The lending business is an important source of leverage for funds, which can both promote the rapid formation of a bull market and amplify market declines due to cascading liquidations. In this bear market, Celsius, FTX, and Genesis have all gone bankrupt due to crypto lending, but the necessity of crypto lending cannot be denied, such as decentralized lending and centralized lending platforms that have collateral and timely liquidation. Recently, Coinbase has relaunched its institutional lending service, indicating that this track is still worth attention.

Ledn is a company that was born before the previous bull market and is also a survivor in the wave of bankruptcies among lending institutions in this bear market. It did not lead to user fund losses in this wave of bankruptcies, which also shows that it is worth attention. According to Crunchbase data, starting from September 2018, Ledn raised $103 million in funding from 6 rounds, with investors including 10T Holdings, Kingsway Capital, White Star Capital, Coinbase Ventures, and others.

Unlike most centralized lending institutions, Ledn mainly relies on over-collateralized lending to generate interest and will liquidate timely when the market falls. At the same time, Ledn not only isolates risks between different products, but even in lending, users will only interact with counterparties that generate income for themselves. The following sections will provide a detailed introduction to Ledn.

Two Assets and Two Account Types in Ledn

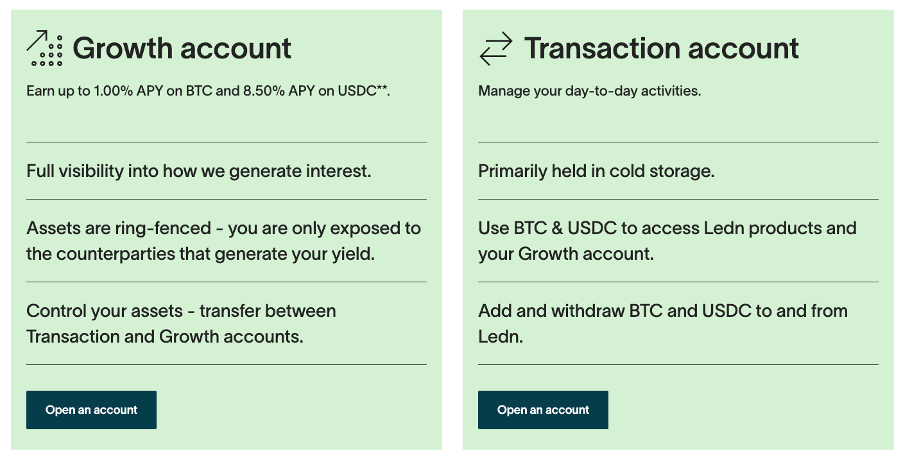

Ledn currently only supports two assets: BTC and USDC, and is expected to add support for USDT and ETH in October. These two assets can be deposited into two types of accounts, namely the Growth account and the Transaction account. The funds in the Growth account are used for lending and can earn interest, theoretically there may be counterparty risks. The funds in the Transaction account are used for trading, cannot earn interest, and are isolated from the funds in the Growth account. This part is mainly stored in cold wallets, with only a small amount of funds reserved for trading and withdrawals.

- Visa After considering numerous blockchains, why did you ultimately choose Solana as the payment network?

- Can El Salvador, which embraces Bitcoin, replicate Singapore’s path to success?

- Friend.tech Deep Report Analyzing various indicators, why can the valuation reach $1.5 billion?

It is worth noting that previously, Ledn only had a savings account, but on September 12, it was completely upgraded to a dual account structure of Growth account and Transaction account. This helps to separate the risks of the Transaction account from the Growth account, and the yield of the Growth account may also be improved.

According to the Ledn website, the annualized yield in the Growth account is 1% for BTC and 8.5% for USDC. In crypto lending, risky assets such as BTC are usually used as collateral to borrow stable assets such as USDC, and the demand for USDC is higher, which leads to a higher yield for USDC. This achieves the purpose of leveraging and also defers the taxes that need to be paid when liquidating.

