MAV IEO has attracted a group of losing traders. Recently, there have been many cases of people losing money after buying in at the opening of LaunchBlockingd/Launchpool on Binance. Although there was a recent surge in price, many people have not yet recovered their losses.

This article provides an understanding of the basic valuation logic of various projects to prevent mindlessly buying at the highest point. It also looks back and compares the historical performance of Launchpool and LaunchBlockingd, and reviews and compares the similarities and differences of these two categories and speculative positions.

A. Valuation Logic

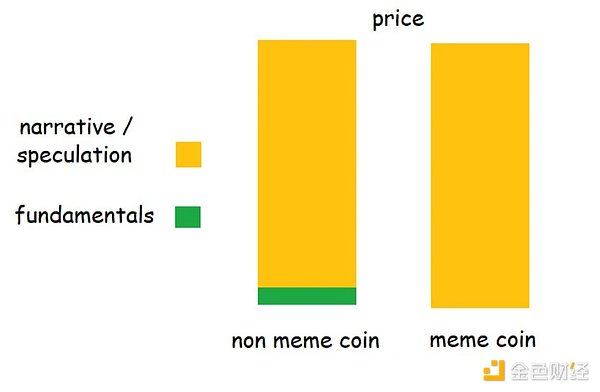

Unless it is a “meaningless governance token” or memecoin, in theory, it can be compared on a larger scale by giving benefits to token holders, but after all, cryptocurrency is an attention game, and the so-called fundamentals are too small in the face of narratives. Therefore, valuation is generally based on benchmarking within the same category of projects.

- Vitalik Buterin: Ordinals Reviving Bitcoin Builder Culture

- Arthur Hayes blog post: When AI controls the earth, Bitcoin will become the preferred currency.

- NFTs dive into the Ice Age – How much have the once high-profile celebrities lost?

For example, MAV belongs to the DEX race in the DeFi category. The common indicators for DeFi are TVL, which is commonly used to evaluate scale, as well as the total fee revenue and protocol revenue, which are not commonly used to evaluate profitability. Specifically, in the DEX field, there is a trading volume (Vol) indicator to evaluate business scale. As for the token itself, there are two indicators: current market value (mcap) and fully diluted market value (FDV), which correspond to short-term and long-term liquidity, respectively.

Referring to the valuation benchmark chart made by @BiteyeCN, the business evaluation indicators, such as TVL or fee income, are used to give valuation opinions under mcap/FDV. Of course, there are often some tricks behind the data. For example, the problem with using the weekly handling fee to evaluate MAV is that MAV has an airdrop and has been listed on Binance, so there is no shortage of scalpers to boost trading volume, which naturally inflates the volume (3/n).

Using more detailed logic and common sense is also a good method. A price of $0.5+ for MAV would lead to an FDV close to Blockingncake. Although MAV is closer to Binance, it is not as close as Cake. Therefore, it is not realistic to expect Binance to raise the price above $0.5. Previously, the DEX Hashflow, which was also launched on Binance Launchpool, currently has an FDV of around 400M, corresponding to an MAV price below $0.2.

Therefore, if someone really rushes in with the belief in Binance’s vision, $0.5 is obviously far beyond the range that the initial launchpool can support. Currently, the market price of around 0.45 is already a relatively high position.

DeFi projects are relatively easy to evaluate because of their application bias and some actual profitability. However, the important user activity data of public chain projects is basically brushed by wool parties, and the reference value is low, leaving only a TVL data that can barely be seen. Therefore, compared with data, public chains seem to value background more, which is one of the reasons why VCs are rampant in this field. Anyway, projects with good backgrounds seem to blindly give 10B.

See the valuation of ARB that we talked about in the past. According to TVL and ecology, we gave a valuation of 2 times OP FDV. However, after ARB issued coins, the price difference was very large and was tragically beaten. Instead, with the continuous decline in the price of op over a period of time, ARB successfully achieved 2 times the OP FDV.

B. FDV is not just a number

FDV = Total token circulation x token price

When evaluating projects, people often prefer to use market capitalization (mcap) rather than FDV for comparison. However, most of these are because the circulation of new projects with high popularity is low, and mcap is used to compare advantages. However, FDV is by no means just a number.

