“Range Protocol is laying the early foundation for the development of Web3 asset management platforms”

In Uniswap v2’s AMM model (and similar models), there are often a large number of trades around the market price, which means that the liquidity of the AMM model fund pool is only effective near the market price. Although it can provide trading liquidity (0, ∞), low capital utilization has always been a problem for the DEX sector.

In Uniswap’s V3, launched in 2021, a higher capital utilization rate CLMM (Concentrated Liquidity) and a three-tier fee model are used. The former allows liquidity providers (LPs) to determine which price range to inject the provided assets into. The latter allows LPs to charge different fees based on the price volatility of the coins they provide (higher risk, higher returns, 0.05%, 0.30%, 1.00%).

The benefits of this design are self-evident, but the concentrated liquidity exacerbates impermanent losses (especially when market volatility causes prices to deviate). To cope with this challenge, liquidity providers need to closely monitor the prices of the assets they provide and take timely action, such as revoking liquidity and reallocating funds to new price ranges, to reduce the impact of impermanent losses, which also incurs gas consumption.

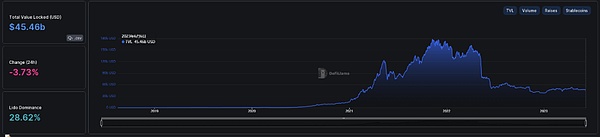

According to a report by ToBlockingz Blue and Bancor Protocol, about 49.5% of liquidity providers on Uniswap v3 have negative profits due to impermanent losses. From an industry perspective, the actual situation is that the TVL of DeFi has fallen by more than 70% compared to its peak, and the overall market increment is insufficient. Most LP profit makers are not satisfied with their returns (even weaker than the gains from “holding coins and waiting for them to rise”), and traders’ desire to participate in DeFi is decreasing.

DeFi TVL trend chart Source: defillama

A new narrative for DeFi composability

As the industry moves towards a more mature direction, traders are becoming more rational and speculative. Of course, from the perspective of traders, the potential purpose of participating in DeFi is mainly twofold: holders can increase the capital utilization of their assets, and obtain potential returns from DeFi that meet expectations. In fact, the development of the DeFi field is becoming more mature and saturated in the short term, and it is becoming difficult to meet the needs of most traders who depend on a single DeFi facility (even becoming a Uniswap LP may result in losses).

Head protocols such as Uniswap, AAVE, Maker DAO, Lido, and Curve dominate the market with the majority of funds and liquidity, and duplicating these protocols is becoming meaningless. However, the large size of the head ecosystem makes it difficult to achieve substantial innovation. The good news is that DeFi is a highly composable facility, and based on these head protocols, it is expected to build more targeted and enriched “LEGO” to unleash the potential of different components in different aspects. This may be a new narrative direction.

As of now, on-chain options are an example of DeFi’s composability, such as the underlying protocols of on-chain options such as Syntheix, OPYN, and Hegic, which can cast options for structured products such as Ribbon Finance and Lyra and provide basic liquidity. A single on-chain option transaction may be supported by multiple option component protocols. Another example is automatic strategy protocols, such as early machine gun pool products YFI and YFII, which can be regarded as projects in this category. They are built on different underlying protocols and Farming profits are carried out in different DeFi protocols. However, limited by passive strategies, the overall returns of these early strategy pool products are not high and their development is slow. Some protocols’ sources of income are even just the dividends of fees.

The automatic strategy revenue sector is one of the most promising areas, and it has full potential to solve the revenue problem faced by cryptocurrency holders by leveraging the composability between different DeFi components. After several years of development, this field is also evolving towards new paradigms. In this race, Range Protocol, Arrakis Finance, and Gamma, which are characterized by liquidity management, have become representative projects of this field after the decline of old protocols.

Among them, Range Protocol not only provides passive strategies but also is the first protocol to provide active strategies with higher alpha revenue. Based on this, Range Protocol can provide more sustainable, stable, observable, and secure returns, which is also highlighting the value of Range Protocol. In the longer term, Range Protocol is also expected to drive the underlying asset of cryptocurrency towards asset management, which is also a blue ocean direction.

Range Protocol with advanced features

Range Protocol is a liquidity management platform. The initial version of the protocol will be built on top decentralized exchanges (DEXs) that use the v3 version (CLMM) of Uniswap, PancakeSwap, and QuickSwap. Range Protocol’s liquidity management strategies, including active and passive strategies, help investors earn significant returns by using LP behavior in DEX. The latest version of Range Protocol is primarily built on Uniswap v3 and will open up services for other v3 DEX chains in future iterations.

The Range Protocol team consists of senior finance professionals (including senior asset management managers) and Web3 developers. The team has over $20 billion in senior OTC trading experience and more than 200 senior market-making experiences. Range Protocol closely cooperates with private market makers and senior trading partners to help them conduct more feasible strategy research.

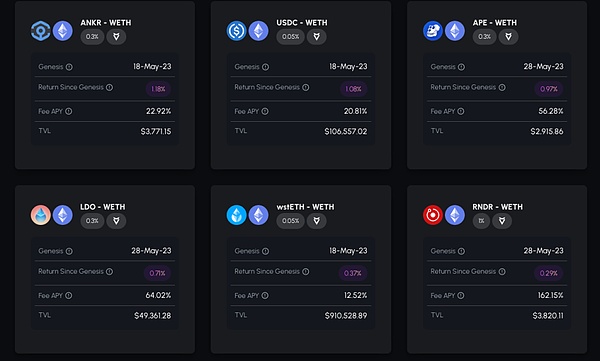

Range Protocol covers the best passive management strategies on the market, including a series of Vault passive strategies. Most liquidity management projects fall into this category, which is based on “Fee APY” as a measure and does not consider changes in the number of coins.

