Original Author: Emperor Osmo

Original Translation: luccy, BlockBeats

With the thriving development of the cryptocurrency derivatives market, it is expected that the market revenue will increase from the current $960 million to $231.2 billion by 2030. Binance recently released a DeFi derivatives report, which explores in-depth how to capture the growth trend of derivatives. The following is a report analysis by cryptocurrency KOL Emperor Osmo on how to leverage this trend. Translated and organized by BlockBeats.

Overview

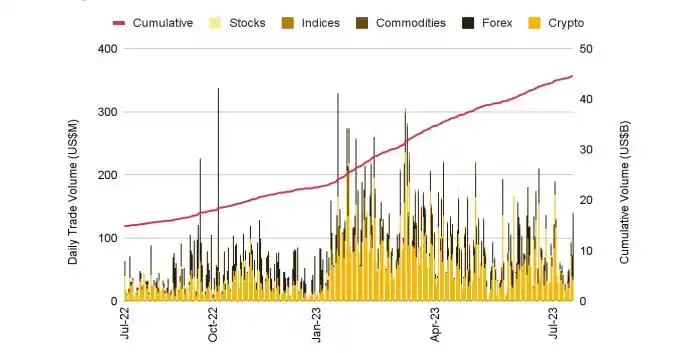

According to Binance’s data, the cryptocurrency derivatives market currently accounts for 74.2% of the total trading volume. The monthly trading volume of cryptocurrency derivatives has reached $1.9 trillion, tripled in the past three years. During this period, the derivatives market has shown diversification and growth.

- Get a deep understanding of Wintermute’s portfolio and what preparations they have made for future market changes?

- Quick Look at 7 Bullish Indicators Will the Crypto Market Go Bullish?

- Investigation into the Mystery of Market Manipulation of ICP Who Precisely Killed the Rising Star DFINITY? (Arkham Chapter)

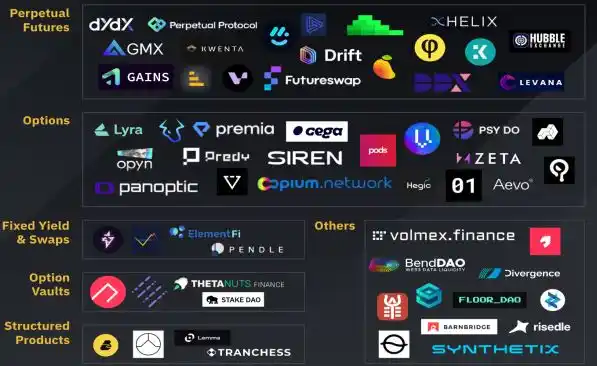

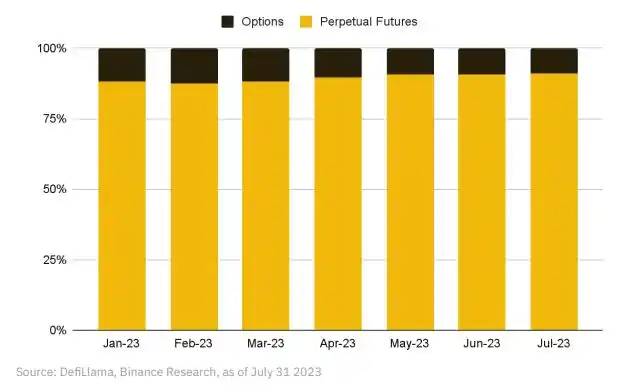

Although the market is highly diversified, perpetual contract trading accounts for 90% of the market trading volume. This is because in a decentralized environment, the modeling of perpetual decentralized exchange platforms (Perp DEXs) is simpler than options. In addition, many perpetual decentralized exchange platforms can provide a similar experience to centralized exchange platforms (CEX).

