Author: Yinan Shuo

Following the approval of the merger by BitDAO community members through governance proposal BIP-21, BitDAO announced the merger with its sponsored Ethereum layer 2 solution Mantle Network, according to its “branding, token and token economics optimization” proposal. BitDAO, Mantle, and BIT ecosystem will be collectively named Mantle. Existing governance and DAO will be referred to as Mantle Governance, and the BIT token will also be converted to Mantle. So how can Mantle stand out from many L2 public chains?

Introduction:

Mantle is an L2 scaling solution incubated by BitDAO that uses Optimistic rollup, modularization, and decentralized data availability to achieve higher throughput and scalability.

How is Mantle different from other L2 solutions?

-

Modular data availability: By using EigenLayer, Mantle is able to improve transaction throughput, surpassing traditional L2s. Accessible data availability also means that Mantle can increase throughput without compromising security and reducing node operation overhead. This reduces the processing requirements of validators and promotes decentralization.

-

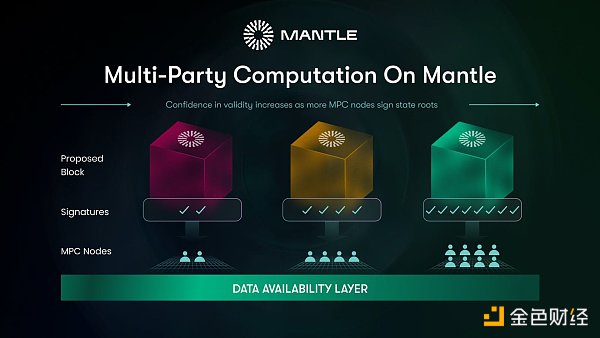

Multi-party computation (MPC): Mantle uses MPC to minimize the trust risk of L2 execution results. Using threshold signature scheme (TSS) technology, specialized nodes contribute to multi-party signatures to improve the correctness of off-chain transaction execution results. This enables the challenge period for withdrawals to be shortened.

-

Decentralized Sequencer: Mantle will decentralize its Sequencer to provide secure and trustless block production. By rotating a permissionless set of sequencers, Mantle will reduce the possibility of single points of failure or censorship on the network. Mantle will decentralize its Sequencer over time to provide secure and trustless block production.

Based on the above features, Mantle adopts a modular approach, using @Eigenlayer as a DA (data availability) solution, avoiding the publication of transaction data on the ETH mainnet, which means that Mantle enjoys the security of ETH while avoiding trading on ETH, providing new possibilities for scalability.

In addition to using Biconomy to provide account abstraction, Mantle also solves the two main problems faced by optimistic rollups.

-

The first is the single point of failure that may be caused by the highly concentrated sorter.

-

The second is the current 7-day fraud proof challenge period. By implementing multi-party computation (MPC), Mantle shortened the challenge period to 1 to 2 days. Independent verification blocks through nodes and increase overall confidence.

Node roles in Mantle:

-

Sorter

Real-time receiving and recording of transactions sent by users

Produce blocks on L2

Aggregate transactions to generate batches with execution status roots

Get blocks verified by the MPC network

Broadcast block data (L1 and L2) through the network

-

Multi-party computation (MPC) node

“Sign” the transaction batch generated by Sequencer and send it to L1

Use the verified batch to broadcast the multi-party computation through the L2 network

-

Rollup verifier

Synchronize summary data from Mantle’s trusted sorter

Verify the state root submitted by Sequencer on L2

Launch fraud proof when invalid state data is found

Provide summary data to users

-

DA node

Choose a copy responsible for storing Mantle transaction data so that it can be accessed when necessary

Make commitments by signing the block data they provide using a BLS signature scheme to ensure their availability. These signatures are verified by the EigenDA contract on Ethereum

BitDao:

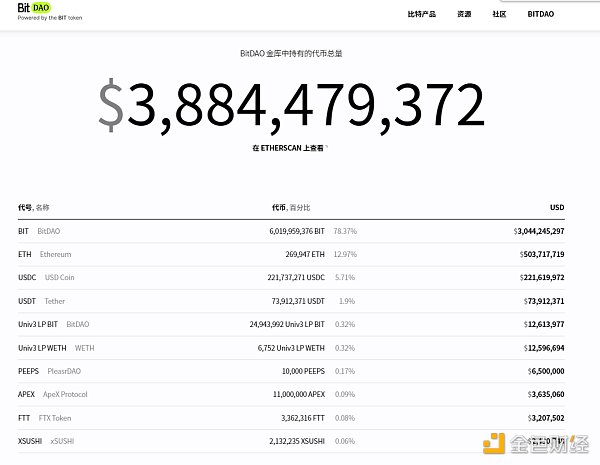

It is currently one of the largest DAO organizations, with a treasury of 3.8 billion US dollars in reserve assets, and raised 230 million US dollars in June 2021.

