As a leader in the DeFi (decentralized finance) space, MakerDAO has been eyeing US Treasuries for some time. After purchasing $500 million in US Treasuries last October, it bought another $700 million a few days ago, bringing its total holdings to over $1.2 billion. We know that in February of this year, MakerDAO voted to approve a proposal allowing it to invest up to $1.28 billion in US Treasuries. So why is it so keen on investing in US Treasuries? What does this move signify? Does MakerDAO have the coin-making power of a sovereign nation?

To answer these questions, we need to start with the nature of money.

What is money?

There’s a widely circulated saying that “the essence of money is credit,” but many people may know the result without knowing the reason.

- OPNX: From Quiet to Booming Transactions, Su Zhu Embarks on a “Fast Life”?

- Atomic Arbitrage and the Current and Future Impact of CeFi-DeFi Arbitrage

- Where did FTX’s money go? A list of their properties in the Bahamas

We’d like to quote from Professor Zhai Dongsheng’s book “Money, Power and People” to explain: “Money is a set of social cooperation system and public products composed of three basic elements.”

An abstract value unit supported by national law:

As an abstract value unit, the value of money does not come from itself (for example, the production cost of a banknote is far lower than the value it represents), but from the trust people have placed in it. This trust is largely conferred and protected by national laws.

Therefore, when we say that money is an abstract value unit supported by national law, we are actually emphasizing the legal status of money and how this status helps maintain the value and credit of money.

A bookkeeping system for tracking and recording credit or debt balances between members of a society when they transact with each other:

In ancient trading systems, without money, people might trade by exchanging goods, such as I give you a chicken and you give me a bag of rice.

However, this method of trading has some obvious problems. First, we need to find trading partners with mutually needed goods, which can be very difficult in many cases. Second, we need to determine the exchange rate, that is, how many bags of rice is one chicken worth? This is also a very complex problem.

To solve these problems, people invented money. Money can be seen as a kind of accounting system, which can help us track and record credit or debt balances. For example, if you provide me with a service, but you may not immediately ask me to provide you with an equivalent service. Instead, I may give you a debt certificate, which is money, indicating that I owe you a service. At some point in the future, you can use this debt certificate to have me or someone else who accepts this certificate (money) provide you with an equivalent service.

In this way, the entire transaction becomes simpler and more efficient, and the measurement and transfer of value becomes easier.

Tokenization:

To understand this, we can use a simple analogy to explain it.

Suppose we are on a small island, and you helped me plant grain today. I may owe you a debt, such as promising to help you fish at some point in the future. However, this kind of debt relationship is difficult to manage because we need to remember who owes whom and when the debt can be repaid.

To solve this problem, we can introduce a standardized representation or symbol (Token) to represent this debt relationship, which is money. For example, I can give you a shell, which represents the debt I owe you. You can use this shell to demand the fishing service I owe you at any time, or you can also give this shell to other people on the island to ask them to demand the service from me. In this way, the shell becomes a standardized representation of the creditor’s transfer of specific debt relationships to third parties.

In modern society, the money we use is based on the same principle. When you hold a $100 bill, what you actually have is a kind of credit (cash is a debt for the central bank that issues it), which allows you to claim a certain value of goods or services from society. You can also give this bill to someone else to transfer this credit to them.

This allows us to manage and transfer debt relationships more effectively. So when we understand that the essence of money is credit, we can see the essence of money as a transferable debt or a transferable credit.

If we further understand the process of currency creation, you will have a deeper understanding of the nature of “currency is credit.”

How is currency created? Types of currency: high-energy currency and credit currency

Currency is generally divided into two categories: base money and credit money:

Base money, also known as basic currency or central bank currency, is directly issued by the central bank and has the ultimate payment capacity of currency. This includes the coins and banknotes we use in our daily lives, as well as commercial bank reserves stored in central bank accounts. Because of its terminal payment capacity, it is usually regarded as the basis of money supply.

