Author: Ignas

Translation: Luffy, Foresight News

Do you hold stablecoins? If so, which ones do you hold? What do you use them for? Are you putting them into DeFi yield activities, or just holding them waiting for a buying opportunity at a low point?

Perhaps you have converted stablecoins into fiat currency to avoid associated risks. This is understandable, especially when one of the main stablecoins, USDC, has experienced a severe depegging in the short term. Or maybe you have chosen fiat currency because it currently offers a higher interest rate than blue-chip DeFi protocols.

- HV-MTL Quarterly Review Can Yuga Games be the Lifeline for APE?

- What are the highlights of dappOS, which leads the LianGuairadigm’s new track of intent trading and is favored by many top VCs?

- Project Research | Bitcoin Layer 2 Protocol Stacks Expanding a New Chapter for Bitcoin Smart Contracts and DApps

In the bear market of the crypto market, the total market value of stablecoins has dropped from its historical high of $200 billion to the current $126 billion, which is not surprising.

But don’t be afraid. The stablecoin market is becoming increasingly fascinating, and the founder of Synthetix has stated, “We are entering the golden age of decentralized stablecoins.”

Are you curious about what this statement means? Let’s break it down in detail.

Which stablecoin is the safest?

This is the most important question because you don’t want to wake up one day and find that your stablecoin has dropped by 50%.

