Author: Jameson Lopp

Translation: Eric, Foresight News

In the past decade, the scale and complexity of the cryptocurrency ecosystem have grown explosively. While the majority of projects can be considered scams or have terrible ideas, one percent of them have managed to innovate and find products that fit the market.

This has led to the evolution of Bitcoin maximalism, but with the appearance of forks, it has also become more complicated. Unfortunately, as I will explain throughout this article, certain aspects of the well-known “maximalist culture” are not conducive to the adoption of Bitcoin.

- HUBDEX Exchange Former Blockchain Rising Star Accused of Pyramid Scheme Crime

- Lawyer’s interpretation of the Hubdex case How did a former blockchain star go astray in the realm of pyramid schemes?

- Explained in One Article | Will USDT Tether be the Biggest Bombshell in the Cryptocurrency Community?

This article will discuss:

- Milestone events in the history of Bitcoin maximalism

- Description of variants of maximalism and the pros and cons of bad behavior

- Providing warnings and advice for moving forward

A History of Bitcoin Maximalism

Genesis

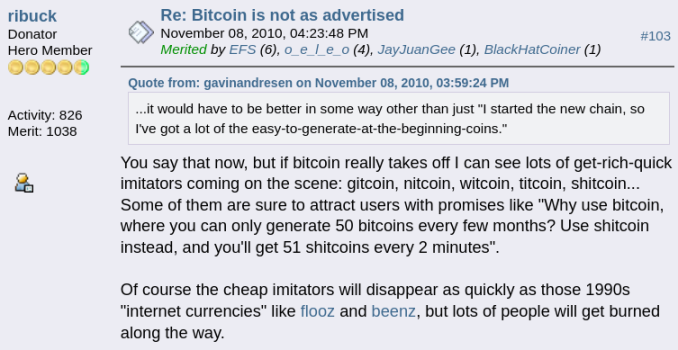

Long ago, before the “Bitcoin Twitter” formed a community, the epicenter of Bitcoin discussion and culture was the BitcoinTalk forum. It was a simpler time, with hundreds of new networks being launched regularly, and their creators promoting them through [ANN] posts in the altcoins section. Almost all of these projects were simple modifications of the Bitcoin codebase, with the main changes being in marketing and lacking substantive content. The term “shitcoin” also originated in the context of creating worthless Bitcoin clones:

Most of these altcoins were pump-and-dump schemes, and as a defense culture emerged from the large number of Bitcoin users being scammed and harmed by unfair economic models. We agreed that “premining” tokens and distributing them to insiders was unethical, and many believed that even if altcoins managed to innovate and create value, that innovation would eventually be absorbed by Bitcoin, rendering them potentially seen as Bitcoin’s testnet and discarded. The altcoins included scams and some meaningless attempts, making them all junk coins that were neither suitable as sound money nor investments.

Extremism certainly existed in the early days, although the term had not yet been coined. Faced with worthless altcoin projects, minimalists tended to firmly say “no, thanks”. Many of us found it distasteful that some people thought they could quickly get rich from Bitcoin clones.

In the early post-Satoshi era of protocol development, when Gavin Andresen was the project maintainer, there wasn’t actually much of an organized development team. Everyone who contributed to the codebase was a volunteer—there was no money to fund development. Therefore, Bitcoin needed a developer culture. One way to attract and retain talented contributors was to prevent them from joining other projects by portraying altcoins as useless scams (which they often were).

In the early years, various aspects of the network were weak, so it was very important to avoid the vampire effect of altcoins. Without the methods mentioned above, the development of Bitcoin may not have achieved self-guidance in the next few years, and we have seen a significant improvement in the understanding of the advantages and disadvantages of the protocol by the talent pool.

By 2014, Bitcoin had a fairly active group of technical contributors. With the release of the sidechain white paper, the future began to brighten: we finally found the answer to how people can innovate within the Bitcoin ecosystem without risking harm to Bitcoin itself. In 2015, the Lightning Network white paper showcased further innovation in low-latency, bulk transactions. Bitcoin maximalists were pleased, as the hyperbitcoinization was clearly underway.

