Project Introduction

Established in 2020, Solv Protocol is committed to lowering the barriers to creating and using on-chain financial tools, bringing diverse asset categories and earning opportunities to the crypto field, and ultimately becoming a key infrastructure that connects decentralized finance (DeFi), centralized finance (CeFi), and traditional finance (TradFi) liquidity.

Solv pioneered the construction of a trustless fund infrastructure based on ERC-3525. By using the ERC-3525 token standard, Solv provides the functionality to create, manage, and trade financial NFTs, addressing the demands for DeFi financial services while incorporating the characteristics of NFTs and DeFi, facilitating the discovery, creation, and realization of real yields.

Author

Elma Ruan, Senior Investment Researcher at WJB, holds dual master’s degrees in Marketing and Finance from Ivy League schools and has 5 years of experience in WEB3, specializing in DeFi, NFTs, and other areas. Prior to entering the crypto industry, she worked as an investment manager at a large securities firm.

1. Research Focus

1.1 Core Investment Logic

The ERC-3525 standard proposed by Solv Protocol defines the Semi-Fungible Token (SFT), which combines the characteristics of both NFTs and FTs, possessing the features of divisibility and high liquidity, serving as a carrier for a new type of on-chain financial asset. By adopting the ERC-3525 standard proposed by Solv Protocol, developers now have the ability to create various advanced financial assets, such as bonds, options, and asset-backed securities (ABS), etc. These new types of on-chain financial products enrich the market choices and provide investors with a wider range of investment opportunities. At the same time, it also increases the scale and scope of on-chain financial products.

- Having the private key guarantees peace of mind? Sorting out the chaos and legal risks of cryptocurrency judicial disposal in China

- Autonomous World A Vision of a Digital Utopia Based on Full-Chain Gaming

- Everyone can be a data scientist, interpreting the rise of Dune.

The primary market has also undergone continuous development, covering various forms of financing, including the initial ICO, endorsed by exchanges through IEO, as well as decentralized IDO and the recent IVO (Initial Voucher Offering). Solv Protocol generates corresponding NFT certificates for project parties by depositing tokens into the Solv protocol and agreeing on the lock-up form, start and end time. This certificate represents the token ownership of the project party during the lock-up period. The person holding the NFT can interact with the smart contract through the protocol and extract tokens from the Solv protocol.

The core mechanism of the Solv protocol is to lock tokens in the smart contract while generating NFT/SFT certificates for the tokens, ensuring the security of the tokens and providing transparency in operations. During the token lock-up period, project parties cannot directly access or transfer the tokens as they are bound to NFT/SFT through smart contracts. Only the person holding the corresponding NFT/SFT can extract the corresponding tokens from the Solv protocol within the specified time through the smart contract.

Solv Protocol has the following advantages: innovation, liquidity improvement, and one-stop service. This protocol introduces many advanced financial mechanisms, creating new investment opportunities and financial instruments. At the same time, by combining functions and introducing the ERC-3525 standard, Solv Protocol strives to enhance the liquidity of financial NFTs, increasing users’ transaction and transfer choices. Therefore, Solv Protocol provides a one-stop service for the issuance and trading of financial NFTs/SFTs, simplifying users’ operational processes. These advantages make Solv Protocol competitive and attractive in the financial market.

The Solv project involves lock-up tokens related to real-world assets, such as US Treasury bonds or other physical assets. The value of these risk assets may fluctuate with market changes, posing risks to token liquidity and operational trust. In addition, the Solv project aims to address liquidity issues during token lock-up periods, but there may be liquidity tightening in unstable markets or when investors redeem tokens on a large scale. If the Solv project fails to meet large-scale redemption requests, it may result in operational risks and additional costs. Therefore, the success of the Solv project is closely related to the management capabilities and decision-making of the project team. If the management team’s strategies are wrong, their abilities are inadequate, or they fail to respond timely to market changes, it may have a negative impact on token performance.

Therefore, as an investor participating in the Solv project, it is also important to pay attention to the background, experience, and past performance of the project team to assess whether they possess appropriate management capabilities. It should be noted that there are differences in structure and operation between the Solv project and open-end funds. When evaluating risks related to the Solv project, other factors need to be considered and evaluated based on specific circumstances.

1.2 Valuation

Due to the lack of publicly available valuation data and market capitalization, it is currently not possible to conduct a detailed valuation analysis of the project.

2. Project Overview

2.1 Business Scope

Solv Protocol is a platform dedicated to reducing the barriers to creating and using on-chain financial tools. Solv Protocol provides a range of innovative products and solutions, including on-chain bill business, market liquidity solution Vesting Voucher, on-chain bond market, and on-chain fund platform Solv V3. Solv V3 is a universal fund infrastructure that includes on-chain fund protocols and a multi-link on-chain risk control system, supporting the issuance, trading, and clearing of on-chain funds. Solv Protocol improves the efficiency and transparency of on-chain finance by providing these services, creating more opportunities and choices for users and participants, and reducing the costs and complexity of financial operations and management.

