Exploration: Hong Kong’s First RWA-themed Summit

Since the new policy was introduced, senior government officials in Hong Kong have been clear on the RWA strategy. Hong Kong government official Leung Hon-keung said, “Are virtual currencies the only transactions in Web3? The answer is no. Our goal is to enable Web3 to empower and serve the real economy. The trading volume of virtual currencies such as Bitcoin and Ether is too small, only $1 trillion. Our goal is to use tokenization to increase the liquidity of various types of assets, including bonds, real estate, and alternative assets, which is a trillion-dollar business opportunity.”

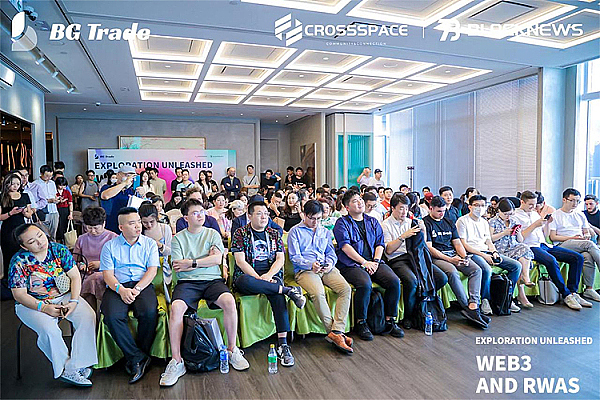

Last Friday (July 7), Exploration Unleashed: Web3 and RWAs, hosted by Dubai’s RWA project BG Trade, was held at 535 Jaffe Road, Wan Chai, Hong Kong.

“Exploration Unleashed: Web3 and RWAs” clearly shows the huge potential for the integration of blockchain technology and real-world assets in the field of change, and Hong Kong is becoming the center for exploration and development in this field of change. “Exploration Unleashed: Web3 and RWAs” attracted more than 500 participants from the Hong Kong industry, representing a wide range of interests and concerns in the Web3 and RWAs fields of the Hong Kong industry in finance, technology, blockchain, investment, media, and other fields.

Release: Dubai’s Dark Horse’s First Roadshow in Hong Kong

In a previous interview, BG Trade’s CEO Ali explained why they first launched in the Dubai market: “I have always believed that to make progress in life or business, you must be in an environment that fosters progress and success. Dubai welcomes future-changing technologies.”

However, since the new policy in Hong Kong, BG Trade has shifted its focus on the coin stock market to Hong Kong. BG Trade aims to integrate multidimensional asset investment on the same platform, providing efficient connectivity opportunities for assets such as stocks, bonds, commodities, and cryptocurrencies, and providing users with RWA (real-world asset) asset allocation solutions.

In their plan, BGT will act as a bridge connecting the traditional stock market and the cryptocurrency world, creating a currency-stock ecosystem, anchoring tokens with traditional stocks at a 1:1 ratio, and breaking down the barriers between the currency circle and the stock market. Today, BGT is a pioneer and demonstration in creating this ecosystem, creating the first tokenized asset of currency stocks through tokens anchored by Hong Kong-listed companies.

Ali presented the BG Trade RWA asset issuance and trading platform to attendees. The BG Trade platform is built on EVM and is a reference for truly realizing asset chaining in traditional finance in Hong Kong. By utilizing blockchain technology and smart contracts, BG Trade enables the financial market to achieve options, futures, and more complex structured financial transactions. Ali also mentioned the zkDID function of the BG Trade platform, which allows users to manage self-owned identities and achieve real data mining. Ali emphasized the importance and use of the BGT token – BGT token holders will receive airdrops of other upcoming RWA tokens, liquidity rewards for LP pool participation, and enjoy rights such as ve-Governance and transaction fee refunds.