Notable Protocols

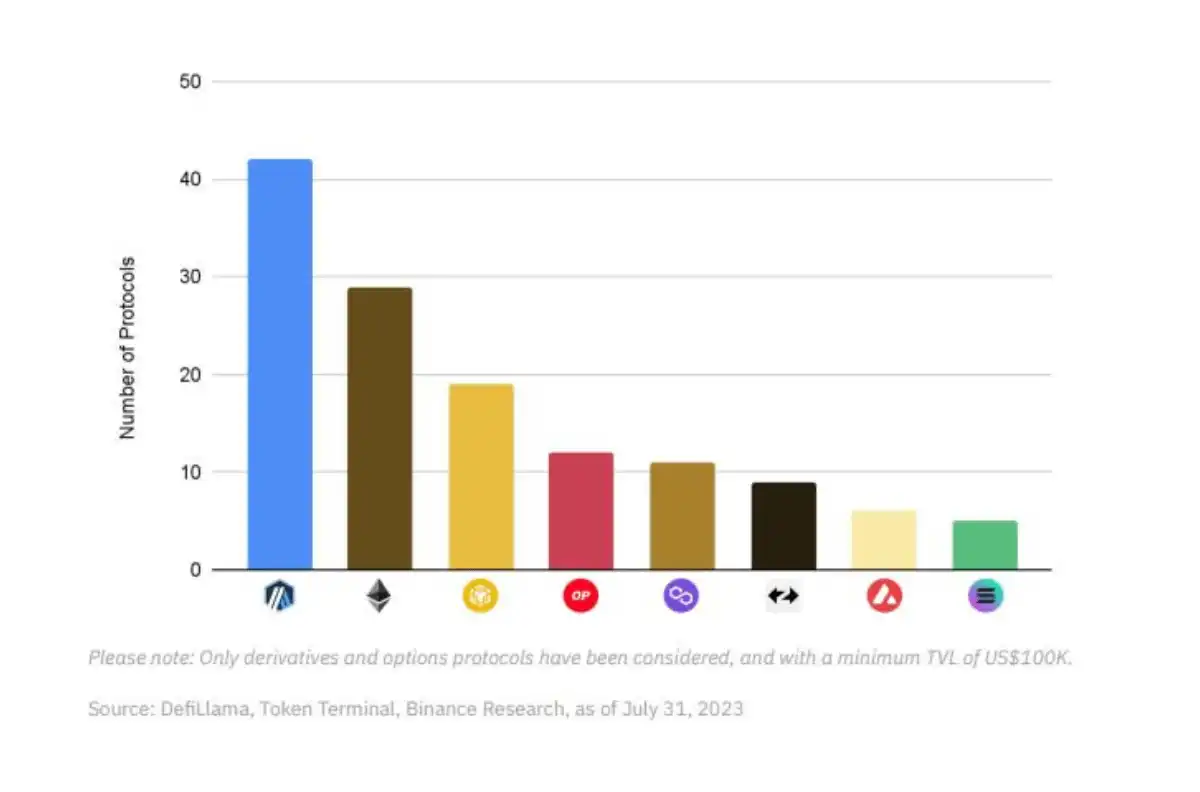

The rising popularity of Layer 2 solutions (L2s) has enabled the derivatives market to expand more rapidly, with Arbitrum leading the way. In the past year, numerous protocols have been launched, making it challenging to track and understand them. The following are 6 protocols worth paying attention to.

