Author: Nancy

Recently, Binance has been “caught in a dilemma,” facing both the increasingly tight scrutiny of US regulators and controversy in the crypto community over its coin listing standards and returns. Aside from expressing dissatisfaction with returns, there are also questions raised about the new listing standards. Tangling with US regulators is sure to be a long-lasting legal battle, and it is widely believed that it will not end until both parties reach a settlement.

Standing at the center of the public opinion storm, as the former “bull market perpetual motion machine,” does the Binance ecosystem have the ability to withstand pressure? Can Binance’s value capture still bring surprises? Is the “traffic effect” of this top crypto giant still there? BlockingNews attempts to explore the truth from data.

Market share and on-chain ecology are both accelerating recovery

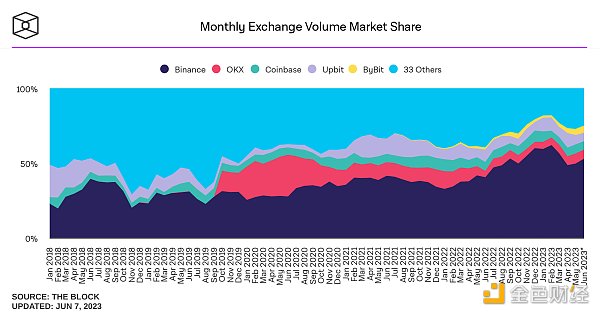

Compared to the lackluster performance of mainstream coins, in recent times, BRC20, Meme, and other coins that have surged by thousands of times have stolen market thunder. The trading volume of these concept coins has been divided among DEXs and the Bitcoin trading market, taking away the traffic of CEXs (centralized exchanges). The Block data shows that at the end of May this year, the ratio of DEX to CEX spot trading volume exceeded 21% for the first time, and CEX trading volume was at its lowest point of the year, and is now significantly back to 13.9%.

- Binance and Coinbase: Experts Interpret What Will Happen Next

- One Month Anniversary of Sui Mainnet Launch: Analysis of On-Chain Token Holders

- Can Binance’s counterattack against SEC’s accusations hold up?

However, behind the seemingly prosperous scene of these popular concept coins are a large number of survivorship biases. Apart from a few “smart money” bets that succeeded, most investors face risks such as insider trading, being left behind, and project running away. Cases of successful high-profit earnings are more easily disseminated in the community. In reality, the current popularity of these altcoins is declining, and market funds are starting to flee, and market heat is returning to CEXs.

The Block data shows that as of June 7th, Binance’s monthly trading volume market share had peaked at 62.01% in February 2023, before falling steadily in March and April to 48.58%, which was during the Meme and BRC20 craze. However, after April, Binance’s trading volume market share began to rebound significantly to its current level of 52.9%.

Moreover, the BNB Chain ecosystem has also begun to recover. According to Messari’s inventory of the Q1 market performance of 15 L1 public chains, BNB Chain’s quarterly financial revenue and market value year-on-year and quarterly cumulative percentage changes ranked second on the list, second only to Ethereum. At the same time, BNB and ETH were the only deflationary tokens in the first quarter.

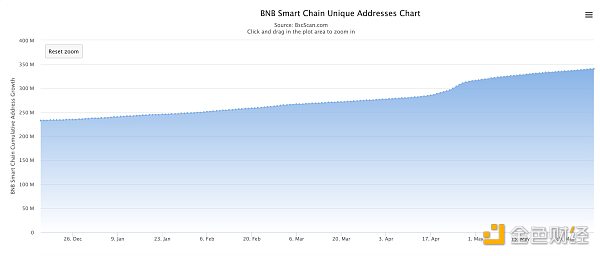

BNB Chain’s on-chain transactions have started to remain active for the past few months. As of June 8th, the total number of transactions on BNB Chain has risen to 4.064 million, an increase of 80.2% from the beginning of the year. At the same time, the number of addresses has increased by more than 110 million since 2023, an increase of about 47.8%.

In addition, BNB Chain’s daily gas consumption has also continued to grow, increasing by 53.1% from the beginning of the year, which indirectly proves that its ecosystem is active. Recently, Binance has launched a new Gas Grant plan, which will provide eligible projects with $200,000 in gas fee incentives per month, which may attract more projects to join.

It is worth mentioning that in April of this year, the BNB Chain development team launched the decentralized storage infrastructure BNB Greenfield and has launched the testnet “Congo”, which will launch its mainnet in Q3 this year. As the data and storage layer of the BNB Chain ecosystem, the launch of BNB Greenfield will further stimulate the growth and prosperity of the BNB Chain ecosystem. In addition, BNB Chain is expected to undergo the “Luban” hard fork (BEP-126, BEP-174, and BEP-221) upgrade on June 12th, which will create a faster and safer network for users. The optimization of user experience means that it will benefit the BNB Chain ecosystem.

Of course, the most direct relationship with ordinary users is whether the assets launched by Binance can truly bring value. “BRC20, Meme, and various other chaotic increases, while various value coins have been ignored.” Under the bear market of cryptocurrencies, the cottage coins with dozens of times returns have attracted funds, which has also caused many “classical players” who believe in value investment to be anxious. The reason behind the “retail revolution” is mainly that assets are heavily discounted in a bearish environment, and investors urgently need more stable and lucrative returns.

Low-priced coins are more likely to capture high gains

For players like Meme, small capital betting on high multiples is the main motivation for participating. In addition to high-net-worth or institutional users, small and medium-sized investors are also the main participants in the market, which also makes low-priced coins their favorite sector, and the data also confirms this.

