in the future due to Lido’s strong position, it will cause significant damage to the property rights of Ethereum developers and users.

Lido is not taking no action on this. As Sacha mentioned, the platform is implementing a staking router to assist “diverse” stakers. Lido will also implement “dual governance” to give staked ETH holders decision-making power in Lido’s governance.

Perhaps we should pay less attention to the amount of ETH staked by these operators and instead focus on the underlying design. Improving decentralization from the bottom-up is the essential requirement for long-term development.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!