Today’s News Highlights:

The US Department of Justice accuses the founder of Tornado Cash of money laundering and violating sanctions

The Central African Republic has approved the tokenization of land and natural resources through the “Tokenization Law”

Coinbase will delist 6 tokens including Multichain and Ooki on September 7th

- Immutable in the Cryptocurrency Winter Continuously Building Game Infrastructure

- New Narrative of DeFi? A New Secure Model for Smart Contracts Without Oracle Protocols

- Bear market top game guild observation Different developments, some running wild, some falling behind.

Bitstamp will stop offering Ethereum staking services to US customers starting from September 25th

CoinList launches Market Maker Incentive Program, waiving 3 months of fees for all eligible market makers

FTX spends up to $1.5 million daily on legal fees

Messari: Assets stored in Safe smart contract accounts exceed $50 billion

Data: Current total value locked (TVL) in DeFi is around $38 billion

Regulatory News

The US Department of Justice accuses the founder of Tornado Cash, Roman Storm, of money laundering and violating sanctions. According to the official announcement, Roman Storm and Roman Semenov are accused of conspiring to launder money, violating sanctions, and operating an unlicensed money transfer business. The indictment states that the two individuals are suspected of creating, operating, and promoting Tornado Cash, facilitating over $1 billion in money laundering transactions and laundering hundreds of millions of dollars for the sanctioned North Korean cybercrime organization, Lazarus Group. Roman Storm has been arrested in Washington state and will appear in the US District Court for the Western District of Washington today, while Roman Semenov remains at large. In addition, Roman Semenov has been added to the Special Designated Nationals and Blocked Persons List by the US Department of the Treasury’s Office of Foreign Assets Control (OFAC).

The Central African Republic has approved the tokenization of land and natural resources through the “Tokenization Law”. The Sango platform, based on the Bitcoin sidechain, launched by the Central African Republic, stated that the country has approved the tokenization of land and natural resources. Local and international entrepreneurs will be able to utilize the blockchain integration of the Sango platform, covering real estate, agriculture, and natural resources.

Earlier, a message in the Telegram group of the Central African Republic’s national cryptocurrency project, Sango, stated that the country has made “significant progress” in formulating laws and regulations that will allow its cryptocurrency, Sango Coin, to be listed on cryptocurrency exchanges. However, according to the project, the listing of Sango Coin will be delayed for a few weeks until the framework is finalized. The Central African Republic launched the Sango platform based on the Bitcoin sidechain on July 25, 2022, and started the SANGO token presale. SANGO is the native cryptocurrency of the ecosystem with a total supply of 21 billion coins.

The Hong Kong Monetary Authority (HKMA) has released a report on blockchain bonds, exploring the potential of tokenized bonds. The report provides details on the “Project Evergreen” for issuing tokenized green bonds and presents available options for various aspects of tokenized bond transactions in Hong Kong, including technical and platform design considerations and transaction structure.

NFT

Project Updates

Coinbase to Delist 6 Tokens including Multichain and Ooki on September 7th

Coinbase Assets tweeted that, based on recent reviews, BarnBridge (BOND), DerivaDAO (DDX), Jupiter (JUP), Multichain (MULTI), Ooki (Ooki), and Voyager (VGX) will be delisted at around 0:00 Beijing time on September 7, 2023. Trading of these 6 tokens will be halted on Coinbase.com, Coinbase Pro, Coinbase Exchange, and Coinbase Prime.

Bitstamp to Halt Ether Staking Services for US Customers Starting from September 25th

Bitstamp US CEO Bobby Zagotta stated in a declaration that starting from September 25th, 2023, Bitstamp will no longer offer Ether staking services to its US customers. Until September 25th, customers will continue to receive staking rewards, after which all staked assets will be unstaked. All other Bitstamp services will remain unaffected. Rewards will be credited to users’ main account balances along with the principal. The company stated that the decision to shut down staking services is due to the regulatory environment in the United States. The US Securities and Exchange Commission (SEC) has targeted staking services in multiple enforcement actions, claiming that these staking projects are investment contracts under the Howey test in lawsuits against Coinbase and Binance.

Cypher Plans to Conduct IDO Early, 7.3% of Tokens to be Airdropped

According to official sources, Cypher will conduct an IDO earlier than originally planned (scheduled for the end of September) to compensate affected users due to the recent attack incident. The funds raised from the IDO will be used to provide funding for development and fill the project treasury. More than 45% of the tokens will be sold to the public, 23% will be allocated to the team, 11% to investors, 1.2% to advisors, and 12% for growth incentives. Additionally, 7.3% will be airdropped to depositors who incurred losses due to the hack attack. Before launching the IDO, Cypher will transfer the funds from the existing smart contract to a new smart contract. This will facilitate the affected users in claiming the specified redemption package. The airdrop will be conducted based on the ratio determined by the snapshot taken at the time of the protocol freeze. Details regarding the airdrop will be announced soon. In previous updates regarding the attack incident, Cypher stated that approximately $600,000 has been frozen on various centralized exchanges (CEXs), and the return of these funds will depend on the cooperation of these CEXs and the issuance of seizure orders by law enforcement agencies.

