Original Author | Ann

Original Translation | BaiZe Research Institute

In the past few days, the cryptocurrency community has been strange. Ethereum maximalists have shown a self-righteous attitude that is only comparable to Bitcoin maximalists in terms of annoyance.

I understand. This situation started with the Multichain vulnerability, and unfortunately, it has the greatest impact on the Fantom blockchain. I don’t know why this makes Ethereum maxis feel superior to others, because similar vulnerabilities could also occur on Ethereum.

- New phishing alert: Attackers on BNB Chain are using fake authorizations to deceive users into giving away Gas.

- Why is weather-beaten UAE a promising region for Bitcoin mining?

- Developer Report 2023: Developer population has decreased by 22% compared to last year, with almost half of new developers leaving the field.

Goodbye to Web3 Social

Yes, Zuck is dividing up this big cake of social media.

But what does this really mean? What is the impact of Threads, the “Twitter competitor” launched by Meta CEO Mark Zuckerberg, on the cryptocurrency industry (especially Ethereum)? Will it have a more significant impact than Elon Musk’s Twitter?

The real victim is not Twitter, but Lens Protocol-the advocate of our Web3 social media future.

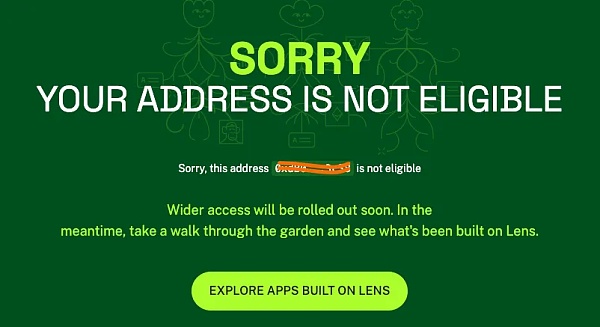

I have been following the development of Lens. It has been launched for more than a year now, but unfortunately, they still restrict their services to invitees only, and check access.

Musk has messed up Twitter several times, and competitors have taken the opportunity to join in. First, it was Mastodon and Nostr, and then Threads. Opportunities have appeared time and time again, but Lens Protocol has missed them every time. This time is no exception.

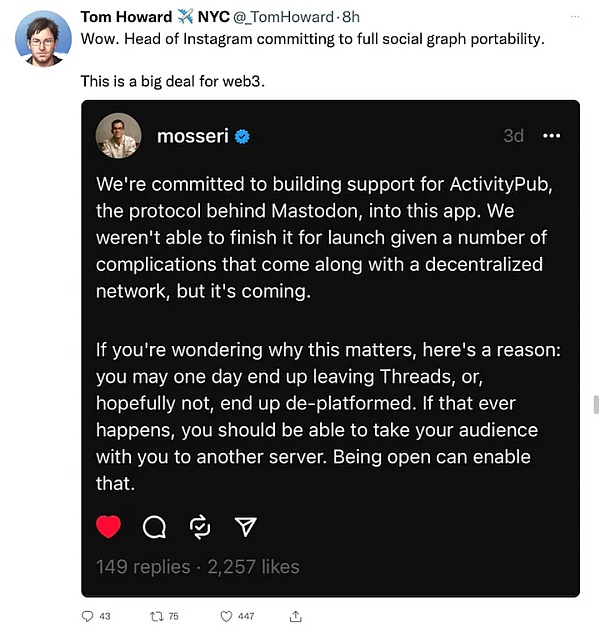

To make matters worse, Meta also plans to make Threads what crypto enthusiasts imagine: you can move your profile and data to any other service or platform.

If Meta can really solve this problem, then we can completely say goodbye to the slow Lens Protocol.

Regarding why the development of Lens is not as fast as we hoped, I have a theory, which I will explore later in this article.

dYdX launches Cosmos-based application chain

Recently, dYdX also coincidentally released the v4 application chain testnet based on Cosmos. It happens that some Ethereum maxis gave Cosmos a hat, saying that there are no applications on Cosmos.

These people easily forget that dYdX’s decision to transition from the L2 solution StarkWare to Cosmos is considered one of Ethereum’s biggest backlashes. What is wrong with Ethereum that a mature protocol like dYdX decided to go their separate ways?

The reason why dYdX chose to abandon the L2 solution is the same reason why you shouldn’t bet 100% on Ethereum.