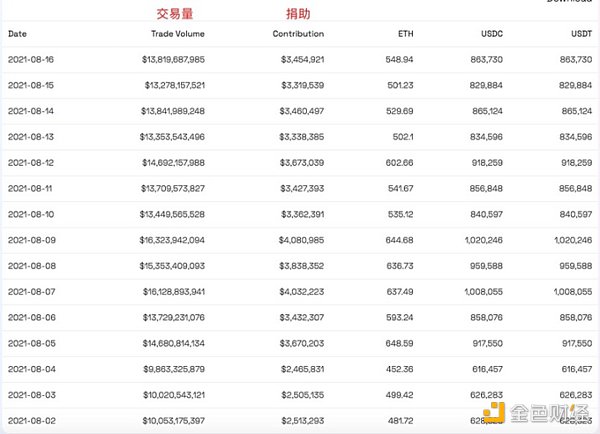

BitDAO is composed of many builders, focusing on Web 3.0 products, and strives to create a win-win ecosystem governed by $BIT token holders. The reason why BitDAO can become popular is inseparable from the contribution of Bybit, the behind-the-scenes sponsor. According to the query, Bybit donates to BitDAO regularly every day, with an average daily donation amount of nearly

$4 million and more than $1 billion in donations over the past year.

Team:

The Mantle team, led by Bybit CEO Ben Zhou and other well-known members of the crypto community (such as Sreeram from EigenLayer, Dow Jones, and Cooper Midroni), developed Mantle to create a user-friendly network that aims to increase Web3 adoption. Initially, they just thought of this project, but later decided to build an L2 to solve Ethereum’s existing scaling problems.

The Mantle team operates with more than 50 team members under horizontal management, and here are some of its members:

@ArjunKalsy Ecosystem Lead, @jacobc_eth Product Lead and Strategic Advisor

Financing:

Mantle is a product of BitDAO, which means they did not raise external funding for the project.

In this regard, BitDAO also completed a private placement led by initial partners Peter Thiel, Founders Fund, Blockingntera Capital, and Dragonfly Capital in June 2021, with a total financing of $230 million. Other investors include Alan Howard, Jump Capital, SBlockingrtan Group, Fenbushi, Kain Warwick (Synthetix), etc.

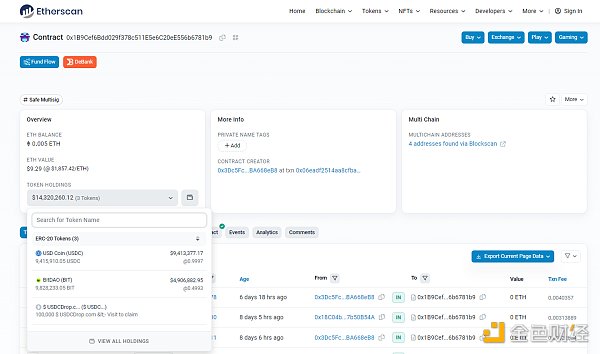

BitDAO now has a treasury of $3.8 billion (78.3% of which is $BIT), and the core budget address of Mantle currently has a total of $14.3 million (including 9.8 million $BIT and 9.4 million USDC).

Roadmap:

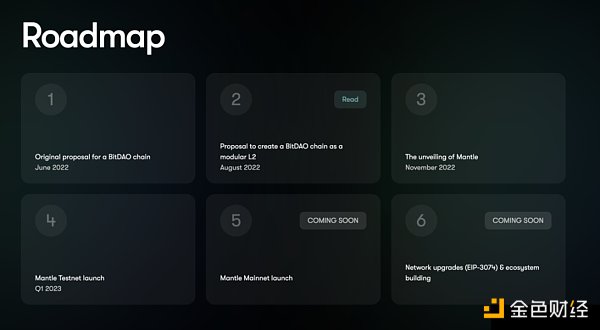

According to the official roadmap, Mantle will launch the testnet (EigenDA+OPU) in Q1 2023, and the mainnet (EigenDA+OPU) based on OPU will be launched after the testnet runs smoothly for 3 months. The mainnet based on zk-Rollup (EigenDA+zkRU) will be launched after the mainnet runs for 6-12 months.

The project is currently in the second phase of the testnet, and the token conversion proposal has been approved. Discussions are underway on the deployment and conversion details of the token. The next phase will be the deployment of the $MNT token and the launch of the mainnet.