CoinList Launches Market Maker Incentive Program, Waives 3-Month Fees for all Eligible Market Makers

CoinList has launched a Market Maker Incentive Program to enhance liquidity on the spot market of CoinList Pro. All fees for eligible market makers on CoinList will be waived for the next 3 months. In addition, a 0.05% maker fee rebate will be provided to the top 5 traders based on the average executed trading volume over 30 days.

To ensure that currency pairs with lower liquidity receive the attention they deserve, CoinList will implement rebate multipliers based on trading categories. At the beginning of each month, rebates will be distributed to the top 5 USDC market makers based on the previous month’s executed trading volume.

Layer 1 (Multiplier 1x): BTC, ETH

Layer 2 (Multiplier 2x): MATIC, SOL, DOGE, SUI, AVAX, LINK, DOT, FIL

Layer 3 (Multiplier 3x): AAVE, ALGO, ICP, FLOW, STX, ROSE, OCEAN, IMX, MKR, XTZ, MINA, CELO, GAL, COMP, T, SKL, CSPR, BICO, CLV, BLD, OXT, BTRST, NYM, VEGA, GODS, CUSD, HMT, GOG, CQT, BZZ, WCFG, UNI, EFI, CYBER, NEON, CFG, WAXL

FTX sells, stakes, and hedges its billions of cryptocurrencies through Galaxy

According to court documents filed on Wednesday evening, bankrupt cryptocurrency exchange FTX hopes to start selling, staking, and hedging its large amount of cryptocurrency assets and is seeking the assistance of Mike Novogratz’s Galaxy as an advisor. FTX hopes to return funds to creditors in fiat currency rather than in the form of Bitcoin (BTC) or Ethereum (ETH), but wants cautious trading to avoid weakening its holdings of over $3 billion worth of cryptocurrencies.

FTX’s lawyers stated in the documents, “Hedging Bitcoin and Ether will limit potential downside risk for FTX before selling such Bitcoin or Ether.” “Pledging certain digital assets… will provide low-risk returns for idle digital assets, benefiting estate management institutions and ultimately creditors.”

FTX hopes that the interest from its cryptocurrency reserves will increase its reserves that can be distributed to customers still awaiting refunds.

USDC to launch on Polygon PoS, Base, Polkadot, NEAR, Optimism, and Cosmos

According to The Block, USDC, a stablecoin co-founded by Circle and Coinbase, is set to launch on six major blockchains: Polygon PoS, Base, Polkadot, NEAR, Optimism, and Cosmos. This expansion aims to increase USDC’s market share in the stablecoin market.

Investment and Financing

Decentralized local peer-to-peer open-source tool Anytype raises $13.4 million in funding, led by Balderton Capital

Decentralized local peer-to-peer open-source tool Anytype announced that it has raised $13.4 million in a new funding round, led by Balderton Capital. Other participants include Inflection, Square One, Script Capital, Protocol Labs, Connect Ventures, New Forge, Foreword VC, and a group of well-known angel investors in the Web3 space. Anytype’s locally-centered peer-to-peer open-source tool provides users with the initial promise of internet freedom while protecting privacy, data autonomy, and control. By combining no-code tools with decentralized architecture, creators and communities can build networks in their own way.

Important Data

Messari: Assets stored in Safe smart contract accounts exceed $50 billion

In its “Unifying Standards: Safe{Core} Protocol” report, Messari states that assets stored in Safe smart contract accounts exceed $50 billion, making it one of the preferred solutions for smart contract wallets. Last week, Safe released the interoperability protocol Safe{Core} for modular smart accounts.

FTX daily legal expenses reach up to $1.5 million

Kris Hansen, the lawyer representing the FTX Creditors Committee, stated that FTX’s monthly legal expenses have reached nearly $50 million, with an average daily cost of $1.5 million. Hundreds of lawyers, financial advisors, and bankers work almost full-time, and every dollar spent on legal fees reduces the amount available to repay creditors.

NVIDIA’s second-quarter revenue grows by 88% higher than expected, AI-related tokens rise

NVIDIA released its second-quarter financial report, with revenue reaching $13.5 billion, an 88% increase from the first quarter, exceeding analysts’ expectations by over $2 billion. As a result, AI-related cryptocurrencies such as FET, RNDR, and AGIX have seen a maximum increase of over 4% in the past 24 hours. Additionally, according to Google Finance data, NVIDIA’s earnings per share (EPS) were $2.48, surpassing analysts’ expectations of $2.08. The company’s EPS for the second quarter increased by 854% year-on-year. NVIDIA’s stock price has also risen due to its better-than-expected performance, surging nearly 10% in after-hours trading. Over the past 10 months, NVIDIA’s stock price has risen by over 300%, and its market value has exceeded $1.16 trillion.

