On the evening of June 6th, the U.S. Securities and Exchange Commission (SEC) once again sued Coinbase, a compliant U.S. cryptocurrency trading platform, for violating U.S. securities trading rules in the federal court in New York.

Afterwards, Coinbase responded to the SEC by saying that the key to solving the problem lies in legislation, not litigation. In the absence of clear regulatory rules, SEC’s enforcement actions have harmed America’s economic competitiveness and companies like Coinbase which have a clear commitment to compliance.

As the “major general” of the Coinbase camp who is facing the SEC directly, Chief Legal Officer Blockingul Grewal emphasized his determination to “fight the SEC to the Supreme Court, and Coinbase will win” while repeatedly mentioning another lawsuit matter (Coinbase actively sued the SEC) on his personal social account and in media interviews, indicating that he sees it as a “winning hand” to turn the tide of the battle.

According to Emily Meyers, General Counsel of Electric Capital, the lawsuit can be traced back to July 2022 at the earliest.

- Decoding Frax Finance’s frxETH V2 Update

- Overview of the House hearing: SEC enforcement actions criticized, new crypto regulations may take several years

- What did SEC Chairman Gensler say in response to the lawsuits filed against cryptocurrency exchanges?

At that time, Coinbase submitted a petition to the SEC to develop regulatory rules, requiring the agency to provide necessary regulatory guidance for the cryptocurrency industry.

Nine months later, the SEC did not respond to this.

In May 2023, Coinbase sued the SEC to the United States Third Circuit Court of Appeals, based on the Administrative Procedures Act, requiring the SEC to respond to the petition within a reasonable time frame — “Give a straight answer, do you or don’t you?”

Coinbase’s reasoning is that based on reasonable administrative rulemaking procedures, if the SEC has made a decision on the issue (regardless of whether the answer is “yes” or “no”), it must respond to the petition, especially in the case of a “no” answer, or the public will never be able to exercise their right to ask the court whether the agency’s decision is appropriate.

However, before the Third Circuit Court of Appeals could make a ruling, the SEC turned around and sued Coinbase in the federal court in New York yesterday.

Early this morning, the Third Circuit Court of Appeals released a document stating that it has noticed the SEC’s lawsuit against Coinbase and other exchanges, and as such is asking the SEC to respond within 7 days on “whether it has decided to deny Coinbase’s petition,” specifically asking the SEC to respond to the following three questions:

- Has the SEC now decided to deny Coinbase’s petition?

- If not, how much longer does the SEC need to decide whether to grant or deny?

- Why should this court not relinquish jurisdiction (SEC ran to the New York federal court)? and instead order periodic reports and set a final deadline? If the SEC has not yet decided whether to grant or deny, the court will rule on Coinbase’s complaint request.

Regarding the Third Circuit Court of Appeals’ request, Blockingul Grewal immediately gave his “rainbow fart,” stating that it not only concerns the cryptocurrency industry, but also demonstrates the normal operating process of government agencies and the correct way to interact with the public.

And for SEC’s potential responses, Blockingul Grewal seems to have prepared for all possibilities.

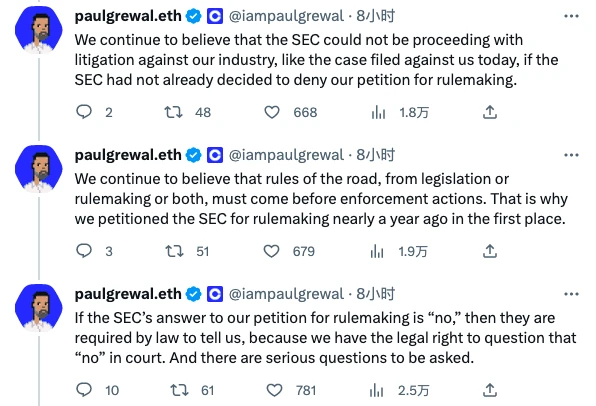

In a personal tweet, Blockingul Grewal wrote:

- If the SEC has not yet decided to deny the petition, then the SEC should not sue us and the entire industry as it is necessary to legislate or regulate before specific enforcement actions are taken.

- If the SEC has decided to deny the petition, Coinbase has the right to ask them to explain why, and also has the right to question it. Coinbase will question some very serious issues.

In short, Blockingul Grewal’s logic now is that he has been seeking compliance, but you won’t give me a reply:

- If you haven’t figured out whether or not to make rules, don’t sue right away. Without specific rules, how dare you say that I violated them?

- If you decide not to make rules, then why? I’m looking for regulation, but you’re not responding to me. I’d like to ask what you’re doing as a regulatory agency.

As of now, no one can guess what the SEC’s response to the Third Circuit Court of Appeals will be, nor can it predict which direction this confrontation will develop in. But it is not difficult to see that the lawsuit brought by Coinbase in April of this year has in some ways gained some initiative for itself, and this slight deviation of the balance may also have a profound impact on the final judgment of last night’s lawsuit.

Another point that can be confirmed is that, from the perspective of the entire industry, regardless of which direction the situation itself will develop, the contradictions arising from regulation will inevitably promote the improvement of regulation itself. Looking towards the longer-term future, the current disputes may be just the birth pangs of a new stage.

Long live crypto.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!