Products in Ledn

The Growth account and the Transaction account are the core products of Ledn, and based on this, lending and trading-related products are also built.

Ledn Loans

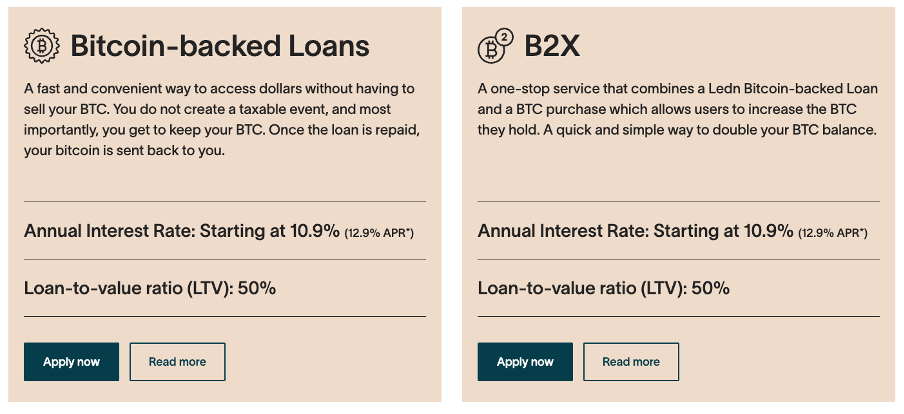

Borrow USDC with BTC as collateral, with a loan-to-value ratio (LTV) of 50%, which is also the main way for Ledn to help users earn returns. There are two types of lending products: Bitcoin-backed Loans, which are loans with BTC as collateral, borrowing USDC or fiat currency; and B2X Loans, where the loan will automatically purchase BTC, that is, going long on BTC through leverage.

Through this method, users can obtain liquidity without selling BTC, or purchase more BTC.

DCN

Dual Cryptocurrency Note (DCN) allows users to set the price and term for buying and selling BTC. If the set price is reached at expiration, the trade is executed and additional interest is earned. If the trading condition is not met, the principal is retained and periodic interest is earned. Compared to limit orders on exchanges, DCN can help users earn interest regardless of whether the trade occurs or not.

Ledn Trade

Ledn Trade enables trading between BTC and USDC (and will expand to include USDT and ETH). The assets acquired through trading are directly deposited into a growth account. This feature, when combined with the growth account, demonstrates its advantages for users who engage in fewer trades and wish to earn interest.

In the previous bear market, the bankruptcies of Celsius, FTX, Genesis, and others were attributed to providing excessive loans to institutions such as Three Arrows Capital and Alameda Research without collateral. Decentralized lending protocols like Maple also face this problem. When the market goes down, loans cannot be repaid by liquidating collateral. During the bankruptcy of FTX/Alameda, Ledn did indeed have some exposure to the risk of FTX/Alameda. However, due to the diversified counterparty risk and minimal losses, Ledn fully covered the risk exposure and no users suffered losses. This also demonstrates that Ledn has the ability to operate normally even under extreme circumstances.

Ledn primarily helps users earn interest through overcollateralized loans (with a small portion being unsecured BTC loans). The collateral is BTC, and the loan funds come from the USDC in the growth account. Unlike other financial products, Ledn’s growth account is also risk-isolated and only engages with counterparties that borrow assets and generate income. The bankruptcy of other borrowers or Ledn itself does not affect user funds.

Overcollateralization and Unsecured Loans

In the previous bear market, centralized lending institutions such as Celsius and Genesis went bankrupt due to unsecured loans. The lending in Ledn is primarily overcollateralized with crypto assets, but there is also a small portion of unsecured loans provided to institutions. Ledn’s monthly report for September showed that as of September 1st, 95.3% of the funds for USDC were lent out through overcollateralization, while the remaining 4.7% was kept in custody institutions or cooperating banks in the form of USDC or USD.

