Original author: Splin Teron, Crypto KOL Translation: Felix, BlockingNews

Regarding the recent developments in the FTX bankruptcy case, BlockingNews has compiled the latest updates and background information on the event, based on the long tweet of crypto KOL Splin Teron.

On November 11, 2022, FTX announced the start of bankruptcy proceedings. The exchange website posted a notice stating that the company was unable to process withdrawals. Subsequently, FTX founder SBF was arrested by US authorities in the Bahamas. Former FTX executives accused SBF of guilt after pleading guilty. After being extradited to the United States, the former FTX executive was released on a $250 million bond. However, SBF did not plead guilty, which makes sense because if he did, he could face more than 115 years in prison. Subsequently, SBF continued to face new charges, this time for bribery. According to reports, the US federal court charged SBF with directing the transfer of at least $40 million in cryptocurrency to bribe Chinese government officials. According to the charges, this transaction was to influence and induce Chinese officials to unfreeze the cryptocurrency account of FTX subsidiary Alameda Research.

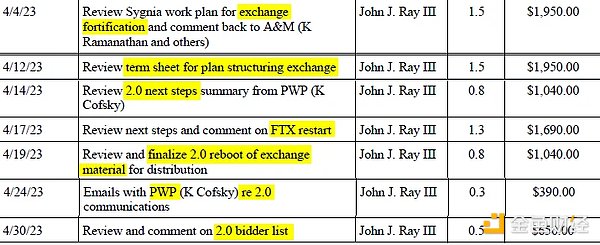

The founder was arrested, but FTX seems not to have ended. According to court documents, bankrupt cryptocurrency exchange FTX may restart, with new CEO John Ray developing a restart plan. The plan was first discussed in January.

- Exploring the Azuki NFT Elementals minting details

- OKX Ventures May 2023 Monthly Report: Covering LSD, Decentralized Derivatives, and MEV Tracks

- Explaining the new gameplay and representative projects of interactive recursive runes

In April, it was reported that lawyers said FTX had recovered $7.3 billion. The FTX team’s goal is to restart trading between the third and fourth quarters of 2024. Court documents show that the CEO has been meeting with creditors and debtors. Alfred Lin, a partner at Sequoia Capital, also claimed that the launch of FTX 2.0 is in preparation.

In April, it was reported that lawyers said FTX had recovered $7.3 billion. The FTX team’s goal is to restart trading between the third and fourth quarters of 2024. Court documents show that the CEO has been meeting with creditors and debtors. Alfred Lin, a partner at Sequoia Capital, also claimed that the launch of FTX 2.0 is in preparation.

However, the road to bankruptcy liquidation is not smooth. Bankruptcy lawyer Katherine Stadler said FTX has spent more than $200 million on bankruptcy proceedings, costs have reached 2% of legacy assets and 10% of reported cash, and it is worth noting that among the 242 lawyers involved, 46 people have an hourly wage of more than $2,000. Among them, according to data from The Block, FTX paid $121.8 million in legal, consulting and financial service fees from February 1 to April 30.

Not only do lawyers’ expenses add up, asset recovery is not an easy task. It is reported that FTX has filed a lawsuit against some investment companies that were associated with it before its bankruptcy in the Delaware bankruptcy court. The lawsuit was filed on June 22 and includes 16 charges, demanding compensation of over 700 million US dollars. The defendants in the lawsuit include incubator and investment companies K 5 Global, Mount Olympus Capital, and SGN Albany Capital, as well as affiliated entities and joint owners of K 5 Global Michael Kives and Bryan Baum.

One wave has not settled before another rises. Recently, Bloomberg, Dow Jones, New York Times and other institutions appealed the court’s ruling to protect FTX’s customers. On June 9th, Judge John Dorsey authorized FTX to “permanently delete” the names of individual customers from all filed documents in order to keep customer names confidential and protect FTX’s legal rights. It is reported that bankrupt companies generally need to disclose the names and debt amounts of their creditors, including the debts of individual customers, but the US bankruptcy law has exceptions for information that may create identity theft or other risks.

Fortunately, major institutions are interested in taking over FTX. According to court documents filed in the Delaware bankruptcy court on June 22nd, FTX’s consulting company Alvarez & Marsal has announced the sale of the company’s assets under the provisions of the US Bankruptcy Code. A list of companies interested in acquiring FTX has also been published. These include Ripple Labs, Galaxy Digital, BlackRock, Tribe Capital, Robinhood, NYDIG, and OKCoin, among others. However, this is not an exclusive list of potential buyers or investors, but those interested in FTX. FTX’s debtors plan to select a “first bidder” in the third or fourth quarter of this year. One of these companies is likely to become the first bidder.

It is worth noting that FTX’s bankruptcy is only the fuse, and regulatory issues have become the most “headache” issue in the cryptocurrency industry. According to statistics, in the six months before FTX’s bankruptcy, the SEC took about 6 enforcement actions; in the six months after FTX’s bankruptcy, the number of SEC enforcement actions related to cryptocurrencies surged by 183%, reaching 17. This number does not yet take into account the two lawsuits filed by the SEC against Binance and Coinbase, and the regulatory situation is still unclear as the cases have not been ruled on yet.

As the biggest victim of the FTX bankruptcy, users are still waiting for specific information regarding the return plan for their losses. However, some users have found an alternative solution. On June 23, Foundation, a liquidity platform on the bankruptcy claim chain, revealed on Twitter that an address marked as “wagmiclaims.eth” had tokenized its $31,307.81 FTX claim on the platform, turning it into an NFT that represents the claim right. Then, the user used the NFT as collateral to obtain a $7,500 loan in the NFT lending DeFi protocol Arcade xyz, which helped to recover some of the losses. As for whether other users will be able to recover their losses and how much, as well as whether the FTX restart plan can be realized, BlockingNews will continue to follow up.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!