According to data, as the frenzy for chasing meme coins gradually shifted to ETF trading, the sales of NFTs in the first week of the second half of 2023 decreased by 23.39% compared to last week, marking a continuous downward trend for two weeks. Currently, the total sales of NFTs are 195.95 million US dollars, of which the sales of NFTs based on Ethereum are 130.77 million US dollars. In the past seven days, the total market value of NFTs has fallen to 6.066 billion US dollars, a decrease of 1.24%, and the total transaction volume has fallen to 131 million US dollars, a decrease of 46.05%.

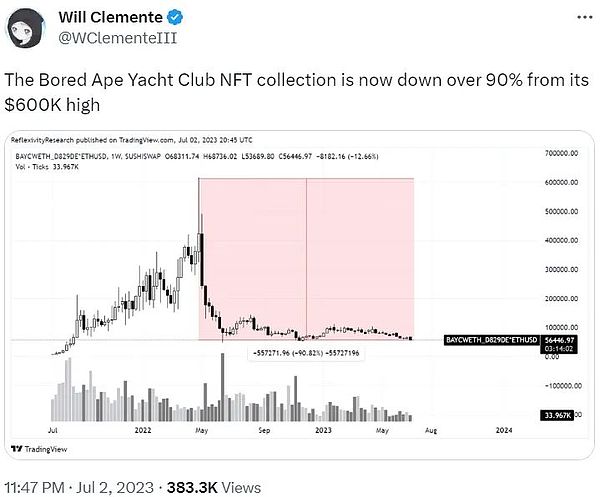

The bottom price of the famous BAYC NFT collection reached 27.4 ETH (about 53,000 US dollars)-the lowest point in 20 months. The bottom price of Bored Ape Yacht Club NFT fell below 30 ETH, reaching the lowest point since October 2021. This decline marks a 90% drop since the historical high of 153.7 ETH in April 2022. The entire NFT market experienced a difficult period in June, and the Blur market may be one of the reasons for the decline. The bottom price of the BAYC NFT collection reported the lowest number in 20 months.

However, BAYC is not the only NFT collection facing a decline in bottom prices. In fact, June was a difficult month for the entire NFT market. Compared with May, the transaction volume of NFTs in June decreased by 31.3 million US dollars. Many collectors are still struggling with the bear market, including top stars. A perfect example is Justin Bieber, who bought the BAYC NFT for an amazing $1.31 million in January 2022.

- Can RWA storytelling sweep away all the haze? MakerDao in the shadow of far-sightedness and immediate concerns

- Lawyer: MiCA’s stablecoin trading limit hinders adoption of cryptocurrency

- UK Prime Minister Rishi Sunak: Determined to make UK a global crypto center

Some people believe that the decline in sales in the NFT market is due to the airdrop activities and zero-tax policies conducted by the Blur market, which disrupted the relatively stable price structure. Although Blur accounted for 65% of the market share in May, after comparing the active users of OpenSea and Blur, it was found that OpenSea still has a huge number of active users in the current environment, while Blur has only one-tenth of the active users of OpenSea. However, after the collapse of the Azuki event, the market began to discover that the reason was not so.

Azuki launched a new series called Elementals, which took away 20,000 ETH from the NFT market and the quality of the opening maps was far below expectations. Under the dual impact of the team’s cash-out event, the capital and confidence of the entire NFT market collapsed, leading to a sharp decline in the prices of blue-chip NFTs. Since June 27, the Azuki floor price has fallen by about 47%, BAYC has fallen by 20%, MAYC has fallen by 18%, and Crypto Punks has fallen by 9%.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!