Credit money, this form of currency is mainly created by commercial banks through loan and deposit activities. When a bank issues a loan to a customer, it is actually creating new currency.

In the modern monetary system, the vast majority of currency is credit money. In other words, in the real world, the vast majority of currency is created by commercial banks rather than central banks.

For example, when a person deposits $1,000 with a commercial bank, the bank needs to deposit 10% of it into the central bank as reserves (assuming a reserve requirement ratio of 10%), and then lend out the remaining $900 as a loan. When this $900 is eventually deposited into another commercial bank, that bank can again reserve $90 according to the 10% reserve requirement ratio, and lend out $810.

This process can be repeated, and each round will create new currency. However, their total amount is limited because the amount of each round of loans will gradually decrease.

Central bank-commercial bank binary structure

In the modern monetary system, the central bank and commercial banks together form a binary structure designed to balance the issue and circulation of currency.

The central bank plays a crucial role in the monetary system. The central bank is responsible for formulating and implementing monetary policy, controlling the supply of base money, regulating the level of interest rates in the economy, and maintaining the stability of the financial market. The central bank influences the money supply through open market operations, such as buying or selling government bonds.

When the central bank buys government bonds, it injects base currency into the market, increasing the money supply. Conversely, when the central bank sells government bonds, it absorbs base currency from the market, reducing the money supply. In addition, the central bank also sets reserve requirements, which is the ratio of deposits that commercial banks must hold with the central bank or with themselves, to influence the money creation ability of commercial banks.

Commercial banks are the main source of money creation. Commercial banks keep their business running by accepting deposits and issuing loans. When a commercial bank issues a loan, it actually creates new money, because the loan amount is added to the borrower’s bank account, thereby increasing the money supply in the economy.

This dual structure of the central bank and commercial banks enables the monetary system to maintain flexibility and stability. The central bank can control the supply of base currency by adjusting monetary policy, thereby affecting the overall interest rate level of the economy and helping the economy cope with risks such as inflation or deflation.

Commercial banks can adjust the supply of credit money through lending activities to meet the funding needs in economic activities. At the same time, because commercial banks are subject to multiple factors such as central bank monetary policy and Basel agreements, their ability to create money is not unlimited. This also avoids the risk of excessive expansion of money supply, leading to inflation or financial bubbles.

The process of money creation

To more intuitively reflect the process of money creation, the use of balance sheets is a very good tool, and observing changes in balance sheets provides us with a microscope to gain insight into financial behavior (for ease of understanding, the following charts are simplified models).

The central bank creates money: Taking the Fed as an example, the Fed usually creates dollars through open market operations, which can be understood as the Fed buying assets (such as government bonds) from market counterparties, and then the dollars are “created out of thin air”. During the pandemic, the Fed’s “big water release” was actually the Fed frantically buying various assets in the market and then sprinkling dollars into the market.

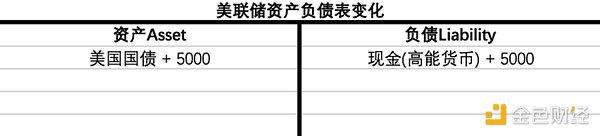

Assuming the Federal Reserve purchases $5,000 of government bonds from a commercial bank, the change in its balance sheet would be as follows:

When the Federal Reserve purchases $5,000 of government bonds, its balance sheet on the asset side has an additional $5,000 bond, and on the liability side has an additional $5,000 of high-energy currency. At this point, high-energy currency is “created out of thin air,” and there is an additional $5,000 of liquidity in the market.

We can see the process of the creation of the dollar from the balance sheet of the Federal Reserve, and this process causes the balance sheet of the Federal Reserve to expand and the liquidity of the dollar in the market to increase. This is called “balance sheet expansion.” You may have heard of the term “balance sheet contraction,” which refers to the Federal Reserve’s plan to withdraw liquidity from the market. If the Fed’s purchase of assets can create dollars, then selling assets can “destroy” dollars, which will lead to a contraction of the balance sheet and a reduction in the supply of dollars.