Of course, just a few months later in 2015, we saw the launch of Ethereum, a new approach to cryptographic asset protocols. This marked a major shift in the development of cryptographic asset protocols.

“Toxic” Bitcoin Maximalism

Mircea Popescu was a leading figure in early Bitcoin maximalism before it even became a term, and he was a prolific writer who spread some enduring ideas. Some of his followers from La Serenissima are still active today and have gained influential positions on social networks…

Mircea’s followers, sometimes referred to as #bitcoin-assets residents (their space on IRC), have formed a unique culture. In their eyes, if you don’t have a GPG key on the WoT (Bitcoin-OTC trust network), then you are not “one of them”. If you do successfully join the WoT, then you need to engage in meaningful interactions and transactions to earn recommendations from other WoT users.

Popescu was the administrator of the IRC room, and if you didn’t fit into their culture, didn’t understand their jargon, and had a low tolerance for prejudice, misogyny, and racism, you might find it uncomfortable. Mircea didn’t care much about his communication effectiveness and would make exaggerated and hard-to-understand statements without caring how others interpreted them. For example, in his article opposing SegWit, he decided to “explain” his viewpoint by offering a bounty for the assassination of a protocol developer. Although he did this to present an interesting point about verifiability, most readers didn’t pay attention to this point due to his shocking values and lack of detailed explanation.

The #bitcoin-assets team strongly opposed changes to Bitcoin to the point that they forked Bitcoin Core 0.5, created the “real” Bitcoin Foundation, and maintained their own full node implementation.

Due to significant friction and ineffective external work, this group remains quite niche. Although Mircea himself has not been able to expand his influence beyond the IRC room (he was banned from using Twitter for making death threats against Andreas Antonopoulos), some of his followers have imitated his behavior on other platforms…

“Bitcoin Maximalism” is becoming popular

Vitalik Buterin popularized the term “Bitcoin Maximalism” in 2014:

“Recently, there has been a new idea that has attracted attention in some parts of the Bitcoin community, which I and others have described as ‘Bitcoin Maximalism’ – essentially, this ideology believes that it is undesirable to have an environment with multiple competing cryptocurrencies, and launching ‘another token’ is a mistake, and Bitcoin’s monopoly position in the cryptocurrency field is legitimate and inevitable.”

Although Buterin did not create this term (it was already in use before, as you can see from his previous blog posts), he did play a role in positioning Ethereum and its views on cryptocurrencies as mainstream views, at a time when the mainstream thinking was that “altcoins are unethical scams”. The term “maximalism” is obviously meant to remind the Bitcoin community of a certain closed-mindedness or lack of imagination, and can even be seen as anti-free market.

In the following years, as countless projects were launched, some Bitcoin maximalists updated their views and became more nuanced, but still considered themselves Bitcoin maximalists because Bitcoin was clearly different from all other projects and had no real competition in the monetary field. The views of other extremists became even more extreme, as they believed that everything outside of Bitcoin was actually a scam, and focused on shaping the narrative to support this view.

Bitcoin Scaling War

By 2015, we saw a massive migration from BitcoinTalk to the Reddit forums, which had already accumulated over 150,000 subscribers (now close to 5 million). While BitcoinTalk did have administrators, it was also a forum composed of many sections for different topics, so as long as you posted in the appropriate section, you didn’t need to be too restrained. Reddit, on the other hand, was a different platform. With moderators and rules for different sections, and the ability to modify the visibility of content through voting, I see Reddit as a platform that incentivizes groupthink and emotional feedback rather than rational debate. The result of this was that large sections inevitably turned into “echo chambers,” where if you tried to discuss a conflicting idea, your post would be downvoted and forgotten without much discussion.

