Since its launch on May 3, Sui has been online for more than 40 days. As one of the representative projects of the Move ecosystem public chain, Sui represents a different development direction from Ethereum L2. Since the project went live, there has been controversy, especially regarding its token issuance method and release model. Some people think that it may follow in the footsteps of ICP, while others believe that it may be similar to a new public chain in 2021.

What is the current status of Sui’s ecological development? How about token release and demand in the near future?

1. On-chain data

1. TVL

- Quickly understand recursive runes: ordinals with LEGO blocks

- Anarchism and Cryptocurrency

- Understanding the Development of NFT on Reddit

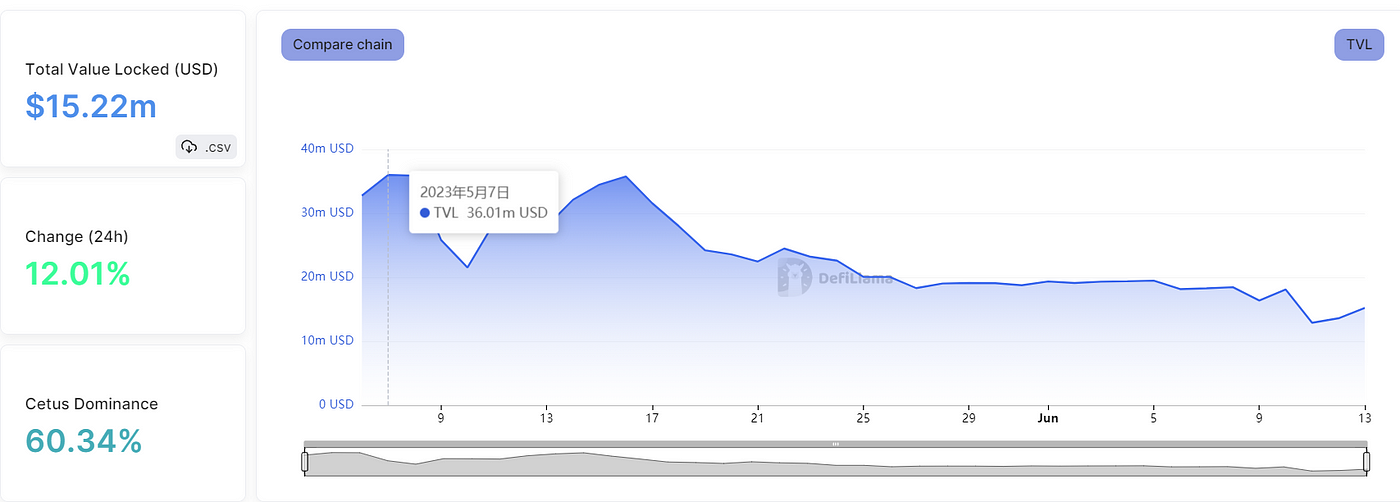

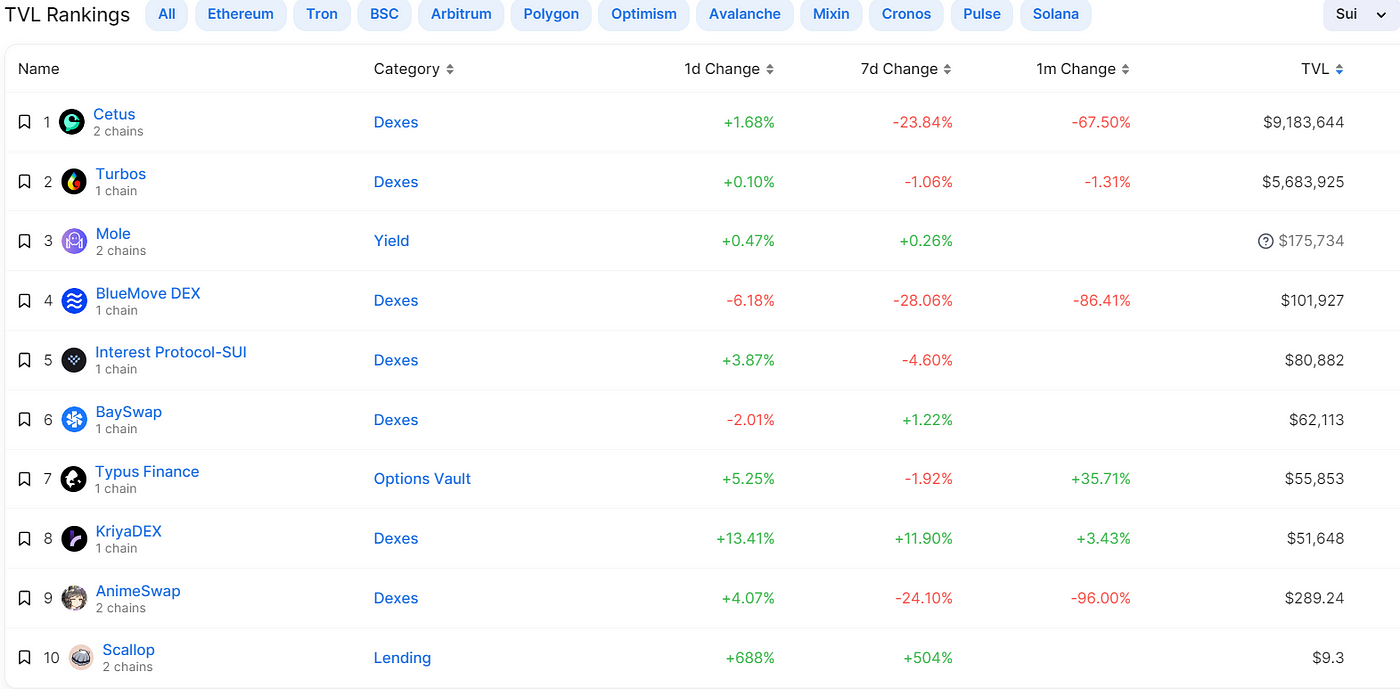

As of June 13, Sui’s TVL is $15.22 million, with DEX Cetus accounting for more than 60% of the TVL. Among all public chains and Layer 2s, this TVL ranks 54th. Its peak TVL was $36.01 million, which is equivalent to a drop of more than 50%.