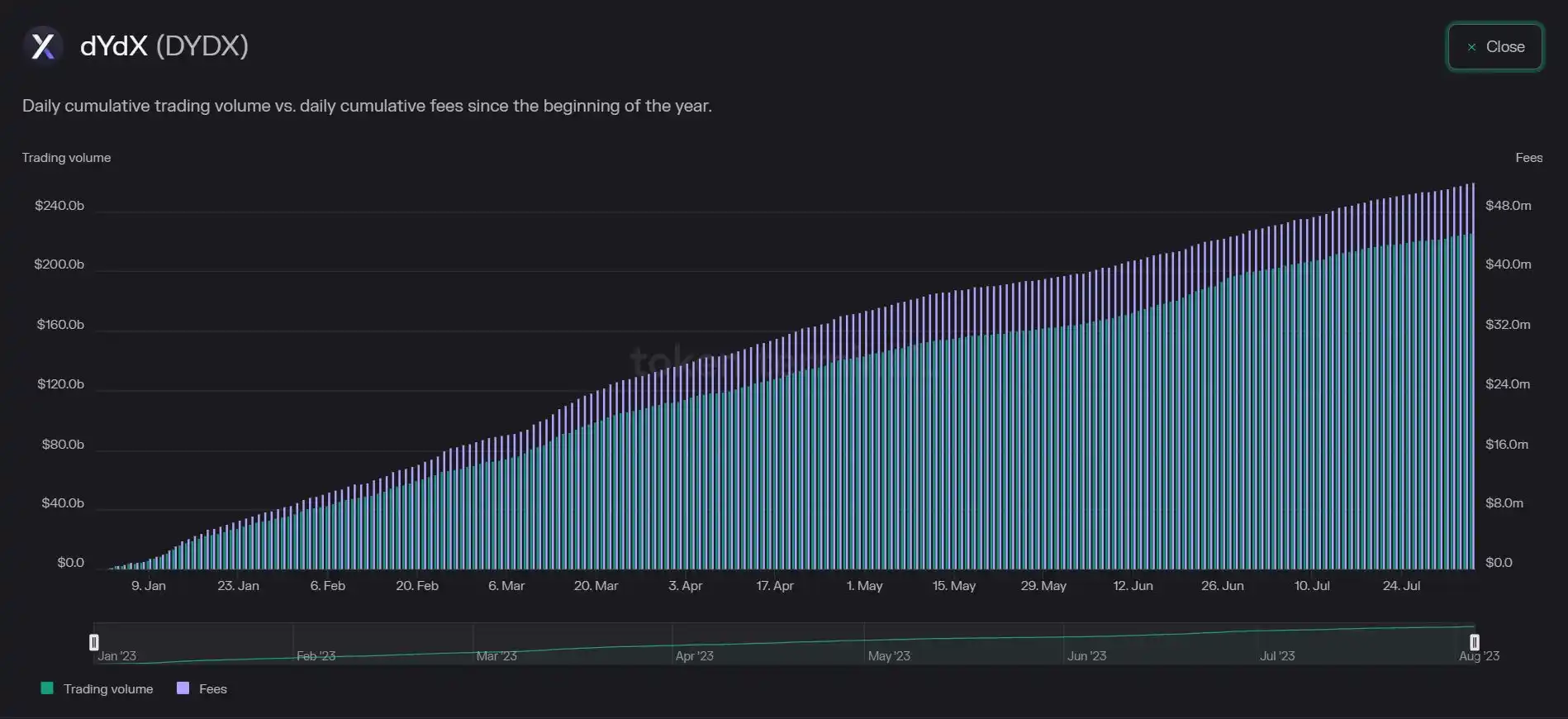

dYdX

dYdX is the largest decentralized perpetual contract trading platform, which operates on an order book model. As of 2023, its trading volume accounts for 69% and the total trading volume reaches $222.7 billion. They provide precise control for market makers, which plays a key role in expanding the range of product types.

dYdX aims to address some of the shortcomings faced by order book and decentralized matching engines. Their V.4 version attempts to change this situation by allowing transactions to be submitted on-chain and leveraging Cosmos SDK and Tendermint POS.

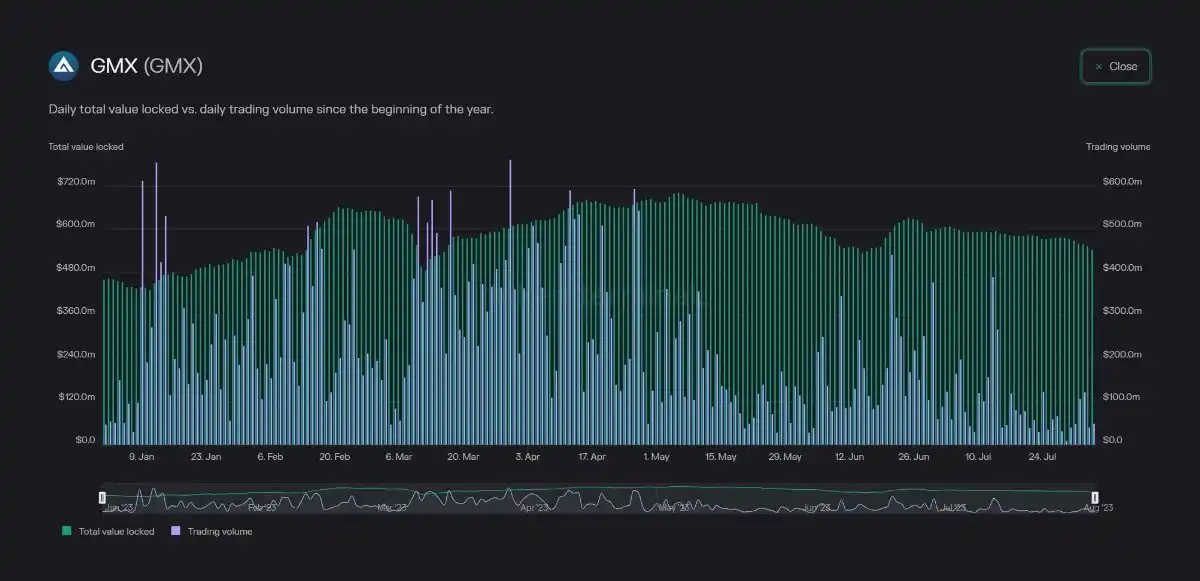

GMX

GMX is the largest protocol in the Arbitrum ecosystem and the first project to launch a shared liquidity pool for maximum efficiency. Its innovative liquidity token GLP has been widely adopted by over 40 forked projects.