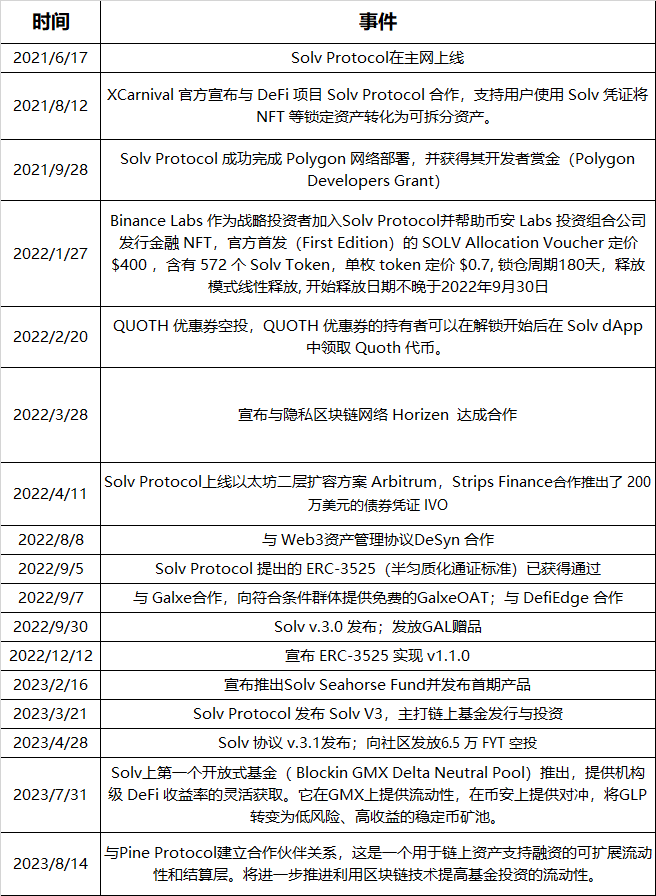

2.2 Past Development and Roadmap

Future roadmap:

August 2023 – Launch ETH benchmark strategy on LSD

Q4 2023 – Launch RWA-related strategy funds. Integrate external NFT lending platforms for fund share mortgage lending.

Q1 2024 – Launch open-ended master fund and corresponding token incentives

Q2 2024 – Launch secondary market for fund shares

2.3 Team Information

2.3.1 Overall Situation

According to LinkedIn data, Solv Protocol currently has 21 employees. The team members’ backgrounds are mainly in fields such as computer science, economics, finance, and mathematics. They have high expertise in blockchain, Java, business development, Python, and operations management. Overall, they drive business development through different team collaborations.

2.3.2 Founders

Ryan Chow Co-founder

Graduated from Beijing Foreign Studies University, he played an important role in promoting the development of the platform, securing $141 million in funding. Solv Protocol is a blockchain-based funding platform. Prior to this, he served as a co-founder at Beijing Youzan Technology, dedicated to applying blockchain technology to the automotive industry database. In addition, he worked as a financial analyst at Singularity Financial, researching the integration of blockchain technology and financial regulation.

Will Wang Co-founder

Created “ERC-3525: Semi-Homogenized Token Standard.” He has worked in the financial IT field for 20 years and led the design and development of the largest bank accounting system based on open platforms and distributed technology. He is the recipient of the “Contribution Award for the 20th Anniversary of Zhongguancun.”

Meng Yan Co-founder

Former Vice President of CSDN, he is also an active KOL in the Crypto field.

2.3.3 Core Members

Cai Yi Core Developer

Co-author of “ERC-3525,” his publicly released works cover a wide range of areas including Ethereum development, smart contracts, system architecture, and databases. He has shared technical practical articles, analyzed the core code of Crypto Kitties, discussed the impact of business models on system architecture, and provided solutions.

2.4 Financing Situation

Solv Protocol has raised a total of $14 million through five rounds of financing. The most recent round of financing was completed on July 31, 2023, and it was led by a series of venture capital firms. Currently, Solv’s investment partners include IOSG Ventures, Defi Alliance, The SLianGuairtan Group, Axia8 Ventures, CMT Digital, and a total of 25 investment institutions.

3. Business Analysis

3.1 Target Audience

1) Individual Investors:

Individual investors seeking opportunities to invest in encrypted assets hope to obtain reliable investment opportunities and sources of income through the decentralized fund infrastructure provided by Solv V3.

2) Institutional investors:

Institutions such as investment funds, family offices, and asset management companies seek risk exposure and investment opportunities through Solv V3’s decentralized fund infrastructure.

3) Financial institutions:

Financial institutions such as fund companies and banks hope to create and manage financial products using Solv V3’s decentralized fund infrastructure.

4) Fund administrators and risk service providers:

Fund administrators are responsible for managing and operating funds and can use Solv V3’s institutional-grade fund service platform for risk control and management. On-chain and off-chain risk service providers collaborate with Solv V3 to build a risk system that provides transparent and non-custodial DeFi risk control and services.

3.2 Business Categories

Solv V3 addresses two major pain points in the on-chain fund field – asset creation and risk management, and does so in a decentralized manner. This provides investors with unprecedented security, transparency, and diversified cryptocurrency investment experiences.

The core of Solv V3 consists of two pillars:

1. Decentralized fund infrastructure based on ERC-3525

Based on ERC-3525, Solv can efficiently create complex financial products on-chain, providing global investors with trusted investment opportunities and abundant sources of income.

2. Institutional-grade fund service platform

Solv enables trusted institutions to collaborate within a decentralized framework, building on-chain and off-chain risk systems and providing transparent, non-custodial DeFi risk control services.

3.3 Business Details

1. Decentralized fund infrastructure based on ERC-3525

The key to DeFi’s large-scale adoption lies in creating more high-quality on-chain assets and establishing permissionless infrastructure for these assets, allowing for their composition and interoperability. Solv pioneered the design of ERC-3525 and built an integrated on-chain fund issuance, trading, and settlement platform based on it. This aims to fully leverage the composability of DeFi while enhancing the utilization of on-chain financial assets, drawing reference from the trillion-dollar traditional fund market to establish decentralized fund infrastructure. After two years of iteration, Solv V3 now supports diverse asset categories, income strategies, and fund structures, bringing a new paradigm of asset management experience for fund managers with quality strategies and investors with diverse needs.

