Introduction

In a certain year, month, and place, the police brought the veteran player in the cryptocurrency circle, Zhang San, from the south to the north late at night.

Looking back at the sudden intrusion of the police that night, Zhang San still had lingering fears and even felt a bit surreal. It was said that there were also technicians from a certain security company who accompanied the police to arrest him at home. With the assistance of professionals, the police took away Zhang San’s mobile phones, computers, cold wallets, foreign currency bank cards, and so on.

After arriving at the police station, the police worked overtime to interrogate Zhang San. During that time, the police had Zhang San sign an authorization letter, the general content of which was to combat crimes and prevent property losses to victims. Zhang San voluntarily authorized the police to dispose of the virtual currency in his cold wallet and exchange accounts through legal means.

Although Zhang San felt that something was not right since the matter had not been clarified, considering that it was necessary to cooperate with the police investigation, as it was the duty of a citizen, Zhang San still cooperated with the police and signed his name on the authorization letter, and provided his account and password on the virtual currency exchange. Afterwards, the virtual currency in Zhang San’s cold wallet and in the exchange was transferred and sold by the security company.

- Autonomous World A Vision of a Digital Utopia Based on Full-Chain Gaming

- Everyone can be a data scientist, interpreting the rise of Dune.

- Jackson Hole Central Bank Meeting Preview Overall Tone Is Hawkish, But US Stocks May Be Reaching a Turning Point.

Several days later, Zhang San met with a lawyer. After multiple communications between the lawyer and the police, Zhang San was released on bail pending trial. After coming out, Zhang San asked friends in the industry and learned that the company that assisted the local police in disposing of virtual currency assets had earned millions of dollars in service fees from this case.

It should be noted that the story above is fictional, but the plot of this story is based on real events. Similar situations may occur among cryptocurrency players every day.