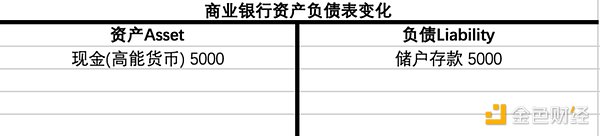

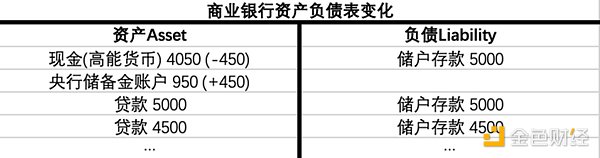

Creation of money by commercial banks: For commercial banks, the creation of money is achieved through the loan process. Assuming a depositor deposits $5,000 with a commercial bank, this $5,000 deposit is an asset for the depositor and a liability for the bank, because it needs to continuously pay interest to depositors.

Of course, commercial banks will not only hold deposits from depositors. In order to earn profits, they will lend at an interest rate higher than the deposit interest rate, and obtain the interest rate differential between deposits and loans as profits. Assuming the bank is ready to lend $5,000, you will find that there is no transfer of cash involved in this process. The commercial bank just adds a loan and deposit out of thin air on the balance sheet, and the new money is born (of course, it still needs to deposit a reserve with the central bank). In fact, the vast majority of bank deposits are created by banks themselves, and these are called credit money.

Commercial banks can continue this process and create new money in each round. Therefore, although the initial high-energy currency is only $5,000, the total money supply generated by the commercial bank’s deposit and loan activities often far exceeds this amount. This is the effect of the money multiplier. Assuming a reserve requirement of 10%, when all $5,000 of high-energy currency returns to the commercial bank’s reserve account at the central bank, the corresponding deposit will eventually become $50,000, expanding 10 times.

So in the end, you will find that commercial banks, because they can create “money” out of thin air, but the money people can withdraw (high-energy currency) is far less than the money created (credit currency). This is a bit like playing the game of “ten bottles and nine caps”, and it is also the reason why any honest bank cannot withstand bank runs.

Before the modern credit currency system matured, any country could arbitrarily issue currency. The current fiat currency issuance system binds the issuance of new currency to the sovereign debt of the country. Each high-energy currency corresponds to an equal amount of national debt, which needs to pay interest, thereby making the issuance of new currency a costly matter. In theory, this can limit the government’s impulse to issue currency arbitrarily.

However, in the matter of creating currency by purchasing national debt, you will find that if the US Department of the Treasury continues to issue new national debt to borrow new funds, and the Federal Reserve continues to use fresh US dollars to purchase them and pay interest, isn’t the US government still able to print as much money as it wants?

In fact, the modern credit currency system implements a system of distributed power and balance here. The Federal Reserve can print unlimited money, but it does not have the right to spend this money at will; the US Department of the Treasury does not have the right to print money, but has the right to issue national debt. The Treasury still needs to borrow funds at market interest rates, and the issuance of national debt will cause the borrowing cost to rise. At the same time, there is a legal debt ceiling for the US Department of the Treasury to issue national debt.

However, although the modern monetary system has made some institutional designs to prevent the sovereign government from issuing currency arbitrarily, in practice there are still loopholes such as “borrowing new to pay old” to evade the cost of issuing debt, and when the US has reached the debt ceiling several times, it always ends up raising the debt ceiling at the last moment.

The entire modern monetary system is essentially a game of passing the buck. National debt needs to be paid with interest. What if you can’t pay it back? You still have to spend money. Continue to print money to pay interest and continue to spend. Of course, if you are a small country like Venezuela, this borrowing and printing behavior will only lead to currency devaluation, and will not solve foreign currency debt.