Non-custodial, product diversity, innovative user experience, and composability are the three main features of Solv V3’s fund platform:

- 1) Non-custodial:

Solv V3 operates funds in a fully automated and non-custodial manner using smart contracts. All fund issuance, management, and settlement are handled by smart contracts. Backend capital permissions are also automated through smart contracts. The net asset value and historical performance of the funds are clearly recorded on the chain through trusted oracles, achieving complete lifecycle transparency. This eliminates centralized black box risks.

- 2) Product Diversity:

Solv V3 supports diverse asset classes and return strategies, allowing investors to complete one-stop asset allocation on Solv V3 according to their risk preferences and capital plans. With the powerful asset expression capability of ERC-3525, Solv V3 allows fund managers to highly customize their fund products. Similar to customizing NFTs, they can visually customize the subscription rules, fee structures, and return strategies of funds managed by smart contracts. This enables Solv V3 to provide:

Rich underlying assets:

DeFi: More diverse sources of income are provided by management strategies built on DEX, derivatives, liquidity mining, NFTFi, etc.

CeFi: Introducing quantitative funds, arbitrage strategy funds, and CeFi market-making funds.

TradFi: More real-world assets are tokenized and matched with income strategies, continuously providing rich and stable sources of income for the crypto field.

Rich return strategies:

Active management funds: Aim to outperform benchmark indexes through active management and security selection.

Yield-enhancing funds: Maximize returns through strategies like liquidity mining.

Mirror trading: Allows investors to follow and automatically replicate trading strategies.

Structured funds: Packaged products with defined risk-return profiles.

Rich fund structures:

Subordinated Fund: Solv supports fund managers to split the income or net assets of the fund into two classes of fund shares with different risk-return characteristics: senior fund and subordinated fund.

First Loss Capital Protected Fund: The role of the first loss capital protected fund is to act as a buffer to protect other investors from the initial losses of the investment portfolio. The downside protection provided by fund managers of this type of fund can give investors more confidence in investing.

Diverse trading currencies:

Solv supports investment in various cryptocurrencies such as BTC, ETH, stablecoins, as well as tokens like BNB, ARB, FIL, etc.

3) Pioneering user experience and composability

Solv provides a visual DeFi user experience and composability through SFT (Semi-Fungible Tokens).

Each fund SFT represents a tokenized liquidity pool (Vault), providing a similar experience for users when investing in funds. Users can buy and redeem fund SFT at any time and access real-time metadata and comprehensive data of fund SFT on a fully visualized dashboard, reducing friction and costs associated with investing and monitoring funds. Fund SFTs have strong composability and interoperability with the entire DeFi and NFT infrastructure, as they are ERC721 compatible and have self-splitting functionality. SFT holders can freely trade on exchanges (in addition to Opensea and Blur, Solv also plans to launch trading on Uniswap) and use SFT as collateral on multiple NFT lending platforms.

2. Institutional Fund Service Platform

Solv V3 has built a highly collaborative decentralized platform network that provides powerful fund services and risk management, creating a trusted framework for on-chain investments.

Institutional Fund Screening

Under Solv’s organization, participating institutions such as fund managers, brokers, and rating agencies jointly conduct rigorous screening of funds based on factors such as asset size, returns, strategies, and team backgrounds. This allows ordinary investors to enjoy professional services in institutional fund screening.

Fund Usage Permission Separation

Whether it is a DeFi or CeFi strategy, all funds raised on the Solv platform will be transferred to designated MPC solutions through Solv V3 smart contracts. A common control measure against fraudulent behavior by fund managers is achieved through permission control and strict role separation. This means that transfer rights, liquidation rights, and operational rights are allocated to different roles to ensure power decentralization and mutual supervision. Investors can view real-time fund flow to identify risks and influence usage permissions through the custody dashboard when necessary.

Coordinated Settlement Process

Solv organizes trusted institutions to set appropriate liquidation rules for each fund to limit losses. Professional risk managers monitor positions, issue alerts, and conduct orderly liquidation processes when triggered. In the event of a liquidation event, fund managers have special permissions to smoothly close positions and cash out funds to prevent additional losses.

3. Fee Mechanism

Calculation Method: Protocol fees are calculated each time the Net Asset Value (NAV) is updated.

The calculation formula is as follows:

Recorded NAV * Total number of shares * Management fee rate / 360 * Number of days since the last fee calculation

Payment Method: Protocol fees are paid to the fund operator in the form of additional fund shares issued, while the corresponding protocol fees are deducted from the total assets to recalculate the NAV.

4. Diversified Returns

Delta Neutral Strategy

Adopting a Delta neutral strategy to reduce drawdowns on both CeFi and DeFi platforms.

Some strategies run on Uniswap or GMX and add initial loss capital to minimize risks. By monitoring open positions and market volatility, fund managers can perform real-time risk hedging operations. Based on historical data, the fund’s annualized return ranges from 10% to 30%. Apart from a slight drawdown of 1.1% during USDC decoupling, the performance has been relatively stable.

Yield Enhancement

This includes strategies such as ETH collateral similar to Liquidity Staking Delegation (LSD).

These strategies involve various underlying assets related to LSD, such as stETH, and can enhance returns by providing liquidity on Curve or Balancer. These returns can be multiple times higher compared to Lido.

Structured Products

This is the high-risk part of the investment portfolio in the Delta neutral strategy. Investors will take on higher risks but also have the potential for higher returns. We usually require fund managers to invest funds in this part.

Real World Assets (RWA)

Includes financing of US Treasury bonds, accounts receivable, and traditional assets.

One example is using on-chain US Treasury bonds to increase yield through circular borrowing or circular investment.