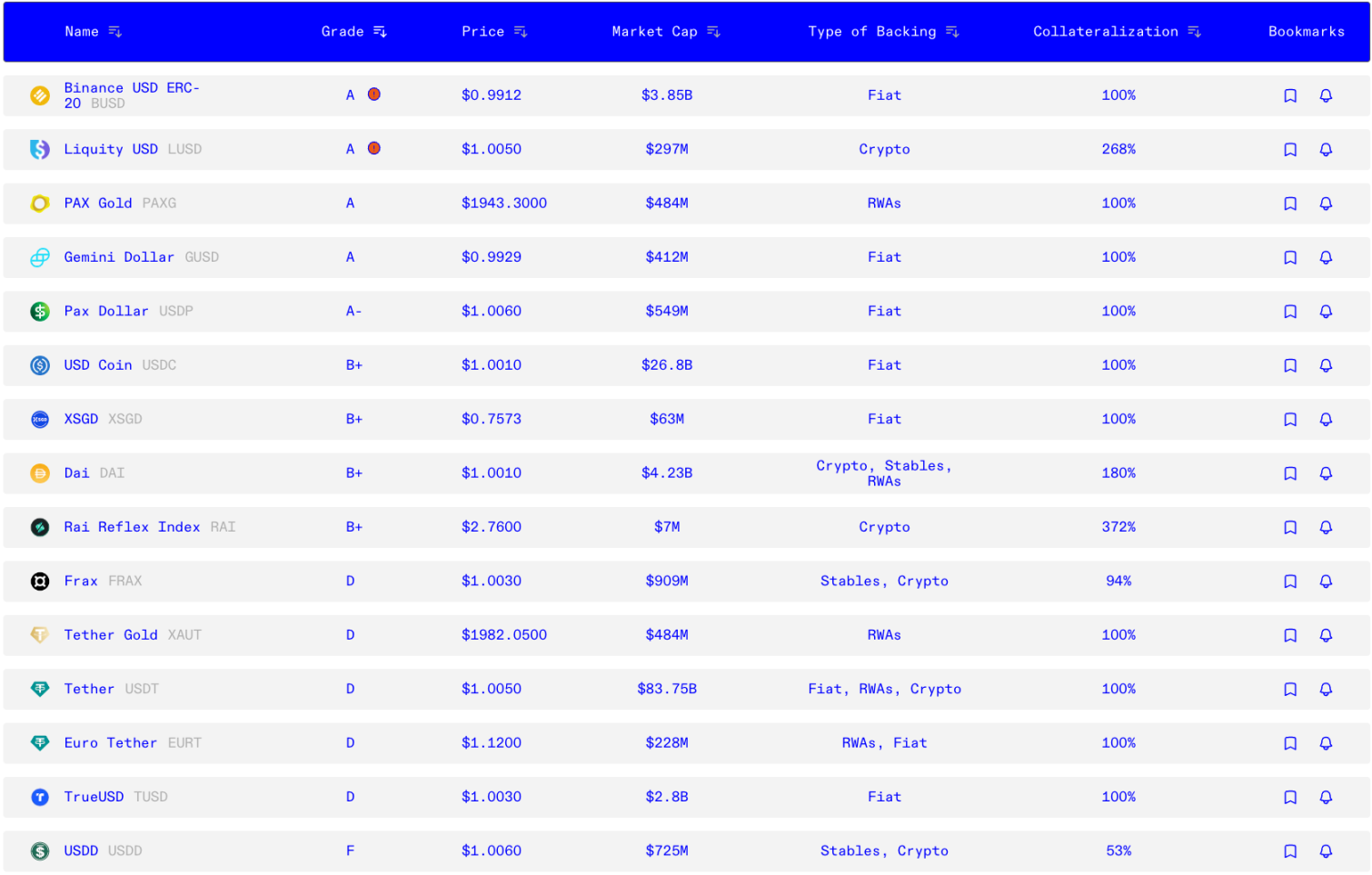

Fortunately, the non-profit organization Bluechip has released an economic security rating for top-tier stablecoins this week. The security rating takes into account the overall performance of stablecoins and provides multidimensional information: stability (S), management (M), implementation (I), decentralization (D), governance (G), and external factors (E).

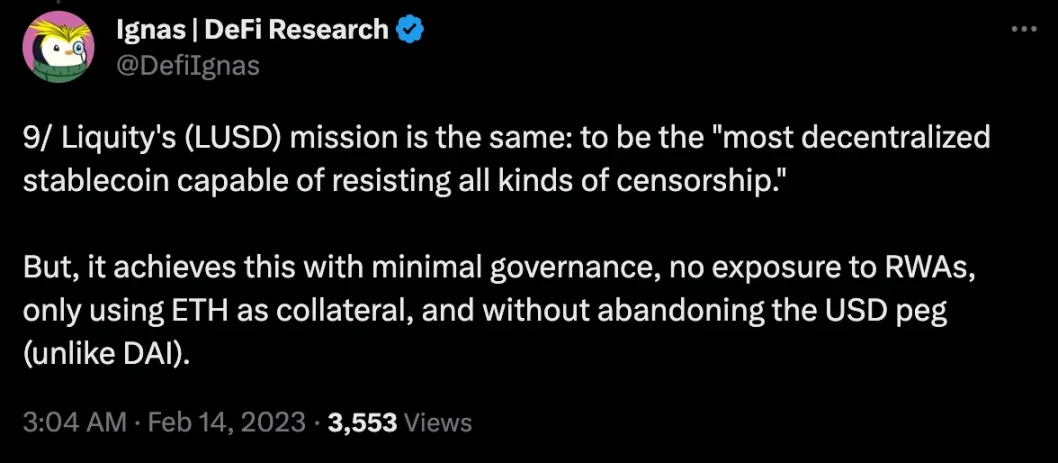

In Bluechip’s evaluation model, the safest stablecoins are BUSD, LianGuaiXG, GUSD, and Liquity’s LUSD. This means that LUSD is the economically safest decentralized stablecoin, even safer than USDC.

This is not surprising. In the severe depegging event of USDC in March, LUSD served as a safe haven.

Interestingly, other DeFi stablecoins are also within the scope of evaluation, with DAI and RAI receiving a B+ rating, while USDD is rated as F.

Tron’s USDD received an F rating because its reserves consist of TRX (69%), BTC (29%), and TUSD (2%). However, Bluechip does not consider the collateral ratio of TRX. The collapse of Terra/Luna illustrates the significant risks hidden in native collateral.

If you are curious about the results of the investigation, here is a brief summary of the selected stablecoin report:

- Binance USD ERC-20 (Rating: A): This stablecoin is issued by LianGuaixos and is considered safe for public use. Although NYDFS stopped issuing it in 2023, the support for BUSD has not been affected.

- Liquity USD (Rating: A): LUSD is part of the Liquity Protocol and is a highly decentralized stablecoin. It is controlled by code rather than by individuals, which is a manifestation of its security. However, please note that there are also risks associated with smart contracts and oracles, so be cautious when purchasing LUSD worth more than $1.

- USD Coin (Rating: B+): USDC is one of the safest stablecoins, with reserves including short-term US Treasury bonds and cash deposits. It has broad applicability and can improve its rating by proving bankruptcy isolation reserves and incorporating redemption schedules into its terms of service.

- DAI (Rating: B+): DAI is the oldest on-chain stablecoin, primarily backed by centralized assets. Nevertheless, it is considered safe and ideal for users seeking permissionless protocols.