Token Economics:

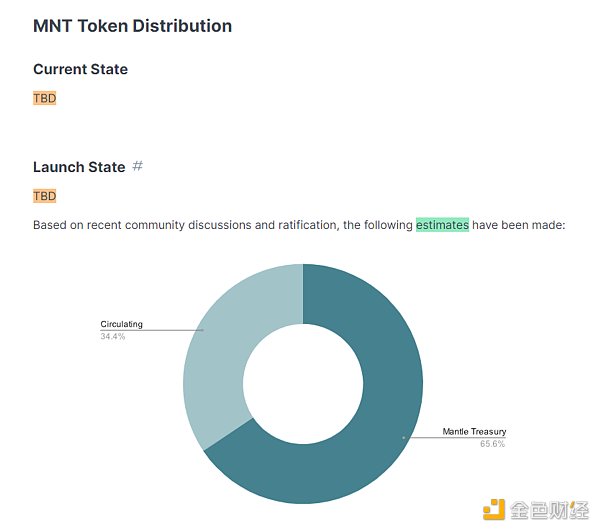

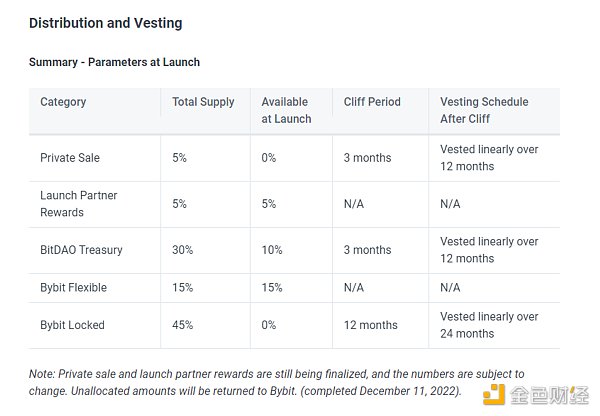

The Mantle ecosystem and $MNT token are currently undergoing a governance approval process to determine key aspects, including token address, token design, and initial token distribution. This process involves key proposals and discussions, such as the BIP-21 merge proposal and the MIP-22 token design discussion.

-

BIP-21 proposal highlights

BIP-21 has approved the merger of brands and tokens and has pre-authorized a token conversion plan ($BIT and $MNT). It is proposed to have a formal discussion and vote on the key issues related to the token conversion plan.

-

MIP-22 proposal highlights

-

The Mantle token $MNT should have functionality similar to the “upgradability” and “mintage” features of $ARB and $OP tokens.

-

The one-way token conversion rate should be set to 1 $BIT token to 3.14 1 $MNT token. (see update 1)

-

The Mantle core contributors will be authorized to determine the best time and order for delisting $BIT tokens, listing $MNT tokens, opening the conversion channel, and launching the Mantle network mainnet.

-

The earnings from the deconstructed $BIT-ETH pool can be utilized to create a $MNT-ETH DEX liquidity pool, with reference to the intent of BIP-10.

-

A temporary conversion vault can be established to support the token creation and conversion process.

-

Currently, there is no formal discussion of macro goals or restrictions on MNT token allocation. However, the core contributors have provided the following estimates of priorities:

-

User incentives: This involves driving user adoption of Mantle products through various means such as multi-season achievements, tasks, and airdrops. Target metrics for user adoption include daily active users, total transactions and protocol fees, total value locked (TVL), and other product adoption metrics.

-

Technical partner incentives: This category includes decentralized applications, infrastructure service providers, and core protocol technology partners that contribute to the Mantle ecosystem.

-

Core contributors and advisors: Budgets, fundraising, and allocation processes follow strict procedures such as BIP-19 Mantle Network Budget.

-

Others: This category includes acquisitions, token swaps, treasury bond sales, and other opportunistic transactions that may arise.

-

Burn: MNT tokens include a burn function that allows MNT tokens to be removed from circulation and total supply analysis. The destruction of MNT tokens from the treasury is determined through the Mantle governance process.

BIT Token Economics:

On July 15, 2021, the $BIT token was launched with a maximum supply of 10,000,000,000 tokens (no inflation)

After the MIP-22 vote, it will be converted to $MNT at a 1:1 ratio

Governance:

Mantle governance mainly follows an off-chain governance process. Discussions are initiated by the Mantle core contributors team or community members, and then introduced to a wider Mantle community through forum discussions. Discussions that generate enough interest and positive sentiment may progress into formal proposals called “MIPs,” which are then voted on by MNT token holders. Once a proposal is approved, core contributors team members will support its implementation in accordance with the outlined terms of the proposal. This approach is considered an “off-chain” governance process, as the governance vote result does not automatically trigger product code updates or automatic financial operations.

Latest Developments:

Since the launch of the testnet on January 10, 2023, Mantle has been relentlessly implementing its decentralized data availability layer, innovative fraud proof, decentralized sorter, etc., all with the highest possible work quality. Five months have passed, and the team is pleased to announce that it will officially upgrade to Mantle Testnet Phase 2 “Ringwood” on May 25, 2023 at 6:00 AM UTC.