5. ERC-3525 Semi-Fungible Token Standard

FT represents fungible tokens, NFT represents non-fungible tokens, and SFT is between the two, a semi-fungible token. FT is a standardized token that can be exchanged, such as currency. NFT is a unique token that cannot be exchanged, such as digital artwork. SFT is a token that is between FT and NFT, it can be exchanged, but also has unique attributes, such as bonds with different face values and maturity dates. The background of SFT’s birth is that NFTs used in DeFi (Decentralized Finance) gradually lost their advantage as financial ownership proof, partly because of their lack of liquidity. To fill this gap, SFT was created. SFT is a liquid and flexible digital ownership representative, with a unique ID and rich metadata that can describe complex information, while also being divisible and tradable like ERC-20 tokens. Therefore, SFT can serve as a better tool for financial ownership proof and can be used in a wider range of applications.

On September 5, 2022, the Ethereum Foundation listed ERC-3525 Semi-Fungible Tokens as the 35th ERC token standard, placing semi-fungible tokens (SFT) on an equally important position with existing fungible tokens (ERC-20) and non-fungible tokens (ERC-721).

ERC-3525 is a universal, full-asset token standard that combines the quantitative properties of ERC-20 tokens with the descriptive characteristics of ERC-721 tokens (NFTs).

It inherits the value-based quantitative operations of ERC-20 while also possessing the non-fungibility characteristics based on token IDs of ERC-721 and has made broader innovations in financial scenarios or commercial uses.

Application Scope of Semi-Fungible Tokens

Unlike ERC-20 tokens representing currencies, company stocks, and point systems, and ERC-721 tokens representing artworks, collectibles, and digital goods, ERC-3525 is a flexible and versatile expression of digital ownership closely related to specific values. ERC-3525 semi-fungible tokens can represent various assets, including simple gift cards, points, and checks, as well as more complex assets such as bonds, futures/options contracts, exchange-traded funds (ETFs), asset-backed securities (ABS), or land ownership. In the cryptocurrency field, ERC-3525 provides a wider range of applications and greater flexibility.

3.4 Industry Space and Potential

3.4.1 Classification

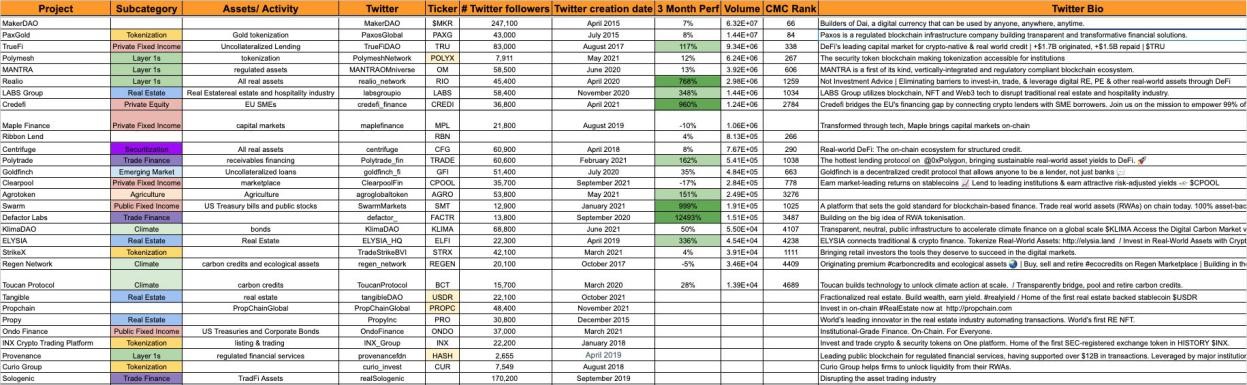

The RWA track has gradually attracted the interest of crypto traders, providing them with opportunities to further expand the field of decentralized finance (DeFi). Some jurisdictions friendly to the cryptocurrency industry are actively promoting the development of RWA, and some well-known traditional institutions such as Goldman Sachs, Siemens, Hamilton Lane, Bank of China International, and Amazon have also started participating in the competition in the RWA field.

RWA, Real World Assets, is often translated into Chinese as “real-world assets on the blockchain,” referring to cars, houses, stocks, carbon offsets, etc. For example, stablecoins are currently the largest use case for RWA. “Real World” refers to all “off-chain” assets relative to “On Chain,” including identity, relationships, and claims. From the public reports of most institutions, they can be roughly divided into two major categories: real-world assets and financial assets, as well as 13 subcategories: stocks, bonds, public equities, private equities, real estate, private fixed assets, public fixed assets, identity, climate/Refi, agriculture, TradFi, Layer1, emerging markets. Almost all asset types have corresponding projects exploring and experimenting, some of which are well-established DeFi protocols such as Maker DAO, AAVE, Compound, Maple, Centrifuge, while others are emerging early-stage projects.

Solv belongs to the sub-track of bonds. Bonds are also financial products in the Web2 world. Issuing bonds can provide an avenue for issuers to raise funds from the public market or qualified groups to promote the efficient use of capital and support the liquidity needs of projects. The subject, time, and amount of the bond are its basic elements. Different from the ordinary ERC-20 and ERC-721 token standards, the development of Web3 bonds mainly relies on the innovation of token standards.