- Rai Reflex Index (Rating: B+): RAI is a decentralized stablecoin with a floating price, not pegged to any fiat currency. Despite being an experimental stablecoin, it has proven to be a reliable low-volatility alternative to traditional stablecoins. It is backed by ETH collateral and is suitable for users who want decentralized and censorship-resistant stablecoins.

- Tether (Rating: D): Although USDT is the oldest and largest stablecoin, it has transparency issues. It is suitable for institutional users, high-net-worth individuals, and advanced traders who can directly use the redemption mechanism.

- Frax (Rating: D): FRAX has a tight peg and performs well under market pressure, but concerns have been raised about its partial collateral mechanism and dependence on centralized assets. It is suitable for risk-taking yield farmers and liquidity providers who can handle protocol complexity.

- USDD (Rating: F): USDD is managed by the Tron DAO Reserve and is similar to the failed UST stablecoin. It is not recommended for use due to concerns about its collateral, as only 50% of its supply is backed by non-TRX collateral (mainly Bitcoin).

You may be wondering, what does this security ranking have to do with the golden age of decentralized stablecoins?

Indeed, there is a connection, as the following content will include experimental DeFi stablecoins that either become the next big thing or collapse entirely.

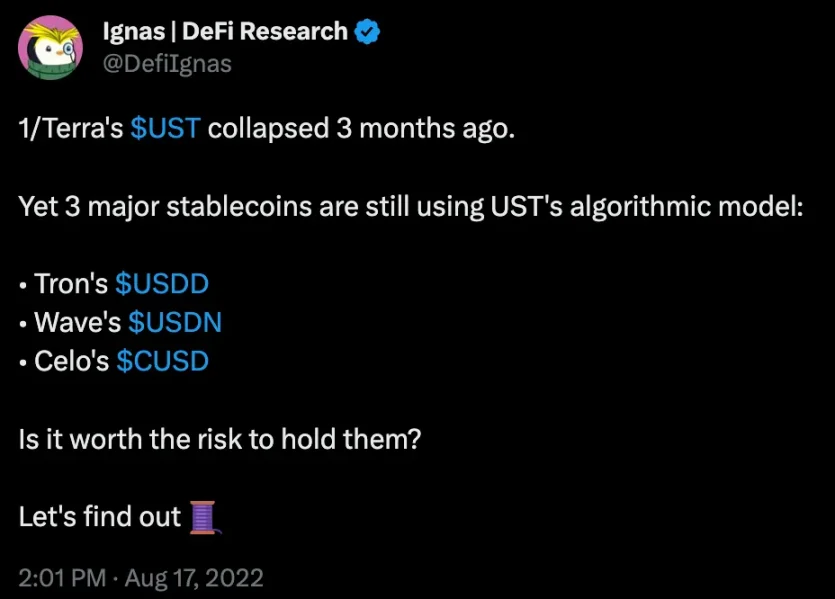

For example, just a year ago, I wrote an article about USDD, USDN, and CUSD algorithmic stablecoins. A few months later, USDN unpegged and was rebranded as another VOLATILE token.

Remember that fund security is of vital importance, let’s see what makes DeFi stablecoins so exciting.

Lybra: The Challenger to LUSD

What is your most impressive stablecoin among the top 10 by market capitalization?

First, USDT occupies an astonishing 66% market share, even though it is rated “D” by Bluechip due to lack of security. Second, only USDT and LUSD have seen an increase in market capitalization this month. All other stablecoins have experienced a decrease, with some experiencing a significant decline.

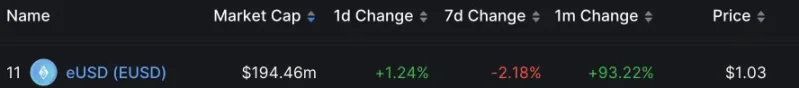

Ranked after the top 10 is eUSD, a stablecoin launched by Lybra Finance.

Interestingly, Lybra is a fork of Liquity, which accepts stETH as collateral, while Liquity only accepts ETH as collateral. Thanks to stETH, eUSD holders can earn an annualized interest rate of 7.2%.

The yield of eUSD is higher than that of stETH because eUSD can be generated with a collateralization ratio of 159% using stETH.

But this also brings a potential problem: the decoupling of stETH because Lybra uses Liquity’s ETH:USD price feed.

Another issue with eUSD is that the yield is distributed through rebase, which means you can earn more eUSD tokens based on the APY rate. To address these issues, Lybra is now introducing v2 and another new stablecoin: peUSD.

The main upgrades of v2 are:

- Full-chain functionality: peUSD is the full-chain version of eUSD (via LayerZero), allowing holders to use their stablecoins across different chains.