As the debate over how to scale Bitcoin grew, the moderators of /r/bitcoin decided to ban discussions of hard fork proposals. And “technological maximalism” (everything will become a Bitcoin sidechain) became a turning point as its views were imposed on mainstream discussions. Why? Because the /r/bitcoin moderators were influenced by Theymos and immersed in technical discussions on development mailing lists. So they simply brought their norms to the attention of more followers on Reddit.

Naturally, the decision by the /r/bitcoin mods to ban the discussion of certain topics has sparked strong opposition and prompted many to migrate to the /r/btc subreddit. Now, 7 years later, users of /r/btc are still “howling” over the loss of the scaling war due to the “censorship regime”. If you want to delve into their grievances, you can check out “A History of Censorship in /r/Bitcoin”. Personally, considering that the discussion on Bitcoin scaling took place on various platforms that were not run by Bitcoin supporters, such as Twitter, I think it is foolish to dwell on this. The key point is: anyone who cares about the scaling debate is well aware of both sides’ positions.

During the scaling war, a large community formed on Twitter, sparking many debates. While this is undoubtedly a positive factor for the Bitcoin culture gene, helping us reach millions of people and strengthening their awareness of Bitcoin, there is reason to believe that the quality of discourse on Twitter is a negative factor. Reddit’s mechanisms and algorithms tend to suppress controversy and create an “echo chamber”, while Twitter’s participation mechanisms have been optimized to amplify the impact and engagement of controversial posts. In addition, the limited length of tweets often leads to high visibility but lack of substance. While this can be an interesting game, it is not particularly healthy for the quality of discussion.

Avoiding Derogatory Terms

The history of cultures redefining derogatory terms is long-standing. I believe this also makes sense in Bitcoin maximalism, as we are talking about ideological differences: what many find repulsive Bitcoin maximalism is actually highly desirable to an acknowledged group. I also believe that while minimalism is one way to govern the crypto ecosystem, it is also an ideal. Please remember that Vitalik’s use of this term was for “maximizing dominance”, meaning the crypto ecosystem would be dominated by Bitcoin. Although Bitcoin undeniably holds dominance after 14 years, it is not as the minimalists hoped.

During the scaling war and the 2017 ICO hype, the use of the term “Bitcoin maximalism” regained significance. It seems that in mid-2018, the use of “toxic” Bitcoin maximalism as a descriptor started to rise again. It is worth mentioning that Bitcoin maximalists were later vindicated when it was discovered that 80% of ICOs were scams.

In the scaling debate, we saw Samson Mow start producing hats as a new form of social signaling. The first hat was “Make Bitcoin Great Again” and “Make Ethereum Immutable” (mocking The DAO fork incident).

The hat manufacturer Mow has sold more than 10 styles in the next few years; at the end of 2019, we saw Samson Mow wearing a “toxic extremism” hat because this term was being used more frequently – this is a social signal that indicates which camp you belong to, whether you only use Bitcoin or use multiple tokens.

It can be fair to say that around 2017, the redefinition of extremism was a resurgence of the ideology. This was a response, partially due to the fact that technical extremism promised that sidechains would trigger an explosive growth of Bitcoin-related innovations, which did not materialize. But compared to the stagnation of sidechains, Ethereum and other protocols have seen increased adoption and iterative introduction of new features. As the notion of technical extremism gradually became untenable, people needed a new narrative that could succeed without the need for sidechains. This is what Mircea provided in the form of users adopting his style as #bitcoin-assets and imposing it on discussions.

By redefining this derogatory term, Bitcoin holders use it as a social signaling mechanism. We can also see extremists sending similar signals when expressing the view that “Bitcoin is not a cryptocurrency”. Although technically this statement is not accurate, it implies the significance of the deep differences between Bitcoin and all other cryptographic asset protocols.

A World of Unity

In 2018 and 2019, we saw the embryonic form of becoming the next cornerstone of typical Bitcoin supremacy. Bitcoin standards were released, countless new memes were created and entered people’s field of vision.

