Author: Jonas@Foresight Ventures

1. What is a short squeeze?

Short selling can allow traders to profit from falling asset prices. This is a common way to hedge existing positions or bearish market conditions. However, short selling can sometimes come with high risks. First, when buying demand suddenly increases, a large number of short sellers are forced to liquidate and continuously buy assets. This can lead to a short squeeze in the market due to insufficient supply and higher prices. Second, when a manipulation group concentrates public float, causing short sellers in the market to have no other source to buy back chips except for this group, it can cause a manipulative short squeeze.

Short squeezes are more likely to occur in small-cap or illiquid altcoins. Especially in the high-leverage crypto market, due to the cascading effect caused by continuous forced liquidation, price changes are more severe. Some advanced traders will observe potential short squeeze opportunities, accumulate positions in the early stages, and sell at the opportune time when the price rises rapidly.

- Is the SEC’s lawsuit against Binance a “business”? A closer look at the differences between Hong Kong’s SFC and the US SEC

- Scammers hijack eight Twitter accounts and steal nearly $1 million in cryptocurrency

- Forbes: SEC’s cryptocurrency enforcement action will not stop at Binance and Coinbase

2. Several key indicators of short squeeze

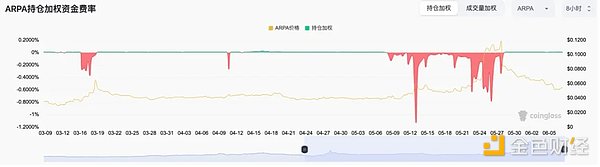

1. Contract funding rate: The premise of a short squeeze is that the short position overwhelmingly exceeds the long position. Specifically, when the funding rate of a certain altcoin contract exceeds -0.1% (that is, the short-term interest rate of the short position is 0.3%, and the annual interest rate exceeds 100%), it indicates that the short-term bearish sentiment is extreme, and it will accelerate the rise if it exceeds -0.75%. In the following discussion cases, we can see extreme negative funding rates.

2. Contract positions: More importantly, the more liquidity is trapped, the greater the volatility caused by short squeeze. This is mainly reflected in two aspects. First, the closer the contract position is to the market capitalization and the contract trading volume is close to 50% of the spot trading volume, the more likely a short squeeze will occur. Secondly, if the contract position increases by more than 50% in a short period, it means that the main funds are entering the market. If the position decreases, it means that the main funds are retreating, and it is necessary to profit and close the position.

3. Chip distribution: Applicable to the manipulative short selling of the dealer, the more concentrated the chip structure, the more extreme the market fluctuations.

Three, analysis of several recent classic cases

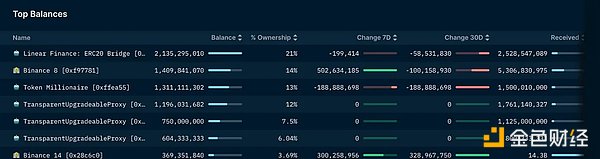

1. LINA: Linear is a cross-chain compatible defi synthetic asset protocol, with poor fundamentals. Starting at the end of May, it pledged to mint the stablecoin LUSD, with a pledge ratio as high as 22% of circulation. The yield of LINA tokens mined by LP for the stablecoins LUSD and BUSD is as high as 60%, attracting an expected 10% of hedging mining. The market’s main force has bought 23% of the circulation, locking up a total of about 50% of LINA chips with 22% pledged and 23% controlled by dealers. This is a typical manipulative short selling, with dealers holding spot to manipulate contracts.

