One of Dai’s main sources of income used to be from users obtaining Dai by pledging collateral and paying loan interest (stability fee) during that period. Later, it adopted a method similar to Tether’s, where stablecoins such as USDC in its PSM module were collateralized and exchanged for income-generating assets such as government bonds or stored in Coinbase’s USDC current account savings.

However, the core of the stablecoin business is the expansion of stablecoin demand. Stablecoins can only obtain sufficient collateral assets and obtain financial income by maintaining a higher issuance scale.

In addition, the main difference between Dai and USDT and USDC is its decentralized positioning. The most important differentiation value of Dai is that “Dai has stronger resistance to censorship and smaller regulatory exposure than USDT and USDC”, and replacing Dai’s collateral with a large number of RWA assets that can be confiscated by centralized forces fundamentally eliminates the differences between Dai and USDC and USDT.

Of course, Dai is still the largest decentralized stablecoin with a market value of $4.3 billion, which is much larger than Frax (nominal market value of $1 billion) and LUSD (market value of $290 million).

- Lawyer: MiCA’s stablecoin trading limit hinders adoption of cryptocurrency

- UK Prime Minister Rishi Sunak: Determined to make UK a global crypto center

- Vitalik: If Bitcoin wants to continue to develop, it needs to test more scaling solutions.

3. The source of Dai’s competitive advantage

In addition to the active attempt to approximate RWA on the asset side, in recent years, Maker’s overall operation of Dai has felt unremarkable. Its competitive advantage in firmly holding the first position in decentralized stablecoin trading still lies in two aspects:

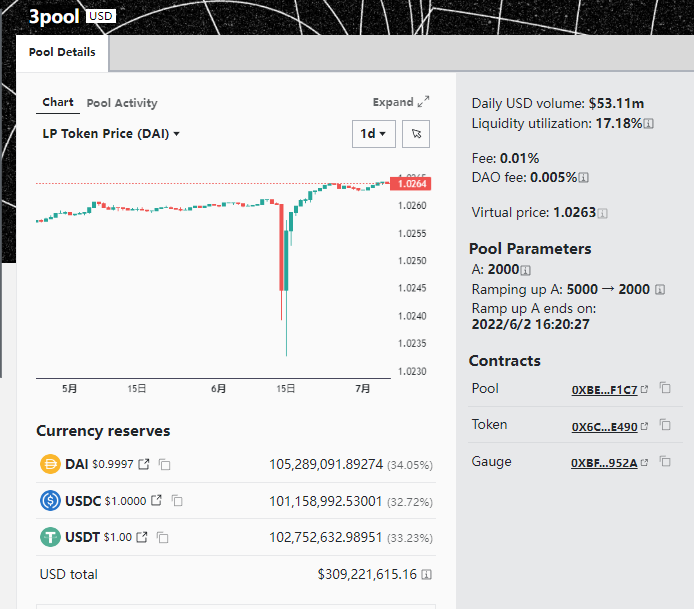

1. The legitimacy and brand of the “first decentralized stablecoin”: This allowed Dai to be integrated and adopted by many top DeFi and Cex earlier, greatly reducing its liquidity and business PR costs. For example, as the oldest stablecoin liquidity base pool (basepool) 3pool in Curve history, Dai is one of the currencies, which is defaulted as the base stablecoin by Curve, which means that Maker, as the issuer of Dai, does not need to spend a penny on Dai’s liquidity on Curve. Moreover, Dai also enjoys indirect subsidies provided by other liquidity bribery parties (when these projects acquire their own tokens and the paired liquidity of 3pool).

Curve's 3pool stablecoin pool, source: https://curve.fi/#/ethereum/pools/3pool/deposit

2. Network effect of stablecoins: People always tend to use the stablecoin with the largest network scale, the most users and scenarios, and the one they are most familiar with. In the sub-category of decentralized stablecoins, Dai’s network scale is still ahead of its competitors.

However, Dai’s main competitor is not Frax or Lusd (who are also in a difficult situation), but when users and project parties choose which stablecoin to use and cooperate with, they often compare it to USDT\USDC. Compared with them, Dai is at a clear network disadvantage.

4. The Real Challenge for MakerDao

Although MakerDao has many short-term favorable factors, the author still holds a pessimistic view of its future development. After discussing the business nature of Maker, which is stablecoin issuance and operation, and the competitive advantages of Dai, let’s face the real problems they face.