Voyager transfers 12.89 million USDC to Circle for conversion to USD

According to on-chain analyst Yu Jin, the matter of Voyager’s coin selling and compensation has finally come to an end. 14 hours ago, Voyager transferred another 12.89 million USDC to Circle for conversion into USD. Since August 12th, it has retrieved 97.89 million USDC through token sales and withdrawals. At this point, Voyager has sold most of its tokens and converted them into USDC for withdrawal. Except for 52.4 million VGX ($6.3 million), the remaining token’s total value is less than $200,000.

Data: Current total value locked (TVL) in DeFi has dropped to around $38 billion

DefiLlama data shows that the total value locked (TVL) in the cryptocurrency market’s DeFi sector has dropped to its lowest level since February 2021, currently around $38.134 billion. This represents a decrease of over 70% from the highest point of over $170 billion during the 2021 Defi Summer.

LianGuaiNews APP’s Points Mall is officially launched

Hardcore prizes for free redemption: imKeyPro hardware wallet, First Class Research Report Monthly Card, Ballet REAL series wallet, AICoin membership, various peripherals, and hundreds of selected research report collections. First come, first served, experience it now!

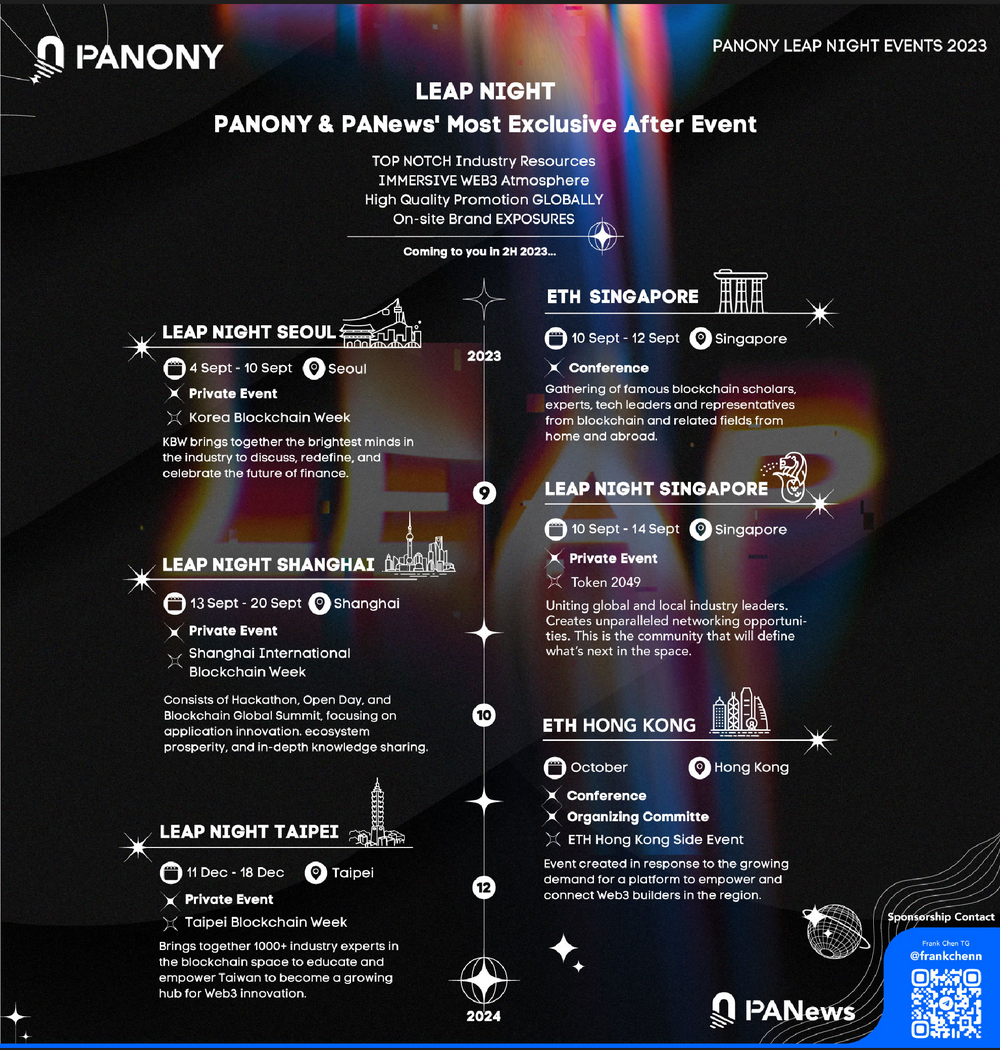

LianGuaiNews launches the global LEAP tour!

South Korea, Singapore, Shanghai, Taipei, September to December, multiple locations come together to witness a new chapter of globalization!

📥Multiple activities are being jointly built in various locations. Welcome to communicate!

This HTML code displays an image.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!