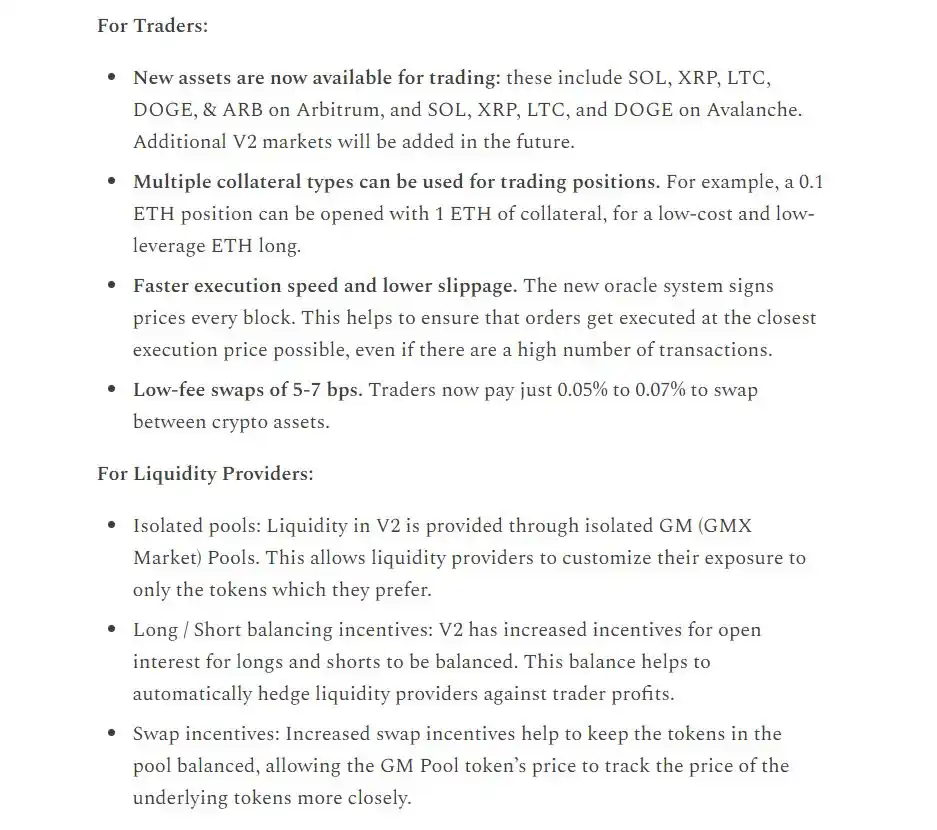

Recently launched GMX V2 has made major reforms for large-scale traders, including:

– Introduction of price impact and funding costs;

– Lower transaction fees;

– Independent LPs;

– Integration of Chainlink low-latency oracle.