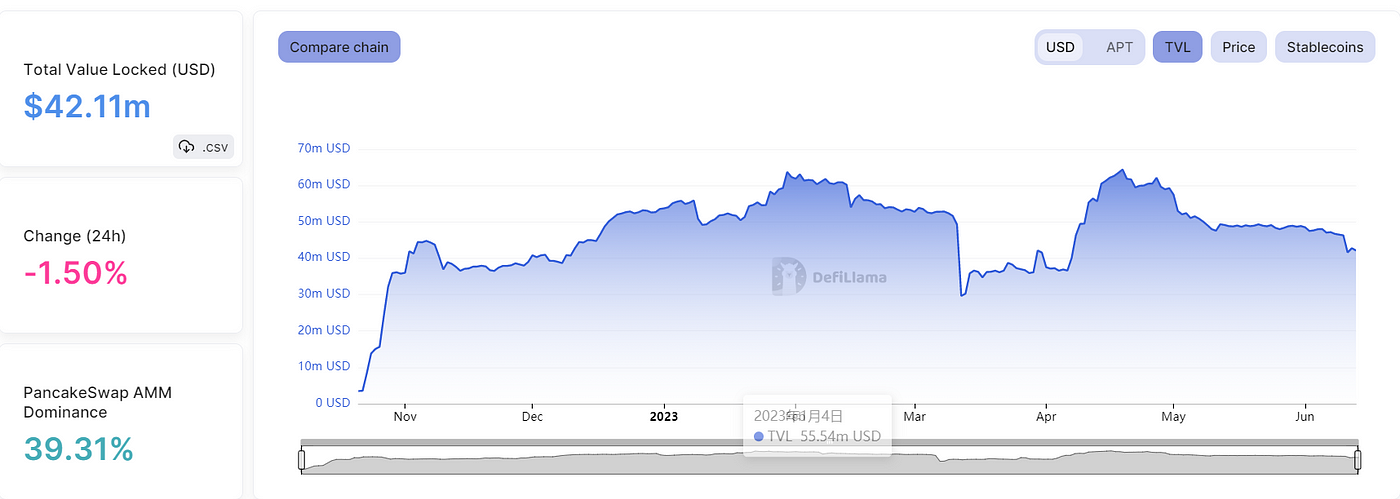

Compared with another representative project of the Move ecosystem, Aptos. Aptos’ current TVL is $42.11 million, with its highest value reaching about $65 million since it went online, ranking 34th in TVL.

2. Transaction volume

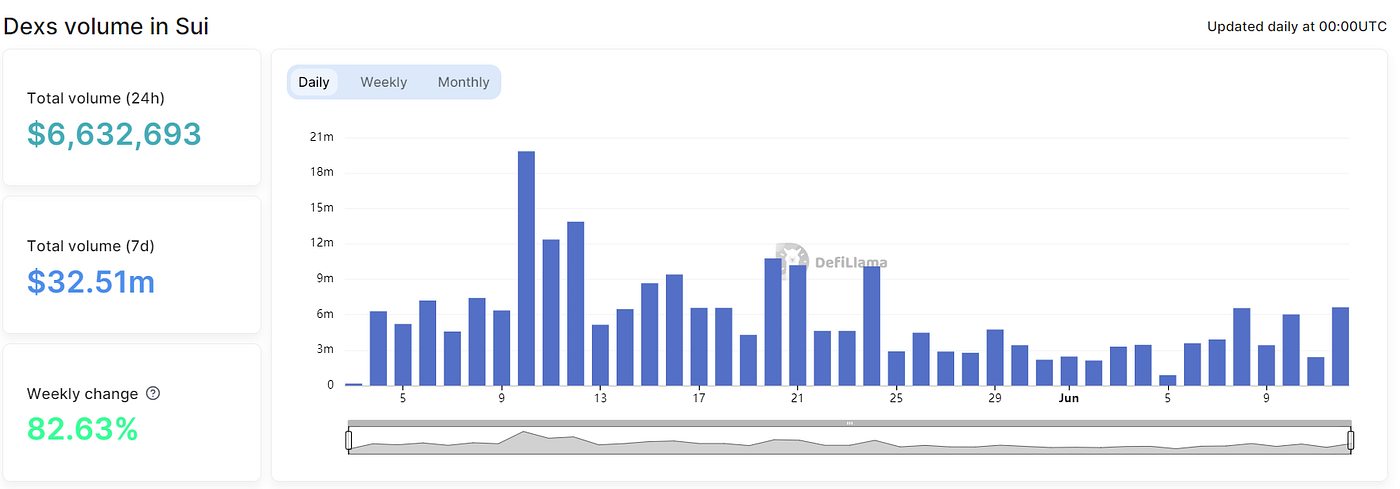

The highest daily trading volume on Sui’s DEX occurred on May 10, exceeding $19 million, and then declined. Since June, the daily trading volume has mostly been between $3 million and $6 million, with relatively low transaction volume.