The latest edition of AMA Mantle contributors Igneus Terrenus, Jordi Alexander, and afkbyte answered some community questions on May 29.

When will the token conversion be implemented?

Token conversion from $BIT to $MNT may be executed at some point in June. The token conversion will take place before the Mantle Network mainnet launch to ensure that $MNT tokens can be used as network fuel tokens (among other things).

What will the tokens be used for besides GAS?

The team has carefully studied various L2 and other network tokens that exist today. The goal is to create a powerful ecosystem of rewards and incentives to help promote the sustainability of network growth.

Airdrops and incentive programs have been effective in this regard, TVL statistics indicate that they help maintain activity on the network. However, since $MNT token holders will manage these funds, the team is taking measures to prevent them from being exploited by sybil attackers. The specific details of the Mantle incentives will be discussed in the future, but the goal will be to ensure that the product and ecosystem benefit from the use of the funds.

Currently, MIP-22 is being voted on Snapshot for token conversion details, the voting time is: May 31, 2023 3:57 PM – June 7, 2023 3:57 PM

Ecosystem:

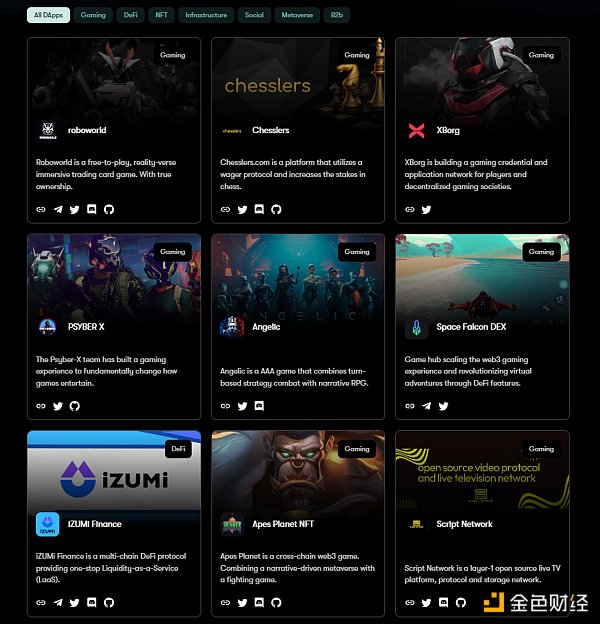

Mantle currently references 49 projects on its ecosystem page (https://mantle.xyz/ecosystem).

A large part of these are in the gaming field, with only a few DeFi/infrastructure projects.

Conclusion:

As a public chain in the L2 track, Mantle is in an extremely competitive position. Other L2 solutions include Optimism and Arbitrum which use Optimistic rollup, and Zksync and Starknet which use Zk-Proof. Various L2 solutions have been introduced to improve ETH’s scalability and reduce costs. The core of Mantle is built using Optimistic rollup, and it uses the modular component DA layer with EigerLayer, introduces MPC multi-party computing, and a more decentralized sorter to improve TPS and reduce costs. This is the solution proposed by the project.

As a part of BitDao, BitDao Treasury has over 3 billion dollars, making Mantle relatively well-funded. However, as a Dao organization with a strong relationship to Bybit, which has donated over 1 billion dollars in the past year alone, and holds a large amount of $BIT, many exchanges do not list $BIT. Additionally, after Bybit donates 2.7 billion $BIT to the BitDao Treasury, it will hold the largest amount of $BIT. Therefore, this is a very centralized point. Furthermore, $BIT’s token performance has gone from $1.4 USD during the ICO to $0.5 USD currently, which has caused concern for many people about Mantle’s future performance.

Currently, there are mostly game Dapps on the ecosystem, while relatively few Defi and infrastructure products. Leading mainstream protocols like Ethereum have not yet been integrated into the Mantle testnet, and it remains to be seen whether they will gradually be integrated after the mainnet is launched. Please stay tuned for the development of the ecosystem.

Finally, as testing incentives have been mentioned in the document as well as by core members in AMA, those interested can try out the Mantle testnet for themselves. As for the future development of the ecosystem, please stay tuned.

Related links:

Website: https://mantle.xyz

Twitter: https://twitter.com/0xMantle

Telegram: https://t.me/mantlenetwork

Discord: https://discord.com/invite/0xMantle

Reddit: https://reddit.com/r/0xMantle/

Mirror: https://mirror.xyz/0xMantle.eth

Medium: https://medium.com/0xMantle

YouTube: https://www.youtube.com/@0xMantle

LinkedIn: https://www.linkedin.com/company/0xmantle/

GitHub: https://github.com/mantlenetworkio

Project Introduction Document: https://docs.mantle.xyz/introducing-mantle/a-gentle-introduction

Related Articles:

What is Mantle?

The strongest DAO organization is going to build the first high-performance modular Layer2

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!