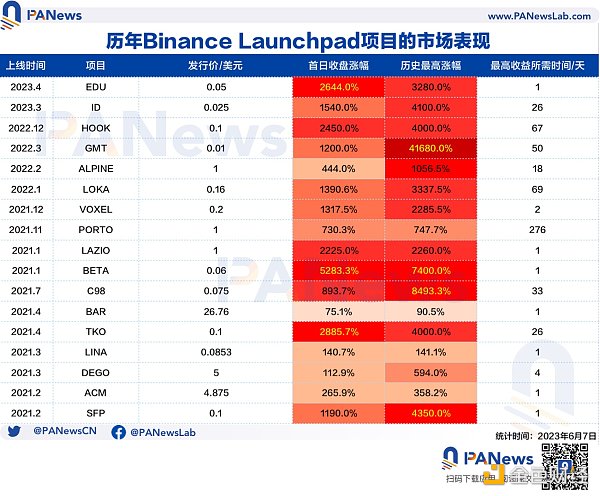

Looking at the 11 projects (including two IEOs) that will be launched on Binance in 2023, projects with lower issuance prices have relatively higher gains, such as ID and EDU, which to some extent indicates that projects with lower prices are more appealing and more favored by investors.

However, overall, these new projects have shown good market returns. From the perspective of the first-day closing increase, the average increase of these projects reached 383.9%, with EDU, SUI and ARB performing the best; from the perspective of the highest historical return rate, the average increase was as high as 823.4%, especially ID and EDU, which increased by 41 times and 32.8 times respectively, and 83.3% of the projects have a higher return rate than Bitcoin during the same period; from the perspective of the highest profit time, users can get the highest return in an average of 17 days, and 58.3% of the projects that hit new highs within a few days account for the overall situation.

Therefore, compared with high-risk assets such as Meme, Binance not only acts as a “gatekeeper” for high-quality investment targets, but also generally brings considerable returns to users. Although there has not been a project with a similar hundred-fold effect since the GMT in December 2022, Binance’s new listing projects have also performed well in the bear market, and tend to provide users with more stable returns.

“The underlying logic of Binance’s new listings is to list projects that can survive for a long time and bring returns to users. Here, there is actually a gap in investment research capabilities and aesthetic differences. Which platform can identify suitable listing projects and timing in the long run, and whose users can survive longer, this is the core competitiveness of the platform. (For) LaunchBlockingd project, the lowest price we can offer to users is what we can negotiate. Therefore, users who participate in the IEO can basically make a profit. But the price in the secondary market is beyond our control. As for who bought cheap chips and who sold early, Binance does not control it, but the project party must unlock according to the public information, and Binance will also supervise it.” Binance co-founder He Yi recently stated in the community.

Dozens of times returns in the bear market still exist

Looking back at the performance of Binance’s new listing market in the past, with excellent marketing and the liquidity of top trading platforms, the “listing effect” of Binance, whether it is empowering projects or investment returns for users, has been obvious. So, in the current bear market environment, let’s take a look at whether Binance’s new listing effect is still there based on the return rates of previous LaunchBlockingd projects and holding BNB over the years.

According to BlockingNews statistics (valued in USDT), Binance Launchpad has launched a total of 17 projects, most of which have achieved returns tens of times over. In terms of holding cost, there are relatively more projects that have obtained high returns at low prices, including TKO, C98, BETA, GMT, and ID, which are more likely to be favored by most investors. In terms of first-day closing gains, the average gain of the 17 projects is 1458.2%, with EDU, ID, HOOK, LAZIO, BETA, and TKO performing the best. The average highest profit in history is as high as 5186.7%, and GMT, BETA, and C98 have the highest returns, especially GMT, whose highest return is as high as 416.8 times. In terms of the highest profit time, the average holding time for users to obtain the highest profit is 34 days, of which 52.9% of the projects reach their all-time highs within a few days. However, in terms of returns, projects with longer holding time have relatively higher returns.

In terms of annual division, in terms of first-day returns, the number of new projects launched on Binance in 2021 and 2022 is quite different, but the average return rate is basically the same, both exceeding 1371%. Although there are only two IEO projects launched in 2023 for the time being, the average increase rate is leading, reaching 2092%. In addition, in terms of the highest historical increase, the average return rate in 2022 is far higher than the other two years, exceeding 153.5 times, mainly due to the hundred-fold project GMT. The second is 2023, which has an increase rate of 3690% and relatively low time cost. The number of new projects on Binance Launchpad also corresponds to the market’s popularity. Under the bear market, although new projects emerge in endlessly, there are still relatively few high-quality projects, and the frequency of new launches has obviously decreased, and there is no need to launch new projects just to increase the quantity.

Furthermore, according to the requirements for participation in Binance Launchpad, the user’s investment amount is determined based on the average holding of BNB. So how has the market performance of BNB been? According to the data, BNB has increased by more than 11.6 times throughout 2021, while the return of Bitcoin during the same period is only 64.4%. In 2022, when the market began to bear, BNB fell by about 52.5% throughout the year, while Bitcoin’s decline exceeded 65.3%. Compared with this, BNB has stronger resistance to falling. From 2023 to now, BNB has only risen by about 12.2%, lagging behind Bitcoin’s 62.3%. This is related to the regulatory tightening of cryptocurrency exchanges including Binance by countries such as the United States. As a platform currency, BNB has also been affected to a certain extent.

However, overall, in the current bear market environment full of regulatory challenges, Binance has not only shown resistance to decline in terms of BNB Chain activity and product selection, but also has selling points that attract capital. It is not difficult to see that Binance can still hold its own, and the entire crypto market is gradually transitioning to a recovery phase after a long period of calm.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!