- Minting with multiple collaterals: peUSD can be minted directly with non-rebase LST collateral, such as Rocket Pool’s rETH, Binance’s WBETH, or Swell’s swETH. The yield accumulates through the underlying LST, and its value increases even if peUSD is spent.

- Continuous yield: When eUSD is converted to peUSD, users can continue to earn interest from their eUSD collateral, even if they spend peUSD.

- Usage in DeFi activities: peUSD is not a rebase token, so it can have a broader usage in the crypto ecosystem.

You can experience v2 on the Arbitrum testnet.

Overall, eUSD poses the biggest threat to LUSD, but there are other potential contenders, such as Raft and Gravita.

However, Liquity is not sitting idly by; it is organizing a counterattack.

Liquity v2: A Standalone New Product

The beauty of Liquity lies in its simplicity. You can use ETH as collateral to mint LUSD at a 0% interest rate, with only a one-time borrowing fee of 0.5%.

Liquity was originally created as an alternative to heavily governed DAI. LUSD has the lowest level of governance, and its smart contract is immutable (not upgradable) – which is useful for economic security but not for growth.

To keep up with competitors, Liquity has also launched v2 with support for LST. However, “condename v2” will be a completely new and different product, not an upgrade of the original.

Liquity v2 aims to solve the “stablecoin trilemma” of decentralization, stability, and scalability through a reserve-backed delta-neutral hedging model.

It’s complex, but the working principle can be simplified as follows:

Let’s say Alice has 1 ETH worth $2000. She can deposit it into Liquity v2 and receive 2000 v2 LUSD. Now, Liquity holds her ETH, and Alice holds 2000 v2 LUSD. If the price of ETH drops below $2000, Alice’s v2 LUSD will no longer be fully backed and will face the risk of a price spiral decline.

To address this issue, Liquity v2 introduces:

Principal protection leverage: Users can hold leveraged positions (betting on future prices) and only bear the risk of the premium paid, not the principal.

Secondary market: Users can sell these protected positions to others. If a position is not purchased, Liquity will subsidize it to ensure all positions are bought and subsidies remain in the system.

If you’re still confused, check out this thread or blog post for a more detailed explanation.

The impact of Liquity v2 is multi-fold, but the goal is to provide DeFi users with everything: principal protection leverage, mining profit opportunities, and trading opportunities in the secondary market. v2 is expected to be launched in 2024.

Synthetix sUSD: Moving towards v3

As mentioned earlier, Synthetix founder Kain is bullish on decentralized stablecoins. Want to know why?

That’s because Synthetix v3 is being gradually rolled out. This is a great timing as despite the growing trading volume of Kwenta, the market cap of sUSD has been declining and is currently at $98 million.

And v3 could bring a turning point.

Synthetix is one of the most complex DeFi protocols currently. However, the core of the Synthetix ecosystem is the sUSD stablecoin, which is backed by SNX.

You can read Thor Hartvigsen’s article on how Synthetix v3 will impact DeFi. v3 is addressing two key pain points for sUSD minters:

- Multiple Collaterals: v3 no longer restricts the collateral and allows any collateral to support synthetic assets (v2 only allows SNX). This will increase the liquidity of sUSD and the markets supported by Synthetix.

- Synthetix Loans: Users can now provide collateral to the system to generate sUSD without facing debt pool risks or incurring any interest or issuance fees.

If you have tried minting sUSD, you will understand how significant these changes are! sUSD now has the potential to compete with other mature stablecoins such as FRAX, LUSD, or DAI.

MakerDAO: The Money-Making Machine

Maker is now in the final stage (please check my Thread for more details). One key point to remember is that if the regulatory environment changes, Dai may even abandon its peg to the US dollar.

Currently, Maker seems to be in a frenzy:

- MKR has increased by 66% in the past 30 days, and the Maker founder keeps buying MKR.

- Due to the reactivated DAI savings rate, DAI has brought a return rate of 3.49% to its holders.

- The SLianGuairk protocol is a fork of Aave, focusing on DAI, and currently has a TVL of $75 million.

- Maker has reduced its dependence on USDC from 65% in March to the current 17%.