3. Activity

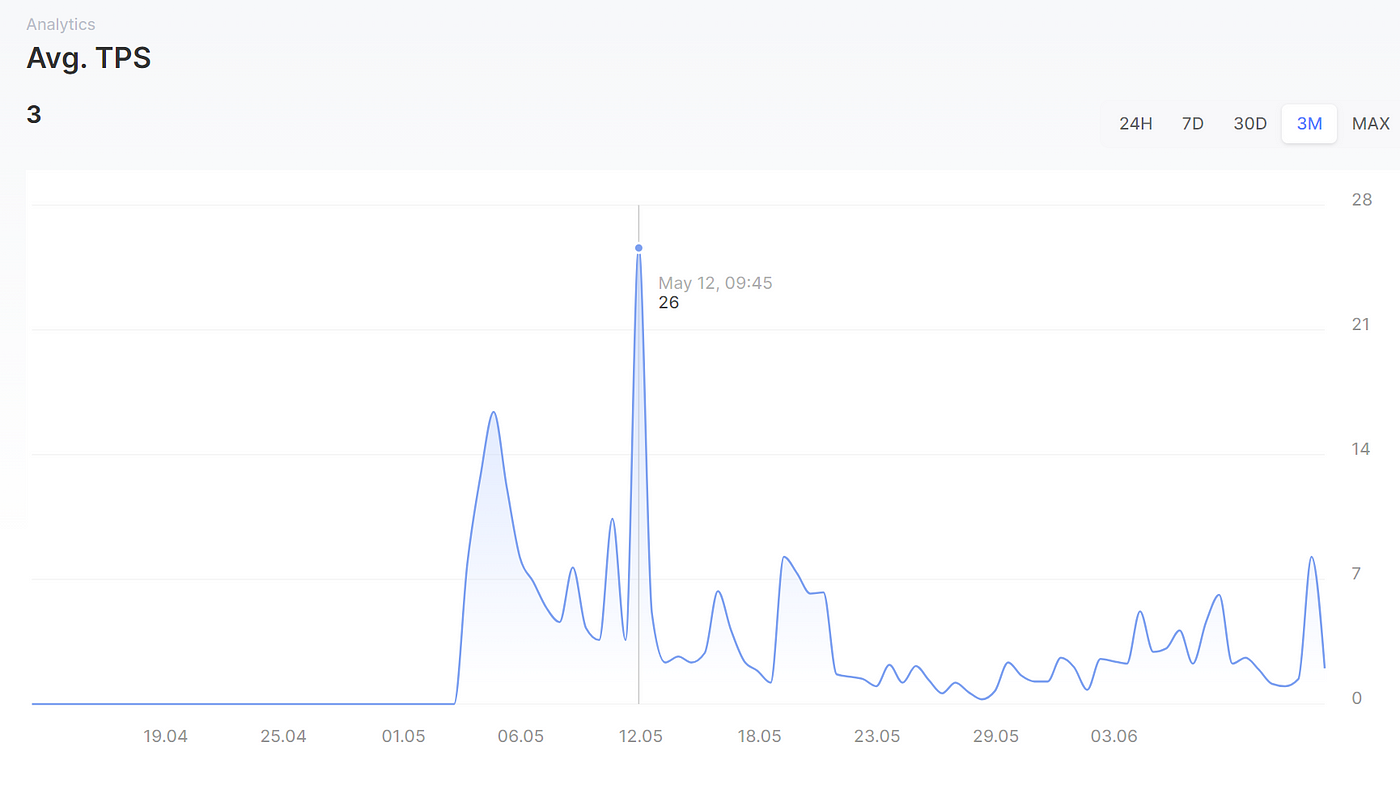

Since its launch, the total number of transactions is 16.53 million, the average TPS* is 3, the total number of active addresses is 850,000, and the number of active nodes is 104. As can be seen from the following graph, the highest TPS since its launch was 26, which appeared on May 12, the date of Turbos IDO.

*Note: Here, TPS refers to the actual TPS in operation, not the theoretical TPS that can be run.