Problem 1: The scale of Dai continues to shrink, and the expansion of application scenarios has long been stagnant

Data Source: https://www.coingecko.com/en/coins/dai

The market value of Dai has now fallen by nearly 56% from its previous high, and there is still no sign of a rebound. Even in the bear market, the market value of USDT has reached a new high.

Data Source: https://www.coingecko.com/en/coins/tether

The last wave of Dai’s scale growth came from the DeFi mining boom, but where will the driving force for its next cycle of growth come from? It seems difficult to find a powerful scenario for Dai within the visible range.

Maker has thought and planned about how to expand the use cases of Dai to be more widely accepted. According to the design of Endgame, the first measure is to introduce renewable energy projects for the underlying assets of Dai, making Dai a “green currency” (Clean money). In the simulation of Endgame, this will give Dai a mainstream brand element, and make the real-world administrative power have higher “political cost” when trying to seize or confiscate Dai’s clean energy projects. In my opinion, it is too naive to think that increasing the “green” content of collateral will increase the acceptance of Dai. People may support environmental protection in thought or slogan, but when it comes to actual actions, they will still choose USDT or USDC with broader acceptance. In the web3 world that is extremely advocating decentralization, it is difficult to promote decentralized stablecoins, let alone expect residents in the real world to use Dai because of “environmental protection”.

The second method, which is also the focus of Endgame, is incubated by the Maker, and the sub-projects (subDAO) around Dai are developed by the community. On the one hand, subDAO undertakes the governance and coordination work that is currently centralized on the MakerDao mainline, turning centralized governance into segmented governance and project-based governance; On the other hand, subDAO can establish separate commercial projects to explore new sources of revenue and provide new demand scenarios for Dai. However, this is also the second major challenge facing Maker.

Question 2: How can subDAO projects succeed in creating startups while supporting MKR and Dai at the same time?

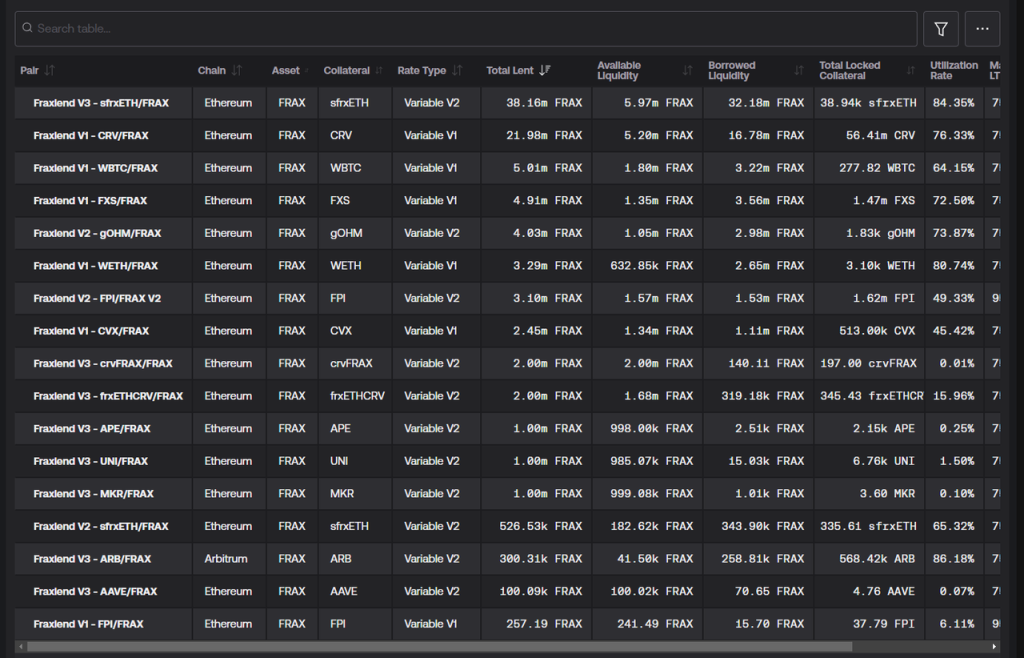

In the future, Maker’s many subDAOs will use subDAO’s own new tokens to incentivize Dai’s liquidity mining, in order to improve Dai’s usage. At the same time, MakerDao will provide low-interest or zero-interest loans in Dai to subDAO commercial projects to help these projects complete early-stage startups. In addition to low-interest financial support, subDAO also inherits MakerDao’s brand credit and community. This endorsement of credit and the import of seed users are very important for the start-up period of DeFi. Compared with relying on the introduction of environmentally friendly projects to increase the adoption of Dai, the subDAO solution sounds more executable, and there are early examples in the DeFi field. For example, Frax has developed its own Fraxlend, which supports borrowing Frax with various collateral to provide usage scenarios for Frax.

