Source: bankless Translation: Nick, Gyro Finance

Although Terra’s Death Spiral happened a year ago, the impact of the billions of dollars evaporated due to the explosion still hasn’t completely dissipated.

The Death Spiral of Terra USD (UST) and the collapse of LUNA shattered the hopes of the cryptocurrency market setting a new historical high in 2022. UST was the first domino to fall in the “high-leverage and fraudulent chain,” leading to the collapse of many cryptocurrency institutions and exchanges, with billions of dollars of assets disappearing in just a few days.

- Canada’s Crypto Winter: Binance and other mainstream exchanges exit, mining share reduces by half

- Inventory of 5 ETH NFT projects with big moves happening in June: y00ts, Memeland…

- May On-Chain Data Review: On-chain transaction volume decreased by 5.3% after adjustments, and Bitcoin miner revenue increased by 13.7%.

Many early supporters of the Terra ecosystem were fascinated by the concept of fully decentralized stablecoins. Although UST’s mechanism was eventually proven to be unsustainable, some people believe that the DeFi field needs a decentralized, fair, and scalable stablecoin.

A year later, as we reflect, we ask ourselves: “What did we learn from the UST collapse?” and “Where is the stablecoin market heading?”

Although decentralized stablecoins have temporarily fallen out of favor, with a total market value of only $9.4 billion, the broader stablecoin industry has continued to consolidate its product-market fit. Today’s DeFi market cannot do without stablecoins, whether as a trading medium or as a means of value storage during bear markets.

Coingecko data shows that the current total market value of stablecoins is about $130.4 billion, with USDT accounting for over 63.8%, USDC over 22.1%, and BUSD 3.98%. Obviously, currently centralized stablecoins have monopolized most of the market share.

In this stablecoin race, on the one hand, we have algorithmic stablecoins, which, although decentralized, are easily influenced by Death Spirals. On the other hand, we have centralized stablecoins supported by fiat currencies, with the underlying collateral assets threatened by bank failures. How do we reconcile this?

In today’s article, we will introduce some new decentralized stablecoin projects worth paying attention to. These new projects not only increase the anti-fragility of token design but also have the potential to weaken USDT’s dominant position.

Curve’s crvUSD

Curve Finance is the go-to stablecoin trading platform in DeFi.

Since entering the space, Curve has made a significant impact on the market. The entire ecosystem is built on the pillar of innovation, whether it is creating stable funds pools on the AMM model or re-inventing tokenomics design with their vote-locking architecture and subsequent gauging mechanism.

Just as users can use Maker to mint DAI with their ETH, Curve users can quickly mint crvUSD with assets on Curve (such as ETH derivatives). With a new loan liquidation AMM algorithm (LLAMMA), Curve intends to improve the stablecoin design of DAI’s proven debt collateral position (CDP = “loan”).

Here’s the ELI5 version of why crvUSD liquidation can be a significant improvement over traditional design:

-

Collateral is gradually liquidated within a certain price range rather than immediately liquidated when the liquidation price is reached. This reduces the possibility of market fluctuations caused by large-scale liquidation.

-

The design of crvUSD is intended to provide Curve’s AMM with a lower price, thereby incentivizing liquidators to arbitrage on external DEXs. In addition, the gradual liquidation strategy reduces the need for external DEX liquidity, thereby reducing the possibility of bad debt accumulation.

-

If the price rebounds above the liquidation price, the liquidation can be canceled.

TapiocaDAO’s USDO

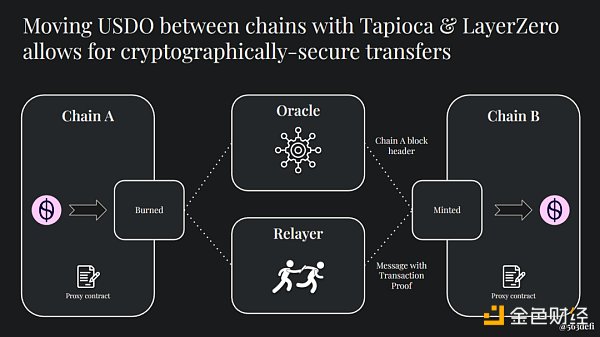

TapiocaDAO is building a fully decentralized bank – one where users can borrow and mint their stablecoin (USDO) across 17 EVM and non-EVM blockchains – all without any bridging. Tapioca achieves this by leveraging LayerZero’s universal messaging network as its all-chain infrastructure, with the goal of being committed to building a robust stablecoin for the multi-chain future.

USDO is another CDP design that uses network gas tokens (such as ETH, MATIC, etc.) and their LSD as collateral. In addition to simple fund transfers, all-chain borrowing and leveraging are also possible. For example, you can:

-

Open a collateral debt position (CDP=”loan”) for your stMATIC on Polygon and mint USDO on Berachain with just one click, using up to 5x leverage.

-

Use your jGLP profits on Arbitrum as collateral to borrow USDO on Starknet, and your profits will help repay your loan.

-

Borrow your USDO on zkSync to users on any of the approximately 17 chains supported by LayerZero – capital efficiency is greatly improved compared to traditional lending platforms.

USDO utilizes LayerZero’s OFT20 V2 full-chain token standard, allowing it to be instantly transferred (through minting and burning mechanisms) on EVM and non-EVM compatible chains without any intermediaries, eliminating slippage, waiting times, and fees. It effectively improves the market efficiency and arbitrage opportunities of USDO.

Redacted Cartel’s DINERO

DINERO is a new stablecoin based on Ethereum and pxETH, launched by Redacted Cartel. It is pegged to the US dollar and has good liquidity and transparency.

In April, Redacted Cartel released LiteBlockingper, which revealed the basic design and motivation behind Dinero. Essentially, Dinero aims to provide users with high-quality Ethereum block space through a private RPC called Redacted Relayer, which sends transaction data from dApps/wallets to the blockchain.

Using Redacted Relayer provides some advantages over trading with default RPCs:

-

Prevents malicious actors from taking advantage of MEV opportunities

-

Meta-transaction – the ability to pay gas fees with DINERO stablecoins instead of ETH

-

Once it reaches a certain scale, additional use cases like privacy transactions and order flow payments become possible

Firstly, since DINERO uses support from Ethereum and pxETH, it has better liquidity and transaction speed, and can better respond to market fluctuations. Secondly, DINERO has higher transparency, as it uses decentralized ledger technology, making all transactions publicly recorded and verified. Finally, since DINERO is pegged to the US dollar, it can provide investors with a relatively stable savings tool, reducing investment risk. The launch of DINERO represents a new era in the stablecoin market, providing investors with better choices and opportunities.

The future trend of stablecoins is over-collateralization

Today, most decentralized stablecoin projects such as FRAX, sUSD, and USDD have abandoned algorithmic design in favor of over-collateralization, making it less likely for another UST-style death spiral to occur. This also indicates that over-collateralized stablecoins are the future trend. As technology and the market continue to evolve, the future of stablecoins should be more robust and reliable.

Overall, compared to centralized stablecoins, DeFi users still prefer to use decentralized stablecoins that are fully backed by on-chain assets. Whether it is dominated by crvUSD, USDO, DINERO, FRAX, RAI, or other decentralized stablecoins in the future, we believe that it is better than being dominated by Tether.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!