3.4.2 Market Size

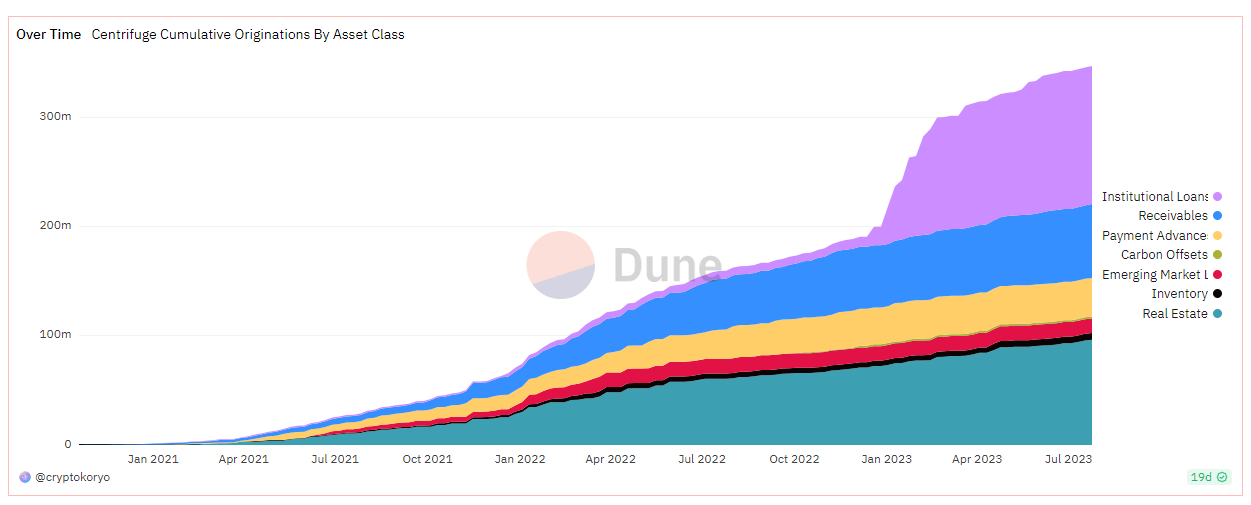

Overview of RWA Projects

According to incomplete statistics, there are currently more than 60 RWA track projects. The ones with high TVL rankings are mainly concentrated in bond RWA. As of the end of July, the cumulative issuance of various assets is as follows: cumulative issuance of institutional loans is $126 million, cumulative issuance of real estate is $96.43 million, and cumulative issuance of receivables is approximately $67.81 million. Most of these RWA projects have officially launched their operations this year, indicating that the RWA track is developing rapidly.

RWA Project Summary (By Crypto Koryo)

The potential for growth in the RWA market is also considerable. A research report titled “Money, Tokens, and Games” published by Citigroup predicts that by 2030, there will be $4 trillion to $5 trillion in digital securities tokenization and the trade finance transaction volume based on distributed ledger technology will reach $1 trillion. This means that the RWA track still has at least 100 times the incremental space.

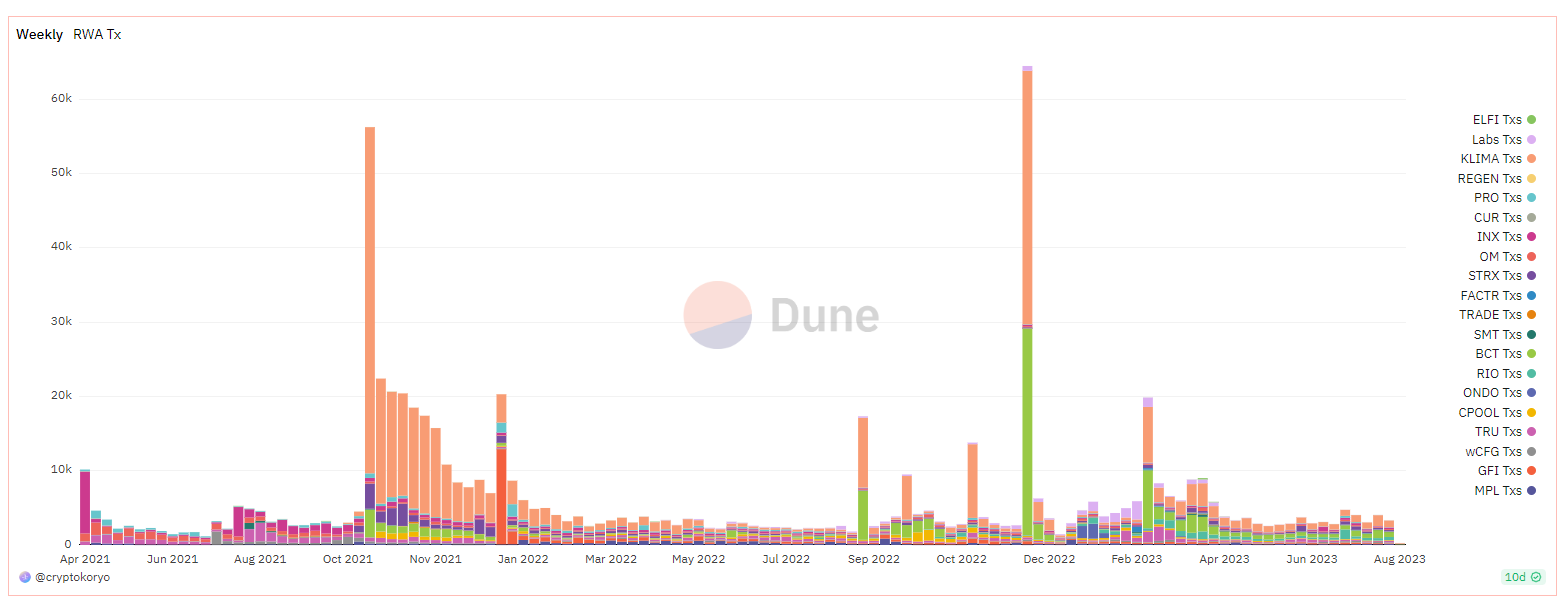

Overall, the RWA track has shown relatively stable development in recent years. According to transaction frequency (TX) data, there was a slight peak in the second half of 2021, but afterwards, due to the impact of the bear market, RWA trading activity remained relatively calm. In 2022, the RWA track experienced a small peak for a month. Although the transaction frequency has been relatively low in the past few months, the overall level remains stable compared to 2022.