Fraxlend asset lending list, image source: https://facts.frax.finance/fraxlend

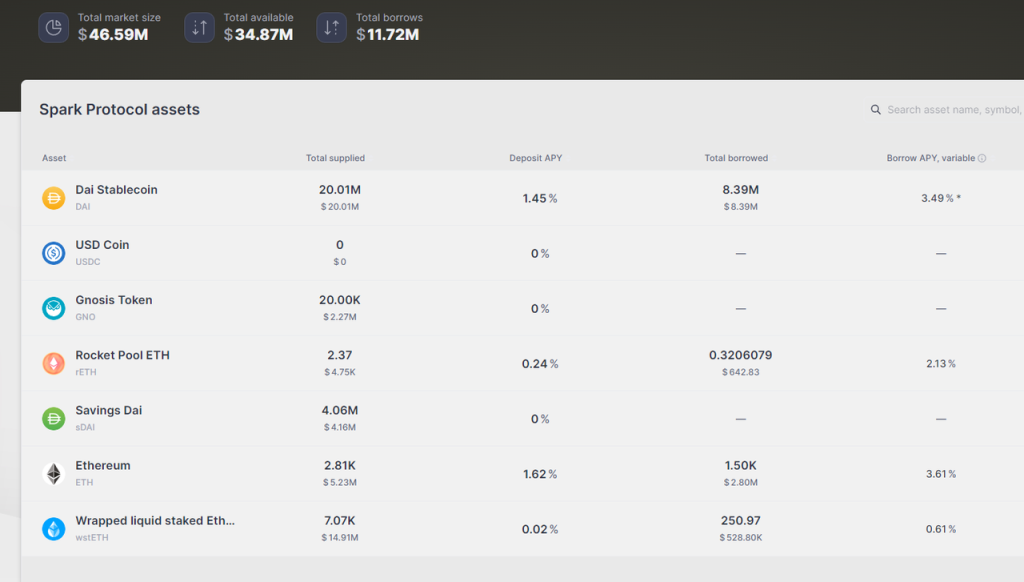

However, the problem is that in the context of DeFi, the “low-hanging fruit” has already been picked by entrepreneurs, and it is not easy to develop a subDAO project that adapts to market demand. More importantly, these subDAOs also need to shoulder the responsibility of delivering value to Dai and MKR while developing projects, because they need to allocate additional project tokens to Dai, ETHD (LST token repackaged version planned in Endgame, used as Dai collateral) and MKR as incentives. Under the premise of such a “tribute mission”, it is difficult to complete the task of satisfying user needs and defeating competitors while developing products. Among them, the lending product SBlockingrk incubated and launched by MakerDao, after deducting the 20 million Dai directly minted by MakerDao, the actual TVL of SBlockingrk is currently only more than 20 million.

Image source: https://app.sBlockingrkprotocol.io/markets/

5. Other concerns of MakerDao

In addition to the two challenges mentioned above, MakerDao also faces other concerns.

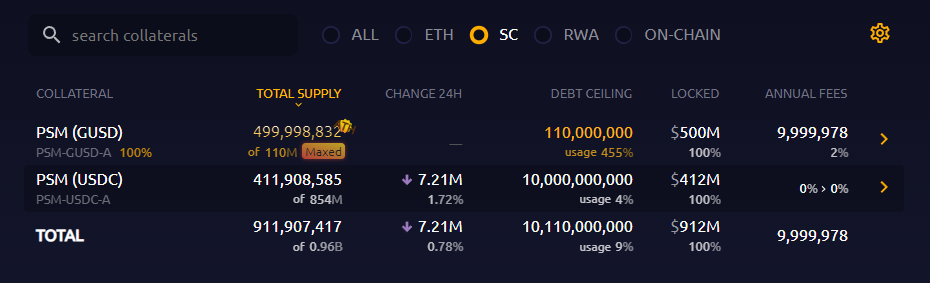

First of all, there is not much stablecoin left on MakerDao’s account that can be used to continue buying RWA, making it difficult to increase holdings of US Treasury bonds.