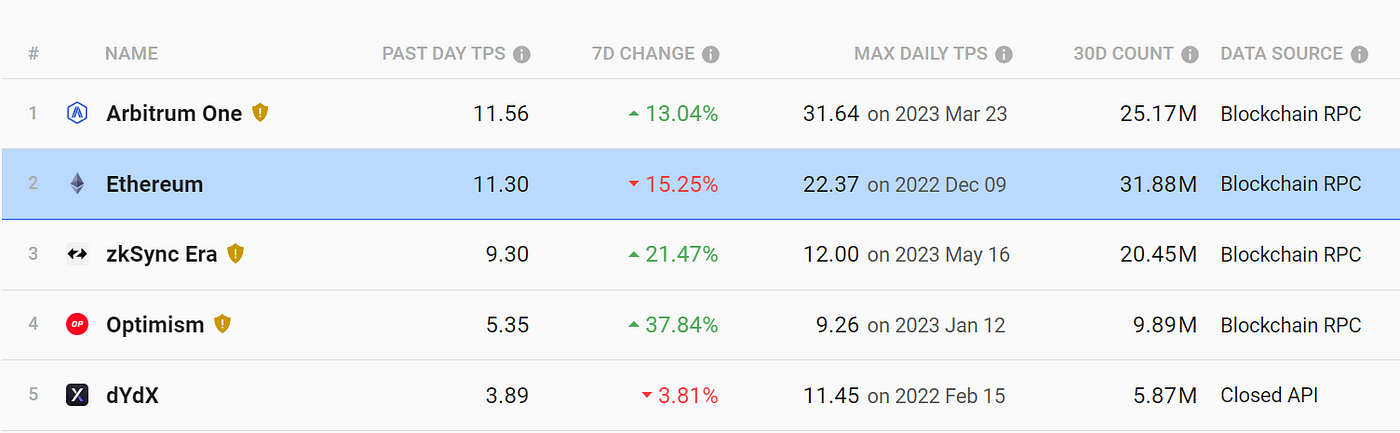

Compared to Ethereum L2’s TPS, Sui’s actual TPS is still very low.