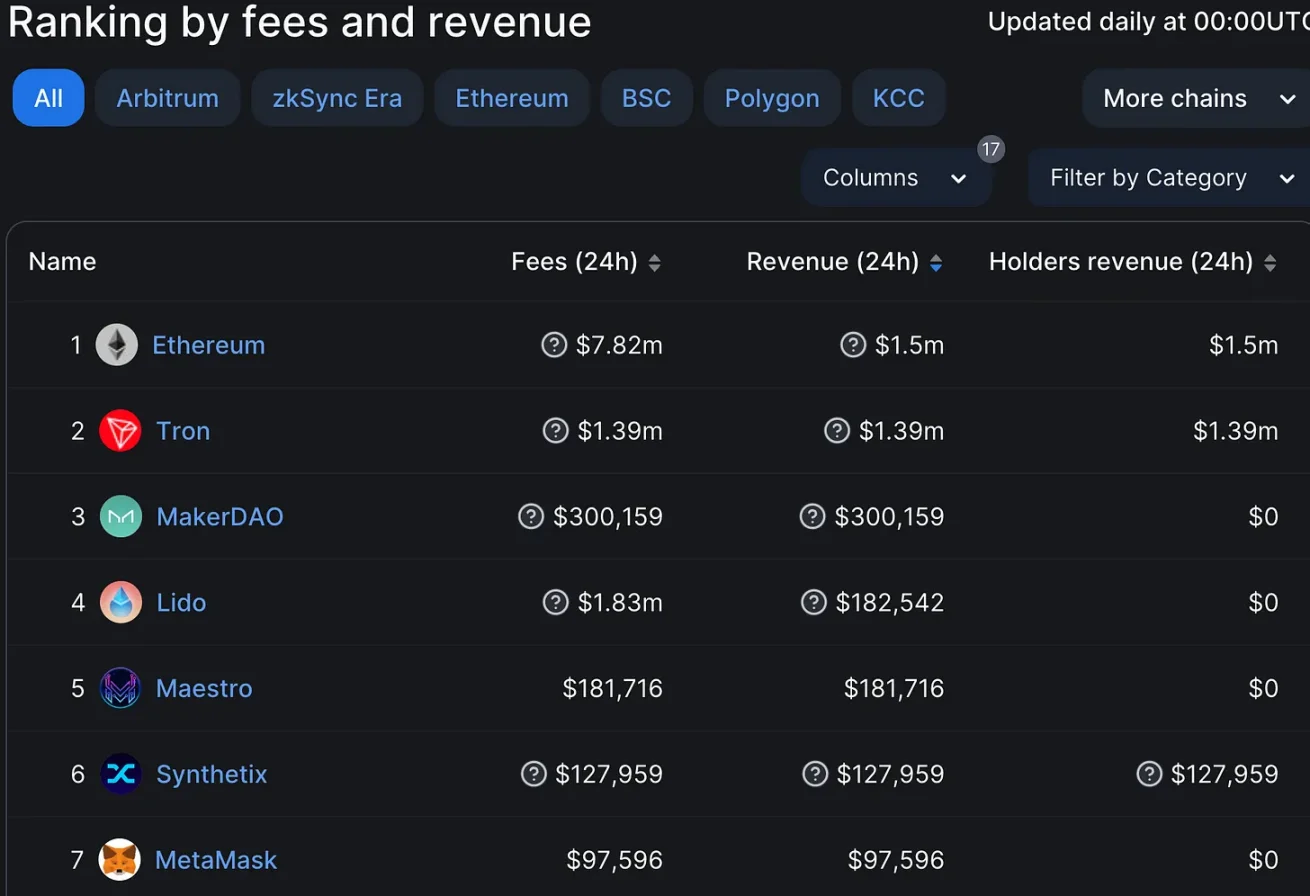

- Maker currently ranks third in revenue generation, higher than Lido, Synthetix, and Metamask.

Not everything is rosy. A consumer electronics company owes MakerDAO $2.1 million in debt. However, with a Bluechip B+ rating, a 3.49% DSR, and growing revenue, Maker’s DAI is experiencing a recovery after the catastrophic event of the USDC decoupling a few months ago.

Frax v3: Giving Up on USDC?

Frax received a D rating in the Bluechip evaluation (unsafe). The report states that FRAX carries risks because a portion of its collateral is the volatile FXS token, relies heavily on centralized assets (USDC), and the core team has control over voting rights and monetary policy.

It is suitable for risk-seeking yield farmers and liquidity providers who can handle the complexity of the protocol.

Like DAI, FRAX also lost its peg to the US dollar during the USDC decoupling period and seems to have learned its lesson.

Frax founder Sam Kazemian shared in a Telegram chat that v3 is expected to be launched within 30 days.

There are few details about v3, but DeFi Cheetah reports that v3 will be “a completely different system that does not rely on fiat currencies, including USDC”.

