Original article author: unex, Amir Ormu, and Atomist Original article translation: Luffy

A few months ago, Arbitrum airdropped over $125 million worth of ARB tokens to protocol DAOs within its ecosystem. The Arbitrum airdrop was one of the most talked-about airdrop events this year, and we wanted to know: what did these protocols that received the airdrop actually do with the millions of dollars?

Governance Token Allocation

On April 24th, the Arbitrum Foundation began distributing 1.128 billion ARB tokens to eligible protocols within its ecosystem.

A total of 137 protocols received the token airdrop. To avoid token distribution centralization, the Arbitrum Foundation worked with Nansen to formulate an airdrop strategy that would diversify the projects that had different KPIs and use cases.

- Deep Dive into the Staking Track: Working Principles, Pros and Cons, and Potential Projects

- Buying $1.2 billion of US bonds – what is MakerDAO’s intention in introducing RWA real assets?

- OPNX: From Quiet to Booming Transactions, Su Zhu Embarks on a “Fast Life”?

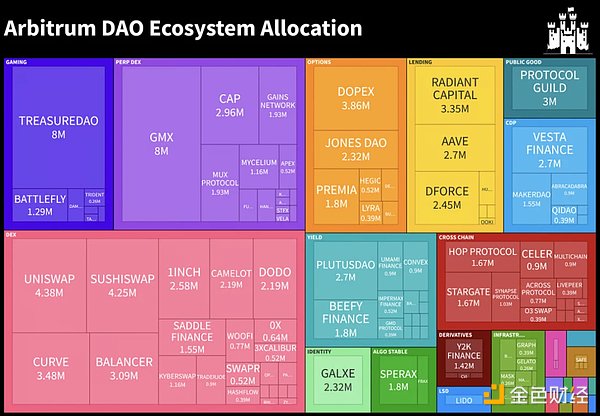

The Arbitrum DAO airdrop map divided by size and category

These protocols have complete autonomy to decide how to use the received airdropped tokens. They can use the funds to directly or retroactively reward users, use the funds to bribe votes, or use them as operating funds.

In a blog post discussing this particular airdrop program, the Arbitrum team clarified that the fundamental goal of token distribution was “localization of community governance”. Directly allocating tokens to the treasuries of Arbitrum protocols was meant to enable them to take on governance responsibilities and participate in decision-making processes within the ecosystem.

This approach allows the protocols to utilize this airdrop to support their operations and push their platform or product forward, ensuring that the protocol and the underlying Arbitrum ecosystem have a brighter future.

In the months following the release of the ARB token, some may have overlooked L2, thinking that there are not many opportunities left. But we believe that even in this crypto winter, the L2 ecosystem is full of catalysts, including:

-

EIP-4844

-

The release of Stylus

-

Sorters gradually decentralizing

-

Fee Switch

The details of these catalysts are beyond the scope of this article, and we will not go into detail here.

On-Chain Investigation Findings and Dune Dashboard

In this report, we focus on on-chain research findings surrounding the Arbitrum airdrop project. Our goal is to provide insight to market participants on capital flow and the integrity of funding decisions for each DAO.

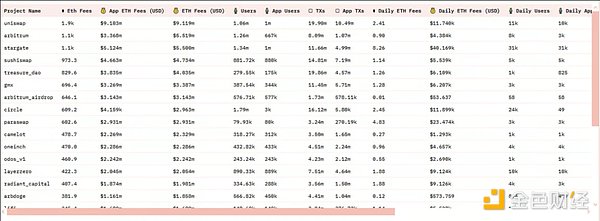

Protocols and their metrics as of June 23, 2023

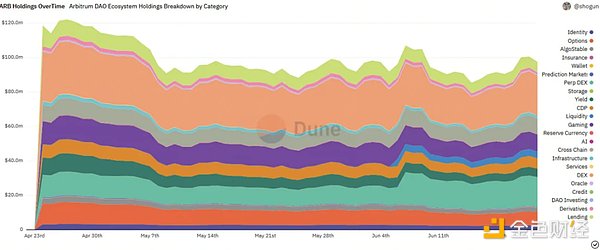

Additionally, our team member Shogun has created a Dune dashboard that provides an overview of initial ARB allocations and current balances for all protocols, as well as a range of metrics such as user count, transaction count, and accrued fees.

Disclaimer: As we are unable to continually track the movements of all 139 treasury wallets, our investigation findings are limited to movements up to June 23rd.

Stranded Whales

Among the protocols that received the largest airdrop amounts, GMX (8 million ARB), Uniswap (4.3 million ARB), SushiSwap (4.2 million ARB), and Curve (3.3 million ARB) have not used any airdropped tokens nor proposed any noteworthy governance proposals to allocate funds. Arrakis is proposing to distribute the airdropped tokens received by Uniswap to liquidity providers on the DEX via Arrakis.