But if your currency is the strongest hard currency in the world, and borrowing and printing will not have a greater superpower to make you pay any additional costs, then you will borrow money for a while and continue to borrow money. Seeing this, you will find that the anchor behind modern currency is actually debt, and debt can be understood as a kind of credit. Seeing this, you will have a deeper understanding of the phrase “the nature of money is credit”.

Does MakerDAO have the ability to mint coins? MakerDAO Operating Principle

We know that MakerDAO is a project running on the Ethereum blockchain, which integrates over-collateralized stablecoins, loans, storage, user governance and development. The core of MakerDAO is the Maker protocol, also known as the Multi-Collateral DAI system, which allows users to use assets approved by the protocol as collateral to generate decentralized stablecoins DAI, such as mortgaging $10,000 worth of ETH to generate $6,500 worth of DAI.

In 2022, MakerDAO passed a proposal to use funds from the peg stability module (PSM) to purchase US government bonds, which is of great significance to MakerDAO.

First of all, let me introduce the PSM (Peg Stability Module), which is an important part of the MakerDAO project, and its main function is to help DAI maintain a 1:1 anchor with the US dollar.

Specifically, the working principle of PSM is as follows: when the market price of DAI is higher than $1, arbitrageurs can use PSM to exchange stablecoins (currently only USDC) for DAI at a 1:1 rate, which is equivalent to buying DAI at a discount and then selling it on the market at a price higher than $1 to make a profit. Conversely, when the market price of DAI is lower than $1, users can use PSM to exchange DAI for US dollar stablecoins at a rate of 1:1, the circulation of DAI will decrease, and the exchange rate will rise back to $1. This mechanism automatically adjusts the supply of DAI through the power of the market to maintain its price stability.

Observing MakerDAO’s balance sheet in 2022, we can see that PSM assets account for over half of MakerDAO’s assets, and PSM is almost entirely composed of centralized stablecoin USDC. This means that DAI is actually a wrapper for USDC to some extent.

Image source: MakerDAO

However, when MakerDAO began purchasing US Treasury bonds, we noticed an interesting phenomenon: the assets and liabilities on MakerDAO’s balance sheet are almost identical to those on the Federal Reserve’s balance sheet (US Treasury bonds: USD high-energy currency vs. US Treasury bonds: DAI stablecoin):

So the question is: does this mean that MakerDAO is sharing the “create currency based on US Treasury bonds” right that was previously monopolized by the Federal Reserve? What does it mean for MakerDAO to buy US Treasury bonds?

Is MakerDAO creating currency?

First, let’s start with the answer: MakerDAO is not creating currency, so where is the problem?

As a stablecoin issuer, MakerDAO has the simplest business model: it collects customers’ dollars, issues stablecoins at a 1:1 ratio, and is responsible for redemption. Similar to Circle issuing USDC and Tether issuing USDT, they theoretically do not have the ability to expand credit, they only keep dollars for customers, and then issue corresponding dollar-pegged stablecoins. MakerDAO’s issuance of DAI is also very similar to theirs, especially its PSM module, which provides a 1:1 exchange service between DAI and USDC. If USDC is considered a “dollar voucher,” then the DAI in the PSM module can also be considered a “USDC voucher.”

When the PSM module has good liquidity, it is very confusing because it continuously provides stable liquidity between DAI and USDC. But fundamentally, it is a “reserve fund.” When everyone wants to exchange their DAI for USDC at a 1:1 ratio through the PSM module, obviously this fund will be depleted.

The USDC in this reserve fund belongs to MakerDAO, but MakerDAO has no lending agreement and no ability to expand credit. It cannot and should not lend out this USDC again. Instead, it should lock up these USDC and only use them when providing a 1:1 exchange between DAI and USDC, just like Circle cannot easily use customers’ dollars.

So where does MakerDAO get the money to buy US Treasury bonds?