If this is true, then v3 has undergone a 180-degree transformation compared to v2.

Sam previously stated that their long-term goal is to obtain a primary account with the Federal Reserve, which will hold US dollars and directly transact with the Federal Reserve, making FRAX the stablecoin closest to risk-free US dollars. This will allow FRAX to break away from USDC collateral and expand its market value to billions of dollars.

I suggest following DeFi Cheetah to get the latest detailed information on Frax.

GHO: A New Player with Unlimited Potential

Despite the hype prior to GHO’s launch, its growth has been steady. While Aave has a total locked value (TVL) of up to $5.8 billion, GHO’s market value is only $8 million.

This could be due to three reasons. Firstly, GHO was just launched 11 days ago, so it is still early. Secondly, integrating GHO into multiple DeFi protocols will take some time, but its growth will accelerate soon. Thirdly, it is currently a bear market.

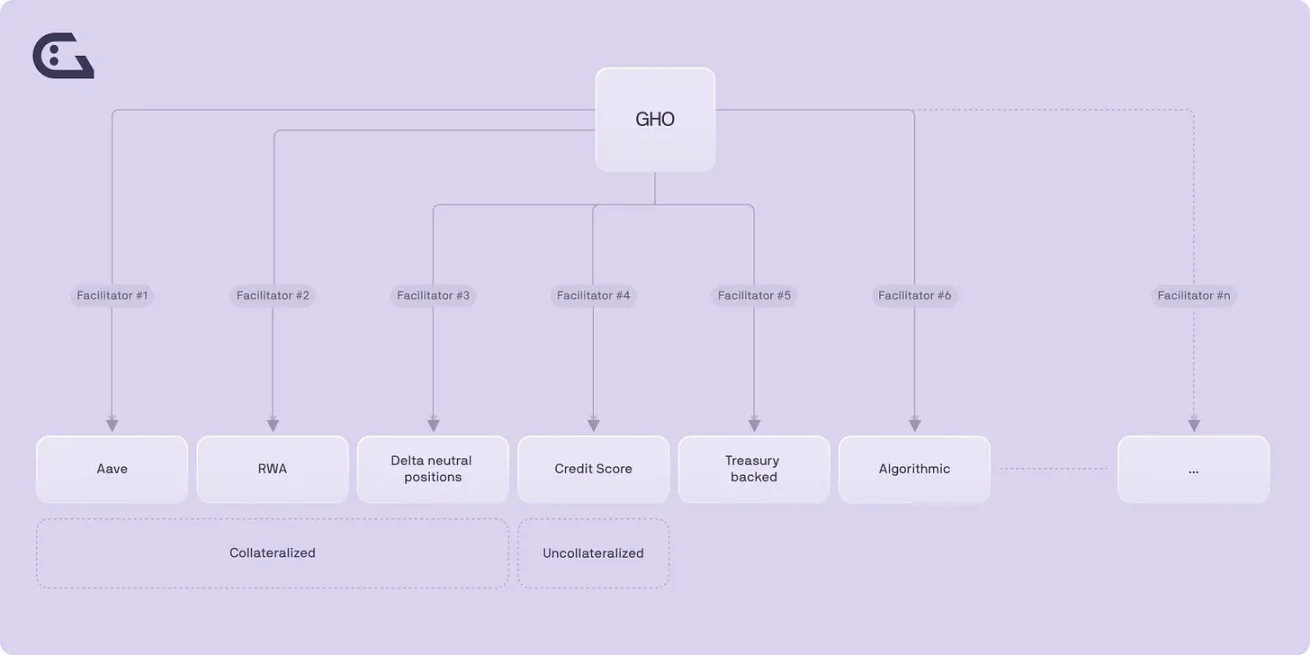

Let’s take a look at how GHO works:

- Uses overcollateralization to maintain the stablecoin’s value.

- Only minted/burned by approved coordinators (such as the Aave protocol itself, but possibly more), but each coordinator has a quota.

- Generates interest when supplied to liquidity protocols, with the interest rate set by Aave governance (currently 1.51%).

- Cannot be supplied to the Aave Ethereum market, which is crucial for security.

- Destroyed after repayment or liquidation, with the interest going to the Aave DAO treasury.

- Interest rates are determined by Aave governance and not dynamically adjusted by supply and demand.

- Provides borrowing discounts to stkAave holders (30% interest discount).

- Maintains a price of $1, set by the Aave protocol (without an oracle), with arbitrageurs restoring the peg when the price deviates from $1.

