Author: Sleep in the Rain

Hey, viewers, we meet again. Time flies like a wild donkey and it’s already mid-year. Here is a list of my expectations for June, and I may have more to talk about this time.

1. Cancun Upgrade

The Ethereum Cancun upgrade is scheduled for October, but it may start to be hyped up in June. In my impression, an interesting phenomenon is that the Ethereum 2.0 upgrade was hyped up two months in advance, while the Shanghai upgrade was hyped up three months in advance. Will the Cancun upgrade be hyped up four months in advance? I think the possibility is relatively high. Just like the lifespan of GameFi is getting shorter, the hype of these large expected events will also be advanced, especially in the current market environment. The targets are $ARB, $OP, and other Layer 2 solutions (there are many, I won’t list them all), Arbitrum’s fundamentals are good, and Optimism has to go through two major events: the cliff unlock on May 31 and the bedrock upgrade on June 6.

- Analysis of the entire process of the Twitter influencer Ben’s “fraud incident”

- Causes, impacts, and solutions to the 2023 US banking crisis

- Interpreting the Market Structure of LDO: What Changes Have Occurred in the Past Year?

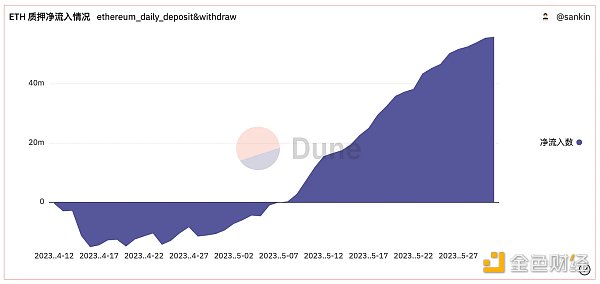

2. LSD & LSDFi

Why focus on LSD? I want to emphasize again that LSD is a long-term business. With the end of withdrawal pressure, currently, ETH LSD is in a net inflow state. Among them, the LSDFi track is entering a period of rapid development-we can also see that many LSDFi protocols have emerged in the previous days. However, most protocols are short-term projects that attract liquidity through high token releases. In my watchlist, PENDLE, AURA, Lybra, and Prisma are the four projects that I will keep an eye on recently. Specific analysis, I have written before, and I will not go into details. They are all available on my Substack. I will actively follow up on the v2 testnet launched by Lybra in mid-June and pay attention to its token price. Prisma’s logic is more self-consistent and simpler, and I am more optimistic about it.

Regarding the LSD track, in addition to Lido still occupying a dominant advantage, Frax’s growth rate is obvious, from a share of 0.72% at the beginning of the year to the current 2.46%. Rocket Pool’s share has risen from 5.24% at the beginning of the year to 7.7%. From the perspective of market share growth rate, Frax has achieved good results. It is also worth noting that the collateral rate of FRAX (stablecoin) will reach 100% in mid-June, and Frax v3 will also be launched soon. At that time, Frax will launch a lending market established for FRAX liquidity (this function may be part of v3, time is Q3/Q4).

Another point is that Lido’s governance-level status has raised some concerns about decentralized staking. In addition to efforts on the underlying infrastructure (DVT), unshETH is committed to balancing relationships between various LSD protocols. However, unshETH encountered some security issues yesterday. The ssv network that uses DVT technology is also about to go live. It was said in Discord that it will happen soon, so I reasonably guess it will be in June.

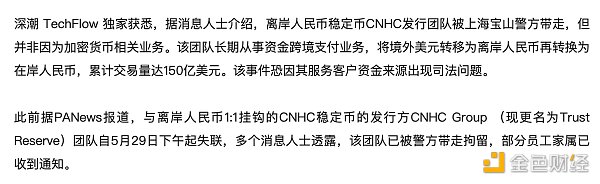

Three, Hong Kong

On June 1st, the “Guidelines for Virtual Asset Trading Platform Operators” will take effect. This will involve some tokens that can ride on the traffic, but I think that in the current market environment, more people choose to sell on news. For example, when CFX was the most popular, it was actually in April, but now it has cooled down. Even after the CNHC incident yesterday, CFX began to decline. Therefore, from my personal perspective, the implementation of the “Guidelines” will bring more selling behavior, and I will reduce some of my attention to Hong Kong concept tokens. Also, I would like to mention Cocos’s name change. Starting at 8:00 on June 2nd (UTC), it is difficult for me to make certain trades through this event. It is not wise to cling to the past with GFT, because the game intensity of this name change has increased exponentially compared to before. If you really want to trade, it’s okay to trade at the opening, but trades like chasing the high points of BNX still need to be cautious.