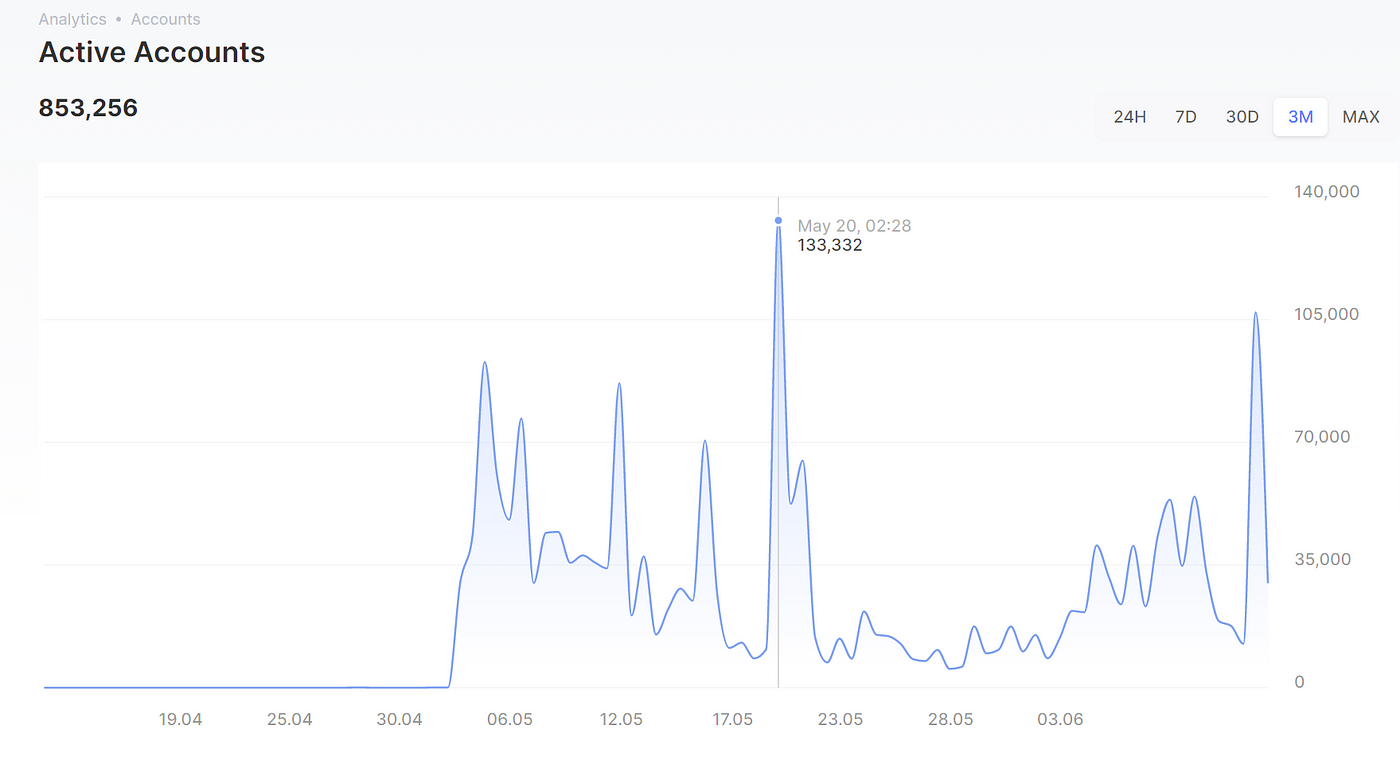

From the number of daily active addresses, the highest number of daily active addresses was recorded on May 20th, reaching 130,000, mainly due to the opening of the Cetus unlicensed pool function on May 19th and the meme project conducting a network-wide airdrop. On normal days, the number of daily active addresses is less than 10,000.

4. Cross-chain bridge

Currently, there are 3 cross-chain bridges that can transfer funds to Sui, namely Wormhole, kriya.finance, and WELLDONE. However, there is no corresponding data dashboard for specific cross-chain amounts.

II. Ecosystem projects

As of June 14th, a total of 66 projects have been included in sui.directory on the Sui official website. These projects are self-reported and many are still in testing and have not yet been officially launched.

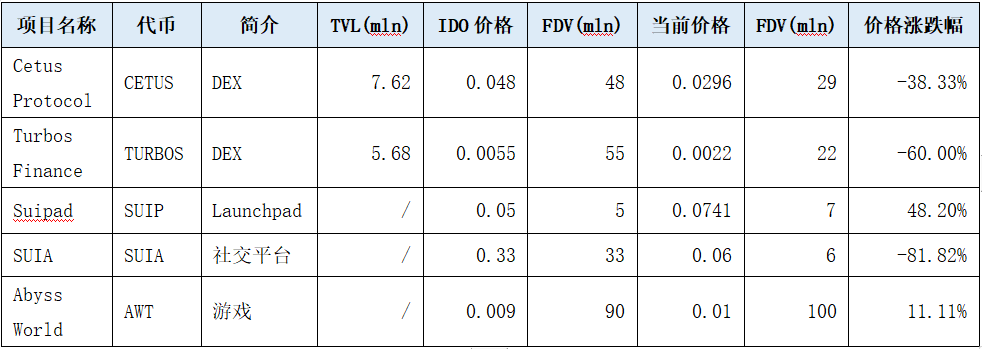

A brief summary of the projects that have already been launched, operated, and issued tokens on Sui is as follows:

Source: coingecko, defillama, LD Capital

It can be seen that most of the ecological projects on Sui have not performed well after they were launched. Both of the top DEX projects have broken through their listing prices. The social platform SUIA has fallen by nearly 81.82%. SuiBlockingd has performed relatively well, mainly because the pricing during the IDO was relatively low, with an FDV of only $5 million.