One of the biggest features of Range Protocol is its active management strategy. Through its proven active management strategy, LP can further optimize returns and achieve significant value-added in coins. It is reported that currently, Range Protocol is the only liquidity management platform that can develop and provide active strategies.

Based on these two strategies, Range Protocol can provide two types of returns for investors: “Return Since Genesis” returns, which are absolute returns compared to holding spot positions, provided by active strategies. Currently, some LPs have “Return Since Genesis” returns of over 1%. Most liquidity management platforms typically do not display “Return Since Genesis” returns because they are usually negative. Another type is “Fee APY,” which is typically the yield calculated from the underlying fees and fee-sharing rates of DEXs (most yield pools use this as a yield measure).

Range Protocol Product Interface

Recently, the Range Protocol team compared the “Return Since Genesis” returns of Arrakis Finance and Gamma for the ETH/USDC trading pair over the same period of time. The results are as follows:

- Arrakis Finance had a “Return Since Genesis” of -1.18%.

- Gamma had a “Return Since Genesis” of -9.58%.

- Range’s “Return Since Genesis” was +1.99%.

As seen from the data, the Range Protocol’s strategy execution has a significant advantage in yield.

As a Web3-enabled on-chain platform, Range Protocol maintains a decentralized ideology and operates by calculating off-chain and executing on-chain. In terms of execution, Range Protocol has set up an on-chain insurance pool and envelope, providing endpoints for trading teams to enter transactions into the chain and using smart contracts to handle tedious DeFi-specific operations to achieve transaction efficiency. At the same time, Range Protocol manages user assets on-chain in the form of non-custodial insurance pools, obtaining security, transparency, and trustlessness.

Range Protocol’s early versions were mainly focused on spot DEX. Of course, Range Protocol plans to continue to launch Derivative Vault, LSD Vault, and NFT Fi Vault in the future versions. In these innovative Vaults, Range Protocol will deploy systemic and automated strategy management to help users profit from these potential markets.

Focusing on several niche markets, the on-chain derivatives market has grown from zero to tens of billions of dollars in trading volume since 2021, and has emerged dYdX, GMX and other head derivatives unicorns. However, in the early stages of development, there were certain defects in the liquidity mechanism, such as the GMX’s GLP mechanism based on vAMM features, which creates opposition between traders and LP and one side always loses in the game. In addition, the liquidity sustainability of the derivatives ecosystem maintained by token incentives and transaction fees is also an issue that cannot be ignored.

The LSD track is a derivative track that came with ETH 2.0. On the one hand, Lido (with around 40% of the share) has long been monopolizing the market, lowering the overall yield, with the current APR at only 4%~8%. On the other hand, the “nested” mode has certain market risks, and users holding LSD assets find it difficult to profit again. The NFT market belongs to the old narrative, and low liquidity and asset utilization have always been the main problems, especially recently with blue-chip assets such as BAYC and MAYC plummeting.

Therefore, Range Protocol has positive implications for the long-term development of the above-mentioned markets. For example, by helping users obtain stable and considerable returns through strategies, it can bring liquidity gains to the on-chain derivative and NFT fields, and reduce potential death spiral risks faced by the LSD track, etc.

With the continuous layout of Range Protocol with stable income strategies, it is expected to gradually establish itself as an upstream foundation in the crypto ecosystem, and promote overall industry innovation and efficiency from an upstream position.

Range Protocol’s ambition: Web3 asset management platform

As a liquidity management protocol that spans multiple sectors and has mature strategies, Range Protocol is linking to a platform for asset providers, income seekers, and asset managers/quantitative traders with systematic trading capabilities, reducing the threshold for investors to obtain returns from DeFi facilities. As a composable on-chain facility, Range Protocol can also provide modular integration services for more on-chain protocols , allowing more on-chain applications to integrate Range Protocol’s features. Range Protocol is facing the market in the form of a professional one-stop Web3 asset management platform.

From the perspective of the cryptocurrency market, the services that on-chain facilities can provide have not yet reached the level of asset management. On the one hand, the asset scale that is actively/passively managed in traditional financial platforms is still small compared to it, and on the other hand, there are fewer platforms that can provide professional management services.

From the development of the traditional financial field over hundreds of years, some relatively mature and professional asset management companies began to appear in the last century. Currently, asset management giants such as Fidelity and BlackRock help customers manage billions of dollars in assets.

As the field of cryptography becomes more mature, an increasing number of investors are becoming long-term believers. With the promotion of compliance and regulations, the progress of the RWA (Real World Asset Virtualization) track is accelerating. For example, some traditional financial systems such as banks are migrating to the chain, or will drive more assets to migrate to the chain, and accelerate the new rigid demand for fund management. This field will also be a potential blue ocean market.

With the support of a professional asset management team, Range Protocol is accumulating valuable experience from serving the early crypto world and promoting a new round of value paradigm shift in the crypto industry. With the advent of the new emerging wave of the industry, Range Protocol’s grand narrative is also pushing it to become the leader in the Web3 asset management field.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!