According to Makerburn’s statistics, there are currently only about US$912 million (USDC+GUSD) of stablecoins held in its PSM. Among them, US$500 million of GUSD is already enjoying Gemini’s annualized 2% income subsidy, which is much lower than the interest rates of other RWAs. However, due to complex factors (such as the fact that GUSD held by Makerdao PSM accounts for 89% of the total issuance, and if it is forced to liquidate and sell for US dollars, there will be a significant price discount), this part of the funds will not change much in the short term.

Image source: https://makerburn.com/#/rundown

Therefore, the flexible cash that Maker can use to continue buying yield-class assets is only the USDC of 412 million in PSM. At worst, it can exchange the US Treasury bonds with 500 million USDC of Coinbase, so the amount of funds that Maker can increase holdings of US Treasury bonds is only about 900 million. In fact, in order to cope with the redemption of PSM, the amount of funds that Maker can use to buy US Treasury bonds will not be too much. Otherwise, once users redeem USDC in large amounts with Dai, Maker will need to sell US Treasury bond assets to accept it. The transaction wear and tear and bond price fluctuations it faces will instead cause losses to Maker. Moreover, if the market value of Dai continues to decline, the investable asset scale of Maker will also be forced to decline further.

Secondly, the question is whether Makerdao’s cost control can continue to be maintained, and the author remains skeptical. According to Endgame’s current plan, although it is trying to decentralize the governance process and power of the DAO from “Maker Center” to various subDAOs, it has also set up complex roles, organizations, and arbitration departments in the governance units of subDAOs. The entire collaboration chain is the most complicated among all projects that the author has known, and it is a real “governance maze”. Interested readers can visit the full version of Endgame V3 for a brain-burning reading experience. In addition, the intersection between DeFi and offline traditional financial entities caused by the introduction of RWA business, the emergence of a large number of high-paid outsourcing jobs, coupled with the current very serious problem of governance centralization (the Endgame plan passed in October 2022, and 70% of the approval votes came from the voting group related to Rune, the founder of Maker), the issue of interest transfer of MakerDao is already the elephant in the room. For example, the largest RWA investment management fund of Maker is managed by a small institution called Monetalis Clydesdale, but it is in charge of 1.25 billion US dollars of Maker’s funds and is responsible for allocating funds to national debt assets and negotiating with other traditional financial institutions. The company charges nearly 1.9 million US dollars/year in service fees, and Maker was its only client at that time. The founder of Maker, Rune Christensen, is also the major shareholder of the company.

6. Endgame is not the end

In the comments section of the Endgame roadmap forum post by Rune Christensen in May (related reading: “Detailed Explanation of MakerDAO’s Endgame Plan, New Roadmap, and AI-Assisted Governance and Deployment of New Chains”), in addition to the usual praise and questions from other governors, two users’ comments stand out:

“The precious resources we once had, including money and energy, were wasted on funding useless people and junk, instead of being invested in creating value for MKR and expanding the scale of Dai. All funds and research should be used to figure out how to make Dai and MKR run autonomously! Remove bloated personnel and complex governance, that’s the right way.”

“Why do we think a globally pre-planned ‘endgame plan’ is better than solving current problems and gradually improving? This plan is always very specific about ‘what we do’, except for the blockchain part, and there is very little related to ‘why we do it’.”

For Web3 projects operating on the blockchain, we should make good use of the efficiency brought about by transparency and low trust costs, rather than building new walls and creating new fogs, renting behind walls and in fog.

Endgame is not the ultimate goal that DeFi should have, it is just MakerDao’s wall and fog.

7. Reference and Acknowledgement

During the writing process, the author discussed Maker topics with @ryanciz233, a researcher at @DigiFTTech. Thanks to him for providing a lot of important information. @ryanciz233’s research on Maker’s RWA section will also be released soon.

MakerDAO Becoming ‘a ComBlockingny Run by Politics’?

Endgame related article collection

A16z Doesn’t Support Plan to Break Up DeFi Giant MakerDAO

MakerDao collateral data: https://makerburn.com/

MakerDao expenditure statistics: https://expenses.makerdao.network/

Dai-related data: https://daistats.com/#/

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!