Adoption and Regulation: Unlocking the Potential of Web3 and RWAs

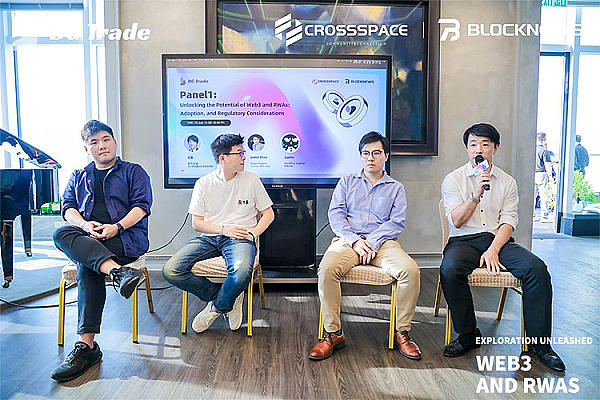

In a roundtable discussion titled “Unlocking the Potential of Web3 and RWAs: Adoption, and Regulatory Considerations,” Terry Chan, head of the Web3 team at InvestHK, Wang Yi, director of the quantitative investment team at Southern Dongying, Jaden Chan, investor and BD head at Flow Traders, and Jupiter, director of investment research at HashKey Capital, shared their perspectives.

Terry Chan emphasized the importance of adoption and promotion of Web3 and RWAs in the Hong Kong market. He pointed out that as an international financial center, Hong Kong should actively promote the application of blockchain technology and work with regulatory agencies to formulate corresponding laws and policies to ensure the health and stability of the market. He emphasized the importance of compliance and regulation to promote the sustainable development of Web3 and RWAs, and encouraged companies and investors to actively participate in innovation and exploration in this field.

Wang Yi shared his views on the potential of Web3 and RWAs from the perspective of quantitative investment. He believes that the combination of Web3 and RWAs will bring investors more opportunities and flexibility, while also providing the market with more liquidity and transparency.

Jaden Chan shared the views of Flow Traders as an investor and BD head. He emphasized the importance of liquidity in the Web3 and RWA markets, and highlighted how market participants can use the services of liquidity providers to optimize trading and investment strategies. He also discussed Flow Traders’ investments and participation in this field, and provided some practical examples of how to achieve success in the Web3 and RWA markets.

Jupiter shared his unique insights into the potential of Web3 and RWA based on his expertise and experience in the cryptocurrency and blockchain fields. He emphasized the advantages of blockchain technology in asset issuance and trading, as well as the innovative power of the Web3 ecosystem. He discussed the development of areas such as decentralized finance (DeFi) and non-fungible tokens (NFTs), and explored their application prospects in the RWA field. As the Director of Investment Research at HashKey Capital, Jupiter also shared their investment strategies and prospects for the Web3 and RWA fields. He emphasized the cautious and innovative attitude that investors should adopt in this field, and encouraged participants to recognize the opportunities and risks that Web3 and RWA bring.

Insight and Inspiration: Value Capture Opportunities

Clearpool is a speaker on the theme of “Exploring Liberation: Web3 and RWAs”. They shared their innovative solutions and experience in the RWA field. In the sharing, the Clearpool representative emphasized how their platform solves many of the challenges and limitations in the traditional financial system. By using the decentralization and transparency of blockchain, they provide users with lower transaction costs, faster transaction speeds, and broader market participation opportunities. Clearpool’s sharing deepened participants’ understanding of the RWA field and created possibilities for cooperation and collaboration with other industry participants.

The purpose of the Dubai RWA project and discussions with many practitioners is clear. They are trying to find value capture opportunities in the new policies and the trillion-dollar RWA business opportunities of the Hong Kong government, which is a path to explore the deepening of the integration of traditional finance (TradFi) into the DeFi world of on-chain assets for the Hong Kong market.

For example, in mid-June, BOC International issued HKD 200 million digital notes for the Hong Kong market through UBS, which is an RWA practice. Some people also propose some comments and suggestions. The original text of UBS mentioned that the “main Ethereum blockchain” is not actually the Ethereum mainnet, but a centralized consortium chain deployed by Ethereum as open-source code. Therefore, it is generally believed that traditional institutions still have a long way to go to deploy business on public chains under uncontrollable risks such as policy compliance, regulation and transaction efficiency.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!