The traditional financial model includes central banks, commercial banks, securities exchanges, securities brokers, and other institutions. These institutions are responsible for managing and processing financial activities such as currency, lending, investment, and trading. Tradfi systems usually comply with regulations and rules of governments and financial regulatory agencies, relying on centralized control entities to execute financial transactions.

3.5 Business Data

Social Media Data

Twitter followers: 133,000

Discord followers: 86,000, active users: 1,781

Telegram followers: 40,100, active users: 1,000

The number of followers and active users on these social media platforms demonstrates the popularity and user base of Solv Protocol in the crypto finance field. The Discord community of Solv Protocol is highly active, indicating high user engagement and discussion about the protocol.

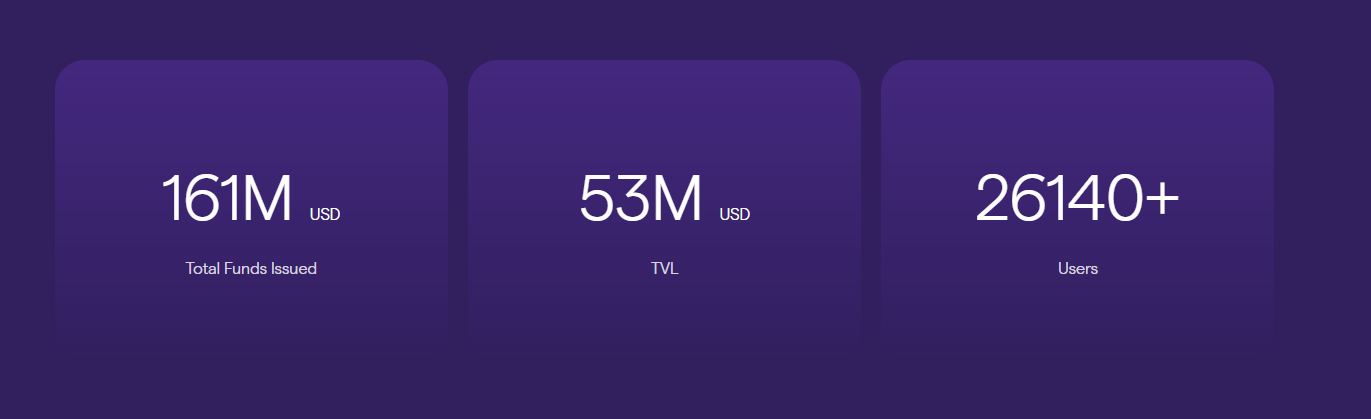

Figure 15

Operational Data

According to the official website data, the number of users of Solv Protocol has reached 26,140, indicating its popularity in the crypto finance market. The Total Value Locked (TVL) of the protocol has exceeded $53 million, demonstrating user trust and participation in Solv Protocol.

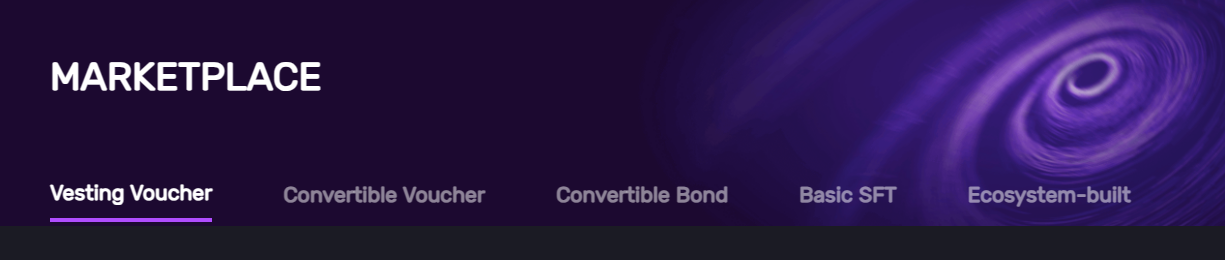

In addition, Solv Protocol has issued a total of $162 million worth of bond projects. Through these bond products, users can earn profits in the crypto finance ecosystem. Currently, Solv Protocol offers 68 fund products to meet the diverse needs of users. These fund products are divided into the following five categories:

Vesting Voucher: These funds represent unlocked tokens during the project’s predetermined period, providing users with higher liquidity.

Convertible Voucher: These funds have the characteristic of being convertible to other assets or tokens, allowing users to make flexible investments based on market conditions.

Convertible Bond: This type of fund is a bond product that allows users to convert it into other assets or tokens after a certain period of time.

Basic SFT: This type of fund is an asset tokenization product that provides a more flexible and liquid investment method.

Ecosystem-built: This type of fund is designed to promote the development of the Solv Protocol ecosystem. By investing in these funds, users can support and participate in the construction and expansion of the ecosystem.

Since its launch, the transaction volume on the Ethereum chain has been relatively low until 2022 when there was some improvement. By mid-2022, the transaction volume increased significantly and reached its peak level. Subsequently, the transaction volume dropped to about one-third of its original level and has remained at this level. On the BSC chain, transaction volume has existed since 2021 and rapidly increased to a peak in mid-2022, but this high level was not sustained for long, and the transaction volume has remained relatively low. Overall, the activity on the chain is still good.

3.6 Project Competition Landscape

There are two decentralized bond projects: Solv and D/BOND, and they use different smart contracts and token standards. Solv uses its own developed ERC-3525 standard, while D/BOND uses its own developed ERC-3475 standard.