01. Secrets that cannot be revealed in the blockchain industry

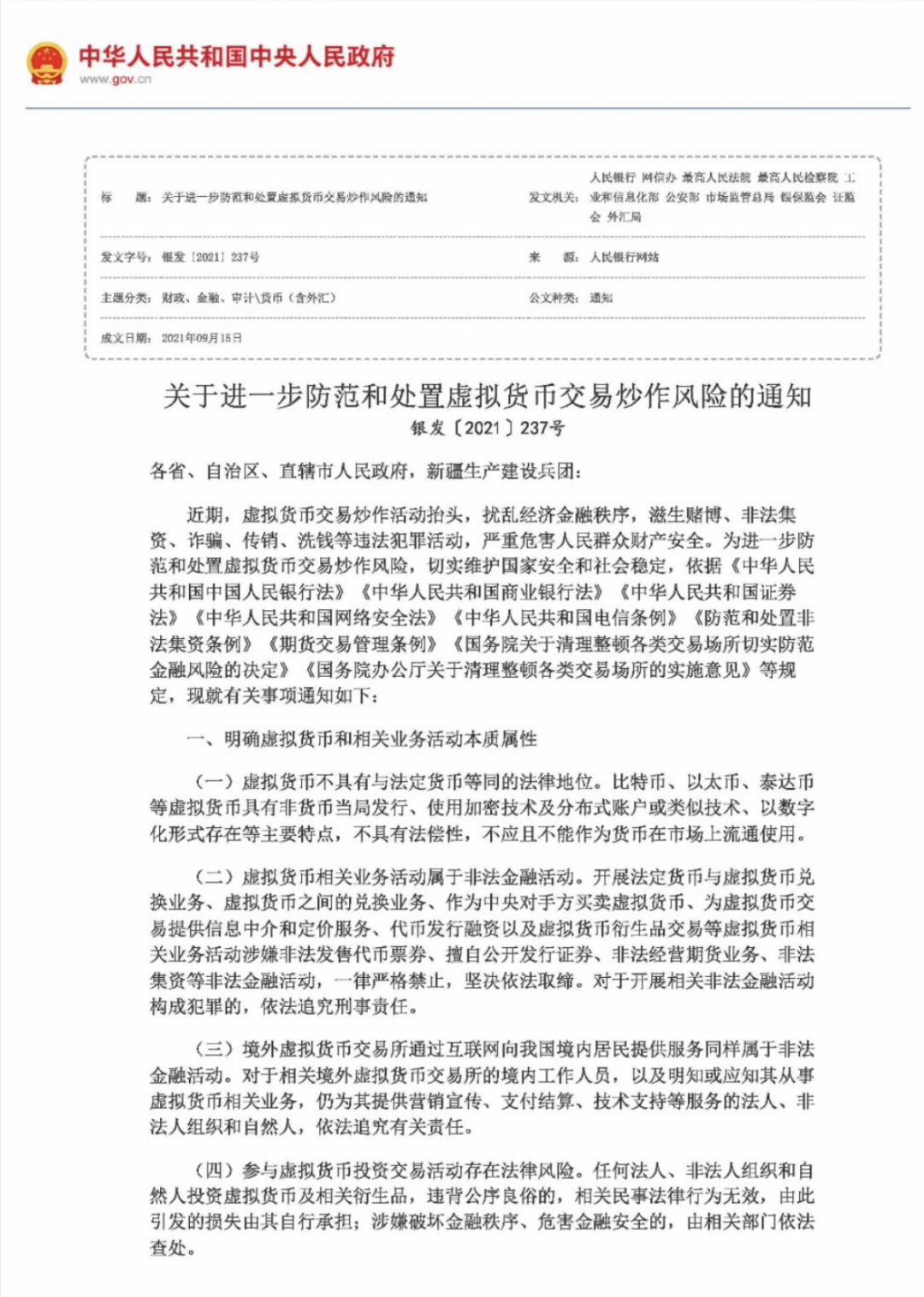

In September 2021, ten departments of the country jointly issued the “Notice on Further Preventing and Handling Risks of Virtual Currency Trading Speculation” (referred to as the “924 Policy”), which classified virtual currency and related business activities as illegal financial activities. Virtual currency does not have the same legal status as legal tender. Virtual currency-related business activities are illegal financial activities. Overseas virtual currency exchanges providing services to residents within China through the Internet are also considered illegal financial activities. Participation in virtual currency investment and trading activities carries legal risks. Those who engage in the above illegal financial activities and commit crimes shall be held criminally responsible according to law.

The introduction of the 924 Policy declared that companies and behaviors engaged in virtual currency and RMB trading services in mainland China are illegal. However, as virtual currency is increasingly used by criminal groups, the number of criminal cases involving virtual currency is naturally increasing, and the amount of money involved is also skyrocketing.

On July 18, 2023, the Public Security Bureau of Shayang County, Jingmen City, Hubei Province, sent the main suspect in a cross-border online gambling case to trial according to law. All transactions by the participants were settled using virtual currency, with a total involved amount of 400 billion. During the handling of the case, the special task force followed the clues and successfully identified and froze virtual currencies worth 160 million US dollars (over 1 billion RMB), and in October 2022, the People’s Court of Shayang County made a ruling to confiscate part of the frozen virtual currencies according to law. This case became the first case of “virtual currency confiscation by court judgment” in China.

Due to their focus on the niche legal services market of blockchain, colleagues including Lawyer Honglin often receive legal consultations and business cooperation requests regarding the judicial disposal of virtual currencies involved in cases, which involve both legal professionals from public security or courts in various regions and friends who have made a fortune in the blockchain industry. The amounts involved in individual cases range from millions to billions. It can be said that the bigger the case, the larger the amount.

So the question is: since engaging in transactions between virtual currencies and RMB within China is illegal, how can the virtual currencies that have been investigated and confiscated by Chinese judicial authorities be converted into legitimate RMB in the national treasury?

With this simple question in mind, we conducted a special survey and had discussions with multiple virtual currency disposal merchants at home and abroad, trying to continuously clarify the common practices and industrial chain of judicial disposal of virtual currencies in current Chinese judicial practice. Frankly speaking, the results of the survey were quite surprising. Many things cannot be said, but many things are being done.

We hope that the publication of Manquan series research articles, including this article, can draw the attention of friends in the industry, and while ensuring the protection of individuals’ legitimate property before judicial trial, promote transparency and compliance in the judicial disposal process of China’s blockchain industry.