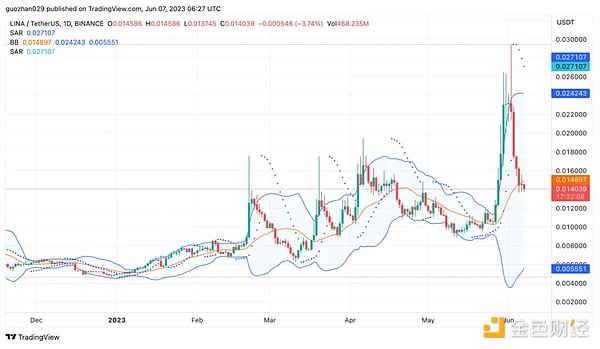

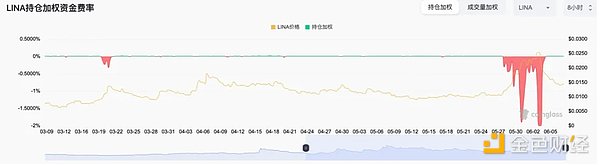

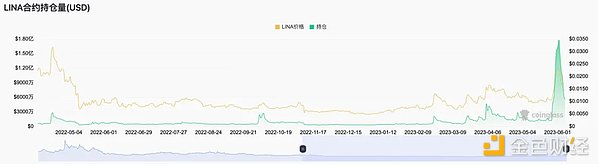

We can observe that LINA’s contract funding rate has exceeded -0.1% significantly since May 28th, reaching the maximum funding rate of -2% on May 31st and June 3rd. The contract positions also rose sharply from May 28th, with a position of $50 million while the circulation market value was only $70 million. The contract trading volume was $50 million, close to 50% of the spot trading volume of $90 million, which could easily lead to a shortage of supply for short covering. As a result, LINA’s coin price rose rapidly by 2-3 times from May 28th to June 3rd.

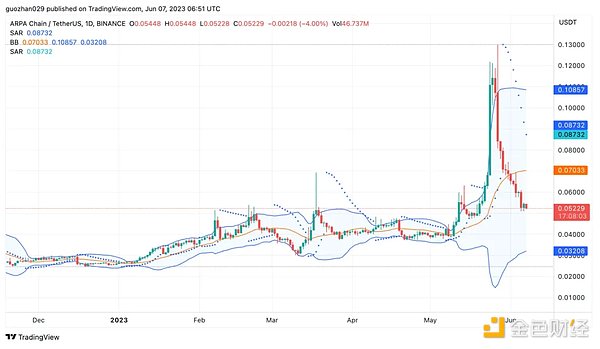

2. ARBlocking: ARBlocking Network is a decentralized secure computing network that is a privacy public chain in 2018. Recently completed the construction of a random number generator and conducted the second phase of testing on the testnet, with the mainnet expected to go live soon. The market maker switched to DWF in April, which has repeatedly manipulated other encryption projects in the past.

We can observe that the funding rate of ARBlocking has significantly exceeded -0.1% since May 12th. Although there have been some ups and downs, the high rate has persisted until May 16th, with the extreme value reaching -1%. More importantly, the contract position has surged since May 12th, with a position of 30 million US dollars, close to the circulating market value of 40 million US dollars. The contract trading volume is 30 million US dollars, close to 50% of the spot trading volume of 70 million US dollars. Therefore, the short-selling trend of ARBlocking has rapidly increased by 3-4 times within two weeks.

3. MTL: Metal is a cryptocurrency asset payment platform with user incentives and is an old project in 2017. The market leader controls about 10% of the circulating shares, and the trading volume in Upbit, a Korean exchange, is very exaggerated recently.

We can observe that the funding rate of MTL appeared abnormal on May 6th, but the short-selling trend ended after one day. Then on June 6th, an abnormality appeared again, and the extreme value reached -1.8% at one point. More importantly, since June 6th, the contract position has increased significantly, with a position of 60 million US dollars, very close to the circulating market value of 80 million US dollars. The contract trading volume is 80 million US dollars, close to 50% of the spot trading volume of 160 million US dollars. In this short-selling trend, MTL rose 2-3 times within one week.

Similarly, small-cap altcoins such as LEVER and BEL experienced similar short-selling tactics last year, such as high funding rates, high contract-to-spot position ratios, high contract-to-spot trading ratios, and sudden increases in positions, and so on, which will not be elaborated here.

Four, risks of short-selling trading

Every coin has two sides, and short-selling trading also has certain uncertainties.

1. Cryptocurrency exchanges will temporarily modify rules. If the default position limit increases, it is bullish; if the default position limit decreases, it is bearish. For example, Binance Exchange temporarily adjusted the LINAUSDT leverage and margin ladder on June 3rd and the MTLUSDT leverage and margin ladder on June 7th, which are strong warning signals that “we may change the rules at any time”, meaning that you cannot make money and let our exchange bear the consequences.

2. The follow-up value regression of altcoins. Although many altcoins have risen after being shorted, more often than not, these altcoins have continued to fall as their prices skyrocketed. There is a commonly used indicator of a peak, which is the comparison of the spot (or contract) trading volume of altcoins with that of the altcoin king ETH. From historical data, once the spot (or contract) trading volume of altcoins exceeds or approaches that of ETH, it is likely to be a short-term emotional peak. It is also recommended to take profits when the 4-hour amplitude exceeds 20%. Overall, the shorting trend tends to be a technical pattern rather than a fundamental event, and often causes some retail investors to suffer losses.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!