Four, computing power & Metaverse & AI

Actually, $RNDR has already experienced a surge, and I mentioned in a previous article that I think computing power will be a narrative theme of the future world, and NVIDIA’s sharp rise is a good example. $RNDR is not fundamentally related to AI computing power, but it can still ride on it. Another catalyst for $RNDR is the Apple conference. The head-mounted display product is an important part of Apple’s future, and $RNDR’s parent company is Apple’s partner. My attitude is that if $RNDR’s parent company (such as marking it supported by the parent company) is not involved when Apple’s products are released on June 6.5, I will not buy $RNDR. If it is involved, I will include $RNDR in my holdings.

Personally, I don’t think there has been a satisfactory Crypto AI application yet, and the hype around Crypto AI will gradually weaken as the AI wave progresses. However, I can see a trend towards some AI applications that give some Crypto behaviors power based on Web2, such as helping you develop trading strategies, etc. I will pay attention to these trends, but I am not currently investing in Crypto AI.

5. Games

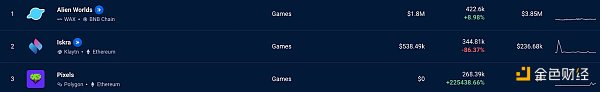

Layer 2 provides a good soil for games, but so far, few games have been able to break out of the Play 2 Earn framework, bringing us a fun + economic incentive + ownership Web3 gaming experience. Mobox has launched a dragon egg game, which will start mining on June 1st, with rewards of $MBOX and MEC gems. Its art design is great and is built on Arbitrum. It is currently unknown what the gems will be used for. This year, Mobox plans to destroy 135 million tokens and add some application scenarios for tokens. From Mobox’s subsequent plans, the main goal is still to increase the token price. We are still unclear about the scenario of $MBOX, but it should be related to the four games that Mobox plans to launch this year.

Another game I am following is Pixels, which is currently ranked third in activity and has risen a lot in the past 30 days. The main driving force is the upcoming release of its native token. The current market is essentially a popularity game, and only by maintaining high popularity can you get more attention. Therefore, narrative>fundamentals. The higher the popularity, the better the token price performance.

There is also $MAGIC, as the TVL and trading volume of Arbitrum increase, more developers will consider deploying games on it, $MAGIC is obviously a beneficiary, but I have not seen any obvious catalysts and the launch of new games yet. Abyss World on Sui/Polygon has launched its IDO, and the game background is good. It has raised funds and reached cooperation with some cloud service providers. I still hope it can drive the on-chain activity of Sui – after all, from my perspective, the advantages brought by Sui can better promote the construction and development of Web3 games. And BladeDAO, the Zksync game platform I mentioned earlier, but I won’t consider investing in its token – investment needs to wait until its game is released. SBlockingrtadex will be released in the next few weeks, and I will continue to pay attention as I hold NFT.

By the way, BAYC may have some new moves in June. My suggestion is to keep an eye on it, after all, $APE token price has been in a continuous decline. It should be noted that if Web3 games do not break away from the traditional Ponzi model, my suggestion is to focus on short-term speculation – unless it is really fun, it is not as good as spending some money to play The Legend of Zelda: Breath of the Wild.

VI. BRC 20

Although the heat of BRC 20 has decreased somewhat, it still has some anticipated space, such as Binance’s listing of BRC 20 tokens. Personally, I don’t like the BRC 20 itself, and I haven’t participated in it much – as I said, it is essentially a hype game, and without hype, the token price will of course be difficult. But Binance’s potential support may trigger a new wave of gains, which we cannot ignore.

VII. Competition of Derivative DEX

A study by LD Capital shows that the trading volume of Kwenta and Level has exceeded that of GMX within a week, mainly driven by more incentive distribution. But my focus is still on GMX and dYdX. In the win-win cooperation between GMX v2 and Chainlink, ChainLink provides low-latency oracle services for GMX, and GMX provides 1.2% revenue sharing for Chainlink. GMX v2 has improved existing products and provides derivative trading with lower risk, larger trading volume, and more assets. dYdX will release v4 later this year. Decentralized order book, DYDX verification income and fee distribution will be important updates brought by v4.

Finally, I will mark some high-quality content of the projects mentioned above for reference.

-

Basic principles of Arbitrum

-

Analysis of $OP unlocking

-

Analysis of OP Bedrock upgrade

-

What is the Prisma protocol?

-

Understanding Frax Finance and some sell on news logic

-

Is AI Bullish for Crypto?

-

$OXBT

-

Derivative DEX battle: Kwenta, Level surpasses GMX in trading volume within a week

-

GMX and ChainLink

-

Interpretation of GMX v2

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!