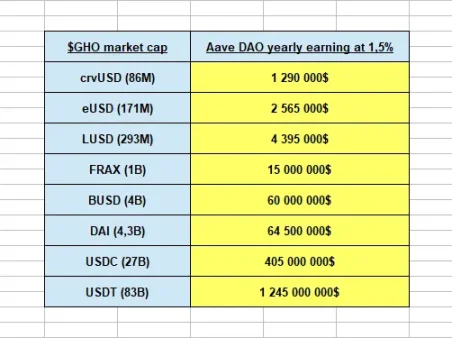

GHO brings new sources of revenue to the Aave DAO. The current borrowing interest rate is set at 1.5%, and if it reaches a market value equivalent to LUSD, GHO could bring $4.4 million in revenue to the Aave DAO.

You can delve deeper into its workings in this post by Moonshot21. However, what truly sparked my interest in GHO is its growth potential.

Aave DAO can choose to mint GHO with real-world assets, government bonds, or even adopt partial algorithmic methods similar to the current FRAX model.

GHO has tremendous potential, but its actual execution remains to be observed.

crvUSD: The Stablecoin for True DeFi Professionals

I believe crvUSD is the most difficult stablecoin to understand.

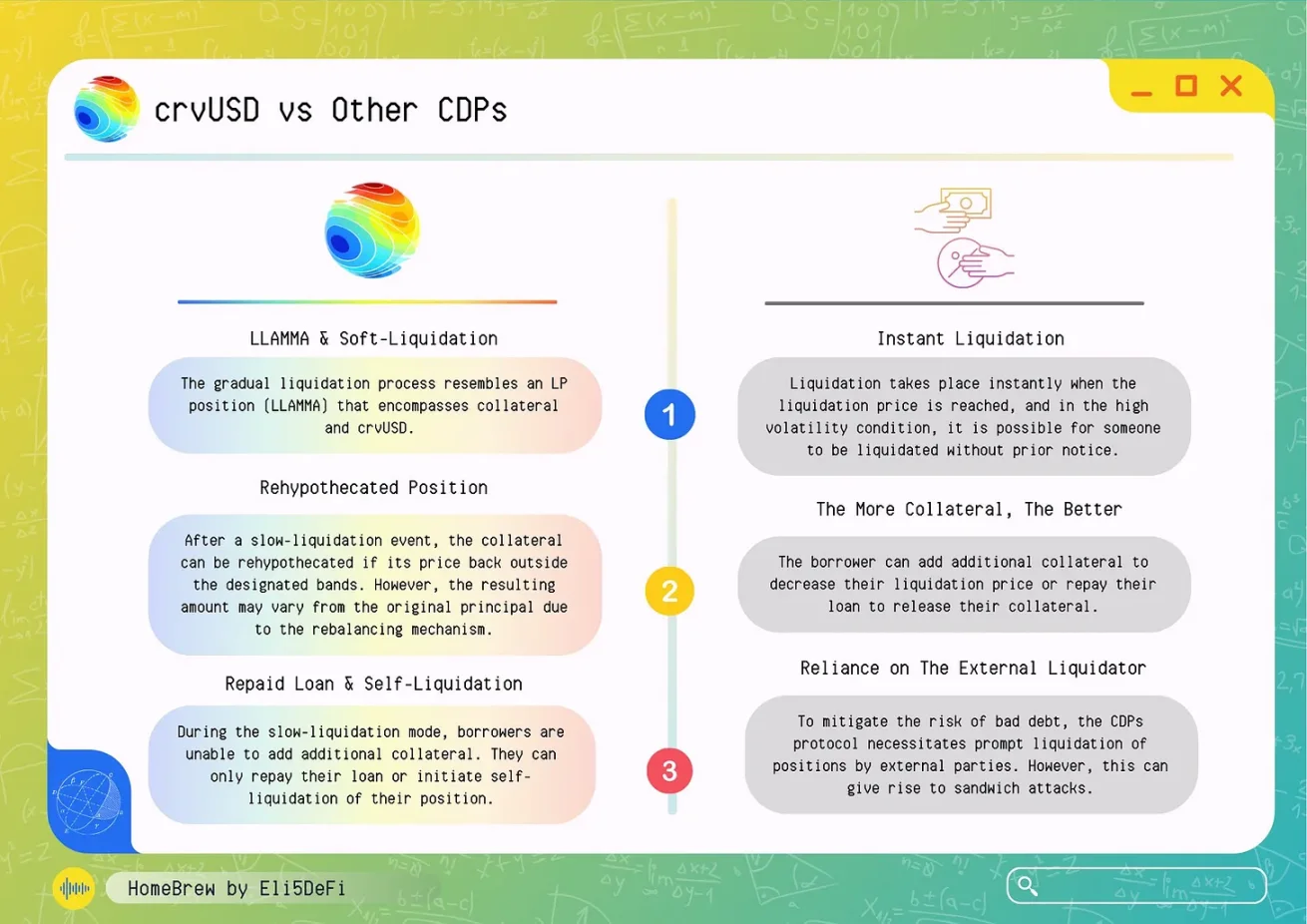

The unique features of crvUSD include LLAMA, soft liquidation, and “de-liquidation”. Here’s a brief summary:

- crvUSD stands out for its use of a special AMM algorithm called Loan Liquidation AMM (LLAMA) to implement the mechanism of soft liquidation.

- In typical DeFi lending protocols, if the value of the collateral provided by the borrower falls below a certain threshold, it will be forcibly liquidated, which can result in significant losses for the borrower.

- On the other hand, LLAMA gradually converts depreciating collateral into crvUSD, facilitating a soft liquidation that helps maintain the peg of crvUSD and protects borrowers from losing all of their collateral during a severe market downturn.

- However, if the price of the collateral continues to drop significantly and soft liquidation cannot cover the losses, a forced liquidation will occur.

- If the price of the collateral recovers, LLAMA will reverse this process by converting crvUSD back into the original collateral, a process known as “de-liquidation”.

- To maintain the peg of crvUSD, Curve uses the PegKeeper contract, which is able to mint and burn crvUSD tokens as needed to keep the price around $1.

The above mechanism provides a more flexible approach to handling collateral liquidation events, offering a new and interesting way to exit positions, making crvUSD unique in DeFi.

Here’s how this game operates:

- Borrow crvUSD using ETH or LST as collateral.

- ETH price increase: If the value of ETH rises, your collateral may increase, allowing for more crvUSD borrowing.

- ETH price decrease: If the price of ETH drops, LLAMA gradually converts your ETH collateral into crvUSD to maintain a safe collateral ratio.

- Forced liquidation: If the price of ETH drops significantly, a forced liquidation will occur.

- Lower liquidation fees: Compared to other protocols, the soft liquidation mechanism of crvUSD may offer lower liquidation fees.

Due to its lower and gradual liquidation fees, this is a more efficient way to exit positions compared to borrowing through other lending protocols. Let’s hope the peg of crvUSD can be maintained.

Final thoughts: The golden age of decentralized stablecoins?

Innovation extends beyond the stablecoins mentioned above, with some lower-market cap projects offering many innovative approaches:

- Beanstalk: A unique stablecoin that uses credit instead of collateral to maintain a $1 peg, adjusting its Bean supply, Soil supply (loan capacity), and maximum interest rate dynamically through its proprietary Sun, Silo, and Field mechanisms. Learn more about it here.

- Reserve Protocol: Allows for permissionless creation of asset-backed stablecoins that generate yield and provide overcollateralization. Anyone can create a stablecoin backed by a basket of ERC20 tokens, including eUSD backed by stablecoins deposited on Aave and Compound v2.

- Reflexer’s RAI: Rated B+ by Bluechip. The value of RAI is determined by supply and demand and continuously adjusted according to its issuance protocol. Unlike traditional stablecoins, the target exchange rate of RAI varies based on market conditions, establishing a balance between RAI minters and holders.

Will the recent changes usher in a new golden age for DeFi stablecoins?

When UST collapsed, the reputation of DeFi stablecoins was hit first, followed by the decoupling of USDC, exposing the reliance of DAI, FRAX, and all DeFi on USDC.

However, Maker’s recent shift away from USDC towards more censorship-resistant stablecoins, and the possibility of Frax v3 transitioning from USDC to more decentralized collateral, can both be seen as steps in the right direction.

In addition, Liquity’s v2 offers a solution to the blockchain trilemma and provides a way to scale stablecoins, as the current LUSD design makes compromises in terms of scalability.

The upgrade of Synthetix sUSD v3 will also enhance the utility of sUSD outside of the Synthetix ecosystem, as it will be minted with various collateral and sUSD minters will no longer be exposed to the debt pool.

Finally, the launch of crvUSD and GHO proposes a new strategy to maximize DeFi yields beyond traditional financial returns, and may even help DeFi enthusiasts sell at the top during the next bull market.

Individually, these changes may seem small, but when considering the broader DeFi landscape, they do inspire hope for a true golden age of decentralized stablecoins.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!