3.6.1 Project Introduction

D/Bond

D/Bond, formerly known as DeBond, is a decentralized bond protocol (Debond Protocol) developed based on the ERC-3475 standard. It is also a decentralized bond ecosystem platform that supports the creation and management of multiple redeemable bonds, as well as bond and bond derivative trading and decentralized ERC-3475 wallet. The platform provides a visual bond and bond derivative creation tool, allowing any institution or individual to design their own bond products for financing with very low technical barriers through a visual programming interface. As the first protocol and ecosystem platform focused on decentralized bond products in the entire network, D/Bond can support the issuance, redemption, trading, and bond derivative trading of various types of bonds, such as fixed-rate bonds, LP bonds, NFT bonds, and hybrid bonds, filling the gap in decentralized bond products in the current DeFi market.

3.6.2 Project Comparison

Technical Aspect

There are two decentralized bond projects: Solv and D/BOND, and they use different smart contracts and token standards. Solv uses its own developed ERC-3525 standard, while D/BOND uses its own developed ERC-3475 standard.

Solv: The core of ERC-3525 lies in ownership and transfer. It establishes a dual-layer asset model to enable the protocol to have the characteristics of both ERC-20 and ERC-721. At the same time, the open nature of ERC-3525 allows it to be compatible with other protocols such as ERC-721 or ERC-5192.

D/BOND: ERC-3475 starts from the overall perspective and emphasizes the format of data reading and writing. Soul Bound Token (SBT), as an non-transferable token, actually has a set of standardized data storage space as its core. The definition of a token object should depend on the parameters in the data storage, which will be stored on the chain in the form of metadata and provide a complete solution in ERC-3475.

Product and Business

Solv Protocol provides simple and customizable tools for startups and DAOs to raise funds. For example, if vouchers have the same underlying features such as lock-up period, vesting schedule, APY, etc., they can be split and merged at will. Solv Vouchers, based on the ERC-3525 token standard, bring liquidity to locked assets. For example, by selling a Vesting Voucher that promises the allocation of future tokens, funds or investors effectively sell their shares in the project before it goes public; there are also Convertible Vouchers and Bond Vouchers. Convertible Vouchers allow high-risk DeFi protocols to raise funds without dilution or liquidation risks and protect investors from the impact of token price fluctuations. The design of Convertible Vouchers retains all the convenient elements of Solv Vouchers (splitting/combining, adjusting release modes, and customizable settlement dates). In addition, it expands the acceptable trading range for the underlying token. If the token is below or above the trading range, the holder of the convertible voucher will receive tokens as payment, equivalent to the face value of the voucher. This design can protect projects from excessive token dumping when early investor allocations are unlocked.

Based on the usage of different vouchers, the demand for Bond Vouchers is for financing, while the demand for Vesting Vouchers is for community governance and investor quota management. The product structure of the D/Bond project is similar to Solv Protocol, providing customizable fundraising tools for startups and DAOs.

In general, D/Bond differs from Solv in the following aspects:

Voucher Type: The D/Bond project introduces D/Bond vouchers as its token standard instead of using the ERC-3525 standard of Solv Protocol. D/Bond vouchers are tokens specifically designed for debt financing. They have similar features to Solv Vouchers, allowing for splitting, merging, and providing liquidity.

Bond Types: The D/Bond project offers different types of bond vouchers to meet various financing needs. These include Convertible Bond Vouchers and Fixed Income Bond Vouchers. Convertible Bond Vouchers allow bondholders to convert their bonds into tokens or equities of specific projects, while Fixed Income Bond Vouchers provide fixed interest returns.

Project Risk Management: The D/Bond project aims to address the high risks and volatility faced by DeFi protocols. By designing convertible bonds, it enables high-risk DeFi protocols to raise funds without dilution or liquidation risks and protects investors from the impact of token price fluctuations.

Specifically, the D/Bond project has similar goals to Solv Protocol, but it focuses on solutions for debt financing and bond types to provide more flexibility and protection.