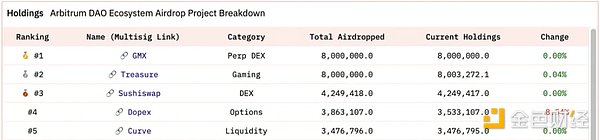

4 out of the top 5 recipients have not transferred or used any ARB tokens

Balancer, Radiant, and Stargate Reward LPs

Balancer has launched and approved a proposal to reward LPs. The protocol has received 3 million tokens and plans to reward active liquidity providers in batches of 100,000 ARB every two weeks. Additionally, the proposal suggests using the remaining 2 million tokens to deploy POL (Protocol Owned Liquidity) by combining the liquidity pool BAL/AURA/ARB with Aura.

Radiant received 3.4 million ARB tokens as another large airdrop recipient. Radiant has approved a governance proposal (RFP-18) regarding airdrop distribution:

-

40% airdropped to all new 6-month and 1-year dLP lock-up users

-

30% distributed next year to all Arbitrum dLP lock-up users

-

30% reserved in the treasury for future use

Stargate DAO has received 1.7 million ARB, and their latest proposal regarding the allocation of these tokens has been passed. 70% of the tokens will be used for liquidity mining incentives on Arbitrum, with STG releases being paused until ARB is depleted. Essentially, this means that all LPs will migrate to the new contract to receive ARB rewards.

Stargate plans to allocate the remaining 30% to partners to encourage greater collaboration in furthering the Arbitrum and Stargate ecosystems.

TreasureDAO Funds Game Developers

TreasureDAO, which received 8 million ARB, posted an interesting proposal on the governance forum on May 9th, which was voted on June 1st.

According to the proposal, 2 million ARB tokens will be allocated to reward deserving game developers. Initially, 500,000 tokens will be distributed to builders through donations or treasury swaps. The remaining 1.5 million tokens will be reserved for future rewards or grants. The game studios receiving rewards include The Beacon, Realm, Tales of Elleria, Knights of the Ether, The Lost Donkeys, Smithonia, Ruffion Reborn, CastleDAO, Power Plins, City Clash, Smol Age, Billy’s World and Kasumi Dungeons. It is not yet clear what the specific allocation amounts are.

Dopex and Cap: Liquidity and Incentives

Dopex received a 3.8 million token airdrop, with founder tztokchad stating on Discord on April 25th that the airdrop would be divided into dpxETH collateral, incentive measures, and rewards for long-term holders. Now, almost two months later, the protocol has used 300,000 ARB to provide liquidity for options products. Additionally, 30,000 ARB tokens were sent to 0xde…7d0b and then distributed to addresses that appear to be for staking contracts.

tztokchad’s response on April 25th, 2023

Cap Finance used the airdrop in a similar way. They sold 1 million tokens for 576,000 USDC and 311 ETH to provide liquidity funding for their trading pool. Additionally, they distribute 100,000 ARB tokens to users each month based on trading volume.

PlutusDAO

Plutus (received 2.7 million ARB) distributed 500,000 tokens to team members without waiting for any community resolutions.

Additionally, Plutus stated that it will use 300,000 ARB to repurchase plsARB and distribute it to plsARB stakers. Interestingly, for plsARB holders, there is no official liquidity pool available for them to convert plsARB back to ARB.

Currently, the only available trading pool has liquidity of only 16,000 ARB, and the trading price of plsARB is 30% lower than its peg. It must be pointed out that this is not an official pool, and the Plutus team has been waiting for Camelot’s centralized liquidity pool to launch a new, more liquid trading pool. So for the 2,936 holders, they still have to wait (currently more than 3 months) for the team to come up with a solution.

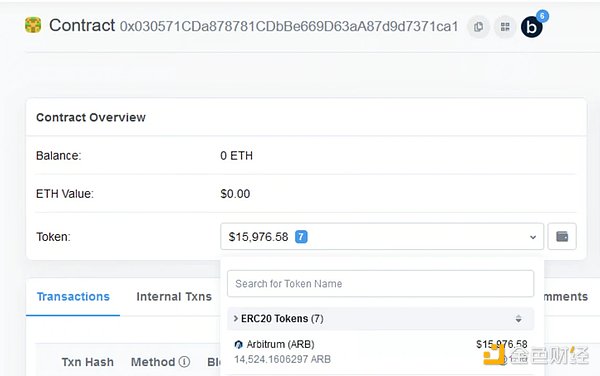

plsARB/ARB liquidity pool as of June 23, 2023

We found that in order to fill the illiquidity black hole of plsARB, the team used 100,000 ARB to provide funding for the supplier pool, allowing plsARB to be used as collateral to borrow ARB. Finally, they provided 200,000 ARB in Silo Finance’s lending pool to obtain returns, for specific reasons that we do not know.