It should be noted that this article represents only Lawyer Honglin’s personal views and does not constitute legal advice or suggestions on any specific matters. It is also not an endorsement or recommendation for any commercial institution. It is purely for learning and communication purposes. Please don’t read too much into it.

02. Common Paths for Judicial Disposal of Virtual Currencies in China

Based on the industry research conducted by the Manquan Law Firm team, overall, whether it is the written authorization obtained by the public security alone from the suspect during the investigation stage, or the confiscation and disposal of virtual currencies after the court’s trial and conclusion, there are generally problems such as illegal procedures, lack of specific regulations, and inconsistent execution methods.

The common methods of disposing of virtual currencies are as follows:

Method 1: After obtaining authorization from the suspect or through judicial trial, the public security organs will entrust specialized technology companies in the market to handle the disposal. The disposal company, without going through the judicial evaluation process, directly sells the virtual currency to OTC merchants on the virtual currency exchange by opening an account on the exchange and conducting over-the-counter transactions. The OTC merchants pay RMB to the disposal company, which deducts service fees (negotiable prices, with a wide range), and then pays the remaining amount to the local financial department designated by the judicial organ. Of course, considering that large-volume transactions in the market may lower prices, this method is suitable for small-amount judicial disposals or cases where the judicial organ does not have high requirements for the disposal period.

Method 2: After signing a contract with the disposal company, the public security organs will pay a small amount of virtual currency for wallet verification. Then, the disposal company will find buyers with a large amount of cash in Yiwu, Shenzhen, and other places. After deducting service fees, the disposal company will hand over or deposit the cash into the local financial department designated by the judicial organ. After the public security organ confirms the receipt of funds, it will transfer the funds to the receiving address provided by the disposal company. These companies that can produce a large amount of cash in a short period of time often have more connections with underground banks.

Method 3: After signing a contract with the disposal company, the public security organs cooperate with domestic and foreign trade companies. Through the fictitious export trade model, overseas companies remit money according to the contract, and the People’s Bank of China’s State Administration of Foreign Exchange converts the remittances into RMB and hands them over to the disposal company. After deducting service fees, the disposal company pays the funds to the local financial department designated by the judicial organ. After the judicial organ confirms the receipt of each payment, it will sequentially pay the corresponding amount of virtual currency to the wallet account specified by the disposal company.

03. Compliance-oriented disposal companies

In order to reduce the concerns of judicial organs about compliance and legality, more and more disposal companies are focusing on compliance. However, in terms of compliance standards and levels currently seen by our team, there is some compliance, but it is not sufficient.

The current common efforts of disposal companies in compliance are as follows:

1. Obtaining written authorization from the public security organs

After reaching a cooperation intention with the judicial organ for disposal, the disposal company will request the public security organ to issue relevant situation explanation letters or authorization letters, authorizing it to dispose of the relevant virtual currency assets; if it is in the stage of case investigation, there will also be a signed authorization letter from the suspect. At the same time as obtaining the authorization letter, the disposal company will sign a cooperation agreement with the public security department, stipulating the quantity of transactions, pricing basis, disposal completion deadline, and other necessary matters. Generally speaking, the text of the contract and authorization is concise, and the relevant legal risks are usually agreed to be borne by the disposal company, taking into account the colleagues of the judicial department.

2. Providing proof of the legitimacy of funds

In order to prove their source of funds and disposal capabilities, proxy disposal companies will actively provide deposit certificates from multiple banks, emphasizing the legitimacy and cleanliness of their funds. They can match funds from different channels according to different disposal repayment ratio requirements from judicial authorities. Generally speaking, the higher the legitimacy of the funds, the higher the disposal cost.

3. Shell companies that change locations after one shot

In order to improve their compliance level, proxy disposal companies usually set up or control multiple shell companies with only one natural person as the shareholder in advance. These companies are often registered as technology companies, and their legal representatives and shareholders are arranged to be “80-year-old seniors”, “cancer patients”, and other people to complete the disposal of a virtual currency asset. Correspondingly, one company will be cancelled to avoid subsequent legal responsibilities.

4. Find partners to cooperate in bidding

In order to meet the requirements of judicial procedures, proxy disposal companies will actively propose judicial disposal of virtual currencies through “auctions” and other forms, and arrange for other third-party cooperative companies to participate in bidding. After winning the bid, they will sign formal agreements. Due to the sensitivity of the matters involved, relevant auction information will not be published through normal government websites.