For BTC, there is a portion of idle funds in the growth account, and another portion is collateralized for borrowing USDC or fiat currency. In the growth account, 72% of BTC is kept in custody institutions, while the remaining 28% is provided as unsecured loans to “high-quality institutions”. As for collateral, 79.7% of BTC is kept in custody institutions, while the remaining 20.3% is provided as loans to high-quality institutions.

Based on the above information, we can summarize the security of Ledn’s over-collateralized and uncollateralized lending as follows:

The funds in the trading account and the growth account are differentiated. The funds in the trading account are mainly stored in cold wallets, with only a small portion stored in hot wallets for withdrawal and other operations.

95.3% of the USDC in the growth account is lent out in an over-collateralized manner, while the remaining 4.7% is stored in partner institutions or banks and is not issued as uncollateralized USDC loans. This allows for higher capital utilization and higher yield for the USDC growth account compared to decentralized platforms.

The growth account is risk-isolated, and only default by counterparties that the user is in contact with can lead to losses. The default of other borrowers and the bankruptcy of the Ledn platform will not affect the security of user funds. Ledn’s risk management also diversifies counterparty risk.

In the current BTC growth account, more than 20% of the funds, whether idle or used as collateral for borrowing USDC, are lent out in an uncollateralized form to high-quality institutions, mainly market makers. Although Ledn believes that the risk of these market makers is low, considering that the annualized yield for BTC deposits is only 1%, the risk is higher and the return is lower compared to USDC.

Liquidation Mechanism and Reserve Proof

The entity behind Ledn, Ledn Cayman SEZC Inc., is a virtual asset service provider regulated by the Cayman Islands Monetary Authority, with BitGo as the custodian for WBTC. USDC loans in Ledn are issued in an over-collateralized manner, with an initial LTV of 50%, meaning 1 BTC with a collateral value of $26,000 can borrow a maximum of $13,000 USDC or the equivalent in fiat currency. As the price of BTC falls, borrowers need to increase their collateral, otherwise they may face liquidation.

When the LTV increases to 70% due to a decline in BTC price, Ledn will send an email to the user, notifying them to add BTC as collateral or repay the loan to reduce the LTV. When the BTC price continues to fall and the LTV continues to increase, if the LTV reaches 75%, Ledn will continue to send emails to the user.

Once the LTV increases to 80%, a portion of the BTC in the collateral will be sold to repay the loan. The remaining funds will be deposited into the trading account or the growth account.

To minimize liquidation, Ledn provides an “Auto-Replenish” feature, where users can set their trading account balance to automatically convert to collateral when the LTV increases. Conversely, if the LTV falls below 35%, users can choose to redeem excess collateral to the trading account.

Regarding reserve proof, after centralized exchanges and other institutions were questioned, Ledn became the first cryptocurrency lending company to conduct reserve proof with an independent third-party accounting firm. Every six months, the accounting firm independently observes Ledn’s custodial assets and total liabilities. Ledn creates a unique hash ID and matches it with each client and their account, ensuring that user assets are included in the proof provided by the accountant while protecting user privacy.

Summary

Ledn has built lending and trading-related products through two types of accounts: the Growth Account and the Trading Account. The assets held by Ledn users are mainly stored in cold wallets in the Trading Account, which are not used for other purposes and do not generate interest. In the Growth Account, the majority of USDC is lent out as overcollateralized loans, with the remaining portion kept with custodians. When the Loan-to-Value (LTV) ratio reaches 80%, liquidation will occur. Since there is no unsecured lending, it is relatively safe.

However, in the BTC funds, over 20% is used for unsecured lending. Although Ledn believes these institutions are relatively safe, the risk is still higher and the returns are lower compared to USDC. If the volatility of BTC increases and there is an increase in lending demand from institutions, the yield of the BTC Growth Account may be increased.

Like what you're reading? Subscribe to our top stories.

We will continue to update Gambling Chain; if you have any questions or suggestions, please contact us!