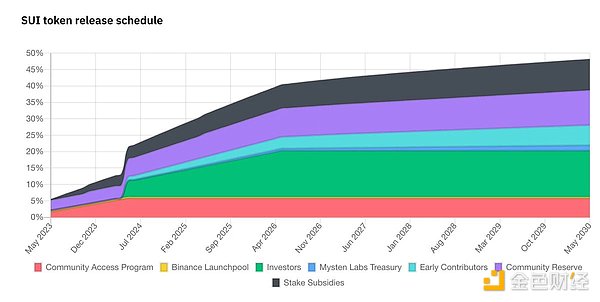

Take the OKX / Bybit / Bitget three-party IEO and the SUI that gave Binance Launchpool 40 million tokens for free to avoid repeating Blur’s mistakes as an example. The price has been falling since the opening.

Recently, it was exposed that the project party was secretly unlocking and selling coins in advance, and claimed to be flexible tokenomics. This is the painful process of gradually approaching FDV from mcap, and the increment will become selling pressure.

However, even if SUI executes the token unlocking plan honestly, its increase is also very fast. Against the benchmark and short-term speculation, SUI has a FDV of more than 10B at the opening, and at this time, mcap & lt; 1B, which can barely be supported by market heat. However, it is reasonable for the price to decrease slowly in the process of realizing FDV into mcap at 10B under the condition that the fundamentals have not improved for a long time.

C. Launchpool & LaunchBlockingd: Differences and Speculation

Many people refer to MAV as the XX phase LaunchBlockingd project, but in fact, it is a Launchpool project. What is the difference between Launchpool and LaunchBlockingd? Launchpool is free, while LaunchBlockingd requires BNB holders to pay, implying Binance’s attitude towards it.

Especially for projects launched through Binance, the implicit support for LaunchBlockingd projects is a tier stronger than Launchpool. As previously discussed in our article, we have explored the overall return data of LaunchBlockingd.

This time, we will analyze from the perspective of users who participated in the opening trade, analyzing the opening price (average price on the first day), the historical highest price (closing price), corresponding FDV, and the ROI of buying at the opening and selling at the ATH. The top chart is the Launchpool data, and the bottom chart is the LaunchBlockingd data. Focus on the last line of the median (15/n).

Looking at historical data, the performance of previous Launchpool projects is far inferior to that of LaunchBlockingd projects. Assuming buying at the average price on the first day and selling at ATH, the median ROI for LaunchBlockingd is 2.9 times, while Launchpool is only 1.9 times.

Additionally, Launchpool has two projects that peaked at the start and have been stuck since then, while LaunchBlockingd has not experienced this situation (of course, the data on the opening day average price is convenient for horizontal comparison, but it cannot reflect the whole picture. EDU is currently in a high probability of being trapped when bought on the opening day).

As for the reason, we can observe that in terms of FDV ATH, LaunchBlockingd and Launchpool are actually close to each other, both around 1.9B, but Launchpool’s median FDV on the first day is much higher than LaunchBlockingd’s 460M. This is mainly due to the liquidity issue of Launchpool. LaunchBlockingd usually gives about 5% of the shares, while Launchpool, as a free giveaway, usually gives less than 2%. Although Launchpool’s opening price is inflated, since most BNB holders sell directly at the opening, the higher the opening price, the more advantageous it is for BNB holders, so Binance naturally has no incentive to distinguish this.

For investors, the long-term game value of Launchpool is obviously lower than LaunchBlockingd, so for Launchpool projects, valuation analysis and more conservative preparations should be done. Blindly rushing and holding for a long time can easily lead to being trapped.

If you are too lazy to do valuation analysis, refer to the median first-day FDV of 460M for LaunchBlockingd, if the FDV of Launchpool’s application project exceeds this value, the probability of high returns in the future is not very high.

Summary

Using similar projects as a valuation benchmark is the most common valuation method. Launchpool’s project performance is not as good as LaunchBlockingd’s, and the currency price is often hyped due to liquidity issues. More caution is needed. There have been a few cases where Launchpool’s opening price was at its peak and has been trapped until now, while LaunchBlockingd has almost no cases of being completely trapped.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!