Next, I will break down the current situation of OP from two perspectives.

- Ecosystem & Projects

- The Future of OP Stack

Ecosystem & Projects

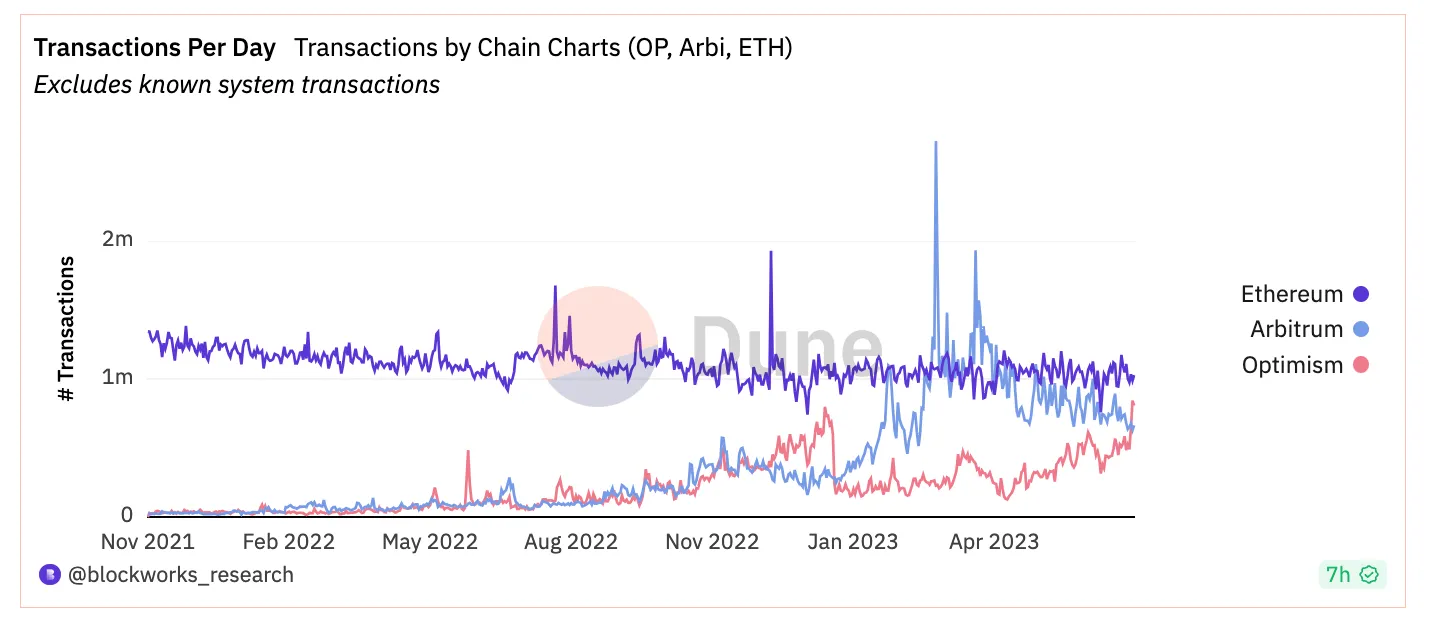

As of now, from a data perspective, Arbitrum is still the leader in Layer 2, and OP is still at a disadvantage in terms of the ecosystem. However, with the widespread adoption of OP Stack, OP has gained more market attention recently (Basechain, Worldcoin) – even though there is continuous unlocking, the overall market value of OP has been growing.

It is worth mentioning that OP has surpassed Arbitrum in terms of daily transaction volume, showing a trend of sucking blood from Arbitrum.

- Celestia Researcher Overview of 4 New Rollup Solutions

- This time, Chainlink’s pricing scheme has achieved great success.

