Author: 2898 Source: Twitter, @punk2898

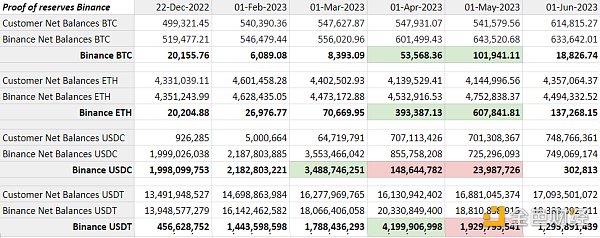

Binance has released its latest reserve proof, revealing:

On March 8th, due to the closure of Silvergate, Binance lacked large-scale channels for deposits and withdrawals, so it started converting USDC reserves into BTC and ETH.

Between March 12th and May 1st, Binance purchased approximately 100,000 BTC and 550,000 ETH, totaling about $3.5 billion.

- The Crazy Cycle Behind the Soaring of ‘Ketai Coin

- Thoughts on the Bitcoin Cycle The Market is Dynamic

- Glassnode The Bitcoin market is experiencing an unprecedented period of low volatility

Although there doesn’t seem to be any problem on the surface, it becomes very interesting when we display the trend of BTC during this period. During this time, Binance purchased $3.4 billion worth of BTC and ETH. BTC rose from $22,000 on March 12th to $29,000 on May 1st. There are several questions involved: Did Binance actively convert USDC to BTC/ETH? Did the rise of BTC this year be influenced by Binance’s $3.5 billion buying pressure?

The first question: Did Binance actively convert USDC to BTC/ETH? Is it that exchange users exchanged USDC for BTC/ETH, and then Binance had to convert it to BTC/ETH in order to maintain sufficient reserves? The answer is: Binance’s free funds actively purchased $3.5 billion worth of BTC/ETH.

Here is the relevant evidence:

– According to the data released by Binance, as of March 1st, exchange users held only slightly over 60 million USDC.

– Binance held $3.5 billion worth of USDC.

– Binance’s own net balance was $3.48 billion in USDC.

By May 1st, Binance’s own net balance became negative $23 million.

The second question: Did Binance’s $3.5 billion buying pressure cause the rise of BTC this year?

Because Binance purchased approximately 100,000 BTC and 550,000 ETH, totaling about $3.5 billion. Therefore, the cost of BTC held by Binance is approximately $26,000, and the cost of ETH is approximately $1,600. Although $26,000 cannot be considered as the bottom point, the position where Binance made the purchase, although not the main driving force in the price trend of BTC, still remains an important driving force.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!