You can’t just take DAI to buy US Treasury bonds, they won’t accept it. MakerDAO swaps USDC belonging to the DAO treasury for dollars, and then uses these dollars to buy US Treasury bonds.

Understanding the modern monetary system based on “central bank – commercial banks,” we can see that the process of stablecoin issuance by stablecoin issuers is very different. Compared to the ability of central banks to create high-energy currency out of thin air and the expansion ability of commercial banks to create currency through loans, stablecoin issuers’ ability to create currency can be said to be minimal. It’s like a bottled water company – we don’t produce currency, we just move it around.

Even from a larger perspective of currency issuance, the way stablecoin issuers supply currency is completely different. In the era of the Bretton Woods system, the US reserve gold-issued dollar gradually played a game of “ten bottles and nine caps”. As the dollar increased and gold reserves were lost, the number of caps decreased.

Source: Shutterstock / CryptoFX

Of course, if stablecoin issuers only do well with voucher stablecoins, they will starve to death, so we also accept Circle’s approach of swapping a portion of its customers’ US dollar deposits for short-term US Treasury bonds. This is essentially swapping liquid US dollar savings deposits for less liquid but higher-yielding US bonds to pay for the company’s business operating costs. What MakerDAO does is similar, swapping interest-free USDC reserves for interest-bearing US bonds to generate income and support the protocol.

This behavior will cause USDC to be unable to cope with 100% of the run (it was theoretically possible when only enjoying savings deposit interest), and will also weaken the anchoring of DAI to USDC. Essentially, it is an exchange of liquidity for profit, but compared to “ten bottles and nine caps,” it is more like “100 bottles and 99 caps.”

In addition, from the perspective of the balance sheet, DAI is a liability for MakerDAO, and USDC in the PSM module is an asset of MakerDAO. This behavior is essentially that MakerDAO swaps some assets USDC in the balance sheet for another asset US Treasury bonds, which is a very normal asset swap process for any company or DAO, and in this process, there is no creation of new DAI out of thin air or credit expansion of DAI as high-energy currency to amplify the money multiplier.

To sum up, MakerDAO does not share the ability of the Federal Reserve to create currency. Especially for a strong currency with valuable scale like the USD stablecoin, it is very difficult to create. This was also BTC’s original idea: to make decentralized currency the anchor of all economies, freeing people from the exploitation of sovereign governments by issuing currency. Even BTC still has a long way to go on the journey to replace fiat currency, and so does DAI on the journey to replace fiat currency (or centralized stablecoins).

What does MakerDAO buying US Treasuries mean?

We pointed out that in the process of adding US Treasuries on the asset side, MakerDAO did not increase the corresponding DAI on the liability side, but only exchanged the assets.

However, from another perspective, can we also consider that some of the DAI’s endorsement was previously reserved USDC, and after the exchange, some of the DAI’s endorsement has become US Treasury bonds issued by the US Department of the Treasury, thus enjoying the credit endorsement of the sovereign United States?

This endorsement switch is valid, and similar things have happened many times in the real world.

>>>> Other fiat currencies mixed with USD endorsement

Historically, it’s not uncommon for smaller economies to use the US dollar as an anchor to increase their own credit.

European countries after World War II

After World War II, all European countries were devastated and did not have enough gold reserves in their treasuries. Governments did not have enough credit to issue bonds. This was very difficult for stabilizing their own currency, and it was easy to form a situation of competitive devaluation.

At that time, the US dollar stood out as a stable bridge for the world economy. The United States held gold reserves, and other countries held US dollars, which was actually borrowing the endorsement of the US dollar to increase the credit of their own weak fiat currencies.

This story is now Web3-ized. The US reserves gold, and MakerDAO over-collateralizes core assets such as ETH to create DAI; holding US dollars is equivalent to DAI holding USDC.

China after Reform and Opening-up

Economic development requires capital, but at that time capital in China was very scarce, and money could not be printed randomly to avoid inflation. How to solve the stability problem of the new issued RMB and what should be its anchor?