Other projects that have allocated more than 600,000 ARB

DForce (received 2.4 million ARB) will use the airdrop for POL: deposit all the airdrop into its own lending pool.

Beefy.Finance (received 1.8 million ARB) will use the airdrop for operation and incentives: apparently, they distributed 1.3 million tokens as incentives and exchanged 100,000 ARB for USDC for operations.

BattleFly (received 1.2 million ARB) sold 280,000 ARB.

KyberSwap (received 1.1 million ARB) used 152,000 ARB as incentives.

Umami Finance (received 900,000 ARB) created on-chain sell order monitoring.

Multichain (received 900,000 ARB) used 167,000 ARB as incentives.

0x Protocol (received 643,000 ARB) kept all the airdrop reserved in the EOA – this is the only project to do so.

Impermax (receiving 500,000 ARB) sent 100,000 ARB to EOA and LP on its platform.

3 xcalibur (receiving 500,000 ARB) airdropped 100,000 ARB to LP, and another 100,000 ARB will be airdropped if TVL remains at $1 million. 3 xcalibur also uses some for bribes/rewards and plans to use some for operations in the future.

For smaller projects, we suggest you use Dune Dashboard to check out so you can do some data mining yourself. We don’t think their movements are worth delving into specifically, the vast majority of projects are still holding the airdrop.

We do want to mention all the projects that have sold their airdrop: TridentDAO, Damned Pirates Society, Covalent, XToken, Bridge Network, Rice DeFi, ApolloX, CREDA, Aelin, Unmarshal, and ZeroSwap.

Conclusion

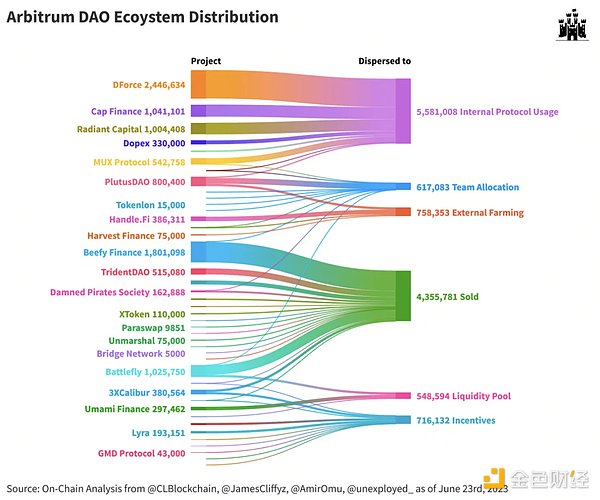

In summary, the vast majority of airdropped tokens are sitting idle in multisig wallets (about 80% of all airdropped tokens), and they seem to be in line with the overall vision of the foundation distributing the airdrop, which is to empower the protocol to be responsible for governance and decision-making processes within the ecosystem.

While some protocols have sold all their airdrops directly to fund their own operations, we believe that these funds will be used to stimulate protocol growth and indirectly benefit the entire Arbitrum ecosystem.

One new issue that arose in our research is that some sellers portray themselves as DAOs that operate according to community governance, but are unwilling to share their distribution plans with their community.

As of June 23, 2023, ARB holdings broken down by category

Ideally, these projects would:

-

Reserve tokens for future Arbitrum governance;

-

Redistribute their value to the community to incentivize product growth within the Arbitrum ecosystem.

By simply tracking on-chain token movements and behavior from multisig wallets, we can clearly differentiate those who are more inclined to participate in the development of the Arbitrum ecosystem.

We encourage anyone interested to do some on-chain investigation on our Dune dashboard. This should be one of the main takeaways of this article: on-chain responsibility of the protocol.

In fact, it is often difficult to truly understand what is happening behind the scenes of Web 3 projects. The governance responsibility airdrop on Arbitrum has the advantage of higher transparency and the ability to monitor how these protocols effectively utilize the allocated funds. This is the second interesting practice (Optimism being the first) that we believe is an interesting model that will be replicated by other projects in the future.

To further adjust the incentive measures, future governance airdrop allocations may set conditions on certain behaviors of the token, such as restricting sales or enforcing long-term redemption. Nevertheless, we believe that the current distribution is fair and is a natural selection of which protocols are more in line with the Arbitrum ecosystem and which are not. If we look back, the airdrop on Optimism had some restrictions.

However, on-chain analysis can only provide one side of the story. For this reason, we invite all relevant protocols to maintain transparency in their airdrop plans.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!