- Financing Weekly Report | 15 Public Financing Events; Flashbots Completes $60 Million Financing at a Valuation of $1 Billion

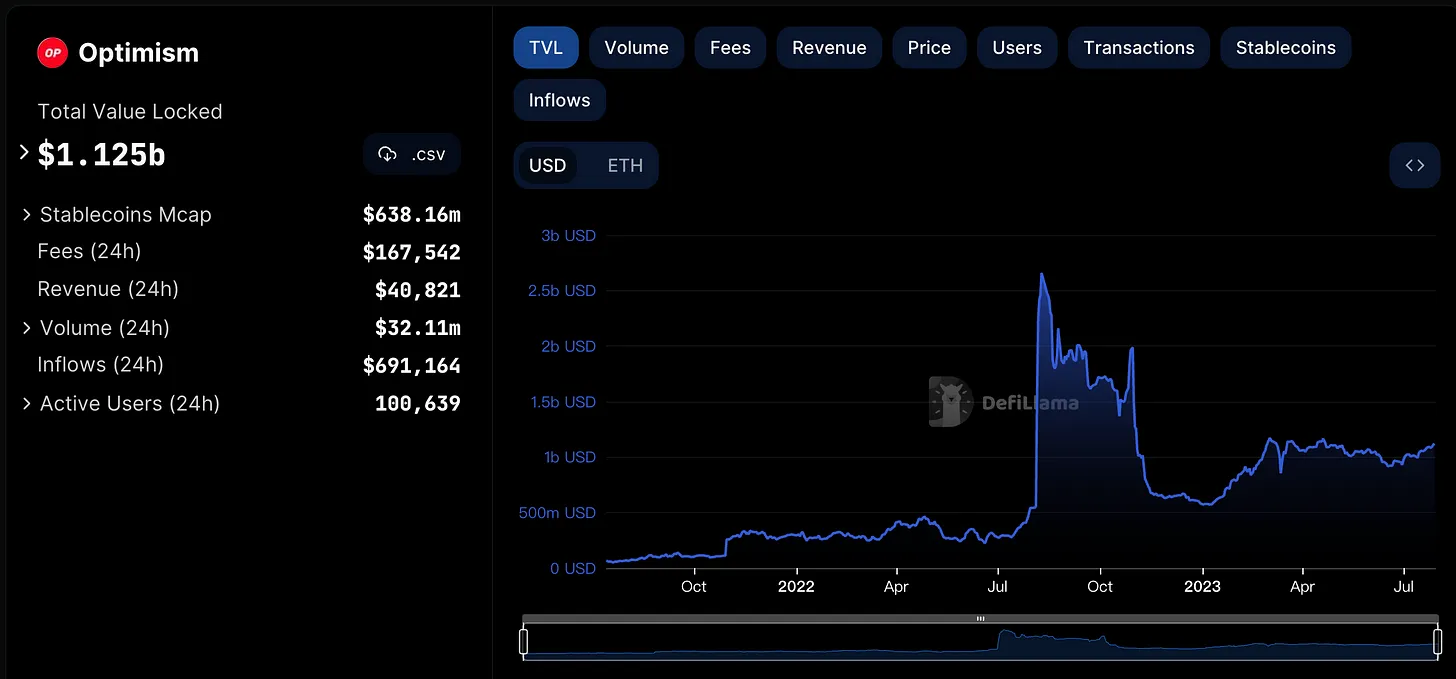

TVL also has an upward trend.

The leading protocol of OP, Velo, is a DEX based on the ve3,3 architecture. It has been relatively low-key because there are not many native assets on the OP chain, far inferior to Arbitrum (GMX, Magic, Dopex, Pendle, etc.). To start the flywheel, ve3,3 needs to attract enough protocol participation. The more native assets on the chain, the stronger the ve3,3 on that chain.

More and powerful native assets – High user adoption (mining + trading demand) – Need deeper liquidity to reduce slippage – ve33 matches low liquidity acquisition cost – Increase the emission value of ve33 tokens and bribe rewards – Positive flywheel

From the current situation, OP’s ecosystem development still has a long way to go. However, we can also see that many protocols have been built around Velo, such as Extra Finance and Exactly Protocol.