Both users and funds on Sui are relatively limited, which resulted in Abyss World choosing Polygon instead of Sui when conducting the IDO from June 1st to 4th.

III. Token release and demand

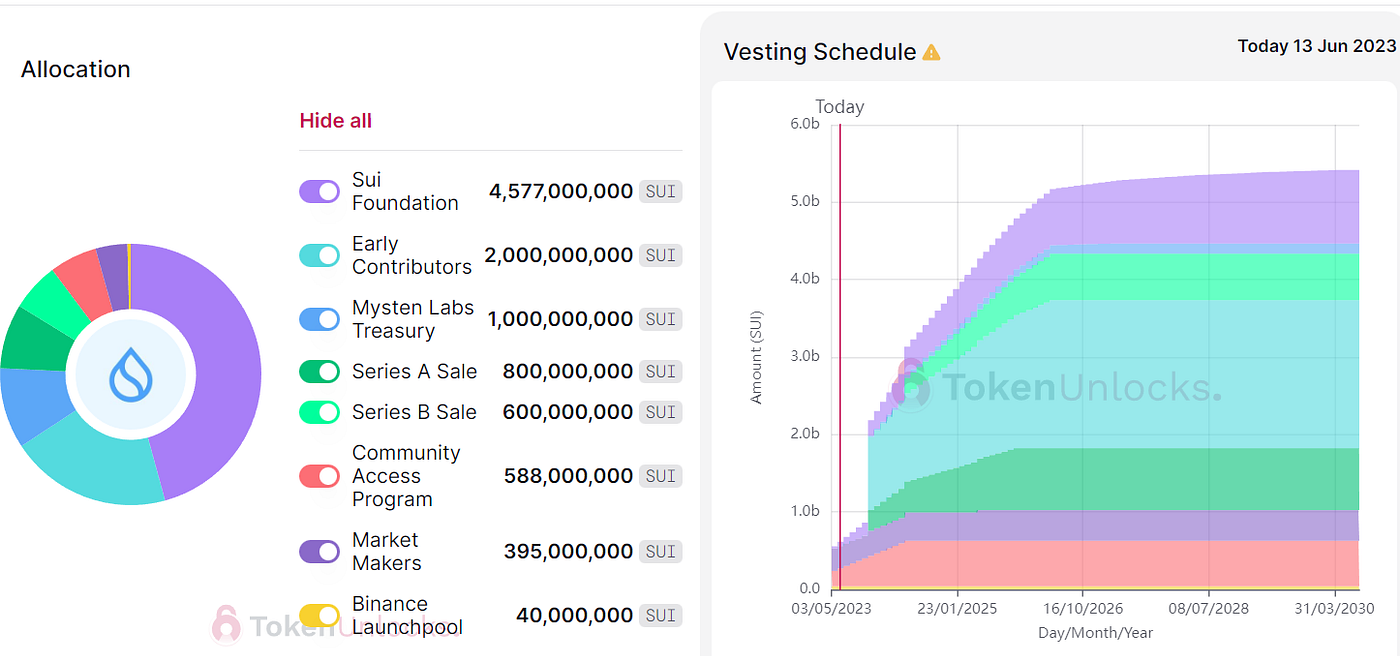

The token release situation of Sui is what the community is most concerned about. This is a token distribution and unlocking diagram from token.unlocks, using data from relevant reports from Binance. The total number of tokens is 10 billion, and the initial circulation is 528 million, accounting for 5.28% of the total circulation.

Between May and October 2023, there will be two types of Sui token releases: those released from the IEO issuance of tokens on the exchange and those released as incentives for staking nodes. The IEO price was $0.1 per SUI token, and a total of 450 million tokens were issued through the IEO. During public sale, 1/13 of the tokens were unlocked, and thereafter 1/13 were unlocked each month, with full unlocking after 12 months. Thus, approximately 34.61 million tokens were released each month.