Ironically, one of Ethereum’s biggest problems for other L1s is that it is too focused on infrastructure (do we really need more new dApps to crash and significantly increase Gas fees when the Ethereum mainnet is congested?), so in fact Ethereum hasn’t built much that makes sense for large-scale adoption (Gas fees are still high).

Some people believe that consumer-oriented applications will be built on top of L2, rollups, but the latter are mostly in continuous development.

So it can be said with certainty that if cryptocurrencies are considered as a whole, any development aimed at large-scale adoption has been stagnant. Ethereum seems to have built many new dApps, but if you look closely, they may just be a new derivatives trading platform, NFT, etc. – many of which are not the applications we need for large-scale adoption.

“A smart contract platform with the largest number of dApps” is indeed a sufficient reason in some cases, but it certainly cannot be used as a reason for Ethereum maxi to belittle competitors.

Ethereum may be the best choice for investment or application development at present. It is relatively stable to some extent because it is a native asset (no bridging risk) and has a high staking rate (liquidity stability), and also provides decent returns for stakers. Staking is currently at an all-time high, and the new narrative of “re-staking” is gaining momentum.

But is it really wise to bet 100% on Ethereum?

SImplicity is the key to mass adoption by eliminating complexity – user experience

In the DeFi user experience, “simplicity” is always preferred, especially from the perspective of Web2 users and non-developers. Users must face the issue of inefficient capitalization of distributing ETH to various L2 solutions, just to save on Gas fees.

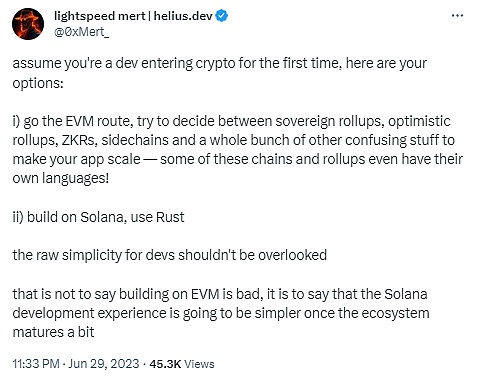

Choosing between L1 and L2 is confusing. What is the reason to choose one blockchain over another when building a dApp? Which blockchain is not only the best right now, but also future-proof as blockchain technology rapidly advances and market demands continue to evolve?

The decision is important.

Now let’s talk about Lens Protocol again.

I have my own hypothesis for why they always miss the mark as a Twitter competitor. It’s because they’re building on Polygon. I don’t know what their reason is (besides the fact that they have Polygon Ventures as a backer), but it’s clear that it’s a bad choice.

As you know, Polygon is slow. I don’t think it has the capability to support a social media app that could potentially have millions of users. Additionally, it’s currently planning to upgrade to Polygon 2.0, which puts existing dApps built on it in an uncertain state. Will they be able to migrate seamlessly? Is staying on Polygon still worth it when there are better blockchains out there?

Building a dApp in the rapidly iterating crypto industry is a risky business in itself, as one wrong move could result in real financial losses.

Developers need to choose the best place to build. Some serious developers with strict technical requirements often end up choosing the Ethereum mainnet. Especially when they know their target market is DeFi whales. This is what happened to Blur (a professional NFT trading platform) and the recently launched EigenLayer. There’s a reason why any hyped-up project ultimately ends up on the Ethereum mainnet. I wouldn’t say it’s “innovation at its finest”, more like “closed innovation at its finest” because very few users are capable of regularly playing on the Ethereum mainnet. We can’t just cater to whales.

Conclusion

The complexity itself is enough reason to seek alternatives, and dYdX’s departure from Ethereum L2 is a good example of this. After all, the practice of “never put all your eggs in one basket” is wise.

Whether you’re an investor or a developer, if you’re still unsure about this, rest assured that even the most fervent Ethereum supporters secretly fund other L1 solutions, as I’ve mentioned in my previous article (the author alludes to Ethereum maximalist Cobie investing in a new L1 Monad this year). I bet there are plenty of these people out there.

Risk Warning:

According to the notice on further preventing and dealing with the risk of virtual currency trading speculation issued by the central bank and other departments, the content of this article is only used for information sharing, and no promotion and endorsement is made for any business and investment behavior. Please strictly abide by the laws and regulations in your area and do not participate in any illegal financial activities.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!