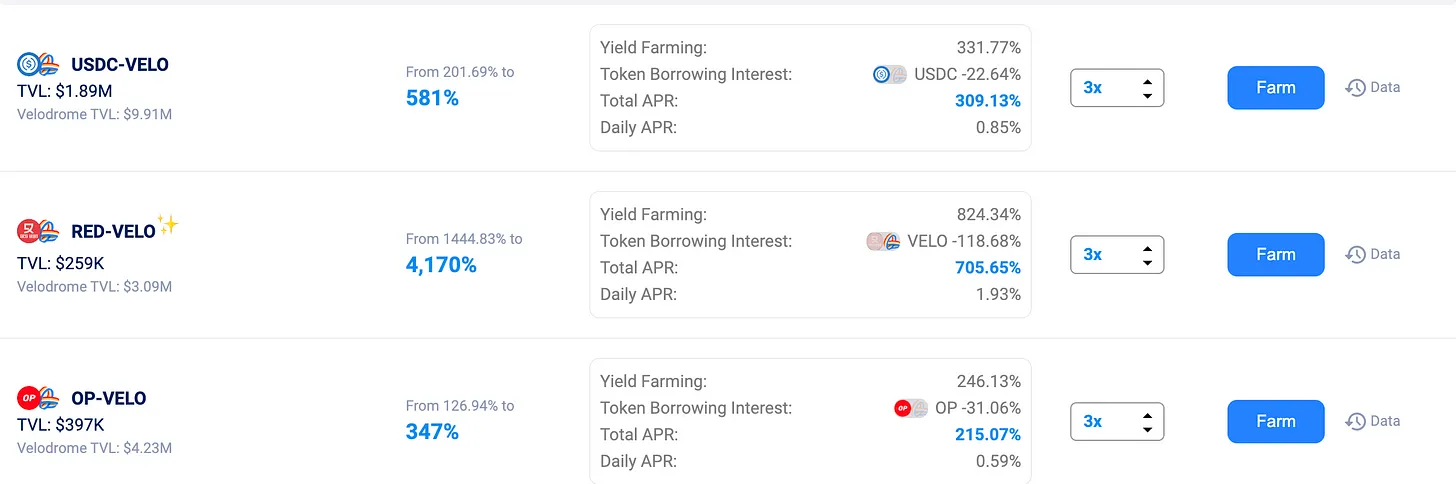

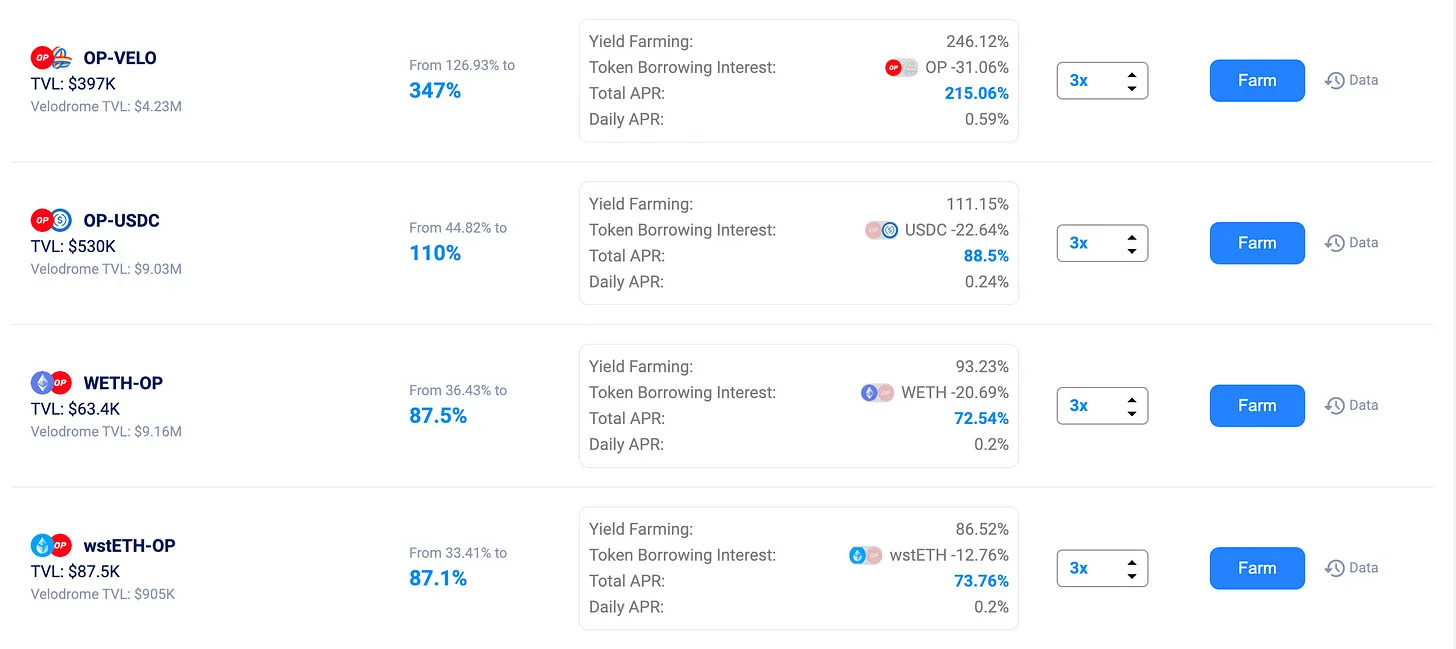

Extra is a lending protocol that provides UI/UX support for users to participate in Velo DEX liquidity mining with leverage through the protocol. So far, the protocol still provides high liquidity rewards. The high LP rewards alleviate the token emissions faced by users holding $VELO (another way is to lock VE for bribe rewards). Its current TVL is 19M, making it the fastest-growing protocol in OP recently.

Exactly is a protocol that provides users with floating/fixed interest rates for assets. Its current TVL is 82M. The native token of Exactly, $EXA, has been deployed on Velo in a liquidity pool and has increased LP rewards through bribes.

Extra and Exactly are two directions that interact with the Velo protocol. The former leverages LP through lending, while the latter establishes liquidity pools to provide more bribes for veVELO holders.

The behavior of Exactly represents the demand for liquidity on the OP native protocol and the satisfaction of its demand by ve3.3 DEX Velo. Extra amplifies the wealth effect on the OP chain, attracting more people to enter the OP chain.

They represent two different catalysts, with Velo being the beneficiary and the ecosystem also benefiting. We can also see from the growth of Velo’s Fee and Incentive Rewards that Velo has gained more dividends in the gradual growth of the OP ecosystem. If the increased market attention and sentiment brought by the OP Stack can continue, Velo will also achieve corresponding growth.