SUI token staking at nodes can earn token incentives, with a total of 1 billion tokens used for node staking incentives. During the first 90 epochs (1 epoch=1 day), 1.11 million SUI tokens were awarded per day. Thereafter, the reward decreases by 10% every 90 epochs. Currently, there are approximately 7.4 billion SUI tokens staked in the system, with an average APY of 5.61%. Based on this calculation, the circulating supply of these tokens will increase by 33.3 million per month for the first three months after launch and by 30 million per month for the fourth to sixth months after launch.

Therefore, the combined IEO and node staking incentive token release will be 67.94 million tokens for the first three months, accounting for 0.67% of the total token supply, with a calculated market value of approximately $47.55 million. For the fourth to sixth months, the number of tokens released will be 64.61 million, accounting for 0.64% of the total token supply, with a calculated market value of approximately $45.22 million.

In November 2023, six months after Sui is launched, there will be a large unlock. Over 1 billion tokens will be unlocked, doubling the circulating token supply.

From the perspective of token demand, according to the analysis of chain data and the ecological project, the trading volume is low and the number of users is small, so there is no significant demand for SUI tokens in the short term.

IV. Comparison with Aptos Token Release Model

Let’s compare Sui’s token release model with that of Aptos in the Move series.

The total supply of Aptos tokens (excluding staking incentives) is 1 billion, with an initial circulation of 130 million, accounting for 13%. In the first year after launch, the community and foundation’s share of the tokens will unlock 4.54 million tokens per month, accounting for 0.45% of the total token supply, with a calculated market value of approximately $28 million.

Starting from the second year after launch, in addition to the community and foundation releasing some tokens, core contributors and investors also have tokens released every month. From the 13th to the 18th month, 20 million tokens are released each month, accounting for 2% of the total token supply; from the 19th to the 50th month, 6.75 million tokens are released each month, accounting for 0.67% of the total token supply.

In addition, Aptos also has node staking incentives. This part of the tokens is not included in the 1 billion tokens mentioned in the initial issuance. Currently, the highest reward rate (APY) for network staking is 7%, and the reward rate decreases by 1.5% each year until it reaches 3.25%.

Currently, a total of 860 million APT tokens are staked in the network, accounting for nearly 86%. It can be seen that the total token supply is 1.039 billion, of which 39.5 million tokens are the additional issuance for node staking incentives. Aptos has been online for about 8 months, so the monthly staking incentive is about 4.9 million tokens, accounting for 0.49% of the total token supply.

Comparing Sui with Aptos, both are low-circulation and high-inflation tokens. However, the initial circulation of SUI is lower than that of APT, equivalent to 50% of APT. The monthly token unlock amount in the first 6 months of SUI is higher than that of APT by 50%. The first large-scale release of SUI was after 6 months of launch, while APT was after 12 months of launch. SUI adopted a one-time release, and a large amount of tokens entered the market on the unlocking day, while APT adopted a monthly unlocking with a buffer period.

Overall, SUI will face a larger token supply than APT in the first year, and APT’s large supply will come in the second year.

V. Conclusion

From the on-chain data and ecological projects, Sui has few users and transactions, and is still in the process of cold start, it needs to attract users and capital inflows through continuous activities and construction.

However, judging from Sui’s current operating activities, the team is more focused on technical construction, including holding hackathons, holding developer activities around the world, and so on. User incentive measures have not yet been launched for the time being.

Meanwhile, on the one hand, in the bear market environment, funds and users tend to be conservative. On the other hand, Ethereum Layer 2 is also continuing to develop. For existing users, it is more convenient and secure to enter Layer 2 from Ethereum. Therefore, it has attracted a large amount of on-chain funds. In comparison, Sui faces increased difficulty in attracting funds and users.

Looking at the token economic model, compared with Aptos, another Move-based public chain, Sui’s token release pressure is concentrated in the first year. In the case of insufficient demand, matching such a large token supply leads to greater selling pressure on SUI tokens.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!