The Bitcoin scaling war did not end spectacularly, but rather came to a halt in years of “whimpers”. By 2020, it became clear that a large number of large block Bitcoin forks did not have strong appeal. Many OGs who were actively involved in the Bitcoin scaling war became tired, but this provided an opportunity for newcomers to fill the void. Soon after, the COVID-19 pandemic provided an opportunity, with many autocrats being criticized and money printing machines running at full speed.

During the COVID-19 pandemic, we saw the accelerated development of extreme lifestyles, which benefited from the strengthening of certain extreme cultures (such as “laser eyes” and political populism).

It should be noted that I myself have participated in some of the activities mentioned above, which is not a judgment on any of the above topics.

The COVID-19 pandemic greatly accelerated the evolution of the Bitcoin supremacy ideology, shifting from traditional face-to-face activities to new media forms such as virtual reality. The chaos caused by the pandemic made it crucial to explore other content distribution channels, and those who participated through social media were the primary beneficiaries. A large number of newcomers with limited knowledge of Bitcoin took the lead in these new stages, while other Bitcoin enthusiasts sought information and entertainment on these stages. Due to the borderless nature of Bitcoin interest groups, Bitcoin enthusiasts have gained the upper hand in this new era of network interaction. Early Bitcoin users were often intelligent and counter-thinking individuals who were willing to discuss and innovate against the authoritarianism associated with the pandemic.

The travel restrictions during the pandemic have also played an important role in shifting people’s attention towards the United States. This helps to enhance the image of Americans who are less affected by the lockdown, making the narrative after 2020 largely inclined towards digital gold. This statement is not new for Bitcoin (it has always been dominant), but logically, it is more attractive to those who can use modern financial infrastructure, as well as those who need to pay US taxes.

During this period, I also observed an accelerating trend of “thought leaders”. I saw educators and builders being overwhelmed by those who appear to be artists and performers. Those who excel at “growth hacking” have accumulated a large audience despite providing superficial content. This situation was already present before the pandemic, but now it is even more serious.

The problem is that the lessons of the “scaling war” are very complex and not easy to understand intuitively. If you want to increase your engagement and influence on social media networks, this content is not suitable for you.

What happened afterwards?

New platforms focus on storytelling. Some “veterans” started telling “great war stories” to naive newcomers. Afterwards, the newcomers started participating in oral storytelling, recounting the traditions of the previous generation, but they did not have first-hand information, so their perspectives lacked innovation and were like copies.

The economics of these platforms (Clubhouse, SLianGuaices) are designed for lengthy monologues, so their participation mechanisms only further stimulate this behavior.

Mainstream Bitcoin culture has thus degenerated from the expression of ideas (the debates of the era in 2017) to the reenactment of old stories. The old enemies have been replaced by new enemies that are more in line with the trends of the times, but we have retained the spirit of the past “Bitcoin players against the world”, which leads to many newcomers excessively defending their beliefs. It is worth noting that this is a recurring cycle, as in 2017, people talked about how good the discussions in 2014 were, and in 2014, people reminisced about the discussions in 2011. This is a natural phenomenon that occurs when a community transitions from being niche to mainstream.

The Counterattack of Anti-Extremists

The toxic extremism of extremist extremists makes many moderate supremacists uncomfortable. Those extremists who dare to speak out openly have accumulated a large audience, and they have to make a decision: continue to talk about what they find interesting and endure insults, or self-censor and confine themselves to the echo chamber of Bitcoin? From a cultural perspective, this is somewhat regrettable, as the cicada effect is certainly produced when some public figures succumb to the captivity of the audience.

Some moderate extremists have turned into provocateurs of extremists, and these people are called “anti-extremists” (Antima). They like to point out the weaknesses/hypocrisy/disgusting behavior of more extreme extremists and stimulate them in every possible way. Nowadays, this also includes “using” Bitcoin in ways that pure extremists despise (such as Bitcoin NFTs).

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!