Similarly, to increase confidence in the RMB, China began promoting the introduction of foreign capital, and foreign capital (mainly US dollars) entering China could not be circulated directly. The actual process is that the foreign exchange control bureau accepts the US dollars, and then issues RMB to be invested to the foreign investors according to the exchange rate. The foreign investors take the RMB to invest in China. After China joined the WTO, this trend grew rapidly, making a large part of the newly issued RMB actually endorsed by the US dollar. Of course, the foreign exchange control bureau cannot sit idly by holding US dollars waiting for depreciation. By buying a large amount of US Treasury bonds to earn interest, it indirectly introduces the credit of the US government through the US dollar and US Treasury bonds as endorsement for the RMB.

Web3 version of this story: The directional issuance of RMB can be understood as a packaged USD (Wrapped USD). These RMB issued through the reserve of USD have borrowed the credit of USD.

Countries and regions implementing linked exchange rate system

The most typical one is Hong Kong, which has implemented the linked exchange rate system since 1983, with 100% foreign exchange reserves to ensure that the Hong Kong dollar exchange rate remains stable within the range of 7.75 to 7.85 Hong Kong dollars to 1 US dollar. The Hong Kong dollar has become a voucher for the US dollar, except that it is not 1:1.

The Hong Kong Monetary Authority does not normally intervene in exchange rate fluctuations. The three note-issuing banks (Bank of China (Hong Kong), Hong Kong and Shanghai Banking Corporation, and Standard Chartered Bank) carry out arbitrage activities to stabilize the exchange rate. When the Hong Kong dollar is about to exceed the narrow range of 7.75 to 7.85, the Hong Kong Monetary Authority will use its US dollar reserves to buy Hong Kong dollars or sell Hong Kong dollars for US dollars, using two-way means to forcefully lock the exchange rate of the two currencies.

Web3 version of this story: The stock of Hong Kong dollars before 1983 was based on the gold standard, just like DAI issued with excess collateral; the arbitrage behavior of the three note-issuing banks is like on-chain arbitrage robots working hard to smooth the price difference between DAI and other stablecoins; and the role of the Hong Kong Monetary Authority is equivalent to the PSM module of MakerDAO.

>>>> Two Forms of Currency Endorsement

From the above example, we can abstract two sources of endorsement:

-

The portion endorsed with hard currency (mainly the US dollar) and precious metals (mainly gold) is called “hard endorsement.”

-

The portion endorsed by the credit of small countries is relatively weaker and can be called “soft endorsement.”

Almost all small countries’ currencies aim to improve the “color” of their own currency by relying on the “hard” portion of their reserves, and then quietly dilute it with the relatively “soft” credit of their own country, while collecting “seigniorage.”

If it is an irresponsible country, such as Venezuela, it also has a certain amount of hard currency foreign exchange reserves, but after crazily diluting its currency denomination by adding a few more zeros, that little bit of hard content becomes meaningless. Such malignant inflation cannot solve the problem of foreign debt, only harvests its own people.

If it is a relatively responsible country itself, it can fully enjoy the benefits of “hard endorsement” in the currency, and slowly add its own “soft” content while maintaining the relative stability of the currency value, completing the gradual expansion of its own credit. Just like Rome in the era of precious metal standards, it continued to dilute the fineness of gold and silver coins in the late imperial period, and continued to collect seigniorage for more than a hundred years.

>>>>DAI is a small country currency

So what is the “soft endorsement” of DAI? Obviously, it is the part generated by over-collateralization, which cannot be called “soft” and is the only issuance method in decentralized stablecoins that can withstand long-term tests. This is more like a “hard-to-hard” behavior, replacing the “soft” part of continuously issuing currency to dilute water, with open and transparent issuance rules of over-collateralization and fully reserved.