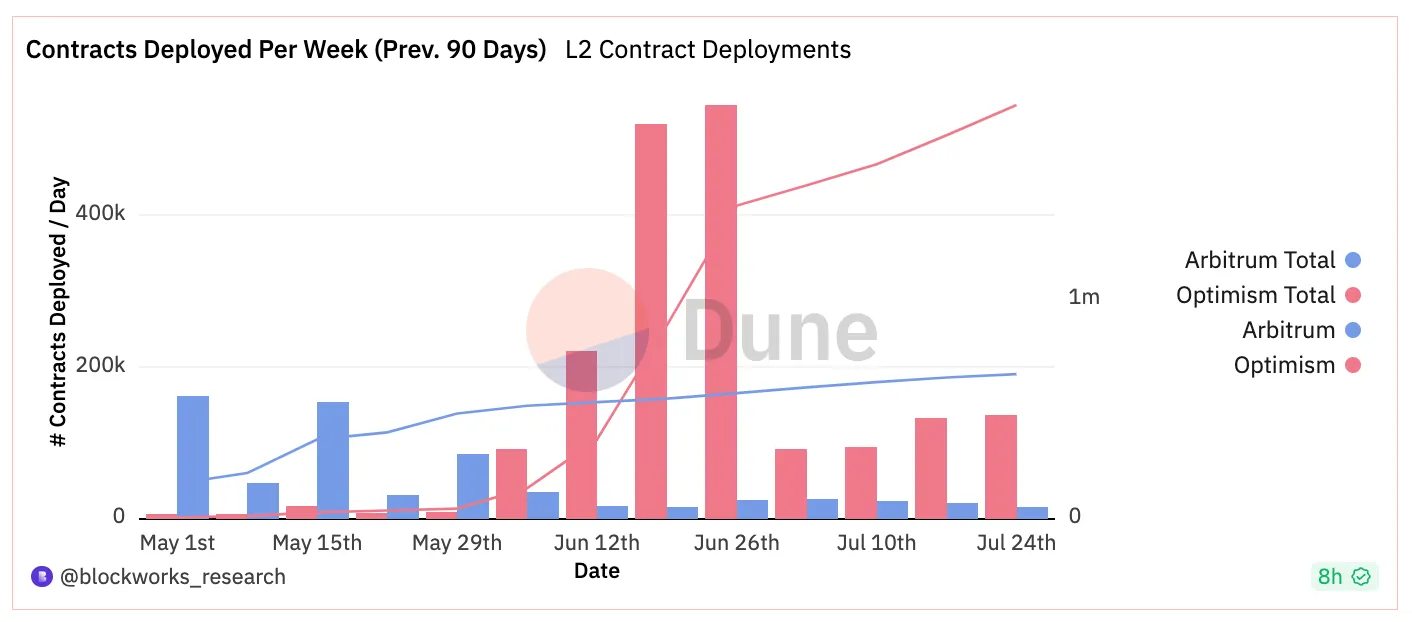

Another proof of the rapid growth of the OP ecosystem is the change in the number of contract deployments in the last 90 days. Therefore, in the past six months, the OP ecosystem should have seen some good-performing protocols.

Another native protocol that has performed well in TVL is Sonne Finance. It is a lending protocol with a TVL of 107M.

Synthetix, on the other hand, is a multi-chain synthetic asset protocol that is well known to everyone, so I won’t go into detail about it. However, the difference between Synthetix and GMX is that GMX’s GLP provides a powerful income-generating asset LEGO for the Arbitrum ecosystem, and various protocols can be built on top of it, thus creating a positive GLP flywheel. Synthetix’s sUSD does not have such an advantage and even bears common debt. SNX stakers are liquidity providers for the protocol, and their income comes from inflation and fee revenue, so the market value of SNX also determines the upper limit of SNX protocol liquidity – this will be addressed in v3 in Q4.

The advantage of Synthetix is that, like Velo, it provides a powerful product LEGO for protocols deployed on the OP. Unfortunately, they have not been able to introduce a powerful income-generating asset LEGO for OP like GMX/GLP.

For the OP ecosystem, this gap is a potential growth opportunity.

The Future of OP Stack

We can now see that OP Stack has gained a lot of adoption. The brand endorsement from institutions like Coinbase has given OP Stack a good brand endorsement. Therefore, we don’t actually need to worry about the future adoption and development of OP Stack. Its main threat comes from zkRollup, but from the current situation, zkRollup is far from mature, and OP Stack has already started to expand its ZKP technology.

Another point worth noting is whether the chains that adopt OP Stack can contribute back to OP. The previous statement from Basechain was that a portion of the revenue would be contributed to Optimism Collective. This is a good thing for OP, as having a source of income in the treasury means “capability,” and “capability” will be more reflected in the token price. If more chains follow Basechain’s operation, it will provide more “capability” to Optimism Collective.

Obviously, the OP team has also realized the “ability” of OP Stack. On July 25th, they released the Law of Chain proposal, aiming to launch a shared governance model and sorter for all chains using OP Stack. This is similar to the shared security model previously established by Cosmos. The essence of the Law of Chain is to standardize the “revenue feedback” model. The implementation of this proposal will also bring more benefits to the Optimism Collective.

Above are my insights into OP, and in the future, I will actively participate in the OP ecosystem.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!