Following the official announcement by LianGuaiyLianGuail on August 7th that they will soon launch their stablecoin LianGuaiyLianGuail USD (PYUSD) in the coming weeks, even though LianGuaiyLianGuail or LianGuaixos have not officially released the PYUSD token address yet, nearly a hundred fake PYUSD tokens have already emerged in the market, appearing on various decentralized platforms, chains, or networks such as Ethereum, BNB Chain, and Base. Most of these counterfeit tokens are already in circulation and have a considerable trading volume.

Scammers are attempting to capitalize on the attention and enthusiasm generated by LianGuaiyLianGuail’s launch of the USD stablecoin PYUSD by issuing fraudulent tokens on various networks to deceive investors. This situation has caused significant confusion, and under pressure, LianGuaixos shared the token contract, official contract, and Github repository with the public on the afternoon of August 8th through social media platforms.

A similar situation occurred with the creation of the “Ketai Coin” due to a coincidence. The movie “Guzhu Yizhi” was officially released on August 8th and has currently grossed 565 million yuan at the box office. The “Ketai Coin” purchased for 8 million RMB by the character played by actor Wang Dalu corresponds to the English subtitle “Ethereum”.

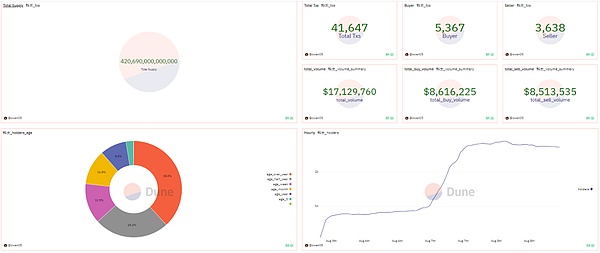

According to Dune data, the trading volume of the Meme token “Ketai Coin,” which shares the same name as the fraudulent coin in the movie “Guzhu Yizhi,” has exceeded 10 million USD (10.7 million USD). There have been 27,950 transactions on the chain, with a total of 2,882 holding addresses. It is now difficult to determine whether the movie “Guzhu Yizhi” created the Meme token “Ketai Coin,” or if the surge in the Meme token “Ketai Coin” attracted more people to see the scenes in the movie. It seems that everyone has forgotten the original intention of “Guzhu Yizhi,” which was to raise awareness among the audience about various scams, including virtual currencies.

- Thoughts on the Bitcoin Cycle The Market is Dynamic

- Glassnode The Bitcoin market is experiencing an unprecedented period of low volatility

- Evening Must-Read | Cryptocurrency Market Sees Endless Volatility, Where Are We Headed?

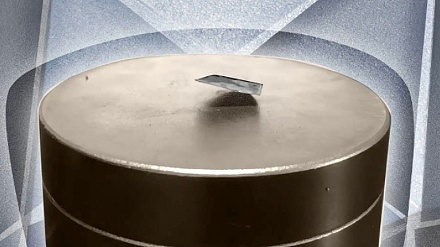

PYUSD is a stablecoin, and the movie “Guzhu Yizhi,” from which the Ketai Coin originated, can be considered a film related to the cryptocurrency industry. Therefore, the various Meme tokens that have emerged as a result are not completely unfounded. Last month, a team of South Korean scientists claimed to have designed a superconducting material called LK-99 that can operate at ambient temperature and pressure. In simple terms, the team claimed to have created a material that allows electric current to flow without resistance or energy loss. Previously, it was believed that such materials could only function at absolute zero temperature.

This so-called new breakthrough has not only caused a sensation in the scientific community but also oddly affected the cryptocurrency community. Just a few days after the release of the so-called LK-99 material, several Meme coins named LK99 or similar variations have already been listed on the decentralized exchange Uniswap (UNI). One ERC-20 LK99 token, in particular, surpassed a total trading volume of 3 million USD in less than 24 hours, and the “LK-99 Protocol” launched on UniswapV2 climbed to 0.01 USD, with a market capitalization of 1.7 million USD according to CoinGecko’s data.

The emergence of superconducting material LK-99 may be a good thing for humanity, as it has the potential to completely change fields such as battery storage, nuclear fusion power generation, and quantum computers. However, no matter how you look at it, superconductivity does not seem to be considered a field with meme value. Tokens like Dogecoin and Pepe have achieved astonishing value due to their recognition derived from internet meme culture, but superconductivity clearly lacks this attribute of public discussion.

Looking back, the reason why many meme tokens are able to emerge is mainly due to the combined effect of market demand, speculative sentiment, decentralized financial technology, community participation, and liquidity mining. These tokens generate attention on social media, and people invest in them due to opportunities for speculation profit, blockchain technology, community interaction, and liquidity rewards, thereby driving the generation and circulation of tokens.

The main reason why the crypto community is enthusiastic about meme tokens is that some investors seek to profit from short-term price fluctuations, and meme tokens happen to meet their speculative needs. Over time, investors will gradually realize that there is a huge gap between technological concepts and actual applications. Speculating on memes is more like a game that used to be called “passing the buck”, but now appears much more cruel.

Although the meme token market was once booming, it is inevitable that as the hype subsides, the problems in the market will gradually surface. The risks of speculative bubbles, lack of actual application scenarios, and insufficient recognition have posed challenges to the development of the meme market. In order to achieve sustainable and stable development, meme tokens need to constantly improve themselves, strengthen their connection with mainstream value coins, and play a greater role in practical applications.

For meme coins, we should perhaps maintain a certain level of calm and restraint, after all, for all projects to have a healthy development, they should ultimately return to the value itself. We urge users to be vigilant, trade cautiously, and avoid losses.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!