The problem with generating stablecoins with over-collateralization is that when the underlying asset prices fluctuate rapidly, large-scale liquidation activities may cause fluctuations in the exchange rate and issuance of DAI, and the growth rate of the money supply is relatively slow. For DAI, the significance of this “hard-to-hard” is more to use the massive inflow of dollars into the decentralized world and quickly increase the issuance of DAI (by increasing reserves through the PSM module) and increase the exchange rate stability of DAI.

Depending on external credit to achieve rapid growth in circulation is very significant. One of the reasons why gold gradually withdrew from being an international trade settlement currency was due to the explosive growth of productivity in modern society after the industrial revolution. Compared to the rapid increase in goods and services, the growth rate of gold as a currency supply cannot keep up, resulting in a deflationary trend. Deflation, like hyperinflation, is a very bad thing for the economy. In addition to maintaining its own stable anchoring, the ability of DAI to increase its circulation to match demand as the entire cryptocurrency market grows is also very important.

>>>>The significance of reserve diversity

Understanding the above example, we find that MakerDAO is actually replacing the reserve components in its own balance sheet in the process of creating currency.

-

Increasing USDC reserves: When real-world dollars continuously flow into the crypto world through stablecoins, DAI also gains the ability to rapidly increase its supply. It is no longer limited to the dilemma of slow supply expansion when mainstream cryptocurrencies such as ETH were used as excess collateral.

-

Increasing US Treasury bond reserves: Skipping Circle’s intermediary and directly enjoying the endorsement of US Treasury bonds issued by the US Treasury Department, if more US Treasury bonds were exchanged for DAI endorsement at the time, the impact received by DAI in the crisis when USDC was squeezed out would also be smaller, which is the positive effect of reserve diversity on exchange rate stability.

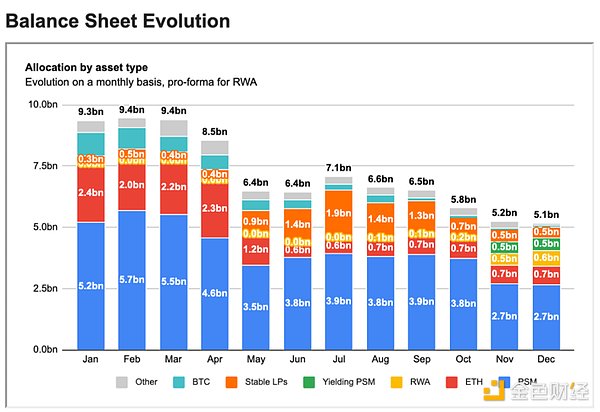

In MakerDAO’s asset types, we can also clearly see that the proportion of real-world assets RWA (such as US Treasury bonds and other assets) is increasing, and the reliance on stablecoin assets is decreasing.

Image source: Dune

After analyzing the question of “whether MakerDAO shares the ability of the Fed to create currency” from two perspectives, we can find that its answer is no longer important. The act of MakerDAO buying US Treasury bonds is a substitution of the assets allocated on the asset side of its own balance sheet as the “central bank” of DAI, and this substitution ability is the most critical.

In fact, central banks in various countries in the real world also have the ability to choose the assets they allocate. For example, in 2008, in order to save the subprime mortgage crisis, the Federal Reserve began accepting mortgage-backed securities MBS into its asset side; the Bank of Japan held a large number of Japanese company stocks through trust funds in a very magical way, so that the Bank of Japan became the largest single shareholder of many large companies.

In summary, the significance of MakerDAO’s purchase of US Treasury bonds is that DAI can use the ability of external credit to diversify the assets behind it, and the long-term additional income brought by US Treasury bonds can help stabilize the exchange rate of DAI, increase the flexibility of its issuance, and the inclusion of US Treasury bonds in the asset-liability balance sheet can reduce DAI’s dependence on USDC and reduce single-point risks. Overall, this is beneficial to its development, and we look forward to its greater achievements in the development process of decentralized stablecoins.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!