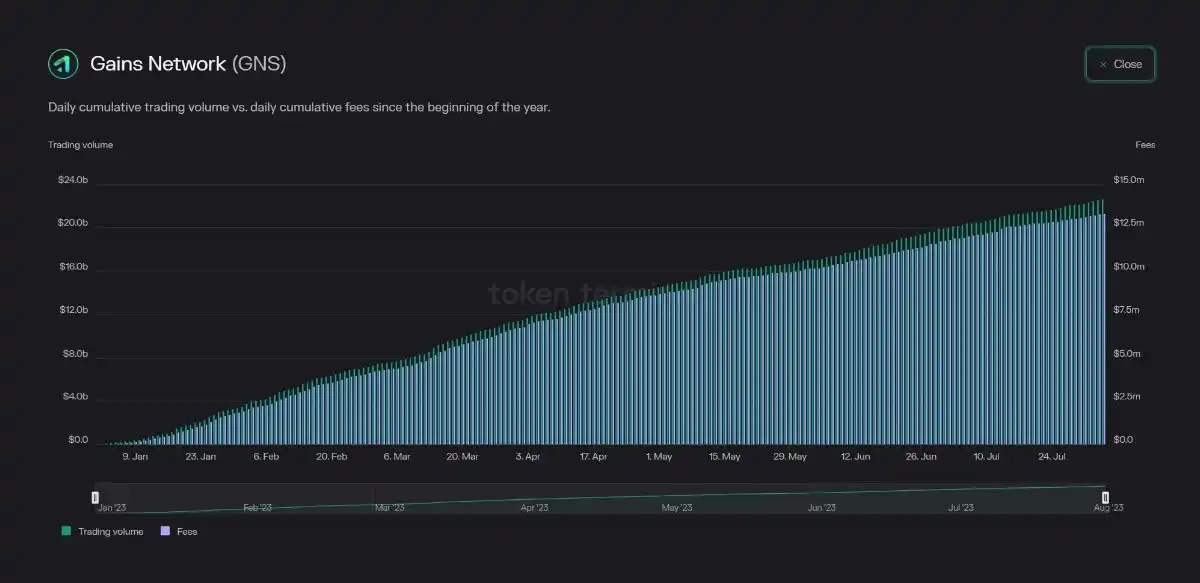

GainsNetwork

Gains is one of the most powerful and profitable perpetual DEXs that has migrated to Arbitrum, with a total daily trading volume of $65.1 million. Similar to GMX, GNS utilizes a single liquidity pool (gDAI) to support trading activities on the Gains Network. Due to its flexibility and user-friendly experience, GainsNetwork has become one of the most popular decentralized trading platforms for forex trading.

MUX Protocol

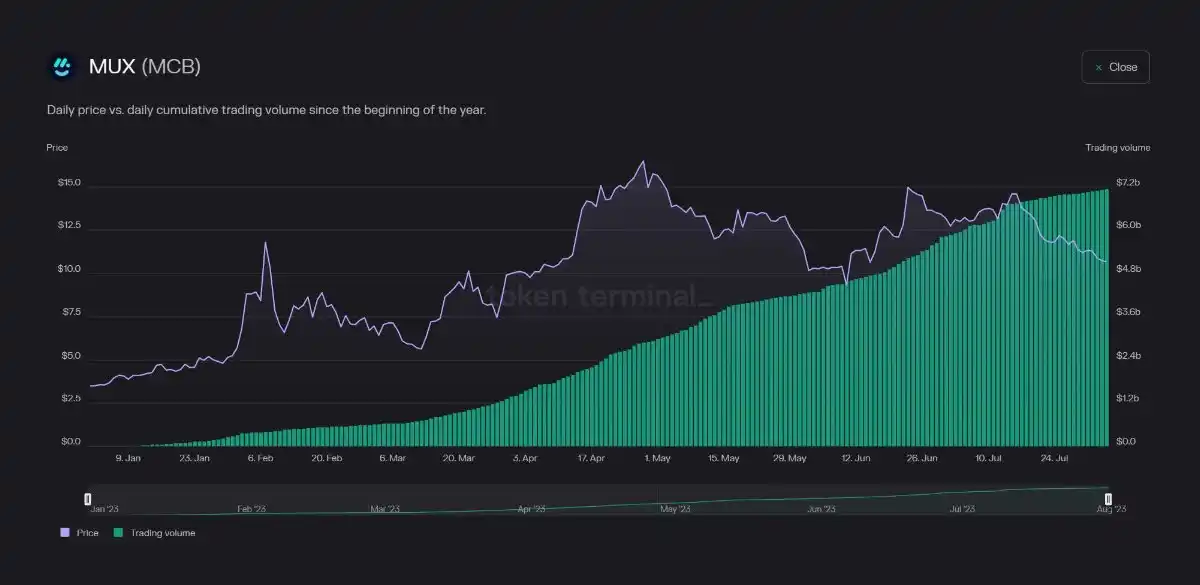

MUX is a cross-chain leverage trading protocol that has been deployed on 5 different chains, with a trading volume growth of over 300% this year. This can be attributed to its cross-chain strategy and real yield in liquidity provisioning. Protocol V3 will focus on achieving cross-chain aggregation, pooling liquidity from multiple networks such as Arbitrum, Optimism, BNB Chain, Avalanche, and Fantom. This will further enhance the success and scalability of its aggregator.

Lyra

As one of the largest options trading platforms in the market, Lyra stands out with a daily trading volume of $586,000. The community has warmly welcomed their expansion to Arbitrum, as it has become the central hub for most of the activity. Lyra is about to upgrade, promising to build the best decentralized options market in today’s DeFi space, and provide:

– Options portfolio margin;

– Cross-margin between options and perpetual contracts;

– Multi-asset collateral.

At the same time, improving UX and building based on the OP stack.

Dopex

Dopex has $20 million in TVL and is a strong force in the options market. Despite having fewer assets under management than competitors, it compensates with a diverse range of products. These products include Atlantic Straddles and interest rate options.

The Dopex V.2 update aims to reduce liquidity fragmentation. Users will be able to more efficiently utilize centralized liquidity to create trading positions. @dLuxGMI has made a great explanation of this: This full protocol update will greatly unify liquidity and improve the user experience.

Currently, the derivatives market is one of the largest markets in the cryptocurrency field, and regulatory pressure and market growth will continue to provide favorable conditions for the development of this field.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!