3.7 Token Model Analysis

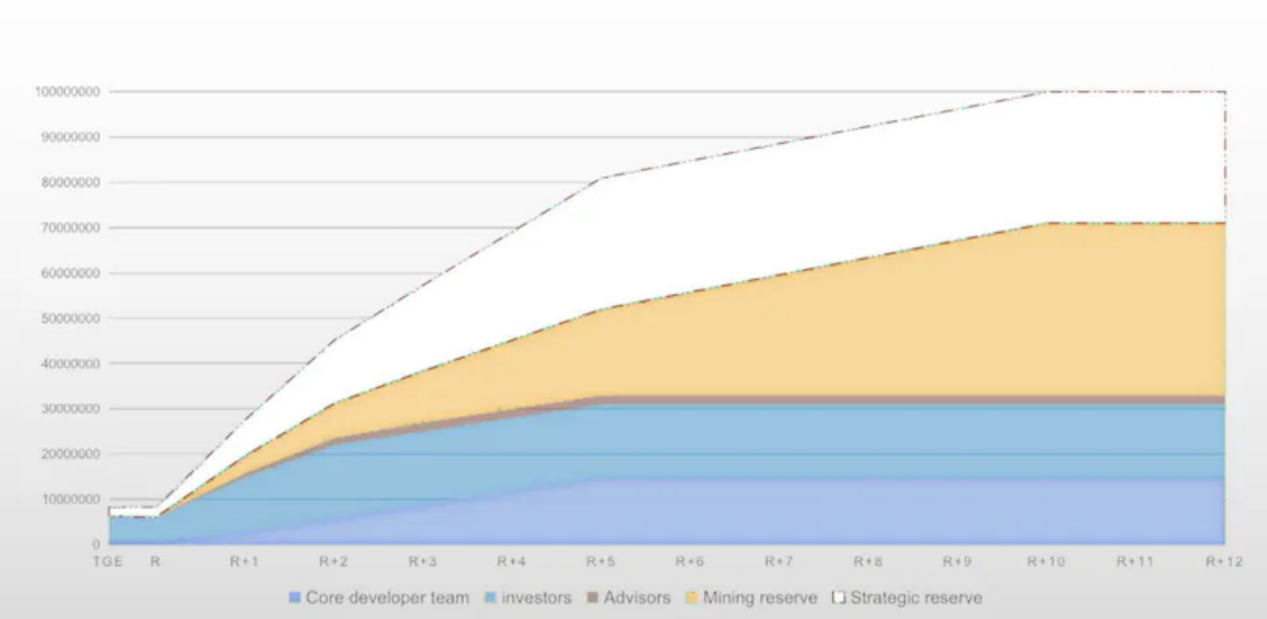

Total Token Supply and Allocation

Initial version of the Solv token model

Total Token Supply: 100 million

Token Allocation: 67% for community incentives, 15% distributed to the core development team, 6-8% distributed to private round financing, 5% distributed to seed round financing, 2% used for IDO, 2% distributed to advisors, 1% used for IVO.

The token unlock schedule is shown in the following diagram:

However, according to the latest information on the official website, a major portion of the $Solv token distribution plan will flow to Solv community members. A portion of the token supply will be prioritized for airdrops to shareholders of open funds. Although specific details have not been finalized, this airdrop will serve as additional income for protocol liquidity providers.

4. Preliminary Valuation

4.1 Key Issues

Does the project have a reliable competitive advantage? Where does this competitive advantage come from?

Customizability: Solv Protocol provides simple and customizable tools for fundraising for startups and DAOs. Its vouchers can be split, merged, and customized according to specific needs. This flexibility and customizability give Solv an advantage in meeting different project requirements and fundraising goals.

Liquidity provision: Solv Vouchers, based on the ERC-3525 token standard, provide liquidity for locked assets. By selling different types of vouchers, such as Vesting Vouchers, Convertible Vouchers, and Bond Vouchers, investors and funds can effectively increase liquidity and sell shares.

Risk management: Solv Protocol manages project risks through the design of Convertible Vouchers and other features. This design allows high-risk DeFi protocols to raise funds without dilution or liquidation risks and protects investors from token price fluctuations. This provides investors with more protection and confidence.

However, the market competition is fierce, and other similar projects may also emerge. Therefore, the Solv project needs to constantly innovate and adapt to market demands to maintain its competitive advantage.

What are the main operational variables of the project? Are these factors easy to quantify and measure?

Fundraising scale: The success and profitability of the Solv project are directly related to the scale of funds raised. The larger the amount of funds raised, the larger the scale and scope the project can support, and the greater the opportunity for more returns.

User participation and adoption rate: User participation and adoption rate are crucial for the success of the project. This includes the willingness of developers and startups to use Solv Protocol for fundraising, as well as the willingness of investors to purchase and hold Solv tokens. High user participation and adoption rates can increase liquidity and activity, bringing more opportunities and potential returns.

Market Demand and Competitive Environment: The success of the project is closely related to market demand and the competitive environment. If there is a continuous growth in the market demand for digital asset fundraising and risk management tools, and the level of competition is relatively low, then Solv project has a greater chance of success.

These variable factors can be quantified and measured to some extent. For example, indicators such as the size of funds raised, user participation and adoption rates, and market demand trends can be tracked and measured. However, the accuracy and precision of measuring these factors may be limited by data availability and data quality.

4.2 Major Risks

1) Legal and Regulatory Risks: Solv project may face compliance issues with laws and regulations when dealing with NFT certificates representing real-world assets. This may include compliance requirements related to securities laws, anti-money laundering regulations, and so on. Incorrect or non-compliant operations may result in legal risks and liabilities.

2) Market Volatility Risk: The Solv project’s open-end fund operation model is exposed to market volatility risks. Although the fund manager protects the investors’ principal safety by investing most of the funds in trading platforms for mining and generating profits, as well as hedging through trading pairs of tokens on the platform, the market always carries uncertainty and volatility. If there is a significant market fluctuation or a drastic drop in digital asset prices, it may have an adverse impact on the fund’s value and result in the loss of investors’ principal.

3) Management Risk: The investment decisions and capabilities of the fund manager are crucial to the performance of the fund. If the fund manager makes incorrect strategies, has poor investment capabilities, or fails to respond timely to market changes, the fund’s performance may decline. Investors need to pay attention to the background, experience, and past performance of the fund manager to evaluate whether they possess appropriate management capabilities.

5. References

1. Official website: https://Solv.finance/

2. Financing information: https://www.crunchbase.com/organization/Solv-protocol/comLianGuainy_financials

3. Official media: https://Solvprotocol.medium.com/

4. Past development events: https://coindar.org/en/event/Solv-protocol-Solv-first-openend-fund-launch-99684?utm_source=twitter&utm_medium=social&utm_camLianGuaiign=coindar&utm_id=twitter+banner

5. Progress of real-world assets on the chain: https://www.defidaonews.com/article/6813990

6. RWA ecosystem: projects, data, challenges, and prospects: https://news.marsbit.co/20230707103545021499.html

7. Dune data panel: https://dune.com/cryptokoryo/rwa

8. Solv Open-end Fund: https://app.Solv.finance/earn/open-fund/detail/2

9. Defi track summary: https://foresightnews.pro/article/detail/22879

10. SFT white paper: https://docs.Solv.finance/Solv-documentation/ERC-3525-SFT/core-mechanisms/id-slot-units

11. Solv data panel: https://dune.com/ahkek/solv-finance-dashboard

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!