04. Legal risk analysis of judicial disposal of virtual currencies

1. What are the legal risks of proxy disposal companies?

As mentioned earlier, proxy disposal companies in the industry are often only general limited liability companies registered for business purposes. They are usually technology companies with business scopes related to blockchain technology development and consultation, but they usually do not have written expressions of virtual currency judicial evaluation or disposal. The companies do not have specific financial licenses or relevant business qualifications, and they do not have any substantial business operations. In short, these companies are born for the judicial disposal of virtual currencies.

According to our understanding of China’s 924 policy, it is obviously illegal for ordinary private companies registered in mainland China to engage in the exchange and matching services between virtual currencies and renminbi without special business qualifications. This illegal behavior will not be changed by the authorization of grassroots judicial departments and the written contractual agreements between the parties. Therefore, many judicial disposal companies on the market actually establish channels for the circulation and transactions between virtual currencies and renminbi, which obviously violates the provisions of the 924 policy and is suspected of illegal business operations.

More importantly, for disposal companies, the obtained virtual currencies must have an exit. After obtaining virtual currencies, proxy disposal companies often use technical means to clean the addresses of the involved virtual currencies for security reasons, such as removing the on-chain addresses of virtual currencies through mixers, and then selling them to domestic foreign trade merchants or high-net-worth buyers; or realizing the virtual currencies overseas through gray channels, and then laundering them back to China through “underground banks” or “false trades” after applying for foreign exchange settlement from the State Administration of Foreign Exchange. These operations often involve violations of the country’s anti-money laundering laws and regulations on foreign exchange management, and have significant criminal legal risks.

2. What are the legal risks for judicial personnel?

(1) Risk of property loss

For most judicial personnel, virtual currencies are still unfamiliar. Most grassroots judicial workers are often unaware of their market prices and transaction models. In the process of judicial disposal, how much can a coin be sold for? Where should it be traded? These questions are usually not clear. Therefore, in the disposal of most virtual currencies involved in cases, there is often no standardized procedure such as judicial appraisal or assessment. Instead, the current transaction price recommended by the recommended disposal company is simply used as the basis for valuation. The phenomenon of market manipulation in exchanges is highly manipulable by big institutional investors, which means that the price benchmark for judicial disposal is also a problem, resulting in a certain risk of loss in the amount of disposal funds returned to the national treasury.

(2) Risk of disposal funds being involved in the case

Every industry is becoming more competitive, and the judicial disposal of virtual currencies is no exception. In addition to providing funds with different levels of cleanliness for disposal, most recommended disposal companies often take the initiative to adopt a “payment first, then transfer the coins” approach in order to dispel concerns from the public security authorities about receiving the coins but not the money.

Generally, disposal companies have a daily disposal capacity of around 500 million RMB, which is quite common. However, the idle funds in normal private trading company accounts are often not so abundant. Therefore, there may be situations where multiple recommended disposal companies transfer funds from their bank accounts to the same receiving account. Previously, there have been cases where a recommended disposal company paid funds to the public security authority, but it turned out to be funds frozen by another local public security authority in another domestic case. It can be said that it’s a case of mistaken identity.

(3) Risk of being held accountable for improper performance of duties

The novelty of the industry and the increasing amount involved in cases have attracted more and more intermediaries to focus on the lucrative business of judicial disposal of virtual currencies. We often receive inquiries from clients in the industry who say they have billions of virtual currency involved in a case that needs judicial disposal. However, when I ask for some details, the other party starts to say that they are also inquiring on behalf of their superiors, and the people in the middle who inquire often form a chain, just like a Russian nesting doll. A friend jokingly said that if nobody in the industry has ever talked to you about the judicial disposal of virtual currencies, then you are definitely not an insider.

In this process, it is inevitable that a lot of rent-seeking activities will occur, creating a new problem in order to solve another problem. As national judicial workers, if they are led into a pit by third-party disposal companies under the guise of compliance because they do not understand the industry’s operations, it would be quite magical if they are later investigated by the disciplinary inspection and supervision commission.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!